Specialty Enzymes Market Size 2025-2029

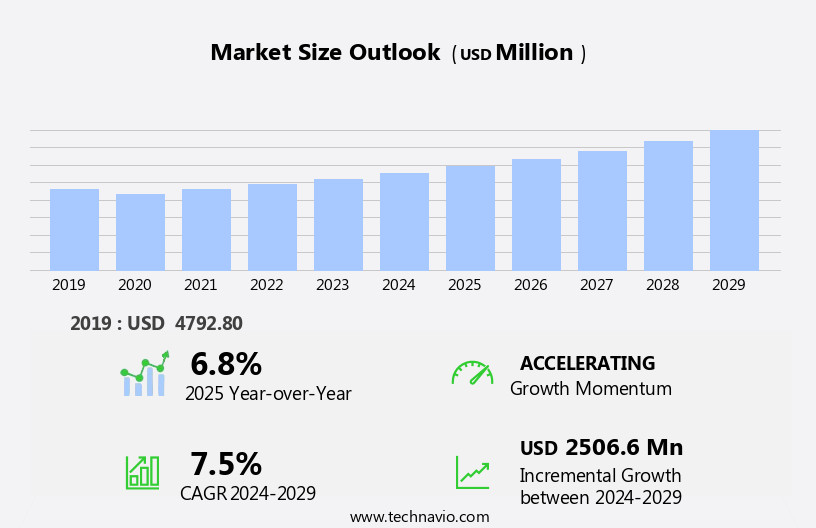

The specialty enzymes market size is forecast to increase by USD 2.51 billion at a CAGR of 7.5% between 2024 and 2029.

- The market is experiencing significant growth due to several key factors. One of the primary drivers is the increasing healthcare expenditure, as specialty enzymes play a crucial role in various medical applications, including pharmaceuticals and diagnostics. Another trend influencing the market is the recent advances in enzyme technology, which have led to the development of more efficient and effective enzymes for various industries, such as food and beverage, biofuels, and detergents. The specialty enzymes market is seeing growth as nutraceutical companies increasingly incorporate these enzymes into their products to enhance digestion, absorption, and overall health benefits. However, safety concerns related to the use of specialty enzymes pose a challenge to market growth. Producers must ensure the safety and efficacy of their products to meet regulatory requirements and consumer expectations. Overall, the market is expected to grow steadily, driven by these factors and the increasing demand for high-performance enzymes in various industries.

What will be the Size of the Specialty Enzymes Market During the Forecast Period?

- The market encompasses a diverse range of biocatalysts used in various industries to enhance productivity, improve product quality, and address the rising demand for healthier and sustainable solutions. This market is driven by the increasing prevalence of chronic diseases, such as cancer and rheumatoid arthritis, leading to a rise in demand for enzymes in pharmaceutical and diagnostic applications. In the food industries, lipases, amylases, proteases, rennet, pectinases, invertases, cellulases, glucose oxidase, and other specialty enzymes play crucial roles in food production, from biosimilar development and DNA modification to DNA sequencing and biotechnology. The market is further fueled by the aging population, which necessitates the development of innovative enzyme-based solutions for healthcare and wellness.

- The microorganism segment, including microbial enzymes produced through fermentation, dominates the market, with the biotechnology industry, agricultural industry, and food production industry being key end-users. Plant sources and animal-derived enzymes also contribute significantly to the market's growth.

How is this Specialty Enzymes Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Research and biotechnology

- Diagnostic

- Others

- Type

- Carbohydrases

- Proteases

- Others

- Source

- Microorganisms

- Plants

- Animal

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South Korea

- Middle East and Africa

- South America

- North America

By Application Insights

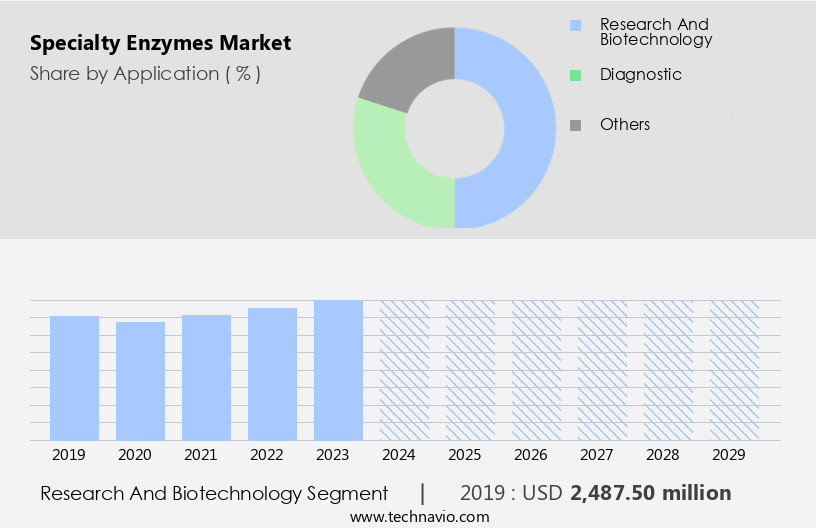

- The research and biotechnology segment is estimated to witness significant growth during the forecast period.

Specialty enzymes play a crucial role in various industries, including biotechnology, medicine, and food production, due to their unique properties and applications. These enzymes, such as lipases, amylases, proteases, rennet, pectinases, invertases, cellulases, glucose oxidase, biosimilar development enzymes, and molecular biology applications enzymes, offer enhanced efficiency, selectivity, and specificity compared to conventional techniques. They are integral to numerous research areas, including DNA modification, DNA sequencing, and diagnostics, enabling advancements in fields like gene therapy, pharmaceuticals, and diagnostics. Industries like the fermentation, agricultural, and food production sectors rely on specialty enzymes for processes such as alcoholic beverage production, oil spill remediation, and waste degradation.

Additionally, they have significant applications In the biomedical sector, treating chronic diseases like cancer, rheumatoid arthritis, diabetes, liver diseases, myocardial infarction, kidney disorders, pancreatitis, and skin disorders. The aging population's increasing need for medicinal drugs and diagnostic solutions further highlights the importance of specialty enzymes.

Get a glance at the Specialty Enzymes Industry report of share of various segments Request Free Sample

The research and biotechnology segment was valued at USD 2.49 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

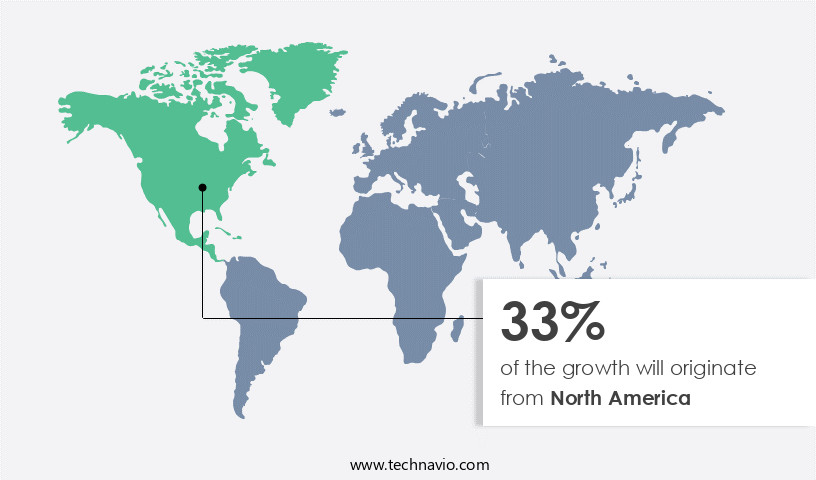

- North America is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing steady growth, driven primarily by the US market. Pharmaceutical and diagnostic applications are key growth areas, fueling the demand for specialty enzymes in this region. Consumer awareness and health consciousness are further boosting the market, particularly for enzyme-fortified consumer products. Proteases and lipases are the major growth drivers In the US market. Specialty enzymes find extensive applications in various industries, including biotechnology, food production, and agriculture. In the biotechnology sector, they are used in molecular biology, gene therapy, and DNA modification. In the food industry, they are employed in alcoholic beverages, fat stains, and biodiesel production.

In the pharmaceutical segment, cysteine proteinases, streptokinase, asparaginase, deoxyribonuclease, glucocerebrosidase, urokinase, pegademase, hyaluronidase, protease, dismutase, elastase, anhydrase, tyrosinase, catalase, and other enzymes are used in medicinal drugs and diagnostic solutions. The aging population and the rise in chronic diseases, including cancer, rheumatoid arthritis, diabetes, liver diseases, myocardial infarction, kidney disorders, pancreatitis, and skin disorders, are further fueling the demand for specialty enzymes. The market is segmented into microorganisms, carbohydrates, and proteases. Microbial enzymes and fermentation processes are used In the production of specialty enzymes. The market is expected to continue growing during the forecast period due to increasing government spending on research and development In the biotechnology, pharmaceutical, and food industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Specialty Enzymes Industry?

Increasing healthcare expenditure is the key driver of the market.

- Specialty enzymes play a significant role in various industries, including healthcare and food production. In the healthcare sector, these enzymes are utilized In the treatment of chronic diseases such as cancer and rheumatoid arthritis. In medicinal applications, enzymes like proteases, amylases, lipases, and nucleases are used for biosimilar development, DNA modification, and DNA sequencing in biotechnology. The aging population and the subsequent rise In the prevalence of diseases like diabetes, liver diseases, bone diseases, and autoimmune & inflammatory diseases further fuel the demand for specialty enzymes. In the food industries, enzymes like rennet, pectinases, invertases, cellulases, and glucose oxidase are used In the fermentation process for alcoholic beverages, waste degradation, and oil spills.

- Additionally, they are employed In the production of dietary supplements, digestive enzymes, and in molecular biology applications like gene therapy and pharmaceutical manufacturing. The biotechnology industry, microbial enzymes, and the fermentation industry are major contributors to the market. The agricultural industry and food production industries also utilize plant sources and animal-derived enzymes for various applications. Furthermore, the biofuel sector, particularly in biodiesel production, utilizes phospholipases and proteases. Government spending on healthcare and research & biotechnology sector also contributes to the growth of the market. Enzymes like catalase, dismutase, elastase, anhydrase, tyrosinase, and catalase are used in various research and diagnostic methods.

What are the market trends shaping the Specialty Enzymes Industry?

Recent advances in enzyme technology is the upcoming market trend.

- Specialty enzymes, distinguished by their specificity and efficiency, are driving innovation across various industries, including pharmaceuticals, biotechnology, and food processing. In pharmaceuticals, these enzymes are integral to drug formulation, diagnostics, and treatments. Proteases and lipases, for example, contribute to the development of treatments for chronic diseases such as cancer and rheumatoid arthritis. In the food industry, specialty enzymes improve product quality and shelf life. Amylases and cellulases enhance texture and nutritional value in food production. The biotechnology industry utilizes specialty enzymes for DNA modification, sequencing, and molecular biology applications, including gene therapy.

- In the medical field, enzymes like cysteine proteinases, streptokinase, asparaginase, deoxyribonuclease, glucocerebrosidase, urokinase, pegademase, hyaluronidase, protease, dismutase, elastase, anhydrase, tyrosinase, catalase, and others find use in treating bone diseases, autoimmune and inflammatory diseases, diabetes, liver diseases, myocardial infarction, kidney disorder, pancreatitis, and skin disorders. Government spending on research and development In these areas further fuels market growth. The microorganism segment, including microbial enzymes, plays a significant role In the fermentation industry, alcoholic beverages, and waste degradation processes. Additionally, the biofuel sector employs specialty enzymes in biodiesel production.

What challenges does the Specialty Enzymes Industry face during its growth?

Safety concerns related to use of specialty enzymes is a key challenge affecting the industry growth.

- Specialty enzymes, derived from microorganisms and plant or animal sources, play a crucial role in various industries, including food production, biotechnology, and pharmaceuticals. In the medical field, they are used In the treatment of chronic diseases such as cancer and rheumatoid arthritis. Lipases, amylases, proteases, rennet, pectinases, invertases, cellulases, glucose oxidase, and other enzymes have significant applications in biosimilar development, DNA modification, DNA sequencing, and molecular biology. The aging population's growth fuels the demand for digestive enzymes and dietary supplements. Enzymes' potential hazards include allergenicity, residual microbiological activity, activity-related toxicity, and chemical toxicity. As proteins, they are potential allergens and repeated exposure can lead to severe responses, even life-threatening ones.

- To mitigate this risk, liquid preparations have replaced dry ones, and sometimes, the liquids are made viscous to prevent aerosol formation during handling. The biotechnology industry relies on microbial enzymes and the fermentation process to produce enzymes for various applications. The agricultural industry uses enzymes in waste degradation, oil spills, and alcoholic beverages, while the food production industry employs them for fat stains and biocatalysts. Pharmaceutical companies utilize enzymes In the production of medicinal drugs, diagnostic solutions, and In the treatment of bone diseases, autoimmune and inflammatory diseases, diabetes, liver diseases, myocardial infarction, kidney disorders, pancreatitis, and skin disorders.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Advanced Enzyme Technologies Ltd. - The company offers specialty enzymes for a variety of industries including human healthcare and nutrition, animal nutrition, baking, and fruit and vegetable processing.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Enzyme Technologies Ltd.

- Amano Enzyme Inc.

- Amicogen Co. Ltd.

- Antozyme Biotech Pvt. Ltd.

- Avantor Inc.

- BASF

- BBI Solutions OEM Ltd.

- BRAIN Biotech AG

- Chr Hansen AS

- Codexis Inc

- Enzyme Development Corp.

- Enzyme Supplies Ltd.

- F. Hoffmann La Roche Ltd.

- International Flavors and Fragrances Inc.

- Kerry Group Plc

- dsm-firmenich

- Maravai LifeSciences Holdings Inc.

- Nagase & Co., Ltd

- Novozymes AS

- Sanofi SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Specialty enzymes are a crucial segment of the broader enzyme market, gaining significant attention due to their diverse applications in various industries. These enzymes, which include lipases, amylases, proteases, rennet, pectinases, invertases, cellulases, glucose oxidase, and others, play essential roles in numerous processes. The demand for specialty enzymes is driven by their applications in chronic diseases, particularly In the pharmaceutical and biotechnology sectors. Enzymes are increasingly used In the development of biosimilars and DNA modification techniques, as well as in DNA sequencing and gene therapy. The aging population is another significant factor fueling the growth of the market, as these enzymes find extensive use in diagnostic methods for various diseases, including cancer, rheumatoid arthritis, diabetes, liver diseases, myocardial infarction, kidney disorders, pancreatitis, and skin disorders.

Moreover, the food industries, including the fermentation, agricultural, and food production industries, are major consumers of specialty enzymes. These industries rely on enzymes for various applications, such as improving food production processes, enhancing food quality, and creating new food products. For instance, lipases are used In the production of biofuels, such as biodiesel, while amylases and proteases are employed In the production of various food products, including alcoholic beverages, fat stains removal, and digestive enzymes. Plant sources and microorganisms are the primary sources of specialty enzymes. Microbial enzymes, produced through fermentation processes, account for a significant share of the market.

Furthermore, animal-derived enzymes, although less common, also find applications in specific industries, such as the pharmaceutical sector. The carbohydrases segment, which includes amylases, cellulases, and pectinases, is a significant subsegment of the market. These enzymes are used extensively in various industries, including the food production industry, where they help improve the production process and enhance food quality. In the pharmaceutical sector, carbohydrates are used In the production of medicinal drugs and diagnostic solutions. The research and biotechnology sector is another major consumer of specialty enzymes. These enzymes find extensive use in cell biology, molecular biology applications, and waste degradation processes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

230 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.5% |

|

Market Growth 2025-2029 |

USD 2.51 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

US, Canada, China, UK, Japan, India, Germany, South Korea, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.