SATCOM On The Move Market Size 2025-2029

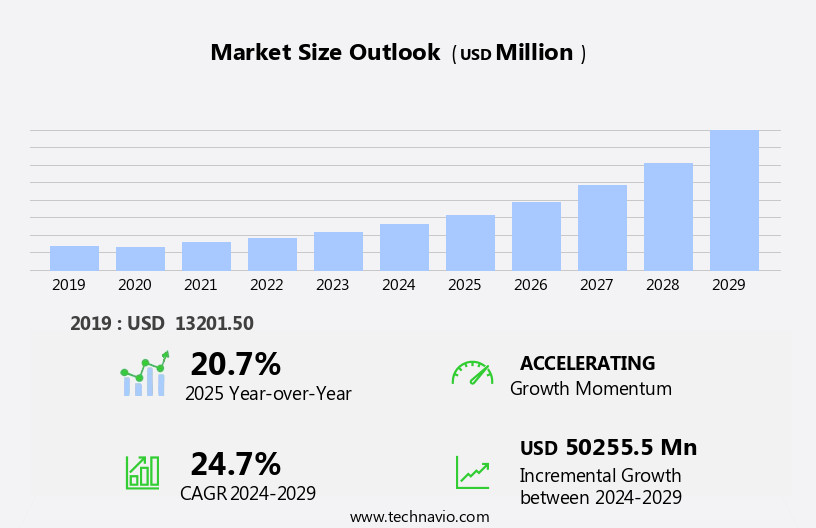

The satcom on the move market size is forecast to increase by USD 50.26 billion, at a CAGR of 24.7% between 2024 and 2029.

- The SATCOM on-the-move market is experiencing significant growth, driven by the increasing demand for customized solutions for unmanned ground vehicles (UGVs). This trend is particularly notable in industries such as defense and transportation, where real-time communication and data transfer are essential. Another key driver is the rising adoption of small satellites for various applications, including broadband connectivity, remote sensing, and disaster management. However, the high cost of satellite services remains a significant challenge for market participants. To capitalize on opportunities and navigate these challenges effectively, companies must focus on innovation and cost optimization.

- This could involve developing more efficient satellite technologies, offering flexible pricing models, or partnering with other industry players to share resources and expertise. By addressing these issues, market participants can position themselves for long-term success in the dynamic and evolving SATCOM on-the-move landscape.

What will be the Size of the SATCOM On The Move Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the increasing demand for reliable and high-performance communications solutions across various sectors. Disaster relief organizations rely on satellite communications for real-time data transmission and emergency response, while data analytics and machine learning applications in the energy sector require low-latency, high-throughput connectivity. Edge computing and maritime communications are also gaining traction, enabling remote control of vessels and optimizing network performance. Air traffic management and network integration are crucial for ensuring network reliability and efficient data transmission in the aviation industry. Frequency spectrum management and interference mitigation are essential for maintaining signal quality and network availability in a crowded satellite environment.

User interface design and network management play a vital role in enhancing user experience and optimizing network performance. Medium earth orbit satellites offer advantages in terms of lower latency and improved coverage for applications such as emergency response and remote monitoring. Network security and government agencies require robust encryption and network optimization for secure communications. Navigation systems, financial services, and logistics & transportation sectors benefit from satellite-based asset tracking and location-based services. Oil & gas exploration and mining operations require high-reliability voice communication and system monitoring. Satellite constellations and high-throughput satellite technology enable faster data transmission and improved network availability for media & broadcasting and business intelligence applications.

RF amplifiers, application programming interfaces, and antenna pointing systems are essential components of satellite networks. Network availability, performance analysis, and packet switching are critical for network optimization and ensuring network reliability in commercial aviation and construction projects. Error correction and antenna stabilization are essential for maintaining network connectivity in challenging environments. In the energy sector, predictive analytics and signal-to-noise ratio optimization are essential for improving network efficiency and reducing downtime. Cloud computing and network optimization are crucial for enabling big data processing and system integration in various industries. The ongoing development of artificial intelligence, modulation techniques, and coding schemes is driving innovation in satellite communications and expanding its applications across various sectors.

TCP/IP protocol and network security are essential for ensuring network reliability and data security. Overall, the market is a dynamic and evolving landscape, with continuous innovation and development driving growth and expansion across various industries.

How is this SATCOM On The Move Industry segmented?

The satcom on the move industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Platform

- Land

- Airborne

- Maritime

- End-user

- Commercial

- Government and defense

- Frequency Range

- Ku-band

- Ka-band

- X-band

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Platform Insights

The land segment is estimated to witness significant growth during the forecast period.

The market encompasses a diverse range of applications and industries, with the land segment being particularly noteworthy. In this sector, satellite communication systems play a pivotal role, especially in sectors requiring real-time connectivity and communication, such as military, disaster relief, and oil & gas exploration. For instance, military forces utilize these systems to ensure uninterrupted communication and data exchange in remote and challenging environments. This enables troops to maintain contact with command headquarters and coordinate operations effectively, enhancing overall mission success. Moreover, the maritime communications segment is another significant contributor to the market's growth. Here, satellite communication systems are employed to provide connectivity to ships and vessels at sea, ensuring seamless communication between crew members, ships, and shore-based teams.

This is crucial for ensuring the safety and efficiency of maritime operations, particularly in areas with limited terrestrial infrastructure. Furthermore, the integration of advanced technologies such as edge computing, machine learning, and data analytics is transforming the market. These technologies enable real-time processing and analysis of data, improving network performance, reliability, and security. Additionally, the use of high-throughput satellites and satellite constellations allows for increased data rates and improved coverage, making satellite communication a viable option for industries previously reliant on terrestrial infrastructure. Network management and optimization are also critical aspects of the market. Service level agreements, network availability, and performance analysis ensure that users receive high-quality, reliable communication services.

Furthermore, the integration of user interfaces and application programming interfaces (APIs) enables easy integration with existing systems and applications, enhancing user experience and productivity. In the energy sector, satellite communication systems are used for remote monitoring and control of infrastructure, improving operational efficiency and reducing downtime. Similarly, in the financial services industry, satellite communication provides secure and reliable connectivity for remote transactions and data exchange. Network security is another crucial aspect of the market, with encryption techniques, coding schemes, and modulation methods ensuring data privacy and protection. Additionally, interference mitigation technologies help maintain signal-to-noise ratios, ensuring clear and reliable communication.

The mining operations sector also benefits from satellite communication systems, enabling real-time monitoring and control of operations, improving safety and efficiency. Construction projects can also leverage satellite communication for remote monitoring and management, ensuring timely progress and reducing costs. In conclusion, the market is a dynamic and evolving industry, driven by the need for reliable, secure, and high-performance communication solutions in various industries and applications. The integration of advanced technologies and the transformation of traditional communication systems are key trends shaping the market's growth.

The Land segment was valued at USD 6.96 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The Ku-band segment of the Satellite Communications On The Move market showcases advanced technological capabilities, providing operational benefits for various applications across multiple sectors. With a frequency spectrum that facilitates uninterrupted connectivity, Ku-band is instrumental in delivering consistent performance, particularly in mission-critical operations. Its compatibility with data transmission, video, and voice communications makes it indispensable for industries such as maritime communications, air traffic management, emergency response, and oil & gas exploration. Advancements in antenna design and frequency stability have further enhanced Ku-band's capabilities, enabling it to meet the evolving demands of its users. Machine learning and artificial intelligence are integrated into network management and system monitoring, ensuring optimal network performance and reliability.

Edge computing and data analytics play a crucial role in real-time data processing, while network integration and packet switching facilitate seamless communication between systems. The energy sector, financial services, media & broadcasting, and logistics & transportation industries have embraced the use of Ku-band for their communication needs. Its high-throughput satellite technology supports asset tracking, location-based services, and remote monitoring, making it an essential tool for fleet management and navigation systems. Moreover, its compatibility with voice communication, cloud computing, and network optimization makes it an attractive choice for commercial aviation and construction projects. The satellite constellation and satellite transponder technologies have expanded the reach of Ku-band, ensuring network availability in remote areas and enabling global connectivity.

Network security and government agencies rely on its robust encryption schemes and modulation techniques to protect sensitive information. The integration of application programming interfaces, rf amplifiers, and ip routing further enhances its functionality and adaptability. In the realm of disaster relief and emergency response, Ku-band's ability to deliver high-speed data transmission and real-time communication is invaluable. Its compatibility with predictive analytics and business intelligence tools enables effective decision-making and efficient resource allocation. In the mining operations sector, Ku-band's high-data rate capabilities support real-time monitoring and error correction, ensuring optimal performance and productivity. The evolving trends in the market include the integration of user interfaces, antenna pointing, and data visualization tools, enhancing user experience and network management.

The satellite network's ability to adapt to low earth orbit and geostationary orbit systems further expands its reach and applicability. Overall, the Ku-band segment of the market continues to innovate and adapt to the evolving communication needs of various industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of SATCOM On The Move Industry?

- The increasing demand for customized Satellite Communications On-The-Move (SATCOM) solutions is the primary driver for market growth in the unmanned ground vehicles (UGVs) sector. These advanced communications systems enable UGVs to maintain real-time connectivity and data transfer capabilities, enhancing their operational efficiency and effectiveness.

- The market is experiencing significant growth due to the increasing demand for uninterrupted communication solutions for Unmanned Ground Vehicles (UGVs). SATCOM on the Move refers to communication systems that enable continuous connectivity while the vehicle is in motion. UGVs are increasingly used in various industries, such as defense, agriculture, mining, and transportation, for tasks requiring real-time data transfer and communication in critical operations. These vehicles are often deployed in remote or hazardous environments where traditional communication systems may not be reliable or accessible. Key technologies driving the market include advanced coding schemes, artificial intelligence, and modulation techniques. The TCP/IP protocol is widely used for data transmission, while system integration of hardware infrastructure and software applications is essential for seamless communication.

- Antenna stabilization and tracking systems ensure network availability, while error correction techniques maintain data integrity. Geostationary orbit provides the necessary coverage for SATCOM on the Move applications. Commercial aviation also benefits from this technology, enabling real-time communication and data transfer during flights. Overall, the market's growth is fueled by the need for efficient and reliable communication systems for UGVs in various industries.

What are the market trends shaping the SATCOM On The Move Industry?

- The increasing utilization of small satellites for diverse applications represents a significant market trend. Small satellites are gaining popularity due to their affordability, flexibility, and ease of deployment.

- The market is experiencing significant growth due to the increasing adoption of small satellites for various applications. These satellites, which weigh between 1 and 500 kilograms, offer cost-effectiveness and versatility, making them popular choices for communication, earth observation, scientific research, and technology demonstration. Small satellites are gaining traction in various industries due to their affordability compared to traditional, larger satellites. The cost savings enable organizations with limited budgets to access space-based services. One of the primary applications of small satellites in the market is disaster relief. These satellites can provide real-time data analytics, machine learning, and edge computing capabilities, enabling faster and more effective emergency response.

- Moreover, they can offer maritime communications, improving safety and efficiency in shipping and fishing industries. Network integration and service level agreements are crucial aspects of the market. User interfaces and network management systems must be designed to provide seamless user experiences. Medium Earth Orbit (MEO) satellites offer advantages such as lower latency and improved frequency spectrum utilization, making them ideal for applications requiring real-time data transmission. Interference mitigation is another essential factor in the market. As the number of satellites and terrestrial networks increases, it becomes essential to manage and mitigate potential interference to ensure reliable data transmission.

- Machine learning algorithms and advanced network management systems can help mitigate interference and optimize network performance. In the aviation industry, air traffic management relies on reliable and secure communication networks. SATCOM on the Move technology can provide real-time data transmission, enabling improved fleet management and remote control capabilities. These capabilities are essential for ensuring safety and efficiency in the aviation industry. In conclusion, the market is witnessing significant growth due to the increasing adoption of small satellites. These satellites offer cost savings, versatility, and advanced capabilities, making them ideal for various applications, including disaster relief, maritime communications, and air traffic management.

- Network integration, user experience, and interference mitigation are essential factors driving the growth of the market.

What challenges does the SATCOM On The Move Industry face during its growth?

- The escalating costs of satellite services pose a significant challenge to the industry's growth trajectory.

- The market faces a significant challenge in the form of high costs, which impedes its expansion and accessibility. The infrastructure necessary for satellite communication involves a constellation of satellites in space, ground control stations, and signal processing equipment. Establishing and maintaining this infrastructure is intricate and costly, with the expense of launching a single satellite reaching millions of dollars. Consequently, these costs are transferred to consumers, resulting in expensive satellite services. In addition to infrastructure costs, other factors impacting the market include the need for high-performance RF amplifiers, application programming interfaces for seamless integration with navigation systems and financial services, and the increasing demand for high-throughput satellite for applications such as energy sector predictive analytics, asset tracking, media & broadcasting, and oil & gas exploration.

- Furthermore, business intelligence, network reliability, system monitoring, packet switching, and signal-to-noise ratio are essential considerations for market growth. By addressing these challenges, the market can offer improved efficiency, cost savings, and enhanced capabilities to various industries.

Exclusive Customer Landscape

The satcom on the move market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the satcom on the move market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, satcom on the move market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Anokiwave Inc. - EM Solutions, a subsidiary of our company, delivers in-motion satellite communications. Leveraging advanced technology, we provide uninterrupted connectivity for mobile platforms, enabling seamless data transfer and real-time information exchange. Our satellite communications solution caters to various industries, including transportation, energy, and emergency services, enhancing operational efficiency and safety. By harnessing the power of geostationary satellites, we ensure reliable connectivity even in remote locations, bridging the gap between isolation and global communication.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anokiwave Inc.

- Ball Corp.

- EchoStar Corp.

- Elbit Systems Ltd.

- Electro Optic Systems Pty Ltd.

- General Dynamics Corp.

- Get SAT Ltd.

- Gilat Satellite Networks Ltd.

- Honeywell International Inc.

- Kymeta Corp.

- L3Harris Technologies Inc.

- ND SatCom GmbH

- Novanta Inc.

- OESIA NETWORKS SL

- Ovzon AB

- Thales Group

- Turkish Aerospace Industries Inc.

- Ultralife Corp.

- VectorNav Technologies LLC

- Viasat Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in SATCOM On The Move Market

- In February 2023, Intelsat, a leading global satellite operator, announced the launch of its next-generation mobility platform, Intelsat OneWeb, which aims to provide high-speed connectivity for aviation and maritime industries (Intelsat Press Release, 2023). This platform, a result of Intelsat's merger with OneWeb, combines the extensive coverage of Intelsat's geostationary satellites with OneWeb's low Earth orbit constellation.

- In October 2024, Thales Alenia Space, a major European aerospace company, unveiled its new on-the-move satellite communication system, FalconSat, in partnership with Airbus Defense and Space (Thales Alenia Space Press Release, 2024). This system, designed for military and civilian applications, offers high-throughput connectivity and is expected to significantly enhance the capabilities of moving platforms.

- In March 2025, Kacific Broadband Satellites, a Singapore-based satellite operator, secured a strategic partnership with the Pacific Islands Country Communications Infrastructure Project (PICCIP) to provide satellite broadband services to remote Pacific Island nations (Kacific Broadband Satellites Press Release, 2025). This collaboration will help bridge the digital divide and improve communication infrastructure in these regions.

- In May 2025, SpaceX, the American aerospace manufacturer and space transportation company, successfully launched its Starlink Gen2 satellite constellation, which is expected to significantly enhance the capacity and coverage of its satellite broadband services (SpaceX Press Release, 2025). This technological advancement will enable faster and more reliable satellite connectivity for on-the-move applications.

- These developments underscore the growing importance and innovation within the market. Companies are focusing on strategic partnerships, mergers, and technological advancements to expand their offerings and cater to the increasing demand for high-speed connectivity for moving platforms.

- Sources:

- Intelsat Press Release (2023, February 15). Intelsat and OneWeb Announce Strategic Partnership to Create Intelsat OneWeb, a New Global Connectivity Powerhouse. Business Wire.

- Thales Alenia Space Press Release (2024, October 12). Thales Alenia Space and Airbus Defense and Space Announce Strategic Partnership for FalconSat. Business Wire.

- Kacific Broadband Satellites Press Release (2025, March 23). Kacific and PICCIP Partner to Deliver Affordable, High-Speed Satellite Broadband to Pacific Island Nations. Business Wire.

- SpaceX Press Release (2025, May 18). SpaceX Successfully Launches Starlink Gen2 Satellites, Marking a Major Milestone in the Expansion of Global Satellite Internet Coverage. Business Wire.

Research Analyst Overview

- In the dynamic the market, transponder bandwidth and antenna gain play crucial roles in ensuring optimal system performance. Software updates are essential for cost optimization and maintaining a competitive edge, as they provide return on investment through improved network latency and enhanced satellite payload capabilities. Ground stations and network monitoring tools enable network design and deployment, while system performance metrics such as signal strength, bit error rate, and data compression are key indicators of network efficiency. Network topology and network architecture require careful planning for network capacity and resilience. Security patches and data backup are vital for safeguarding against potential network vulnerabilities.

- Network upgrades and system maintenance are ongoing tasks to ensure network troubleshooting and data recovery are effective. Power consumption and network optimization techniques are essential for operational efficiency, while data de-duplication and data storage help manage the vast amounts of data generated. Network capacity planning and network architecture design are ongoing processes, with cloud-based platforms offering flexible solutions for businesses seeking to stay competitive. The market trends include the integration of advanced network monitoring tools, network design innovations, and the adoption of new network optimization techniques to enhance system performance and reduce costs.

- Competitive advantages lie in the ability to provide reliable, high-speed connectivity with minimal latency, making Satcom on the Move an indispensable solution for businesses requiring seamless, mobile communications.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled SATCOM On The Move Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 24.7% |

|

Market growth 2025-2029 |

USD 50255.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

20.7 |

|

Key countries |

US, China, Germany, UK, Canada, Japan, France, Italy, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this SATCOM On The Move Market Research and Growth Report?

- CAGR of the SATCOM On The Move industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the satcom on the move market growth of industry companies

We can help! Our analysts can customize this satcom on the move market research report to meet your requirements.