Soy Flour Market Size 2024-2028

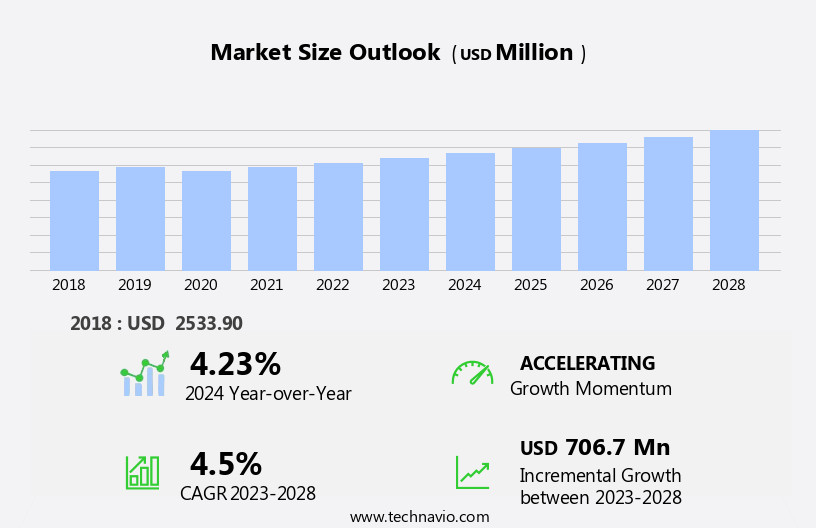

The soy flour market size is forecast to increase by USD 706.7 million, at a CAGR of 4.5% between 2023 and 2028.

- The market is driven by the increasing preference for plant-based food options, with the growing vegan population being a significant factor. Soybeans are a rich source of essential nutrients, including protein, fiber, and essential amino acids, making soy flour an attractive alternative to animal-derived products. However, the market faces challenges from the presence of other substitutes, such as wheat and corn flour. These alternatives offer price competitiveness and broader application scope, posing a threat to soy flour's market penetration. Companies in the market must focus on product innovation, price competitiveness, and expanding their distribution networks to cater to the evolving consumer preferences and navigate the competitive landscape effectively.

- Additionally, strategic collaborations and partnerships can help soy flour providers overcome the challenges posed by alternative flour sources and capitalize on the growing demand for plant-based food options.

What will be the Size of the Soy Flour Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the constant quest for innovation and improvement in the functional properties of this versatile ingredient. Soy flour oxidation, for instance, is a critical aspect of the production process that impacts the final product's flavor, color, and nutritional value. Similarly, soy flour functionality, including its viscosity, solubility, dispersibility, and rheology, is a key consideration for various industries, from food and beverage to pharmaceuticals and cosmetics. Organic Soy protein isolate, a popular derivative of soy flour, offers unique advantages in terms of nutritional content and functional properties. Its high protein content and excellent emulsifying and gelling properties make it a preferred choice in numerous applications, from baked goods to meat substitutes.

Moreover, sustainability remains a significant factor in the market, with a growing emphasis on traceability and eco-friendly production methods. As consumer preferences shift towards more sustainable and ethically-sourced ingredients, soy flour producers are responding by implementing sustainable farming practices and improving their production processes to minimize waste and reduce their carbon footprint. In summary, the market is a dynamic and evolving landscape, with ongoing research and development efforts focused on optimizing the functional properties of soy flour and its derivatives, while also addressing sustainability concerns. From soy flour oxidation to soy protein isolate, the various aspects of this market are interconnected and continually unfolding, reflecting the industry's commitment to innovation and improvement.

How is this Soy Flour Industry segmented?

The soy flour industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Bakery and confectionery

- Meat substitutes

- Others

- Distribution Channel

- B2B

- Supermarkets and Hypermarkets

- Online Retail

- Health Food Stores

- Type

- Full-Fat Soy Flour

- Defatted Soy Flour

- Low-Fat Soy Flour

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Indonesia

- Japan

- Malaysia

- South Korea

- Thailand

- South America

- Brazil

- Rest of World (ROW)

- North America

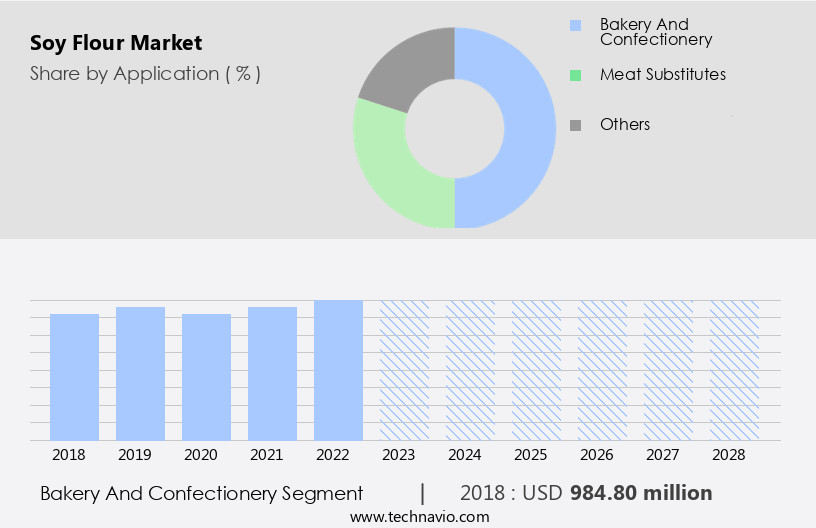

By Application Insights

The bakery and confectionery segment is estimated to witness significant growth during the forecast period.

The market experienced notable growth in 2023, with the bakery and confectionery segment holding a substantial share. Soy flour's unique properties, such as solubility, absorption capabilities, and nutritional benefits, including natural sweetness, make it an ideal ingredient for gluten-free, trans-fat-free, and whole-grain bakery products. The rising demand for baked goods like bread, pastries, and cake, particularly during festive seasons and special occasions, has significantly boosted market sales. Furthermore, soy flour's sustainability, texture, flavor, color, traceability, and dispersibility contribute to its extensive applications in various industries, including food, beverages, and pharmaceuticals.

Soy protein isolate and defatted soy flour are popular derivatives with varying viscosity and rheology, catering to diverse industrial requirements. The market's growth is also driven by the increasing focus on plant-based alternatives and the potential health benefits associated with soy flour consumption.

The Bakery and confectionery segment was valued at USD 984.80 million in 2018 and showed a gradual increase during the forecast period.

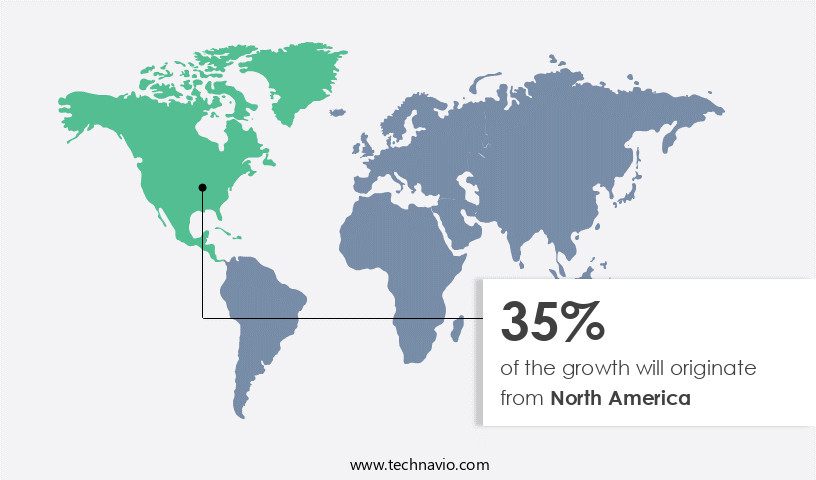

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing consistent expansion due to the increasing population and escalating demand for plant-based food alternatives, particularly in the United States. Soy flour's functional properties, including its high protein content, make it an ideal ingredient for various applications, such as baked goods, meat substitutes, and nutrition bars. Soy protein isolate, a derivative of soy flour, is widely used in the production of these products due to its superior nutritional profile and solubility. Soy flour's viscosity and texture are crucial factors in its application, ensuring the desired consistency in various food products. Soy flour's color and flavor are also essential considerations, as they can significantly impact the final product's appearance and taste.

Traceability and sustainability are increasingly important factors in the market, with consumers demanding transparency in the sourcing and production of their food ingredients. Soy flour's rheological properties are essential in various industries, including food, pharmaceuticals, and cosmetics. Defatted soy flour, a byproduct of soybean oil extraction, is gaining popularity due to its high protein content and potential applications in various industries. The market's growth is also driven by its versatility and ability to replace traditional animal-derived ingredients, making it a preferred choice for vegan and vegetarian consumers.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global soy flour market size and forecast projects growth, driven by soy flour market trends 2024-2028. B2B soy flour supply solutions leverage advanced soy processing technologies for quality. Soy flour market growth opportunities 2025 include soy flour for baking and non-GMO soy flour products, meeting demand. Soy flour supply chain software optimizes operations, while soy flour market competitive analysis highlights key suppliers. Sustainable soy flour practices align with eco-friendly food trends. Soy flour regulations 2024-2028 shapes soy flour demand in North America 2025. High-protein soy flour solutions and premium soy flour insights boost adoption. Soy flour for plant-based foods and customized soy flour formulations target niches. Soy flour market challenges and solutions address allergen concerns, with direct procurement strategies for soy flour and soy flour pricing optimization enhancing profitability. Data-driven soy flour analytics and plant-based ingredient trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Soy Flour Industry?

- The vegan population's continued growth serves as the primary catalyst for market expansion.

- Soy flour's demand is on the rise due to the increasing trend of veganism and the associated health benefits. The number of consumers adopting plant-based diets, particularly millennials, is increasing globally. In nations like the US and Canada, the proportion of millennials living vegan lifestyles is growing. Mexico's youthful population is also embracing veganism at an increasing rate, and this trend is expected to continue.

- Soy flour's applications extend beyond the food industry, including cosmetics, pharmaceuticals, and animal feed. Its dispersibility properties make it an ideal ingredient for various food products, including baked goods, meat alternatives, and beverages. As the vegan population expands, soy flour's demand is poised to grow, providing opportunities for businesses in this sector.

What are the market trends shaping the Soy Flour Industry?

- Soybeans are recognized for their high nutritional value, making them a current market trend in the food industry. The nutritional richness of soybeans, including their significant protein content and essential vitamins and minerals, contributes to their growing popularity.

- Soy flour, derived from soybeans, is a valuable ingredient in various food industries due to its functional properties. Soy flour is rich in protein, specifically soy protein isolate, which contributes to its excellent nutritional value. Proteins in soy flour play a significant role in dough strengthening and improving texture in baked goods. Additionally, soy flour's oxidation properties contribute to the browning and crisping of baked items. Soy flour's functionality extends beyond the baking industry. In the food processing sector, it is used as a thickener, stabilizer, and emulsifier. Its viscosity makes it an ideal ingredient for sauces, soups, and dips.

- Furthermore, soy flour is an essential component in the production of textured vegetable protein, a popular meat substitute. The versatility of soy flour makes it a preferred choice for food manufacturers seeking plant-based alternatives to animal-derived ingredients. As a complete protein source, it contains all nine essential amino acids, making it a nutritious addition to various food products. Soy flour's nutritional benefits, coupled with its functional properties, make it a valuable ingredient in the food industry.

What challenges does the Soy Flour Industry face during its growth?

- The expansion of the industry is significantly influenced by the presence and proliferation of alternative options, posing a substantial challenge to its growth.

- The market faces challenges from the increasing popularity of alternative plant-based proteins. Soy flour extraction continues to be a significant process in the production of soy-based foods. However, consumer perceptions towards soy products have been unfavorable in certain regions, leading to a decrease in demand. As a result, the food and beverage industry is turning to alternatives like pea, wheat, rice, pulse, canola, flax, and chia proteins. These substitutes offer similar benefits at lower costs, making them attractive options for producers.

- The high cost of soy is another factor contributing to the market's restraint. Despite these challenges, the market maintains sustainability through advancements in soy flour rheology and texture to cater to consumer preferences. The industry remains committed to continuous innovation and improvement to meet evolving market demands.

Exclusive Customer Landscape

The soy flour market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the soy flour market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, soy flour market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Archer Daniels Midland Co. - The PurelyNature brand, under the company's umbrella, specializes in providing high-quality soy flour to the market. This product caters to consumers seeking natural, plant-based alternatives for various applications. The company's commitment to sustainability and transparency sets it apart, ensuring customer trust and satisfaction.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Archer Daniels Midland Co.

- Batory Foods

- Bobs Red Mill Natural Foods Inc.

- Calpro Specialities

- Cargill Inc.

- CHS Inc

- Devansoy Inc.

- Foodchem International Corp.

- International Flavors and Fragrances Inc.

- Kerry Group Plc

- Linyi Shansong Biological Products Co. Ltd.

- PacificSoybean and Grain

- Qingdao ICD Biochemistry Co.Ltd.

- Sakthi Soyas Ltd

- Shandong Yuxin Biotechnology Co. Ltd.

- Soy Austria GmbH

- Sonic Biochem Extraction Pvt. Ltd.

- The Scoular Co.

- Unitechem Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Soy Flour Market

- In January 2024, Archer Daniels Midland Company (ADM) announced the expansion of its soy flour production capacity at its Decatur, Illinois, facility. This USD100 million investment aimed to increase production by 25%, strengthening ADM's position as a leading soy flour supplier (ADM press release).

- In March 2024, Cargill and DuPont Nutrition & Biosciences entered into a strategic partnership to co-develop and commercialize plant-based protein solutions, including soy flour. This collaboration aimed to address the growing demand for plant-based alternatives in the food industry (Cargill press release).

- In May 2024, Ingredion Incorporated completed the acquisition of Penford Corporation, a specialty ingredient supplier with a significant presence in the market. This acquisition expanded Ingredion's product portfolio and broadened its customer base (Ingredion press release).

- In April 2025, the European Commission approved the use of soy flour as a novel food ingredient. This approval opened the European market to increased soy flour imports and applications, benefiting global soy flour producers (European Commission press release).

Research Analyst Overview

- The market encompasses a range of products and processes, including modification, fortification, and derivatization. Soy flour undergoes various techniques such as microencapsulation, encapsulation, and extrusion to enhance its bioavailability and digestibility. Soy flour mixtures and blends are commonly used to create innovative food products, while coating, flakes, and pellets expand its application scope. Soy flour enrichment and fortification improve its nutritional value, making it a preferred ingredient in the food industry. Soy flour ingredients, including paste and slurry, are essential in various food processing applications.

- The use of soy flour in the production of bioavailability-enhanced derivatives and fortified food items continues to gain traction, driving market growth. Soy flour's versatility and nutritional benefits make it a valuable component in numerous industries, from food and beverage to pharmaceuticals and cosmetics.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Soy Flour Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

138 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 706.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, Malaysia, Indonesia, Germany, UK, South Korea, France, Canada, Brazil, Thailand, UAE, Mexico, China, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Soy Flour Market Research and Growth Report?

- CAGR of the Soy Flour industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the soy flour market growth of industry companies

We can help! Our analysts can customize this soy flour market research report to meet your requirements.