Sports Composites Market Size 2025-2029

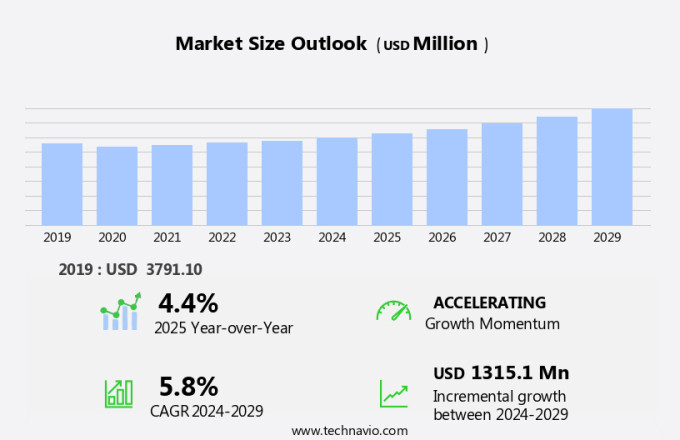

The sports composites market size is forecast to increase by USD 1.32 billion, at a CAGR of 5.8% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing participation in various sports and fitness activities worldwide. This trend is fueled by a growing awareness of health and wellness, as well as the availability of more accessible and affordable sports equipment. Another key driver is the introduction of new, advanced composite materials, which offer superior strength, durability, and lightweight properties compared to conventional materials.

- However, the market also faces challenges, including intense competition from established players using conventional materials and the high production costs associated with composite manufacturing. To capitalize on market opportunities and navigate these challenges effectively, companies must focus on innovation, cost reduction, and strategic partnerships to remain competitive in the evolving sports composites landscape.

What will be the Size of the Sports Composites Market during the forecast period?

The market continues to evolve, driven by the relentless pursuit of enhanced performance and lighter weight in various sectors. Carbon fiber, with its superior strength-to-weight ratio, is a key component in the production of advanced tennis rackets and golf clubs. Performance enhancement in sports equipment is a primary focus, with lightweight construction and advanced composites leading the charge. In tennis, carbon fiber's high stiffness and strength contribute to improved power and control in rackets. In golf, lighter clubs made from carbon fiber composites offer increased swing speed and distance. The use of advanced composites extends beyond sports, finding applications in civil engineering, wind energy, and even racing bikes.

Corrosion resistance is another crucial factor, ensuring durability and longevity in sports equipment. Supply chain management and autoclave curing are essential processes in composite manufacturing, ensuring consistent quality and structural integrity. The market's dynamics are influenced by various factors, including material selection, manufacturing processes, and industry standards. Vacuum bagging, molding processes, and resin infusion are common manufacturing techniques used to produce high-performance materials with optimal thermal stability and moisture absorption. Bio-based composites and recyclable materials are emerging trends, addressing sustainability concerns while maintaining performance. Aramid fiber and glass fiber are popular reinforcement options, offering excellent fatigue resistance and impact resistance.

Testing and certification are crucial in ensuring product safety and performance. Finite element analysis and surface finishing techniques contribute to the development of high-performance materials and structures. The ongoing unfolding of market activities reveals a continuous quest for innovation and improvement, with applications spanning from tennis rackets to windsurf boards.

How is this Sports Composites Industry segmented?

The sports composites industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Carbon fiber

- Glass fiber

- Others

- Application

- Golf equipment

- Bicycle parts

- Skis and snowboards

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The carbon fiber segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth as carbon fiber gains popularity for its superior properties in enhancing sports equipment performance. Carbon fiber's lightweight, high strength, and vibration-damping capabilities make it an ideal material for various applications, particularly in competitive cycling. Bikes made with carbon fiber frames and components, including handlebars, seat posts, and rims, offer weight savings and superior vibration damping, improving bike speed, agility, and rider comfort. This material's adoption is driven by the increasing demand for high-performance materials that can withstand rigorous use while providing a competitive edge. In civil engineering, carbon fiber composites are used for their impact and fatigue resistance, making them suitable for infrastructure applications.

Vacuum bagging and molding processes are commonly used in composite manufacturing, ensuring consistent quality and precise shapes. Finite element analysis and structural analysis are essential tools in designing and optimizing composite structures for various sports applications. Road bikes and mountain bikes benefit from carbon fiber's strength-to-weight ratio, providing better performance and durability. Advanced composites, such as bio-based and recyclable composites, are gaining traction due to their environmental sustainability and cost-effectiveness. Aramid fiber and glass fiber are also used in sports composites for their unique properties, such as high tensile strength and stiffness. Epoxy resin is a popular resin used in composite manufacturing due to its excellent adhesive properties and thermal stability.

Surface finishing and UV resistance are crucial factors in the production of high-quality sports composites. Industry standards and testing and certification are essential to ensure product safety and reliability. The market also extends to other applications, such as wind energy, archery bows, hockey sticks, tennis rackets, golf clubs, and corrosion resistance. Supply chain management and autoclave curing are essential processes in the production and delivery of sports composites. Overall, the market is continuously evolving, driven by advancements in materials science and manufacturing technologies.

The Carbon fiber segment was valued at USD 1.86 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market experiences significant growth due to the increasing demand for high-performance, durable, and lightweight sports equipment. In North America, a large consumer base and substantial investments in sports infrastructure drive market expansion. Golf, in particular, is a popular sport in the United States, with approximately 5.5 million individuals aged 18 to 34 participating in off-course activities in 2023. This demographic trend highlights the growing interest in advanced composite materials, such as carbon fiber and graphite, for manufacturing high-quality golf clubs. Civil engineering applications, including infrastructure and construction, also contribute to market growth. Advanced composites offer superior impact resistance, fatigue resistance, and thermal stability compared to traditional materials.

Vacuum bagging and molding processes are widely used for manufacturing composites in various industries, including sporting goods. Racing bikes, tennis rackets, archery bows, hockey sticks, and golf clubs are some of the major sports equipment categories that extensively use advanced composites. Carbon fiber and glass fiber reinforcements are commonly used for their high strength-to-weight ratio and excellent performance enhancement. Bio-based composites and recyclable composites are emerging trends in the market, driven by the growing focus on sustainability and eco-friendliness. Epoxy and polyester resins are commonly used as matrix materials in composite manufacturing. Industry standards and testing and certification are crucial aspects of the market.

Advanced composites undergo rigorous testing for structural analysis, corrosion resistance, moisture absorption, and surface finishing to ensure optimal performance and durability. Wind energy is another significant application area for sports composites, with windsurf boards and wind turbine blades being major end-use products. The market also caters to niche applications, such as mountain bikes and uv resistance, to meet the diverse needs of various industries. Autoclave curing and resin infusion are popular manufacturing processes for producing high-performance sports composites. Supply chain management plays a crucial role in ensuring timely delivery and quality control. In summary, the market is driven by the demand for high-performance, durable, and lightweight sports equipment across various applications, including golf, civil engineering, and wind energy.

The use of advanced materials, such as carbon fiber and glass fiber, and manufacturing processes, such as vacuum bagging and autoclave curing, are key trends shaping the market's growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Sports Composites Industry?

- Participating in sports is a crucial factor fueling market growth, as an increasing number of individuals engage in sports activities.

- The market is experiencing significant growth due to the increasing participation in sports and fitness activities across the world. In 2023, over 240 million people in the US engaged in sports or fitness activities, demonstrating a strong commitment to maintaining an active lifestyle. This trend is also reflected in the United Kingdom, where approximately 63% of the population aged over 16 regularly participated in sports in 2023. This consistent engagement in sports activities necessitates the use of durable and high-performance sports equipment. Advanced composite materials, such as carbon fiber and fiberglass, are in high demand due to their superior strength-to-weight ratio and resistance to fatigue.

- Composite manufacturing processes, including the use of epoxy resin and aramid fiber, ensure the production of high-quality sports equipment for various applications, including road bikes, archery bows, hockey sticks, and more. Furthermore, the development of bio-based composites and recyclable composites is expected to enhance the market's growth potential by addressing sustainability concerns and reducing the environmental impact of sports equipment production.

What are the market trends shaping the Sports Composites Industry?

- The introduction of new products is a significant market trend. Professionals anticipate continued innovation and product development in various industries.

- The market is experiencing notable growth due to the increasing adoption of advanced composites in the production of high-performance sports equipment. Structural analysis and innovation in composite technology are key drivers of this trend, as these materials offer significant benefits over traditional materials. For instance, carbon fiber is widely used in the production of tennis rackets and golf clubs due to its lightweight construction and corrosion resistance. Advanced composites are also favored for their ability to enhance the performance of sports equipment. For example, Toray Advanced Composites recently introduced Toray Cetex TC915 PA+, a thermoplastic composite material designed specifically for sporting goods.

- This new material boasts superior properties, including enhanced performance and durability, making it an ideal choice for various sports equipment applications. Effective supply chain management and autoclave curing processes are essential in the production of sports composites to ensure the highest quality and consistency. The use of these materials in sports equipment is expected to set new standards in the industry, providing athletes with durable and high-performing gear that can withstand rigorous use. Overall, The market is poised for continued growth as the demand for advanced and durable sports equipment increases.

What challenges does the Sports Composites Industry face during its growth?

- The growth of the industry is significantly impacted by the intense competition posed by conventional materials.

- The market encounters significant competition from traditional materials like aluminum, wood, and steel. These materials maintain their dominance in various sectors due to their cost-effectiveness, long-standing popularity, and satisfactory performance for numerous applications. For instance, in the golf industry, high-performance carbon fiber composites are favored by elite players, but mass-market consumers continue to prefer metal clubs made of steel or titanium. These traditional materials offer affordability and consumer trust, making them a formidable challenge for composites in the sports equipment market. In the realm of wind energy, composites have gained prominence due to their high strength-to-weight ratio and resistance to moisture absorption and UV radiation.

- Stringent testing and certification procedures ensure industry standards are met, enhancing consumer confidence. Techniques like resin infusion streamline production processes, making composites increasingly competitive. Surface finishing plays a crucial role in enhancing the aesthetic appeal and performance of sports composites. Moisture absorption and UV resistance are essential considerations in applications like windsurf boards and mountain bikes, where exposure to environmental elements is common. The industry continues to innovate, focusing on harmonious designs that strike a balance between functionality and aesthetics. In conclusion, while composites like carbon fiber offer superior properties, traditional materials remain competitive in various sports applications due to their affordability, availability, and consumer trust.

- The market continues to evolve, driven by advancements in materials science, manufacturing processes, and design aesthetics.

Exclusive Customer Landscape

The sports composites market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sports composites market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, sports composites market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ACP COMPOSITES INC. - The company specializes in the production of advanced sports composites, including carbon fiber and fiberglass, enabling the manufacturing of intricate sports and recreation equipment and accessories with unparalleled precision and dimensional stability. These materials offer superior strength-to-weight ratios and resistance to environmental factors, making them ideal for high-performance applications. By utilizing cutting-edge manufacturing techniques, the company ensures consistent quality and adherence to tight tolerances, ultimately delivering innovative and durable solutions to the global market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACP COMPOSITES INC.

- Advanced Composites Inc.

- ARRIS Composites Inc.

- Arvind Composite

- Blackfabric

- Celanese Corp.

- Dexcraft

- EPSILON Composite

- Exel Composites

- Hexcel Corp.

- LAMILUX Heinrich Strunz Holding GmbH and Co. KG

- Lantor Composites

- Mitsubishi Chemical Group Corp.

- New Era Materials

- Plastic Reinforcement Fabrics Ltd.

- Rockman Advanced Composites Pvt. Ltd.

- SGL Carbon SE

- Teijin Ltd.

- Topkey Corp.

- Toray Composite Materials America Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Sports Composites Market

- In February 2023, Hexcel Corporation, a leading advanced composites company, announced the expansion of its Quinzano, Italy, facility to produce advanced composites for the sports industry. This investment is expected to increase the company's production capacity by 50%, catering to the growing demand for lightweight and high-performance sports equipment (Hexcel Corporation Press Release).

- In July 2022, Teijin Aramid, a global aramid fiber technology company, and Adidas, a leading sports brand, signed a long-term partnership to develop and commercialize high-performance, sustainable sports materials. This collaboration aims to reduce the carbon footprint in the sports industry and enhance the performance of sportswear and equipment (Teijin Aramid Press Release).

- In April 2021, Toray Industries, a major chemical company, launched its new carbon fiber material, TORAYCA T700S, for use in sports equipment. This lightweight and high-strength material is expected to significantly improve the performance of golf clubs and tennis rackets, making them more durable and responsive (Toray Industries Press Release).

- In October 2020, SGL Carbon, a global carbon fiber manufacturer, acquired the composite materials business of SABIC, a leading chemical company. This acquisition strengthened SGL Carbon's position in the market, expanding its product portfolio and customer base (SGL Carbon Press Release).

- These developments highlight significant strategic partnerships, capacity expansions, and new product launches, reflecting the growing importance and innovation in the market.

Research Analyst Overview

- The market is experiencing dynamic growth, driven by advancements in technology and evolving consumer preferences. Product development in this sector is focused on enhancing the durability and performance of composites through various testing methods. X-ray inspection and ultrasonic testing are used for defect detection, while corrosion testing ensures longevity. Pricing strategies are under scrutiny as 3D printing and design optimization reduce manufacturing costs. Matrix materials are being analyzed for life cycle assessment, and joining techniques are being refined for improved durability. Consumer preferences influence composite design, with a focus on lightweight, high-performance materials. Manufacturing automation and non-destructive testing are essential for ensuring consistent quality.

- Fiber reinforcement, moisture testing, UV testing, and performance testing are integral to the production process. Cost analysis and thermal testing are crucial for optimizing material selection and understanding the impact of various factors on composite properties. Fatigue testing ensures the longevity and reliability of sports composites.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Sports Composites Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 1315.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, Japan, Germany, China, UK, Canada, South Korea, France, Italy, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Sports Composites Market Research and Growth Report?

- CAGR of the Sports Composites industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the sports composites market growth of industry companies

We can help! Our analysts can customize this sports composites market research report to meet your requirements.