Retail Logistics Market Size 2024-2028

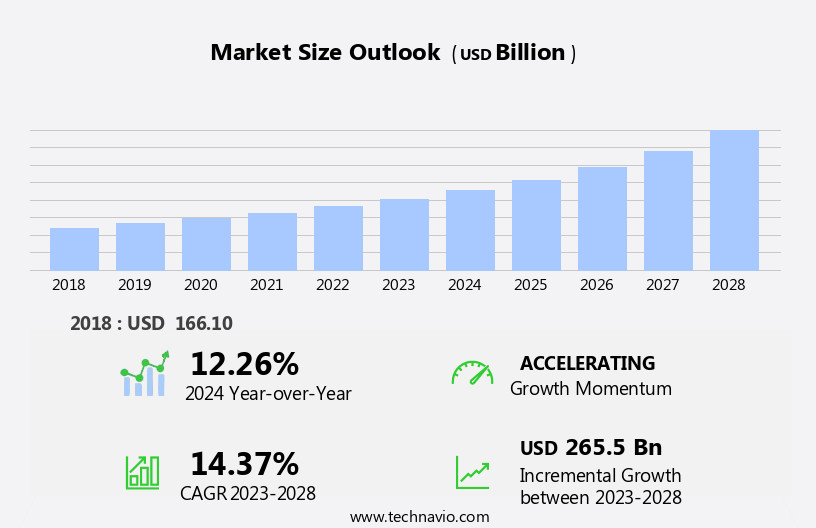

The retail logistics market size is forecast to increase by USD 265.5 billion at a CAGR of 14.37% between 2023 and 2028.

- The rise in international retailing is the key driver of the retail logistics market, as global retail expansion increases the demand for efficient, reliable logistics solutions such as rail logistics. The upcoming trend is the use of sustainable logistics. Retailers are increasingly adopting eco-friendly practices, such as reducing carbon emissions, optimizing supply chains, and using green packaging, to meet sustainability goals and appeal to environmentally conscious consumers.

- Additionally, the use of data analytics and predictive modeling is becoming increasingly important for retailers to gain insights into consumer behavior and optimize their inventory management and delivery strategies. By staying abreast of these trends and implementing innovative logistics solutions, retailers can enhance their competitiveness and meet the evolving demands of their customers.

What will be the Size of the Retail Logistics Market During the Forecast Period?

- The market encompasses the efficient movement and delivery of goods from manufacturers to wholesalers, retailers, and ultimately, consumers. This market is driven by the demand for timely and cost-effective fulfillment of both durable and non-durable goods. Global commodity prices and international commerce operations significantly impact retail logistics, necessitating the use of multimodal transportation, including trains, trucks, ships, and airplanes.

- Big data analytics and artificial intelligence are transforming retail logistics, optimizing delivery times, reducing fulfillment expenses, and improving inventory management. Urbanization and e-commerce have increased the importance of last-mile delivery and after-sales logistics. Logistical infrastructure, including logistics parks and warehouse productivity, plays a crucial role in ensuring fast delivery and efficient operations.

- International competition and tax money contribute to the continuous evolution of retail logistics, with a focus on optimizing inventory management, railcar utilization, and aircraft fleet size.

How is this Retail Logistics Industry segmented and which is the largest segment?

The retail logistics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Mode Of Transportation

- Roadways

- Railways

- Waterways

- Airways

- Type

- Conventional retail logistics

- E-commerce retail logistics

- Solution

- Commerce Enablement

- Supply Chain Solutions

- Reverse Logistics and Liquidation

- Transportation Management

- Others

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- UK

- South America

- Middle East and Africa

- APAC

By Mode Of Transportation Insights

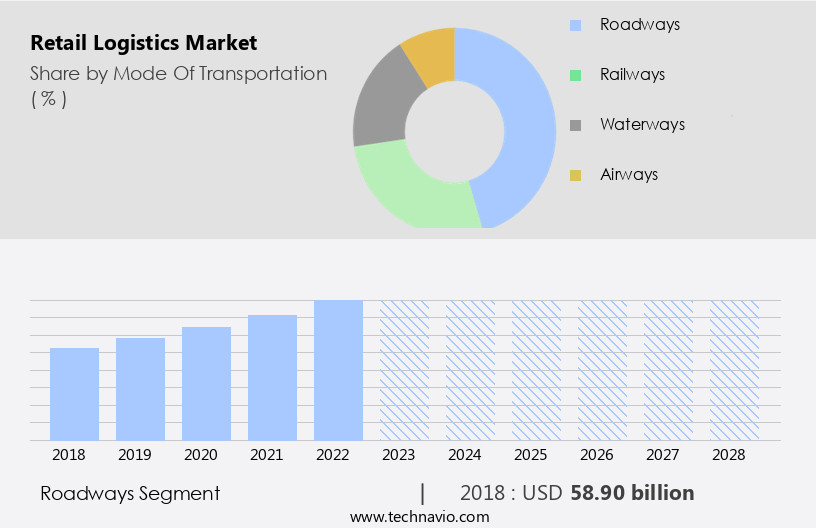

The roadways segment is estimated to witness significant growth during the forecast period. The segment is anticipated to witness substantial growth during the forecast period owing to rapid urbanization and population growth coupled with the e-commerce industry expanding across the globe. The thriving global online retail industry has demonstrated the need for fast parcel delivery. The growth of the e-commerce industry has given rise to new service requirements, such as express delivery and a new class of logistics companies.

Get a glance at the share of various segments. Request Free Sample

The Roadways segment was valued at USD 58.90 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

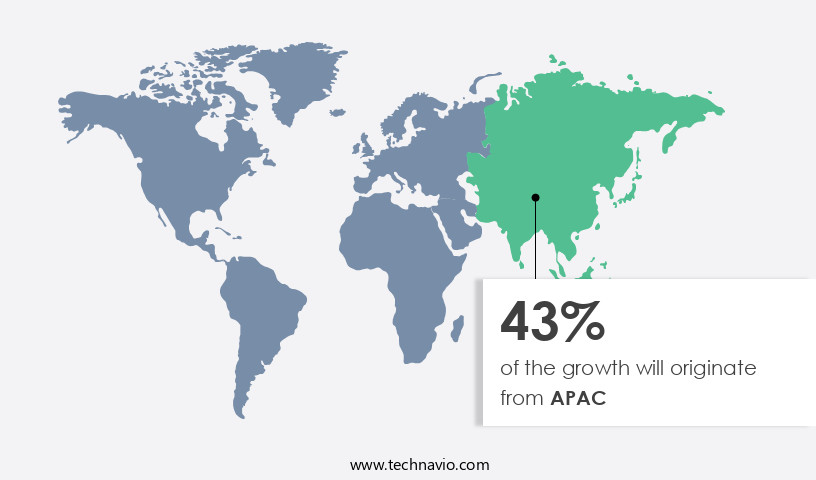

APAC is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is projected to experience the fastest growth due to the expansion of the e-commerce business and the presence of a substantial consumer base for retail goods. With large, populated countries like China and India having high Internet penetration rates, online businesses are thriving, positively influencing the e-commerce the market. In 2023, the e-commerce industries in India and China generated significant revenue of over USD63 billion and USD2.2 trillion, respectively. The increasing Internet penetration enables efficient movement of goods, reduces delivery times, and lowers fulfillment expenses. Advanced technologies such as big data analytics, artificial intelligence, and machine learning algorithms are being employed to optimize supply chain operations, improve demand forecasting, and manage inventory levels in real-time.

The implementation of these technologies streamlines customs controls, reduces cargo handling time, and enhances warehouse productivity. Multimodal transportation, including trucks, ships, railcars, and aircraft, is utilized to ensure reliable, cost-effective delivery. The retail e-commerce market's growth is further driven by factors such as fast delivery, lower shipping costs, vast product selection, and personalized kitting and order fulfillment. Logistics companies employ on-time delivery, omnichannel operations, and reliable reverse logistics to meet customer expectations. The integration of last-mile delivery solutions, such as drones and micro-mobility options, caters to urban areas' specific needs. In conclusion, the market in APAC is experiencing significant growth due to the e-commerce industry's expansion, increasing Internet penetration, and advanced technologies' implementation.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Retail Logistics Industry?

Rise in international retailing is the key driver of the market.

- The market is experiencing significant growth due to the increasing globalization and the expanding e-commerce industry. International retailing, which involves the transfer of retail technology, management skills, and buying functions across borders, presents new opportunities for retailers in emerging markets, particularly In the Asia Pacific region. The penetration of the Internet has led to an increase in e-commerce and trade opportunities, allowing global grocery retailers and fashion brands to expand their businesses by selling goods and services across international borders. This international commerce contributes to economic growth through increased tax revenue. Efficient movement of goods is crucial in retail logistics to ensure delivery times are met and fulfillment expenses are minimized.

- Big data analytics, artificial intelligence, and machine learning algorithms are being employed to optimize supply chain operations, improve demand forecasting, and manage inventory levels in real-time. Proactive inventory management helps prevent stockouts and overstock situations, while working capital utilization and carrying costs are reduced through effective inventory planning. Multimodal transportation, including trucks, ships, railcars, and aircraft, is used to transport goods efficiently and cost-effectively. Reduced vehicle costs, streamlined customs controls, and compatibility requirements are essential for retailers to maintain a competitive edge. Traditional distributors, brick-and-mortar businesses, e-commerce platforms, and e-commerce retailers all rely on logistics companies to ensure personalized kitting, order fulfillment, and on-time delivery.

- Omnichannel operations require reliable reverse logistics for customer returns, direct-to-consumer shipment, and direct-to-store shipment. Warehouse efficiency is crucial in e-commerce businesses, where vast product selection, fast delivery, and lower shipping costs are key differentiators. Logistics parks and multimodal logistics parks provide essential infrastructure for inventory management, road transportation, and packaging solutions. After-sales logistics and transportation management are also important aspects of retail logistics. Urbanization and customer preferences are driving the need for integrated logistics solutions, including road contract logistics, air freight, and sea freight. The use of technology, such as drone delivery and micro-mobility options, is transforming last-mile delivery in urban areas.

- The retail e-commerce market continues to grow, with increasing competition and the need for efficient, cost-effective logistics solutions.

What are the market trends shaping the Retail Logistics Industry?

Use of sustainable logistics is the upcoming market trend.

- In the market, global commodity prices and environmental concerns are driving companies to adopt sustainable practices. Sustainable logistics is a growing trend aimed at improving supply chain operations through eco-friendly measures, reducing carbon emissions, and saving resources. companies are turning to electric vehicles for retail logistics, which is expected to significantly decrease carbon emissions during merchandise transportation. Additionally, big data analytics, artificial intelligence, and machine learning algorithms are being utilized for demand forecasting and inventory management to ensure efficient movement of goods and reduce stockouts and overstock situations. Real-time data and proactive inventory management help retailers optimize working capital utilization and lower inventory costs.

- Multimodal transportation, including trucks, ships, railcars, and aircraft, is being used to reduce vehicle costs and cargo handling time. Streamlined customs controls and compatibility requirements enable seamless international commerce operations. E-commerce retail logistics, including personalized kitting, order fulfillment, and on-time delivery, require omnichannel operations and reliable reverse logistics for customer returns and direct-to-consumer or direct-to-store shipments. Warehouse efficiency and productivity are essential for e-commerce businesses to meet customer expectations for fast delivery, lower shipping costs, and vast product selection. Logistics companies are integrating transportation management, roadways, railways, airways, and direct-to-consumer or direct-to-store delivery to meet the demands of e-shoppers. Inventory management, road transportation, and multimodal logistics parks are crucial for optimizing inventory levels and reducing carrying costs.

- Urbanization, customer preferences, and limited transportation infrastructure are factors influencing the market. Government measures, roadway connectivity, and road infrastructure development are also impacting the market.

What challenges does the Retail Logistics Industry face during its growth?

Operational inefficiencies is a key challenge affecting the industry growth.

- Retail logistics entails managing the efficient movement of durable and non-durable goods from manufacturers to consumers or retail stores. Global commodity price fluctuations impact inventory levels and carrying costs, necessitating proactive inventory management and demand forecasting. Big data analytics, artificial intelligence, and machine learning algorithms facilitate real-time data analysis, enabling retailers to optimize inventory levels, reduce stockouts and overstock situations, and improve working capital utilization. Multimodal transportation, including trucks, ships, railcars, and aircraft, plays a crucial role in reducing vehicle costs and cargo handling time. Streamlined customs controls and compatibility requirements ensure reliable reverse logistics for customer returns and direct-to-consumer or direct-to-store shipments.

- E-commerce platforms and brick-and-mortar businesses require integrated logistics solutions for omnichannel operations, fast delivery, and lower shipping costs. Logistics companies employ personalized kitting and order fulfillment, ensuring on-time delivery and inventory management. E-commerce business growth, driven by urbanization, customer preferences, and internet penetration, necessitates the development of logistical infrastructure, including large shops, wholesalers, trains, airplanes, and international commerce operations. Warehouse productivity and inventory management are essential for e-commerce enablement and supply chain solutions. Roadway vehicles, railways, airways, and multimodal logistics parks contribute to road transportation and inventory costs. Government measures, road connectivity, and road infrastructure development are essential for reducing transportation costs and improving supply chain efficiency.

- E-commerce business growth and the rise of e-shoppers necessitate reliable last-mile delivery and micro-mobility options in urban areas. Inventory costs, inventory operators, and outbound logistics are crucial components of retail logistics. Traditional distributors and retail outlets face competition from e-commerce platforms, necessitating the adoption of advanced logistics technologies and strategies. Logistics companies must offer packaging solutions, after-sales logistics, and transportation management to cater to the diverse needs of e-commerce businesses.

Exclusive Customer Landscape

The retail logistics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the retail logistics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, retail logistics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Burris Logistics Co. - The market encompasses the transportation, storage, and distribution of goods from manufacturers to retailers, ultimately ensuring the timely availability of products for consumers. This sector plays a critical role In the sports industry, facilitating the efficient movement of equipment and apparel from producers to retail outlets. By optimizing logistics processes, retailers can reduce costs, enhance customer satisfaction, and stay competitive in an increasingly global marketplace. The market's growth is driven by factors such as expanding consumer demand, advancements in technology, and the increasing popularity of e-commerce. Effective logistics strategies enable retailers to streamline their supply chains, minimize inventory holding costs, and adapt to shifting market trends.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Burris Logistics Co.

- C H Robinson Worldwide Inc.

- DB Schenker

- Deutsche Post AG

- DSV AS

- Expeditors International of Washington Inc.

- FedEx Corp.

- Hub Group Inc.

- J B Hunt Transport Services Inc.

- Kenco Group Inc.

- Kuehne Nagel Management AG

- Lineage Logistics Holdings LLC

- Nippon Express Holdings Inc.

- Penske Corp.

- Ryder System Inc.

- Schneider and Cie. AG

- Total Quality Logistics LLC

- Uber Technologies Inc.

- United Parcel Service Inc.

- XPO Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Retail logistics plays a crucial role In the efficient movement and delivery of goods from manufacturers to end consumers. Durable and non-durable goods alike require careful management to ensure timely delivery and optimal inventory levels. The retail industry's reliance on big data analytics and artificial intelligence (AI) has revolutionized supply chain operations, enabling proactive inventory management and demand forecasting. Real-time data and machine learning algorithms facilitate accurate inventory levels and help prevent stockouts and overstock situations. The implementation of AI in retail logistics has led to significant reductions in fulfillment expenses and improved working capital utilization. The retail landscape is undergoing a transformation, with e-commerce platforms gaining popularity due to their convenience, fast delivery, and vast product selection.

Logistics companies have adapted to this shift by offering multimodal transportation options, including trucks, ships, railcars, and aircraft, to cater to the unique requirements of e-commerce businesses. Traditional distributors and brick-and-mortar businesses have also embraced e-commerce enablement to remain competitive. Omnichannel operations, which integrate both online and offline channels, have become essential for retailers to meet customer preferences for seamless shopping experiences. Internet penetration and the rise of e-shoppers have led to increased demand for reliable reverse logistics, particularly for customer returns. Direct-to-consumer shipment and direct-to-store shipment have become essential components of retail logistics, requiring compatibility with various e-commerce platforms and retail systems.

Warehouse efficiency is a critical factor in retail logistics, with e-commerce businesses requiring high productivity to meet customer expectations for fast delivery. Logistics companies have responded by implementing advanced technologies, such as automation and robotics, to streamline warehouse operations and reduce cargo handling time. The retail industry's shift towards e-commerce has also led to increased focus on reducing vehicle costs and streamlining customs controls. Multimodal logistics parks and logistics parks have emerged as solutions to address the limited transportation infrastructure in some regions. The retail e-commerce market continues to grow, with international competition intensifying. Governments have implemented various measures to improve road connectivity and infrastructure, including highways, waterways, and railways, to support the growth of international commerce operations.

Urbanization and customer preferences for fast delivery have led to the emergence of last-mile delivery solutions, such as drones and micro-mobility options, to address the challenges of urban areas. Integrated logistics and road contract logistics have become essential for retailers to manage their supply chains effectively and efficiently. Air freight and sea freight have become crucial components of international commerce operations, with packaging solutions and after-sales logistics playing a significant role in ensuring customer satisfaction. The retail industry's focus on inventory costs and inventory operators has led to the adoption of advanced technologies, such as AI and machine learning algorithms, to optimize inventory levels and reduce carrying costs.

In conclusion, retail logistics plays a vital role In the efficient movement and delivery of goods in today's dynamic retail landscape. The integration of advanced technologies, such as big data analytics and AI, has revolutionized supply chain operations, enabling retailers to meet customer expectations for fast delivery, vast product selection, and personalized experiences. The retail industry's shift towards e-commerce has led to a focus on reducing costs, improving warehouse efficiency, and streamlining customs controls to remain competitive.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.37% |

|

Market growth 2024-2028 |

USD 265.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.26 |

|

Key countries |

US, China, Japan, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Retail Logistics Market Research and Growth Report?

- CAGR of the Retail Logistics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the retail logistics market growth of industry companies

We can help! Our analysts can customize this retail logistics market research report to meet your requirements.