Smart Home Cameras Market Size 2025-2029

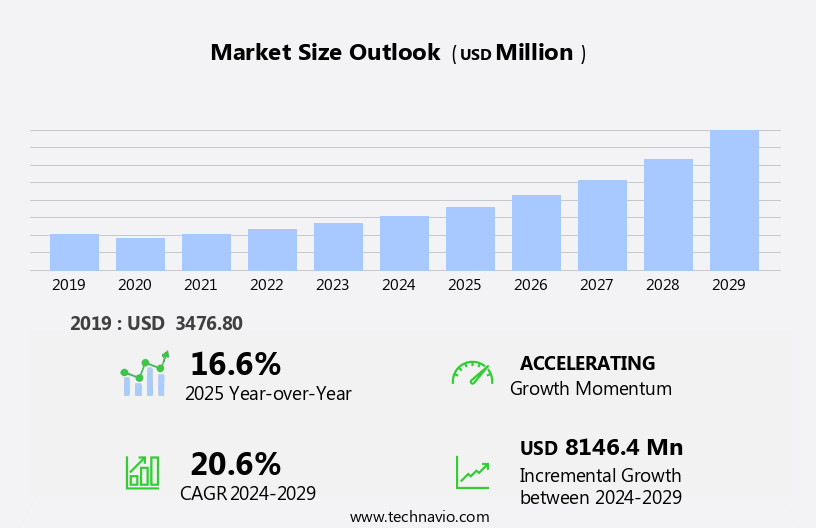

The smart home cameras market size is forecast to increase by USD 8.15 billion at a CAGR of 20.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for advanced security solutions and the proliferation of the Internet of Things (IoT) technology. Premiumization of products through innovation and portfolio extension is a key trend in the market, as manufacturers seek to differentiate themselves by offering features such as high-definition video, night vision, and two-way audio. This trend is expected to continue, as consumers become more willing to pay a premium for enhanced security and convenience. However, the market is not without challenges. The distribution channel expansion strategy is crucial for market players, as they look to reach a wider customer base. These advancements include voice control, energy efficiency, and connectivity features that enhance convenience and functionality for consumers. However, the high cost of smart home appliances remains a challenge for some consumers, limiting market penetration.

- At the same time, the presence of counterfeit and low-quality products poses a significant threat to the market's growth. These products not only undermine the reputation of legitimate players but also pose a security risk to consumers. To navigate these challenges effectively, companies must focus on building strong brand reputations, investing in research and development, and implementing quality control measures. By capitalizing on market opportunities and addressing these challenges head-on, players in the market can look forward to significant growth in the coming years.

What will be the Size of the Smart Home Cameras Market during the forecast period?

- The market in the United States is experiencing growth due to the increasing demand for enhanced home security and home automation solutions. This market encompasses various offerings, including smart security devices, wireless security cameras, multi-camera systems, and outdoor security cameras. Cloud-based video recording, remote monitoring systems, and voice assistant integration are key features driving market expansion. Advanced camera features such as motion detection technology, real-time video analytics, and remote access control are increasingly popular among consumers. The integration of smart home platforms and home security monitoring systems further enhances the functionality of these devices. Outdoor security cameras, security camera bundles, and home monitoring systems are gaining traction, as homeowners seek comprehensive security solutions.

- The market is also witnessing the adoption of advanced technologies like data encryption and cybersecurity measures to address growing concerns regarding privacy and security. The future of the market lies in the integration of advanced AI capabilities and the expansion of home automation solutions. As the market continues to evolve, it is expected to deliver innovative, user-friendly, and cost-effective security solutions for homeowners.

How is this Smart Home Cameras Industry segmented?

The smart home cameras industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Connectivity

- Wire-free smart home cameras

- Wired smart home cameras

- Variant

- HD

- Non-HD

- Application

- Outdoor

- Indoor

- Geography

- North America

- US

- Canada

- Mexico

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Distribution Channel Insights

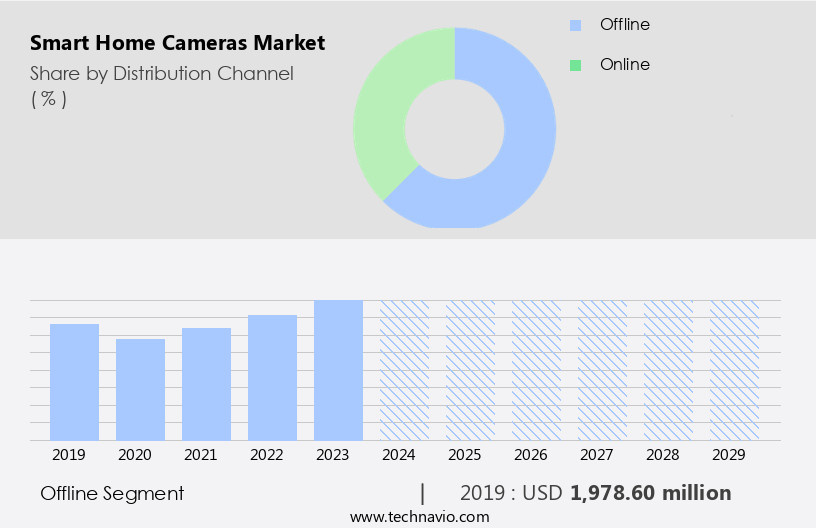

The offline segment is estimated to witness significant growth during the forecast period. The global market, including smart doorbells and related devices, primarily generates revenue through offline sales channels. Retail formats such as specialty stores, hypermarkets, department stores, and warehouse clubs play a significant role in this market. The internet's influence on marketing strategies has led marketers to consider offline channels as alternatives to online media. Offline marketing involves utilizing traditional media channels to create product awareness. As technology adoption continues to rise, user interface, integration, facial recognition, data encryption, motion detection, wide-angle lenses, high-definition video, object detection, activity tracking, app integration, voice control, two-way audio, data security, sales channels, ecosystems, customer service, pet monitors, home automation, live streaming, AI-powered analytics, home security, standards, edge computing, remote monitoring, smart lighting, wireless connectivity, outdoor cameras, and marketing strategies remain key market dynamics.

Get a glance at the market report of share of various segments Request Free Sample

The Offline segment was valued at USD 1.98 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

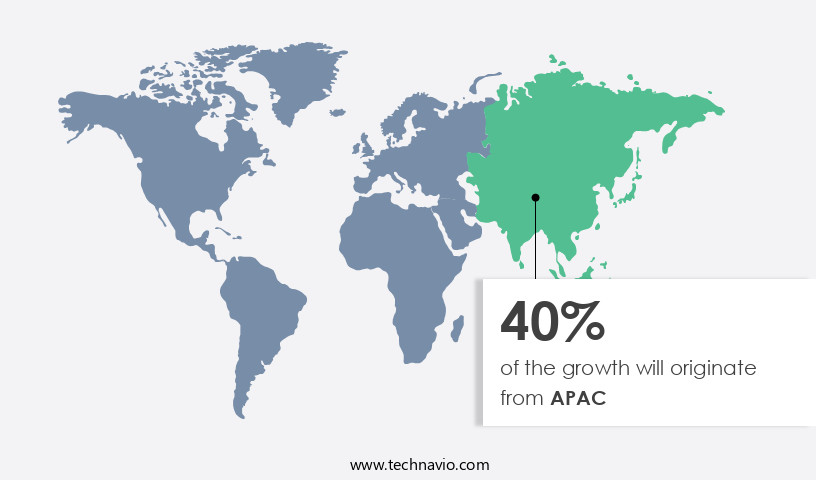

APAC is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Smart home cameras continue to gain traction in the US market, with a focus on advanced features and seamless integration into the smart home ecosystem. These devices offer user-friendly interfaces, including app integration, voice control, and two-way audio, making them convenient for homeowners. Privacy concerns remain a priority, with data encryption, facial recognition, and object detection ensuring data security. Product development in this space includes high-definition video, motion detection, night vision, and AI-powered analytics. Smart appliances, including refrigerators, dishwashers, washing machines, and air conditioners, are transforming traditional household chores into automated tasks. Smart Doorbells and baby monitors are popular subcategories, while home automation, smart locks, and smart lighting are complementary offerings. Sales channels include both online and offline, with offline sales through retailers such as hypermarkets, department stores, and specialty stores.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Smart Home Cameras Industry?

- Innovation and portfolio extension leading to premiumization of products is the key driver of the market. In the market, the demand for advanced and innovative features is driving the growth of high-end cameras. These devices, while more expensive than traditional home security cameras, offer integrated technologies and superior functionality that resonates with tech-savvy consumers. Companies are responding to this trend by expanding their product offerings and differentiating themselves through add-on features and unique designs. For example, Arlo Technologies Inc. Provides the Arlo Pro 2 camera, which caters to both indoor and outdoor usage, providing flexibility for homeowners. This strategic approach allows companies to cater to the evolving needs of consumers and maintain a competitive edge in the market.

- The US market is characterized by a strong emphasis on home security, leading to the adoption of advanced technologies like edge computing and cloud-based services for remote monitoring. Customer service and brand reputation are essential factors in the decision-making process. Weatherproof design and outdoor cameras cater to the needs of pet owners and those seeking to secure their properties. Marketing strategies include partnerships with security systems and IoT devices, as well as subscription services and cloud storage offerings. The market is expected to grow as the US population continues to prioritize home safety and convenience.

What are the market trends shaping the Smart Home Cameras Industry?

- Distribution channel expansion strategy is the upcoming market trend. The market is experiencing significant growth as companies adopt various strategies to expand their customer base. One such strategy is the expansion of distribution channels. An omnichannel approach is increasingly popular among home security product manufacturers that offer cameras. This strategy allows for the sale of cameras through both physical retailers and third-party online retailers. Major players in the market, such as SAMSUNG and Robert Bosch, are capitalizing on this trend by making their cameras available on popular online shopping portals.

- As a result, the distribution channel expansion strategy is expected to significantly contribute to the revenue growth of the market during the forecast period. Wireless solutions are increasingly popular, enabling remote control and automation of appliances through personal area networks and connectivity. This market encompasses a wide range of devices, from refrigerators and air conditioners to lighting systems and security cameras. Brands prioritize user experience, night vision, weatherproof design, indoor cameras, smart locks, video surveillance, cloud storage, subscription services, and brand reputation to differentiate themselves. IoT devices and cloud-based services are integral to the smart home ecosystem.

What challenges does the Smart Home Cameras Industry face during its growth?

- Presence of counterfeit and low-quality products is a key challenge affecting the industry growth. The market faces challenges due to the proliferation of counterfeit and low-quality products. These unauthorized manufacturers, predominantly in developing countries, offer equivalent products at lower prices than established brands. This competition intensifies as these players are not registered with the government, and their employment terms are neither fixed nor regular. The availability of counterfeit products is particularly high in regions like China. While these products may meet basic functionality requirements, they lack the reliability, security features, and customer support offered by reputable companies.

- Consequently, brand and price become the primary differentiating factors for consumers in their purchasing decisions. This situation poses a significant challenge for established players in the market, requiring them to maintain their brand reputation and competitive pricing strategies. App integration and voice control are important marketing strategies for smart home camera manufacturers. These features allow users to access their cameras using popular smart home ecosystems and voice assistants. Two-way audio enables communication between users and visitors, adding an extra layer of security and convenience. Data security is a major concern for consumers in the smart home camera market. Manufacturers are addressing this issue by implementing advanced encryption methods and offering cloud storage solutions with security measures. Subscription services provide additional features, such as AI-powered analytics and remote monitoring, to enhance the user experience. Smart home cameras are not limited to doorbell applications.

Exclusive Customer Landscape

The smart home cameras market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smart home cameras market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smart home cameras market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

56 AI Technologies Pvt Ltd. - The company provides advanced smart home security solutions, including weather-resistant HD outdoor cameras with motion detection technology.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 56 AI Technologies Pvt Ltd.

- ADT Inc.

- Alarm.com Holdings Inc.

- Arlo Technologies Inc.

- Comcast Corp.

- D Link Corp.

- Deep Sentinel Corp.

- Frontpoint Security Solutions LLC

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Monitronics International Inc.

- Nest Labs Inc.

- Resideo Technologies Inc.

- Ring LLC

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Simplisafe Inc.

- Skylink Group

- Vivint Inc.

- Wyze Labs Inc.

- Zmodo Technology Corp. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The smart home camera market is experiencing significant growth as consumers seek to enhance their home security and convenience. This market is characterized by continuous product development and integration with various smart home devices and hubs. The user interface of these cameras is a crucial factor, as it allows users to easily access live streaming, motion detection alerts, and other features. Facial recognition technology is increasingly being incorporated into smart home cameras, offering enhanced security and convenience for users. Data encryption and motion detection are essential features for ensuring privacy and security. Wide-angle lenses and high-definition video provide clear images, while object detection and activity tracking enable users to monitor their homes more effectively.

They are also used as baby monitors, pet monitors, and for home automation. Outdoor cameras offer weatherproof designs and night vision capabilities, making them ideal for monitoring outdoor areas. Indoor cameras can be integrated with smart lighting and security systems, providing a comprehensive home security solution. The sales channels for smart home cameras are diverse, including online retailers, home improvement stores, and direct sales from manufacturers. IoT devices and cloud-based services are essential components of the smart home ecosystem, driving the growth of the smart home camera market. Customer service is a critical factor in the success of smart home camera manufacturers.

Providing responsive and effective support is essential for addressing user concerns and ensuring customer satisfaction. Brands with strong reputations and reliable products are likely to gain a competitive advantage in this market. The smart home camera market is dynamic, with constant innovation and advancements in technology. Edge computing, remote monitoring, and smart lighting are some of the emerging trends in this market. As the market continues to grow, manufacturers must stay ahead of the competition by offering innovative features and exceptional user experiences.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.6% |

|

Market growth 2025-2029 |

USD 8.15 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.6 |

|

Key countries |

US, Canada, UK, Germany, China, India, Mexico, Japan, South Korea, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Smart Home Cameras Market Research and Growth Report?

- CAGR of the Smart Home Cameras industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smart home cameras market growth of industry companies

We can help! Our analysts can customize this smart home cameras market research report to meet your requirements.