Ruminant Feed Market Size 2024-2028

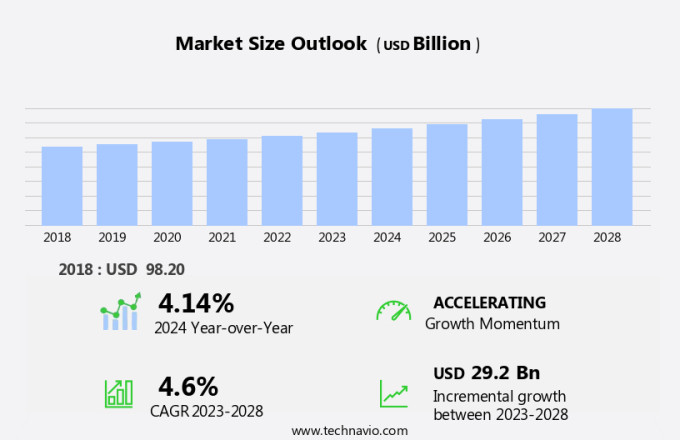

The ruminant feed market size is forecast to increase by USD 29.2 billion at a CAGR of 4.6% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. One of the primary drivers is the rising concerns over cattle health, leading farmers to invest in high-quality feed to ensure optimal animal growth and productivity. Another trend influencing the market is the increasing demand for meat products, particularly in North America, as consumers continue to prioritize protein-rich diets. Additionally, shifting consumer preferences towards vegan and plant-based food options are posing challenges to the market, necessitating the development of alternative feed sources for ruminants. Overall, these trends and challenges create a dynamic market environment, requiring continuous innovation and adaptation from feed manufacturers and suppliers.

What will be the Size of the Ruminant Feed Market During the Forecast Period?

- The market caters to the nutritional requirements of ruminant animals, including cattle, sheep, and goats, which are raised primarily for meat and milk production. Feed technologies play a significant role in enhancing feed efficiency, animal health, and sustainability. These technologies focus on optimizing the use of raw materials, such as grains and soybeans, as protein sources, as well as vitamins, minerals, fats, and other essential nutrients. Weather conditions and geopolitical events significantly impact the market, influencing the availability and pricing of raw materials. Livestock producers strive to maintain a cattle health routine and adhere to regulatory standards to ensure the quantity and quality of milk and meat production.

- Animal health remains a top priority, with a focus on preventing diseases and minimizing their impact on productivity. The market is subject to the fluctuations of commodity markets, with the prices of grains, soybeans, and other feed ingredients influencing the overall market dynamics. The industry's focus on sustainability and animal welfare continues to gain importance, driving the adoption of innovative feed solutions and production methods. Food and Agriculture Organization (FAO) reports indicate that ruminant farming contributes approximately 14.5% of global greenhouse gas emissions, making the need for sustainable feed solutions increasingly critical.

How is this Ruminant Feed Industry segmented and which is the largest segment?

The ruminant feed industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Animal Type

- Dairy cattle

- Beef cattle

- Others

- End-user

- Dairy farm

- Veterinary hospitals

- Others

- Geography

- APAC

- China

- Europe

- Spain

- North America

- US

- South America

- Brazil

- Middle East and Africa

- APAC

By Animal Type Insights

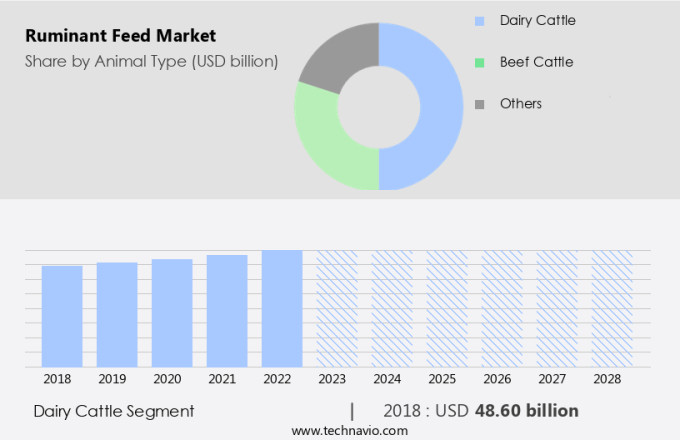

- The dairy cattle segment is estimated to witness significant growth during the forecast period.

Ruminant animals, including cattle, water buffalo, goats, and sheep, are essential for the production of various dairy products, such as milk, cheese, butter, yogurt, and more. These animals require specialized feed to maintain optimal health and productivity. The global market for ruminant feed is primarily driven by the dairy industry, which demands high-quality feed to ensure efficient milk production and animal health. Feed technologies, such as precision nutrition and functional feed additives, play a crucial role in improving feed efficiency and animal welfare. Sustainability, regulatory standards, and animal health are key considerations for feed producers.

Major raw materials include grains, soybeans, and protein sources, while weather conditions and geopolitical events can impact supply and demand. Livestock producers invest heavily in cattle healthcare to ensure productivity and outcome, focusing on disease prevention and treatment. The Food and Agriculture Organization emphasizes the importance of nutritious feed in maintaining livestock health and contributing to agriculture output, food security, and food safety.

Get a glance at the Ruminant Feed Industry report of share of various segments Request Free Sample

The dairy cattle segment was valued at USD 48.60 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

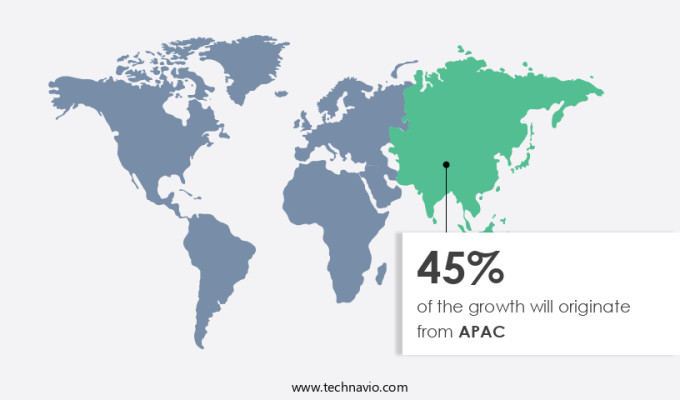

- APAC is estimated to contribute 45% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific region holds the largest share In the market due to increasing meat consumption and stringent regulations on meat quality. With abundant raw materials like corn, the market is projected to expand further. Developing economies, particularly China and India, have witnessed significant growth in livestock stocks due to their large populations and rising meat demand. Cattle, sheep, and goats are the primary focus In the ruminant feed segment. Feed technologies, including precision nutrition, functional feed additives, and eco-friendly options, are gaining popularity for improving feed efficiency, animal health, and sustainability.

Animal welfare, food safety, and cattle healthcare are crucial aspects of the industry, influencing productivity and outcome in animal farming. Factors like weather conditions, geopolitical events, and commodity markets impact the cost and availability of raw materials. The Food and Agriculture Organization emphasizes the importance of nutritious feed in livestock health and food security. Chronic diseases in livestock and disease outbreaks necessitate continuous investment and expenditure in animal healthcare.

Market Dynamics

Our ruminant feed market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of the Ruminant Feed Industry?

Rising concerns over cattle health is the key driver of the market.

- The market is witnessing significant growth due to the increasing focus on animal health and sustainability. Ruminant animals, including cattle, sheep, and goats, require specialized feed to ensure optimal productivity and outcome in meat and milk production. Feed technologies, such as precision nutrition and functional feed additives, are being adopted to improve feed efficiency and reduce the impact on the environment. Grains, such as corn and soybeans, and protein sources, like cakes and meals, are major raw materials in ruminant feed production. However, weather conditions and geopolitical events can impact the availability and prices of these raw materials, affecting the revenues of feed producers.

- Animal welfare and food safety are critical factors In the market, with the Food and Agriculture Organization emphasizing the importance of nutritious feed in livestock health and agriculture output. Cattle healthcare and productivity are essential for food security and meeting the growing demand for meat. A cattle health routine, including a schedule for vaccinations and disease prevention, is crucial for minimizing the quantity and quality of diseases in livestock. Livestock producers are also focusing on implementing regulatory standards to ensure animal health and food safety. Investment and expenditure in animal healthcare are increasing, with developed countries leading the way.

- The advantages of a healthy herd include improved immunity, reduced medication costs, and higher milk and meat production. However, poor implementation of health protocols can result in disease outbreaks, leading to increased veterinary health costs and decreased productivity. The forage feed segment, including hay, pasture, silage, starter feeds, grower feeds, and finisher feeds, is also a significant contributor to the market. Cereals, such as oats, barley, and wheat, are commonly used in these feeds.

What are the market trends shaping the Ruminant Feed Industry?

Growing demand for meat products is the upcoming market trend.

- The market is experiencing significant growth due to the increasing demand for meat and dairy products. Consumers' growing awareness of the nutritional benefits of these products, particularly protein, is driving the need for efficient and high-quality ruminant feed. The rise in meat consumption, fueled by the expansion of the food service and retail industries, is a major factor contributing to the market's growth. Weather conditions and geopolitical events can impact the availability and pricing of raw materials, such as grains and soybeans, which are crucial protein sources for ruminant animals. Feed technologies, feed efficiency, animal health, sustainability, and regulatory standards are key considerations for feed producers to ensure the production of nutritious and eco-friendly feed.

- Cattle, sheep, and goats are the primary ruminant animals In the market, with the cattle segment dominating. The forage feed segment includes hay, pasture, and silage, while starter feeds, grower feeds, and finisher feeds are used in different stages of cattle farming. Major feed producers, such as ADM, Charoen Pokphand Foods, De Heus, ForFarmers, AB Vista, Bentoli, BRF Ingredients, Haid Group, Muyuan Foods, and New Hope Liuhe, offer a range of feed products and services to cater to the varying needs of livestock producers. Animal welfare, food safety, precision nutrition, and functional feed additives are essential aspects of modern cattle farming, with a focus on improving productivity, animal health, and outcomes.

What challenges does the Ruminant Feed Industry face during its growth?

Shifting consumer preferences for vegan food is a key challenge affecting the industry growth.

- The market encompasses the production and distribution of nutritious feed for ruminant animals, including cattle, sheep, and goats, to optimize their health, productivity, and milk or meat production. Feed technologies play a crucial role in enhancing feed efficiency, animal health, and sustainability, utilizing a variety of raw materials such as grains, soybeans, and protein sources. Weather conditions and geopolitical events can impact the availability and pricing of these raw materials, influencing the revenues of feed producers. Animal welfare, food safety, and precision nutrition are essential considerations in the ruminant feed industry.

- Cattle healthcare and productivity are significant outcomes of a well-planned cattle farming routine, which includes a schedule for vaccinations, disease prevention, and nutrient management. Cattle diseases, such as chronic diseases, can impact the quantity and quality of milk and meat production, leading to increased costs for livestock owners. The Food and Agriculture Organization emphasizes the importance of nutritious feed in livestock agriculture output, contributing to food security and sustainable livestock production. The market is expected to grow due to increasing meat demand and disease outbreaks in livestock, necessitating investment and expenditure in animal healthcare.

Exclusive Customer Landscape

The ruminant feed market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ruminant feed market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ruminant feed market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alltech Inc.

- Archer Daniels Midland Co.

- Beneo GmbH

- Bentoli

- Cargill Inc.

- Charoen Pokphand Foods PCL

- Davidson Brothers Shotts Ltd.

- Epol

- Evonik Industries AG

- ForFarmers NV

- Godrej Agrovet Ltd.

- International Flavors and Fragrances Inc.

- Kamdhenu Cattle Feeds Pvt. Ltd.

- Kemin Industries Inc.

- Koninklijke DSM NV

- Land O Lakes Inc.

- Neogen Corp.

- Perdue Farms Inc.

- SHV Holdings N.V.

- Tyson Foods Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Ruminant animals, such as cattle, sheep, and goats, play a significant role in global agriculture as they provide essential sources of meat and milk. The production of these animals relies heavily on the availability and efficiency of their feed. Feed technologies have advanced significantly in recent years, focusing on improving feed efficiency, animal health, and sustainability. Feed efficiency is a critical factor In the profitability of ruminant farming. Producers strive to optimize the conversion of feed into meat or milk, as this directly impacts their revenue. Feed producers and livestock farmers collaborate to develop and implement feed strategies that maximize productivity and minimize waste.

Animal health is another crucial aspect of ruminant farming. Ensuring the wellbeing of animals is essential for optimal milk and meat production. Preventive measures, such as vaccination schedules and disease prevention routines, are implemented to minimize the impact of diseases on livestock. Precision nutrition, which involves tailoring feed formulations to meet the specific nutritional needs of individual animals, is becoming increasingly popular to improve animal health and productivity. Sustainability is a growing concern In the market. Producers are focusing on eco-friendly practices, such as using renewable resources and minimizing waste. Functional feed additives, derived from natural sources, are gaining popularity due to their ability to improve animal health and productivity while reducing the environmental impact of farming.

Further, regulatory standards play a significant role in the market. Compliance with food safety and animal welfare regulations is essential to maintain consumer trust and ensure the safety of the food supply. Additionally, regulations governing the use of certain raw materials, such as grains and soybeans, can impact the availability and cost of feed ingredients. Weather conditions and geopolitical events can also impact the market. Extreme weather events, such as droughts or floods, can disrupt the availability of forage feeds, such as hay, pasture, and silage. Geopolitical events, such as trade disputes or political instability, can impact the availability and cost of raw materials, such as grains and soybeans.

|

Ruminant Feed Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2024-2028 |

USD 29.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.14 |

|

Key countries |

China, US, Russia, Brazil, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ruminant Feed Market Research and Growth Report?

- CAGR of the Ruminant Feed industry during the forecast period

- Detailed information on factors that will drive the Ruminant Feed Market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ruminant feed market growth of industry companies

We can help! Our analysts can customize this ruminant feed market research report to meet your requirements.