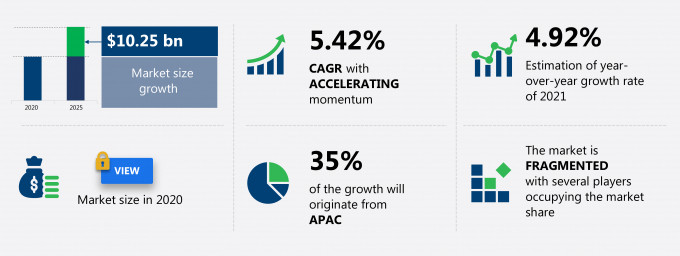

The running gear market share is expected to increase by USD 10.25 billion from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 5.42%.

This running gear market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers running gear market segmentation by product (running footwear, running apparel, and others) and geography (APAC, Europe, North America, South America, and MEA). The running gear market report also offers information on several market vendors, including Adidas AG, ANTA Sports Products Ltd., ASICS Corp., Columbia Sportswear Co., New Balance Athletics Inc., Nike Inc., PUMA SE, Skechers USA Inc., Under Armour Inc., and VF Corp. among others.

What will the Running Gear Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Running Gear Market Size for the Forecast Period and Other Important Statistics

Running Gear Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a negative impact on the market growth during and post COVID-19 era. The increasing number of anti-sweatshop campaigns is notably driving the running gear market growth, although factors such as increasing raw material cost impacting pricing strategy may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the running gear industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Running Gear Market Driver

The increasing number of anti-sweatshop campaigns is one of the key drivers supporting the running gear market growth. The growth of online stores is expected to escalate rapidly during the forecast period due to Internet penetration and a growing number of smartphone users. Competitive prices, convenience, heavy discounts, COD options, and fast-delivery services are some of the factors attracting consumers to shop online. Moreover, this also results in an increase in sales through the online channel. In addition, increasing internet penetration in developing economies is a positive indicator of growing online sales during the forecast period. This will also help the global running gear market grow during the forecast period

Key Running Gear Market Trend

Customization and personalization of running footwear and apparel is another factor supporting the running gear market growth. The customization facility allows consumers to choose their own designs, styles, and colors to get custom-made running footwear. For instance, Nike's running shoe named Nike Air Zoom Pegasus 34 GPX Id Running Shoe can be easily customized and personalized by a buyer. The parts of the running shoe, which can be customized, include the company's logo, as well as the shoe uppers, lining, midsole, topline midsole, laces, and outsole. In addition, the buyers can also personalize products by incorporating their desired text and graphics on the running shoe. This trend may help in the significant growth of the market during the forecast period. The vendors are emphasizing such strategies to build a wider consumer base.

Key Running Gear Market Challenge

The increasing raw material cost impacting pricing strategy is hindering the running gear market growth. Ethylene-vinyl acetate (EVA), which is an elastomeric polymer, is the raw material used in the production of soles of sports footwear, including running footwear. Fluctuations in the price of this material have a direct impact on the prices of running footwear and other specific sports footwear. This further leads the vendors to increase the prices of their products. This chain of increasing costs impacts the pricing strategy of vendors, having a detrimental effect on the cash flow of the players in the running gear market. The slimming of profit margins makes spending their earnings on other activities or marketing campaigns difficult for the vendors to due to fluctuations in raw material costs. This may limit the market's growth during the forecast period.

This running gear market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the running gear market as a part of the global apparel, accessories, and luxury goods market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the running gear market during the forecast period.

Who are the Major Running Gear Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Adidas AG

- ANTA Sports Products Ltd.

- ASICS Corp.

- Columbia Sportswear Co.

- New Balance Athletics Inc.

- Nike Inc.

- PUMA SE

- Skechers USA Inc.

- Under Armour Inc.

- VF Corp.

This statistical study of the running gear market encompasses successful business strategies deployed by the key vendors. The running gear market is fragmented and the vendors are adopting growth strategies such as innovations, price, and product quality to compete in the market.

Product Insights and News

- PUMA SE - The company offers running gears that includes running shorts, running shoes and training shorts which are constructed from high-tech fabric with innovative body temperature regulation, under the brand name of PUMA.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The running gear market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Running Gear Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the running gear market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chains is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Running Gear Market?

For more insights on the market share of various regions Request for a FREE sample now!

35% of the market’s growth will originate from APAC during the forecast period. China and Japan are the key markets for running gear market in APAC. Market growth in this region will be faster than the growth of the market in other regions.

The growing awareness of the benefits of running and other physical activities will facilitate the running gear market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The market in the region witnessed certain challenges due to the COVID-19 pandemic in 2020. India, China, and Pakistan are some of the countries in the region that have been badly affected by the pandemic. For instance, as of December 23, 2021, the total number of recorded COVID 19 cases in India was 34.6 million, with 4.78 million associated deaths. However, with government-imposed restrictions lifted in the fourth quarter of 2021 because of the initiation of vaccination drives and people returning to their normal lives, outdoor activities and sporting events across countries are again being held. Considering these factors, the global running gear market is expected to grow during the forecast period.

What are the Revenue-generating Product Segments in the Running Gear Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The running gear market share growth by the running footwear segment will be significant during the forecast period. Running footwear refers to shoes that are designed for outdoor activities, such as athletics and workouts. The new running shoe uses the innovative GUIDESOLE technology, which is designed to reduce energy loss and give that feeling of effortless running. Also, it has an ergonomic, precision-shaped curved sole, which works by limiting the movement of the ankle joint, an area that expends the most amount of energy. The launch of such innovative products with added features can lead to the growth of the market during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the running gear market size and actionable market insights on post COVID-19 impact on each segment.

|

Running Gear Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.42% |

|

Market growth 2021-2025 |

$ 10.25 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

4.92 |

|

Regional analysis |

APAC, Europe, North America, South America, and MEA |

|

Performing market contribution |

APAC at 35% |

|

Key consumer countries |

US, China, UK, Germany, and Japan |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

adidas AG, ANTA Sports Products Ltd., ASICS Corp., Columbia Sportswear Co., New Balance Athletics Inc., Nike Inc., PUMA SE, Skechers USA Inc., Under Armour Inc., and VF Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Running Gear Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive running gear market growth during the next five years

- Precise estimation of the running gear market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the running gear industry across APAC, Europe, North America, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of running gear market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch