What is the Size of Sodium Silicate Market?

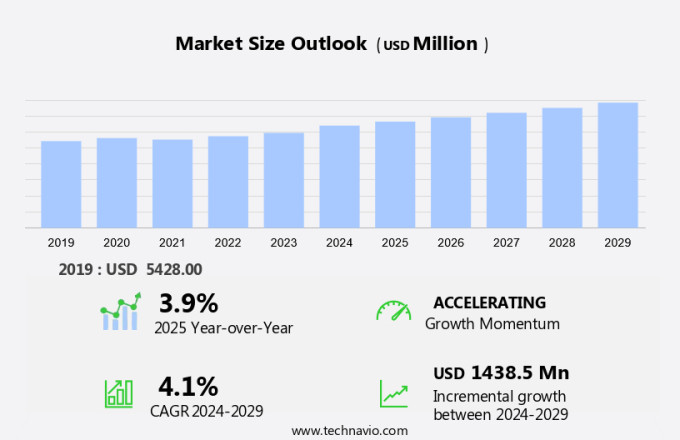

The sodium silicate market size is forecast to increase by USD 1.44 billion, at a CAGR of 4.1% between 2024 and 2029. The market is driven by the increasing demand for detergent builders in various industries, including textiles, pulp and paper, and water treatment. Sodium silicate's unique properties, such as emulsification, wetting, and deflocculation, make it an essential ingredient in detergent formulations. Additionally, its ability to reduce surface tension and enhance dirt removal makes it a preferred choice for manufacturers. In terms of trends, the use of sodium silicate in the pulp and paper industry for bleaching applications, particularly in conjunction with hydrogen peroxide, is gaining popularity. Furthermore, the use of sodium silicate as a replacement for polyvalent cations, such as zeolite, precipitated silica, and manganese, in water treatment applications is on the rise due to its cost-effectiveness and superior performance. However, challenges such as stringent regulatory guidelines and the availability of alternative products pose a threat to market growth.

Request Free Sodium Silicate Market Sample

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019 - 2023 for the following segments.

- Application

- Detergent

- Pulp and paper

- Derivative silicates

- Construction

- Others

- Form Factor

- Liquid

- Solid

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- Brazil

- APAC

Which is the Largest Segment Driving Market Growth?

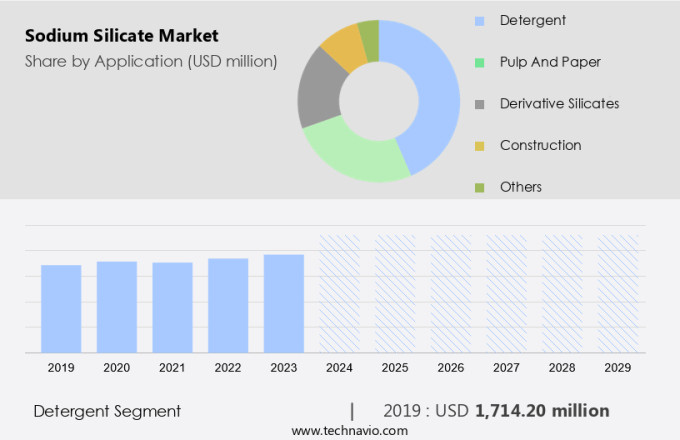

The detergent segment is estimated to witness significant growth during the forecast period. Sodium silicate, an inorganic compound derived from the synthesis process of water glass and silica sand, plays a pivotal role in various industries, including the production of silicone rubber compounds. One of its major applications is in the field of detergents, where it offers several advantages. Sodium silicate's alkalinity and solubility in water make it an effective softener for hard water, which is prevalent in many regions.

Get a glance at the market share of various regions Download the PDF Sample

The detergent segment was valued at USD 1.71 billion in 2019. In the realm of electronics, nanopatterning is crucial for producing high-performance biosensors and anti-reflection films. By neutralizing metal ions such as calcium and magnesium, it enhances the performance of detergents, leading to better cleaning results. Moreover, sodium silicate's adhesive nature improves the detergent's ability to remove tough stains and grime from fabrics. This is crucial for ensuring thorough cleaning, even under challenging conditions. The compound's high temperature stability and resistance to water make it an ideal ingredient for detergents. Incorporating sodium silicate into detergent formulations not only boosts their cleaning power but also contributes to their overall effectiveness. This makes it a valuable addition to the detergent industry.

Which Region is Leading the Market?

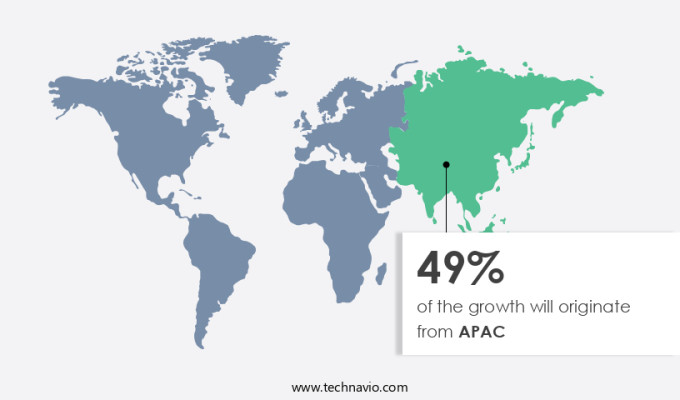

For more insights on the market share of various regions Request Free Sample

APAC is estimated to contribute 49% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The Asia Pacific region represents a substantial and expanding sector within the market. Notable investments and expansions in manufacturing facilities, such as Hindustan Unilever Limited (HUL)'s announcement to invest USD 83.33 million by 2025 in a new facility in Sumerpur, Uttar Pradesh, India, are driving growth. This facility, which includes a spray-dried detergent powder plant and a distribution center, was formally inaugurated by Unilever India Limited (UIL). By 2025, this facility will become HUL's largest volume strategic sourcing site for the production of spray-dried detergent powder. Leading Unilever brands, including Surf Excel, will manufacture their products at this location. Sodium silicate, also known as waterglass, is an inorganic sodium salt used in various industries, including soaps and laundry detergents. Its derivatives, such as silica, zeolites, and infection prevention agents, find applications in construction, paper and pulp, medical, industrial products, and wastewater treatment. Sodium silicate's versatility and wide range of applications contribute to its growing demand in these sectors.

How do Technavio's company ranking index and market positioning come to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Ankit Silicate - This company offers sodium silicate that are used in various industries, including textiles and detergents.

Technavio provides the ranking index for the top 18 companies along with insights on the market positioning of:

- Antika Officina Botanika

- BASF SE

- Evonik Industries AG

- Fuji Silysia Chemical Ltd.

- Hindcon Chemicals Ltd.

- Hi-Tech Minerals and Chemicals

- Marsina Engineering S R L

- NM Enterprises

- Noble Alchem Pvt Ltd.

- Occidental Petroleum Corp.

- Possehl Erzkontor GmbH & Co. KG

- PQ Group Holdings Inc.

- Qemetica

- Silmaco NV

- W. R. Grace and Co.

- Welcome Chemicals

- Z. Ch. Rudniki SA

Explore our company rankings and market positioning Request Free Sample

How can Technavio Assist you in Making Critical Decisions?

What is the Market Structure and Year-over-Year growth of the Market?

|

Market structure |

Fragmented |

|

YoY growth 2024-2025 |

3.9 |

Market Dynamic

Sodium silicate, also known as water glass, is an inorganic compound that has gained significant attention in various industries due to its unique properties. This alkaline, viscous liquid is formed by the synthesis process of sodium hydroxide and silicon dioxide, primarily in the presence of water. The resulting compound offers a wide range of applications, from infection prevention and construction to paper and pulp production and downstream chemicals. In the realm of personal care and household products, sodium silicate is a crucial ingredient in the formulation of soaps and laundry detergents. Its ability to enhance the cleansing power of these products, as well as its capacity to improve their suspension and dispersing properties, makes it an essential component. Sodium silicate acts as a builder, which enhances the alkalinity of the detergent solution, thereby improving its ability to dissolve and suspend impurities, thus ensuring effective cleaning. The construction industry also benefits from the use of sodium silicate. In this sector, it is employed as a reinforcing agent in concrete and mortar, enhancing their strength and durability. The compound's high alkalinity and ability to form a gel-like structure when combined with water make it an ideal choice for these applications. In the field of infection prevention, sodium silicate is used to produce silica gels and sols. These derivatives of sodium silicate are effective in absorbing and retaining water, making them an excellent choice for medical applications such as wound dressings and bandages.

The ability to maintain a moist environment aids in the healing process while preventing infection. Sodium silicate is also widely used in the paper and pulp industry. It acts as a coagulant, helping to remove impurities from the pulp during the papermaking process. Additionally, it is used in the production of silica sols, which are employed as fillers and coatings in paper production. In the realm of downstream chemicals, sodium silicate is used in the production of various products, including zeolites, reactive silica, and silica gels. These derivatives find applications in various industries such as rubber, food and beverage, paints and coatings, plastics, ink, and more. The versatility of sodium silicate is further highlighted by its use in the production of silica sand. By subjecting the compound to high temperatures, silica sand can be produced, which is used extensively in the glass industry. Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Primary Factors Driving the Market Growth?

The expansion of sodium silicate production facilities is notably driving the market growth. The market experiences continuous growth due to the expanding production capacity of key players and increasing demand for this versatile inorganic compound. Sodium Silicate, also known as waterglass, is a valuable chemical compound with numerous applications. Its chemical properties, including alkalinity, solubility, and physical properties like crystalline and anhydrous forms, make it an essential ingredient in various industries. Inorganic sodium salt, derivative silicates, and silica gels are some of its popular forms. Sodium Silicate plays a crucial role in various sectors, including construction, infection prevention, and industrial products. It is used as a detergent builder in liquid and solid detergents, enhancing their cleaning power. In the paper and pulp industry, it is used as a pulp bleaching agent, improving the brightness and quality of paper.

In the medical field, it is used for infection prevention and as a coagulant in water purification and wastewater treatment. Its adhesive nature makes it an essential component in adhesives and elastomers, while its acid resistance and catalytic properties are used in various chemical processes. In the food and beverage industry, it is used as a stabilizer and thickener. The versatility of Sodium Silicate makes it an indispensable ingredient in numerous industries, driving the market's growth. Thus, such factors are driving the growth of the market during the forecast period.

What are the Significant Trends being Witnessed in the Market?

Strategic partnerships are an emerging trend shaping market growth. The market is experiencing notable growth, driven by strategic business moves among industry leaders. Sodium Silicate is a versatile inorganic compound, primarily used as an alkaline sodium silicate, waterglass, or reactive silica in various industries. Its applications span from detergent applications in soaps and laundry detergents to infection prevention, construction, paper and pulp, industrial products, and wastewater treatment. In the detergent sector, sodium silicate acts as a detergent builder, emulsifier, wetting agent, and deflocculant, enhancing the cleaning power and improving the performance of phosphate-free detergents. In the construction sector, it serves as an adhesive, catalyst, and coagulant in cement, concrete, and water purification processes. In the paper and pulp industry, it is used as a pulp bleaching agent, while in the medical field, it is employed for infection prevention.

The synthesis process of sodium silicate involves the reaction of silica sand with sodium carbonate at high temperatures and alkalinity. The resulting product is a clear, colorless, or slightly yellowish liquid or solid, depending on the specific application. Sodium silicate's chemical properties include high solubility, low toxicity, and alkaline irritants, making it a valuable component in various industries. Its physical properties, such as surface tension reduction and dirt removal, contribute to its effectiveness in various applications. Thus, such trends will shape the growth of the market during the forecast period.

What are the Major Market Challenges?

Regulatory guideline| is an emerging trend shaping the market growth. The market encompasses the production and distribution of inorganic sodium salts, commonly known as waterglass. Sodium Silicate is a versatile chemical compound, with applications ranging from soaps and laundry detergents to infection prevention, construction, and industrial products. In the realm of hygiene and cleaning, it functions as a detergent builder, emulsifier, and wetting agent. In the paper and pulp industry, it serves as a pulp bleaching agent and a coagulant for water treatment. Sodium Silicate's chemical properties include high alkalinity, solubility, and an adhesive nature. It reacts with various substances, such as silica, zeolites, manganese, iron, and copper, to form downstream chemicals like silicone rubber compounds, which exhibit fatigue resistance and excellent acid resistance. The synthesis process involves the reaction of sodium carbonate with silica sand at high temperatures. Despite its benefits, the market faces regulatory challenges. In the US, it is classified as a synthetic inert ingredient by the Environmental Protection Agency (EPA) and must comply with stringent regulations to ensure safety.

The Food and Drug Administration (FDA) recognizes it as safe when used in accordance with good manufacturing practices (GMP), provided it does not contain heavy metal residues or contaminants beyond the established tolerances. Adherence to these regulations necessitates continuous quality control measures and monitoring. Sodium Silicate's applications extend to various industries, including construction materials like cement and concrete, paints and coatings, plastics, ink, and adhesive products. Its uses in water treatment, soil stabilization, fire protection, and infrastructural development further underscore its significance in diverse sectors. In summary, the market caters to a broad spectrum of industries, offering a wide range of applications and benefits, while adhering to stringent regulatory guidelines. Hence, the above factors will impede the growth of the market during the forecast period.

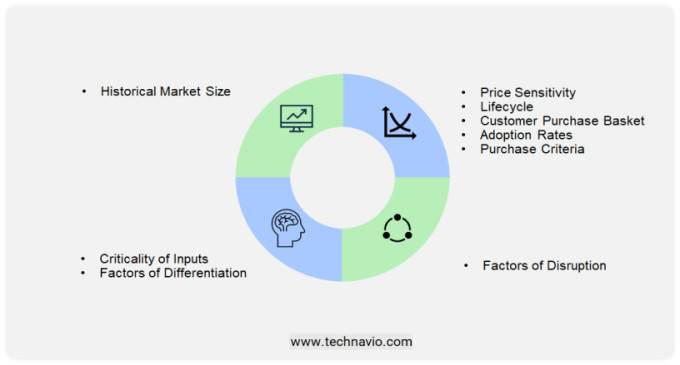

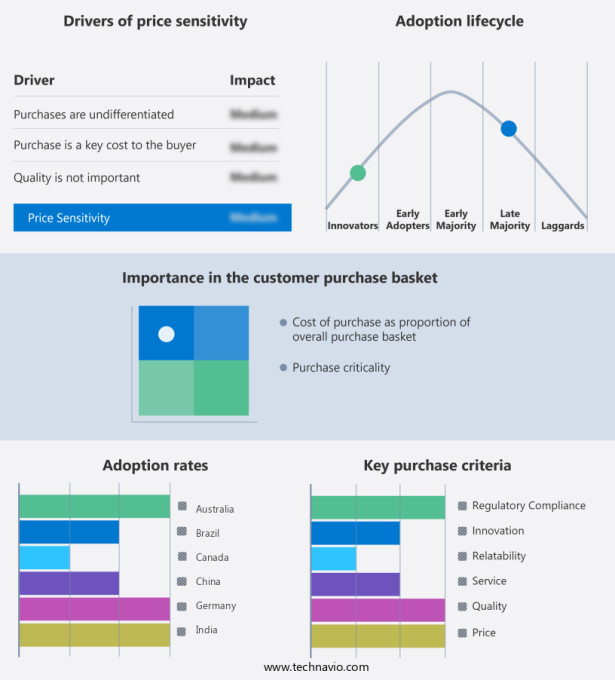

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market research and growth, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

Sodium silicate, also known as waterglass, is an inorganic sodium salt of silicic acid. This versatile chemical compound is used in various industries, including soaps and laundry detergents, construction, paper and pulp, and medical and industrial products. In the realm of cleaning, sodium silicate acts as a detergent builder, enhancing the cleaning power of other ingredients. In the medical field, it plays a role in infection prevention. Beyond cleaning, sodium silicate finds applications in construction as an adhesive and in water treatment for soil stabilization and infrastructural development. In the paper and pulp industry, it is used in the recycling process and for pulp bleaching. Sodium silicate's chemical properties make it an effective catalyst and emulsifier, while its physical properties, such as high alkalinity and solubility, contribute to its use in various applications.

In addition, the downstream chemicals derived from sodium silicate include silica gels, silica sols, and precipitated silica. These derivatives are used in paints and coatings, plastics, ink, and adhesive products. Sodium silicate's ability to form a silica gel when exposed to air makes it useful in filtration and water purification. Sodium silicate is also used in the production of silicone rubber compounds, which exhibit excellent fatigue resistance. In the food and beverage industry, sodium silicate is used as a stabilizer and thickener. With its wide range of applications and benefits, the market continues to grow, catering to diverse industries and chemical environments.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019 - 2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.1% |

|

Market Growth 2025-2029 |

USD 1.44 billion |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 49% |

|

Key countries |

US, China, India, Germany, Japan, Canada, Brazil, UK, South Korea, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Ankit Silicate, Antika Officina Botanika, BASF SE, Evonik Industries AG, Fuji Silysia Chemical Ltd., Hindcon Chemicals Ltd., Hi-Tech Minerals and Chemicals, Marsina Engineering S R L, NM Enterprises, Noble Alchem Pvt Ltd., Occidental Petroleum Corp., Possehl Erzkontor GmbH & Co. KG, PQ Group Holdings Inc., Qemetica, Silmaco NV, W. R. Grace and Co., Welcome Chemicals, and Z. Ch. Rudniki SA |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, fast-growing and slow-growing segment analysis, AI impact on market trends, COVID-19 impact and recovery analysis and future consumer dynamics, and market condition analysis for the market forecast period. |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies