Seitan Market Size 2024-2028

The seitan market size is forecast to increase by USD 63.8 million, at a CAGR of 3.27% between 2023 and 2028.

- The market is experiencing significant growth, driven by the expanding vegan population and enhanced channels of distribution. The vegan demographic continues to expand, fueled by increasing consumer awareness and concern for animal welfare and health. Seitan, a versatile plant-based protein derived from wheat gluten, caters to the dietary needs and preferences of this demographic. However, the market faces challenges due to the adverse effects of highly processed food. Consumers are increasingly seeking natural, whole food alternatives, which could potentially limit the appeal of seitan, as it is a highly processed food.

- Manufacturers must address these concerns by focusing on product innovation, such as developing more natural and minimally processed seitan options, to cater to the evolving consumer preferences and maintain market competitiveness.

What will be the Size of the Seitan Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by consumer demand for gluten-free alternatives and the ongoing research and development in the field. Gluten strength and textural characteristics are key considerations in the production process, with processing parameters such as seitan texture analysis, wheat protein isolate, and functional properties playing crucial roles. Manufacturers strive for optimal yield and cost efficiency, employing various techniques like vital wheat gluten, gluten washing, and emulsifying capacity to enhance product quality. Consumer acceptance of seitan and other gluten-free alternatives is on the rise, driven by increasing awareness of celiac disease and gluten intolerance. This trend has led to innovation in seitan culinary applications, with dough kneading methods and rheological properties being explored to create a more authentic texture and mouthfeel.

Storage conditions and shelf life extension are essential factors in ensuring product quality and safety. Food safety regulations and food processing technology are continuously evolving to address concerns around microbial contamination and gluten hydration capacity. The seitan production process is a dynamic and complex one, with ongoing research focusing on protein solubility, water absorption, and protein denaturation effects to optimize yield and improve nutritional composition. The amino acid profile and allergenic protein content of seitan are important considerations for manufacturers and consumers alike. Gluten elasticity and gluten hydrolysis are key factors in the production process, with sensory evaluation playing a critical role in ensuring product quality and consumer satisfaction.

The market is a continually unfolding landscape, with ongoing research and innovation driving new developments and applications across various sectors. From food manufacturing to culinary arts, the potential for seitan and other gluten-free alternatives is vast and evolving.

How is this Seitan Industry segmented?

The seitan industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Conventional seitan

- Organic seitan

- End-User

- Vegan Consumers

- Restaurants

- Food Manufacturers

- Distribution Channel

- Supermarkets

- Online Retail

- Specialty Stores

- Application

- Meat Substitutes

- Bakery Products

- Processed Foods

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

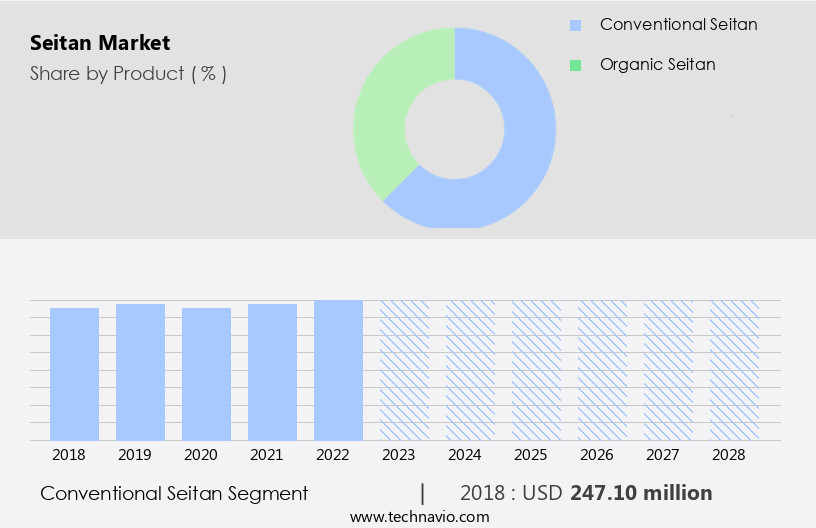

The conventional seitan segment is estimated to witness significant growth during the forecast period.

Seitan, a versatile and nutritious plant-based protein derived from wheat gluten, has gained significant attention in the global food industry due to its textural similarities to meat and its potential health benefits. The market for seitan continues to evolve, driven by increasing consumer acceptance of gluten-free alternatives and the functional properties of wheat protein isolate. Seitan's textural characteristics, achieved through various processing parameters, make it an excellent substitute for meat in various culinary applications. Manufacturers employ different methods to optimize yield and enhance the elasticity and protein solubility of seitan. Sensory evaluation plays a crucial role in ensuring product quality, while food safety regulations and processing technology help maintain product safety and extend shelf life.

Seitan's nutritional composition, rich in essential amino acids and low in saturated fats, caters to the dietary needs of various consumer segments. The production process involves gluten washing techniques, followed by kneading and hydration to achieve the desired texture. Packaging methods and storage conditions are essential to maintain the product's quality and extend its shelf life. Microbial contamination and protein denaturation effects are critical concerns in seitan production, necessitating stringent quality control measures. The conventional seitan segment dominates the market due to its widespread availability and consumer preference. Major manufacturers include Biolab, Upton's Naturals, and Primal Spirits. APAC is the largest producer and consumer of seitan, driven by its cultural acceptance and health consciousness.

Seitan's high protein content, low-fat profile, and health benefits make it an attractive alternative to meat for bodybuilders, athletes, and consumers seeking healthier food options. These factors are expected to fuel the market's growth during the forecast period.

The Conventional seitan segment was valued at USD 247.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

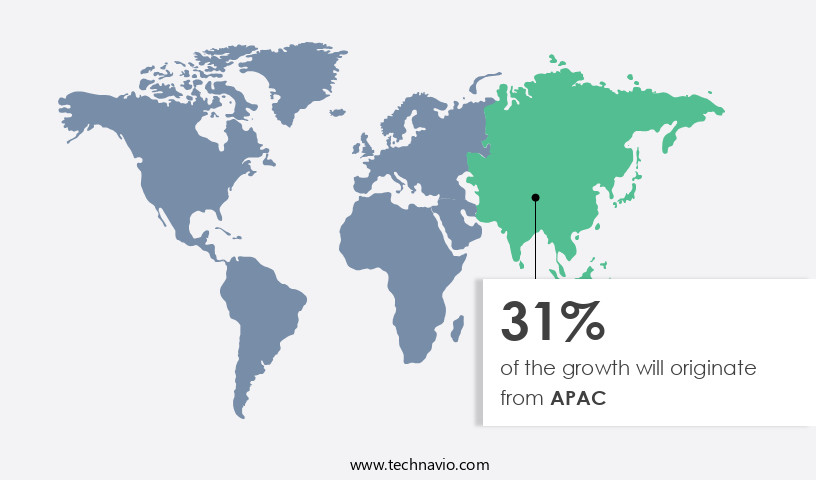

APAC is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Seitan, a wheat-based meat alternative, gains popularity in Asia and beyond due to its gluten strength and textural characteristics. In Japan, China, Vietnam, and South Korea, this plant-based protein is widely used, often referred to as "Buddha's food" or "mock duck." Seitan's versatility shines in various dishes, such as tacos with cooked vegetables and seasoned with cumin and chili powder, or meaty sautéed seitan marinated in barbecue sauce and vinegar, suitable for sandwiches and burritos. The production process involves the extraction of wheat protein isolate, which showcases functional properties essential for seitan's desirable texture. Processing parameters like gluten hydration capacity, protein denaturation effects, and yield optimization are crucial in achieving the optimal texture.

Sensory evaluation plays a significant role in ensuring consumer acceptance. Manufacturing cost, food safety regulations, and food processing technology are critical factors in the production process. Gluten washing techniques and vital wheat gluten are employed to enhance the protein's solubility and water absorption. Shelf life extension is achieved through proper storage conditions and packaging methods. Microbial contamination and protein denaturation effects are addressed through rigorous product quality control measures. Seitan's amino acid profile and allergenic protein content are essential considerations for those with dietary restrictions. Gluten hydrolysis and emulsifying capacity contribute to its nutritional composition. Dough kneading methods and rheological properties influence seitan's final texture.

Understanding these factors and maintaining optimal processing conditions are key to producing high-quality seitan.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global seitan market size and forecast projects growth, driven by seitan market trends 2024-2028. B2B seitan supply solutions leverage plant-based protein technologies for quality. Seitan market growth opportunities 2025 include seitan for vegan foods and organic seitan products, meeting demand. Seitan supply chain software optimizes operations, while seitan market competitive analysis highlights key brands. Sustainable seitan production practices align with eco-friendly food trends. Seitan regulations 2024-2028 shapes seitan demand in North America 2025. High-protein seitan solutions and premium seitan market insights boost adoption. Seitan for foodservice and customized seitan products target niches. Seitan market challenges and solutions address texture, with direct procurement strategies for seitan and seitan pricing optimization enhancing profitability.

What are the key market drivers leading to the rise in the adoption of Seitan Industry?

- The implementation of advanced distribution channels serves as the primary catalyst for market growth. Seitan, a versatile plant-based protein derived from vital wheat gluten, is gaining popularity in the global food industry due to its high nutritional value and texture similar to meat. Supermarkets serve as significant distribution channels for this product, catering to the increasing demand for convenient and nutritious food options. Seitan is easily accessible in major supermarkets and convenience stores, including Kroger, Walmart, Whole Foods, and Trader Joe's. The production process of Seitan involves gluten washing techniques to remove starch and other impurities, ensuring the highest gluten hydration capacity for optimal product quality. Food safety regulations and advanced food processing technology are crucial in the production and packaging methods to prevent microbial contamination and protein denaturation effects.

- These factors contribute to the growing market demand for Seitan and its availability in various product sizes and formats. The supermarket industry's continuous growth, driven by population expansion and consumer preferences, further bolsters the market potential for Seitan.

What are the market trends shaping the Seitan Industry?

- The vegan population is experiencing significant growth, making it a noteworthy market trend for professionals to acknowledge. This expanding demographic presents valuable opportunities for businesses catering to plant-based diets.

- The market is experiencing significant growth due to the increasing adoption of vegan diets by consumers seeking healthier alternatives. Seitan, a popular vegan protein source derived from wheat gluten, offers various health benefits such as increased fiber intake, antioxidants, and essential nutrients like potassium, magnesium, folate, and vitamins A, C, and E. This plant-based protein is also known to aid in weight loss and improve kidney functions while lowering blood sugar levels. Consumer acceptance of gluten-free alternatives, including seitan, has been on the rise due to the growing awareness of the health benefits associated with such diets.

- The production process of seitan involves the extraction and processing of wheat protein isolate, which is then shaped and cooked to achieve the desired textural characteristics. The processing parameters, including temperature, pressure, and time, significantly impact the final texture of seitan. Seitan texture analysis is crucial to ensure the desired texture and palatability of the final product. The functional properties of wheat protein isolate play a significant role in the production process, determining the texture, taste, and overall quality of seitan.

What challenges does the Seitan Industry face during its growth?

- The growth of the food industry is significantly challenged by the adverse effects associated with highly processed food. These effects, which can include negative health consequences for consumers, present a major concern that must be addressed by industry professionals.

- Seitan, a nutritious yet processed food item, is derived from wheat gluten. Its production involves rinsing starch from kneaded wheat flour dough. While Seitan offers various health benefits due to its high protein content and amino acid profile, it is not suitable for individuals with gluten intolerance, wheat sensitivity, celiac disease, or fatigue due to its gluten protein content. Manufacturing Seitan involves several processes, including gluten protein extraction and gluten hydrolysis, to optimize yield and gluten elasticity. Sensory evaluation plays a crucial role in assessing the final product's texture and taste. However, the use of wheat gluten in Seitan production increases its manufacturing cost and allergenic protein content.

- Consumers' growing awareness of health and wellness trends and the availability of alternative protein sources may impact the demand for Seitan. Manufacturers continue to focus on research and development to improve the production process and reduce the manufacturing cost while maintaining product quality.

Exclusive Customer Landscape

The seitan market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the seitan market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, seitan market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amy's Kitchen - The company specializes in producing and marketing plant-based protein alternatives, including tofu, seitan, and tempeh, catering to the growing demand for sustainable and ethical food choices in the global market. These soy and wheat-based products provide consumers with high-protein, low-fat options, aligning with dietary preferences and health-conscious lifestyles.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amy's Kitchen

- Beyond Meat

- Bobs Red Mill

- Conagra Brands

- Field Roast

- Gardein

- Hain Celestial Group

- Hodo Foods

- House Foods Group

- Lightlife Foods

- MorningStar Farms

- Nasoya

- Pacific Foods

- Sweet Earth Foods

- Tofurky

- Upton's Naturals

- Vbites

- West Soy

- Wheaty

- Yves Veggie Cuisine

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Seitan Market

- In January 2024, The Quorn Foods Company, a leading player in the meat alternative market, announced the launch of its new seitan-based product line, "Quorn Seitan Strips," in collaboration with US-based vegan restaurant chain, VeggieGrill. This strategic partnership aimed to expand Quorn's presence in the US market and cater to the growing demand for plant-based protein options (Quorn Foods Press Release, 2024).

- In March 2024, Greenleaf Foods, a major producer of plant-based proteins, completed the acquisition of Field Roast Grain Meat Co., a well-known seitan brand. This strategic move strengthened Greenleaf's product portfolio and broadened its customer base, as Field Roast's offerings complemented Greenleaf's existing product lines (Greenleaf Foods Press Release, 2024).

- In May 2024, The Good Food Institute (GFI), a nonprofit organization promoting alternative proteins, secured a USD17 million investment from the Bill & Melinda Gates Foundation. This funding would support GFI's research and development efforts in the alternative protein sector, including seitan, to address global food security challenges and reduce the environmental impact of animal agriculture (Gates Foundation Press Release, 2024).

- In February 2025, Eat Just, Inc., the creators of the plant-based egg product, Just Egg, revealed their latest innovation: Just Seitan. This new product line, made from wheat protein, aimed to cater to the growing demand for plant-based meat alternatives and expand Eat Just's product offerings beyond eggs (Eat Just Press Release, 2025).

Research Analyst Overview

- In the dynamic the market, consumer perception plays a significant role in shaping trends. Gluten-free labeling, a key consideration for many consumers, drives process optimization and ingredient sourcing strategies. Sustainability practices and environmental impact are increasingly important, offering competitive advantages for brands. New product development, often driven by protein extraction methods and product differentiation, requires careful supply chain management and sales promotion. Gluten network formation and quality control metrics are essential for maintaining brand positioning and regulatory compliance. Energy consumption and cost reduction strategies are crucial for optimizing manufacturing techniques, while research and development continues to explore innovative ingredients and pricing strategies.

- Packaging materials and distribution channels are critical for reaching consumers, with waste management and labor cost being key considerations. As the market evolves, brands must stay agile, adapting to changing consumer preferences and regulatory requirements while minimizing their environmental footprint.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Seitan Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.27% |

|

Market growth 2024-2028 |

USD 63.8 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

3.12 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Seitan Market Research and Growth Report?

- CAGR of the Seitan industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the seitan market growth of industry companies

We can help! Our analysts can customize this seitan market research report to meet your requirements.