Safety Headgear Market Size 2024-2028

The safety headgear market size is forecast to increase by USD 2.06 billion at a CAGR of 4.5% between 2023 and 2028. In the market, employers are increasingly prioritizing the use of head protection to ensure worker safety. This is particularly important in industries with high risks of falling objects or hazards to the eyes. The market is witnessing significant trends, including the adoption of engineering controls, Personal Protective Equipment, administrative controls, and quality options to enhance the effectiveness of safety headgear. Moreover, the integration of advanced technologies, such as smart textiles, is gaining traction, providing enhanced protection and comfort to users. However, fluctuations in raw material prices pose a challenge to market growth. Employers must carefully consider these factors when selecting safety headgear to ensure optimal protection and cost-effectiveness.

Market Analysis

The market holds significant importance in the realm of industrial activities, with a primary focus on safeguarding employees from various workplace hazards. Brain injuries, a serious concern in industrial settings, can result from falling objects, electrical exposure, or other workplace mishaps. Employer responsibility towards employee safety is paramount, and safety headgear serves as an essential component in ensuring a secure work environment. Worker safety awareness has been on the rise, with a growing emphasis on implementing engineering and administrative controls to mitigate potential risks. Statutory restrictions mandate the use of safety headgear in specific industrial applications, further underscoring its importance.

Furthermore, the market for safety headgear encompasses a diverse range of products designed to protect various areas of the head, including those that shield the eyes and neck from harm. Industrialization has led to an increased need for safety measures, particularly in sectors with high-risk activities. Safety headgear plays a crucial role in this regard, offering quality options that cater to different industries and applications. Fatal head injuries can result from various workplace hazards, including falling objects and electrical exposure. Safety headgear acts as a barrier against these hazards, significantly reducing the risk of serious injury or fatality. In the context of industrial workplaces, safety headgear is an indispensable investment for employers seeking to prioritize employee safety and adhere to regulatory requirements. Moreover, by implementing the use of safety headgear, employers can create a safer work environment and minimize the potential for workplace accidents.

Market Segmentation

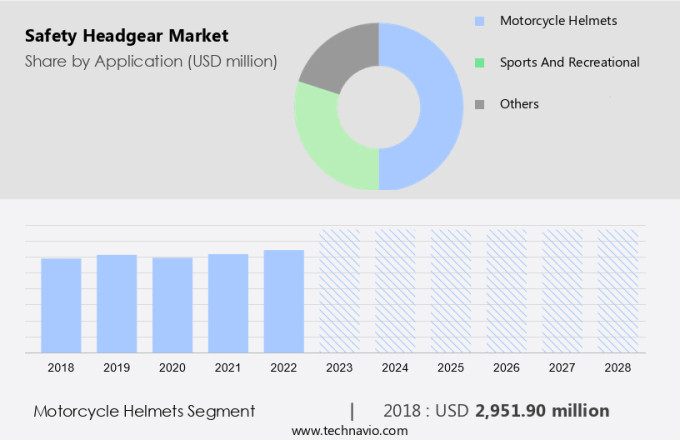

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Motorcycle helmets

- Sports and recreational

- Others

- Product

- Conventional safety headgear

- Bulletproof safety headgear

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- UK

- France

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

The motorcycle helmets segment is estimated to witness significant growth during the forecast period. The market encompasses various types of protective headgear used in industrial workplaces and specific industries, including mining and construction. One of the most significant segments within this market is motorcycle helmets, which are essential for riders to ensure their safety from fatal head injuries caused by electrical exposure or accidents. Motorcycle helmets are mandatory in some, but not all, states in the US, making it crucial for riders to prioritize their safety. The motorcycle helmets segment is thriving due to its extensive range of offerings, catering to various purposes and regional standards. However, the lack of mandatory helmet use laws in several states can hinder the market growth.

Despite this, the importance of motorcycle helmets in safeguarding riders from potential head injuries cannot be overstated. Mining and construction industries also rely heavily on safety headgear to protect workers from various hazards, including falling objects, electrical exposure, and other workplace accidents. Proper implementation and enforcement of safety regulations in these industries can significantly reduce the risk of fatal head injuries and contribute to the growth of the market. In conclusion, the market in the US is a vital sector that plays a crucial role in safeguarding the health and well-being of individuals in various industries and activities.

Get a glance at the market share of various segments Request Free Sample

The Motorcycle helmets segment accounted for USD 2.95 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

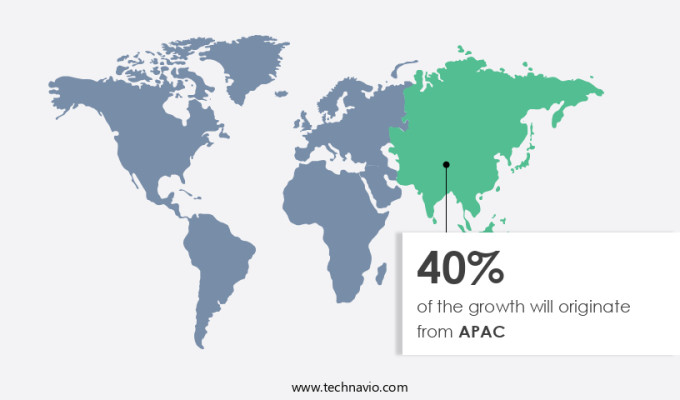

APAC is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the global market, the significance of safety headgear continues to increase due to the rising awareness of worker safety and the potential risks associated with brain injuries. Statutory restrictions mandate the use of protective headgear in various industries, particularly those with high-risk activities. PE helmets, a type of safety headgear, are gaining popularity due to their ability to protect against impact and penetration. Advancements in technology, including Artificial Intelligence (AI), are contributing to the evolution of safety headgear. These innovations offer enhanced protection and improved comfort for employees. The market is expected to grow substantially due to these factors, as well as the increasing demand for employee safety in various sectors.

In the Asia Pacific (APAC) region, the market for safety headgear is expected to experience significant growth. The region's rapid industrialization and commercial development are driving the demand for safety equipment. Countries like China and India are leading this growth due to their expanding economies and increasing industrial activity. Moreover, defense expenditure in the region is also a major factor fueling the demand for bulletproof headgear. Australia, alongside China and Singapore, is a popular destination for investments in safety headgear manufacturing and distribution. The market for safety headgear in APAC is expected to remain strong, with China being the largest importer of oil and gas, leading to a high demand for protective headgear in the energy sector.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The increasing number of road accidents is notably driving market growth. Brain injuries and head injuries are common occupational hazards in various industries, particularly in construction and mining. Employer responsibility for worker safety awareness is paramount, with statutory restrictions mandating the use of safety headgear during industrial activities. PE helmets made of polyethylene material and ABS helmets offer protection against lateral shock and falling objects, while bump caps shield the head from minor impacts. Industrialization has led to an increased focus on employee safety, with hard hats, made of polycarbonate material, becoming a standard requirement.

Moreover, these protective headgears come in various quality options, with features such as protective padding, colours, and stickers for identification. They safeguard against electrical exposure, eye and neck injuries, and fatal head injuries. Engineering and administrative controls are essential complements to safety headgear, but they cannot replace the importance of these protective devices. Protective padding made of materials like polyurethane offers additional comfort and protection for the skull and spinal cord. Employers must ensure compliance with safety regulations to prevent occupational accidents and minimize the risk of skin damage and fatalities. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

The adoption of smart textiles and advanced technologies is the key trend in the market. Brain injuries and head injuries are common occupational hazards in various industries, particularly in construction and mining. Employer responsibility for worker safety awareness is paramount, with statutory restrictions mandating the use of safety headgear during industrial activities. Hard hats, PE helmets, ABS helmets, bump caps, and other protective headgear are essential to prevent injuries from falling objects, electrical exposure, and lateral shock.

Furthermore, materials like polyethylene, polycarbonate, and even protective padding made of polyurethane offer varying levels of protection. Employers implement engineering and administrative controls, such as quality options, colours, stickers, and identification markings, to ensure employee safety. Hard hats shield the head, eyes, neck, and even the spinal cord from harm. Protective padding and colours help in quick identification of employees in case of occupational accidents. In the event of fatal head injuries, safety headgear can be a lifesaver. Industrialization has necessitated the use of safety headgear in various workplace settings, making it an indispensable component of industrial workplaces. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

The fluctuations in raw material prices is the major challenge that affects the growth of the market. Brain injuries and head injuries are common occupational hazards in various industrial activities and construction sites. With increasing worker safety awareness, statutory restrictions, and engineering controls, the use of safety headgear has become mandatory for labourers/workers engaged in industrial workplaces. Hard hats, PE helmets, ABS helmets, bump caps, and other protective headgear are widely used to shield employees from lateral shock, falling objects, electrical exposure, and other hazards. The materials used in manufacturing safety headgear include polyethylene, polycarbonate, and polyurethane, which offer varying levels of protection against impact and penetration.

In addition, PE helmets are lightweight and suitable for electrical work, while polycarbonate and ABS helmets provide enhanced protection against lateral shock and impact. Protective padding, colours, and stickers are used for identification purposes, making it easier for employers to keep track of their employees' safety equipment. Safety headgear also comes in various colours and designs to cater to individual preferences. In addition, some headgear may have identification stickers to help in the event of occupational accidents. Safety headgear is essential for protecting the head, eyes, neck, and spine from fatal injuries. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M Co. - The company offers safety headgear that includes 3M SecureFit Safety Helmet, 3M SecureFit Safety Helmet X5001-ANSI, and 3M SecureFit Safety Helmet X5001V-ANSI.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- ArmorSource LLC

- BAE Systems Plc

- Centurion Safety Products Ltd.

- Concord Helmet and Safety Products Pvt. Ltd.

- Dainese Spa

- Delta Plus Group SA

- Dragerwerk AG and Co. KGaA

- Bullard

- ELMON SA

- Honeywell International Inc.

- JSP Ltd.

- Kimberly Clark Corp.

- MKU Ltd.

- MSA Safety Inc.

- OccuNomix International LLC

- Pyramex Safety

- Schuberth GmbH

- UVEX WINTER HOLDING GmbH and Co. KG

- VOSS HELME GmbH and Co KG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing worker safety awareness and statutory restrictions in various industries. Brain injuries, a common result of head trauma, are a major concern in industrial workplaces such as construction sites and mining. Hard hats, including PE helmets and ABS helmets, are the most common safety headgear used to prevent head injuries. These helmets are made of materials like polyethylene and polycarbonate, providing protection against lateral shock, falling objects, and electrical exposure. Employers are implementing engineering and administrative controls to minimize workplace hazards. Safety headgear comes in various quality options, with protective padding, colours, stickers, and identification features to ensure employee safety.

Furthermore, the market is witnessing innovation with the introduction of AI-enabled helmets, offering advanced features like impact absorption and electrical insulation. Head injuries can result in fatalities, affecting the victim's brain, eyes, neck, and spinal cord. The market aims to prevent occupational accidents, saving lives and reducing the emotional burden on loved ones. Industrialization and the increase in industrial activities have led to a growing demand for safety headgear in industries like construction and engineering.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 2.06 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 40% |

|

Key countries |

US, China, Japan, Germany, France, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., ArmorSource LLC, BAE Systems Plc, Centurion Safety Products Ltd., Concord Helmet and Safety Products Pvt. Ltd., Dainese Spa, Delta Plus Group SA, Dragerwerk AG and Co. KGaA, Bullard, ELMON SA, Honeywell International Inc., JSP Ltd., Kimberly Clark Corp., MKU Ltd., MSA Safety Inc., OccuNomix International LLC, Pyramex Safety, Schuberth GmbH, UVEX WINTER HOLDING GmbH and Co. KG, and VOSS HELME GmbH and Co KG |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch