Superfoods Market Size 2025-2029

The superfoods market size is forecast to increase by USD 90.2 billion, at a CAGR of 8.1% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing adoption of superfoods in various applications, particularly in the food and beverage industry. Superfoods, known for their high nutritional value, are gaining popularity as consumers seek healthier dietary options. Beyond food, the market is expanding into new sectors, with superfood ingredients finding a place in beauty and personal care products. This trend is driven by the perceived health benefits and the desire for natural and organic offerings. However, the market faces a substantial challenge from substitutes.

- Many traditional food items, while not technically classified as superfoods, offer similar nutritional benefits at lower costs. This price disparity poses a threat to market growth, as price-sensitive consumers may opt for these alternatives instead. Companies in the market must differentiate themselves through product innovation, value-added services, and effective marketing strategies to maintain their competitive edge and capture market share.

What will be the Size of the Superfoods Market during the forecast period?

The superfood market continues to evolve, driven by the growing health and wellness trend and consumer demand for nutrient-dense foods. Superfood snacks, such as chia seeds and acai berries, have gained popularity due to their antioxidant properties and energy boost. Packaging design plays a crucial role in attracting consumers, with an emphasis on transparency and eco-friendly materials. Health food stores and wellness coaches promote superfoods as part of a clean eating lifestyle, while food safety standards ensure product quality and regulatory compliance. Superfood smoothies, juices, and bars offer convenient options for consumers seeking an immune boost or heart health benefits.

Brands differentiate themselves through product innovation, ingredient transparency, and sustainable sourcing. Functional foods, such as superfood powders and supplements, cater to consumers seeking specific health benefits. Social media influence and content marketing help build brand awareness and consumer education. Dietary guidelines and health professionals advocate for the inclusion of superfoods in various diets, including vegetarian, vegan, and plant-based options. Superfoods' antioxidant properties and anti-inflammatory effects have led to their use in skincare and natural remedies. Superfood bowls and recipes showcase their versatility in whole foods. Supply chain management and distribution channels ensure a steady supply of these nutrient-dense ingredients.

Consumer perception and brand loyalty continue to shape market dynamics, with ongoing research and scientific evidence supporting the health benefits of superfoods.

How is this Superfoods Industry segmented?

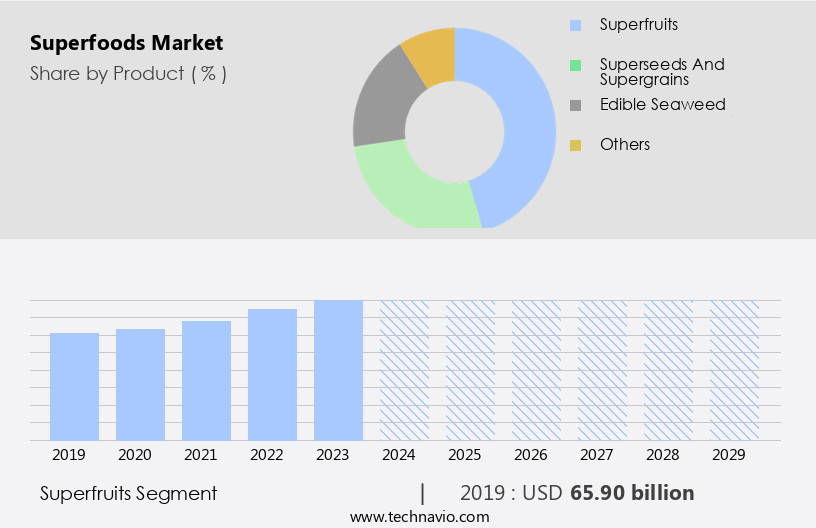

The superfoods industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Superfruits

- Superseeds and supergrains

- Edible seaweed

- Others

- Distribution Channel

- Offline

- Online

- Form Factor

- Whole foods

- Powders

- Juices

- Frozen products

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

The superfruits segment is estimated to witness significant growth during the forecast period.

Superfoods, a term used for nutrient-dense foods, have gained significant attention in the health and wellness industry. Fitness professionals often recommend chia seeds and flax seeds for their high fiber and omega-3 fat content, contributing to digestive health and energy boost. Acai berries and goji berries, considered exotic superfruits, are rich in vitamins, antioxidants, and phytochemicals, supporting heart health and immune system function. Raw foods, including superfoods, are popular among vegan and vegetarian diets, catering to consumer demand for clean eating. Marketing campaigns emphasize the unique health benefits of these foods, driving brand awareness and consumer perception. Superfood smoothies and beverages have gained popularity as convenient ways to incorporate these nutrient-dense foods into daily routines.

Superfood powders and bars offer product innovation, making it easier for consumers to add these foods to their diets. Grocery stores and health food stores stock a variety of superfoods, ensuring accessibility. Online retailers and distributors expand the reach of these products, catering to consumers' convenience. Product labeling and ingredient transparency are crucial for consumer education and trust. Regulatory compliance and food safety standards are essential for maintaining consumer confidence. Functional foods, including superfoods, offer additional health benefits beyond basic nutritional value. Skin health, brain function, and anti-inflammatory effects are some of the claimed benefits. Clinical trials and scientific research support these claims, adding credibility to the market.

Brand loyalty is a significant factor in the superfood market, with consumers seeking high-quality, sustainable sourcing and organic farming practices. Sustainability trends influence consumer perception and purchasing decisions. Hemp seeds, a lesser-known superfood, offer similar health benefits and are gaining popularity. Product differentiation is essential for brands, with superfood juices, superfood bowls, and natural remedies catering to various consumer preferences. Wellness coaches and health professionals recommend these foods as part of a balanced diet, further promoting their popularity. In summary, the superfood market is dynamic, driven by consumer demand for nutrient-dense, convenient, and sustainable food options. Superfoods, including superfruits, cater to various health concerns and offer unique health benefits.

Marketing campaigns, product innovation, and consumer education play crucial roles in the market's growth.

The Superfruits segment was valued at USD 65.90 billion in 2019 and showed a gradual increase during the forecast period.

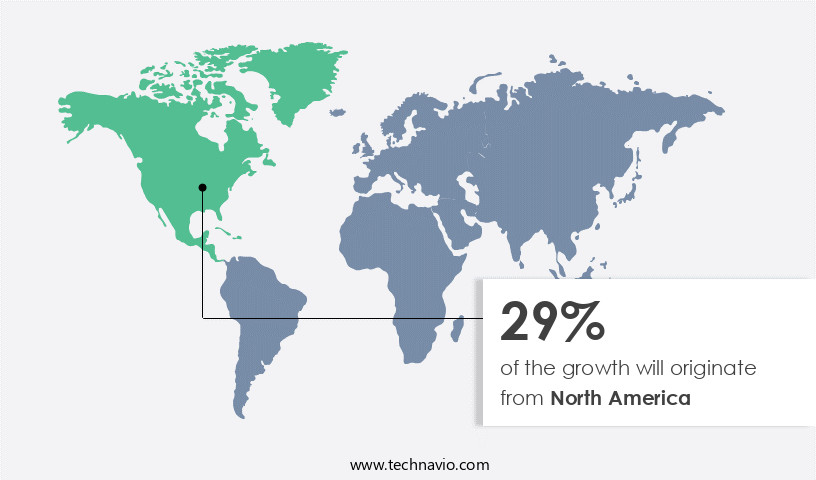

Regional Analysis

North America is estimated to contribute 29% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The US market for superfoods in North America is experiencing significant growth, driven by increasing health consciousness and consumer awareness of their nutritional benefits. Superfoods, including chia seeds, acai berries, and goji berries, are increasingly incorporated into raw food diets, superfood smoothies, and functional foods. Clinical trials and regulatory compliance ensure product safety and efficacy. Pricing strategies vary, with some superfoods, like hemp seeds and flax seeds, becoming more accessible due to mass production and supply chain optimization. Superfoods are used in various applications, from superfood bowls and superfood snacks to powders, beverages, and bars.

Brands prioritize ingredient transparency and product innovation to differentiate themselves. Influencer marketing and content marketing help build brand awareness and consumer education. Superfoods are not only consumed for energy boost and heart health but also for immune system support, digestive health, and skin health. Superfoods are also used in natural remedies and whole foods, reflecting sustainability trends and organic farming practices. Superfoods' antioxidant properties and anti-inflammatory effects contribute to their popularity. Grocery stores, health food stores, online retailers, and distribution channels cater to consumer demand for these nutrient-dense foods. Food safety standards and dietary guidelines ensure their quality and effectiveness.

Food science and scientific research continue to uncover new benefits of these superfoods, fueling further innovation and consumer interest.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Superfoods Industry?

- The increasing prevalence of superfoods in consumer diets is the primary factor fueling market growth.

- Superfoods, including avocado, blueberries, and cranberries, have seen substantial export growth in recent years. Major exporters include Mexico, the Netherlands, and Peru. The integration of superfoods, such as avocado, berries, and baobab seeds and fruits, into value-added products like superfood powders and packaged snacks is driving the export market. Consumer demand for clean eating and plant-based diets, coupled with sustainability trends, has fueled the production of these value-added products. Brands prioritize product innovation and consumer education to build brand loyalty. Health professionals and consumers view superfoods as natural remedies due to their antioxidant properties and anti-inflammatory effects.

- The distribution of superfoods through various channels, including e-commerce and brick-and-mortar stores, has broadened their reach. The nutritional value of superfoods, such as hemp seeds and superfood bowls, continues to attract consumers. The market is expected to remain dynamic, with an increasing number of superfood product launches. For instance, Kuli Kuli Foods introduced new superfood blends and gummies at Natural Products Expo West in March, featuring Marine Glow (spirulina, kelp, marine minerals) and Citrus C Defense (acerola cherry, baobab, hibiscus).

What are the market trends shaping the Superfoods Industry?

- The application of superfood ingredients in beauty and personal care products is a current market trend. Superfoods, such as acai, goji berries, and kale, are increasingly being incorporated into cosmetics and skincare formulations due to their nutrient-rich properties.

- Superfoods, recognized for their high nutritional value and health benefits, are increasingly gaining popularity in various consumer markets. Superfood snacks, such as goji berries and flax seeds, are favored for their role in promoting brain function, energy, and overall wellness. The demand for these ingredients is driven by health-conscious consumers, including wellness coaches and those following vegetarian diets. Packaging design plays a significant role in the market, as consumers seek convenient and visually appealing options. The market adheres to stringent food safety standards and dietary guidelines to ensure product quality and authenticity. Social media influence is a significant market dynamic, with consumers turning to online platforms for product information and recommendations.

- Supply chain management is crucial to maintain product differentiation and meet the increasing demand for superfoods. Superfood juices, derived from ingredients like acai berries and kale, offer a convenient and nutrient-dense alternative to traditional beverages. Scientific research continues to uncover new benefits of these ingredients, further fueling market growth. Dietary supplements, containing superfood ingredients, cater to consumers seeking additional nutritional support. The market's continuous expansion is attributed to the growing awareness of the importance of maintaining optimal health and wellness.

What challenges does the Superfoods Industry face during its growth?

- The industry's growth is threatened by the significant competition posed by substitutes, which represents a key challenge that professionals must address.

- The global market for superfoods continues to gain traction among fitness professionals and health-conscious consumers due to the perceived health benefits associated with these nutrient-dense foods. Superfoods, such as chia seeds, acai berries, and raw foods, are marketed as functional foods that offer various health advantages. However, the market faces competition from whole foods and functional foods, including probiotics and prebiotics, which provide similar health benefits at lower prices and greater availability. In 2023, the average selling price of superfoods in the US was significantly higher than that of whole foods, making the latter a more attractive option for some consumers.

- To remain competitive, superfoods manufacturers must focus on regulatory compliance, quality control, and product labeling to support health claims. Clinical trials and research studies are crucial in validating the health benefits of superfoods and ensuring regulatory compliance. Superfood smoothies and beverages have gained popularity in recent years due to their convenience and ease of consumption. Skin health is another area where superfoods are gaining attention, with various recipes highlighting the benefits of superfoods for maintaining healthy skin. Pricing strategies and product innovation are essential for superfoods manufacturers to differentiate themselves from competitors. Functional foods, such as superfood beverages and nutraceuticals, offer opportunities for innovation and differentiation.

- However, maintaining quality control and regulatory compliance can be challenging, requiring significant investment in research and development. The market is facing competition from whole foods and functional foods, particularly in terms of pricing and availability. To remain competitive, superfoods manufacturers must focus on regulatory compliance, quality control, and product innovation while maintaining transparency and accuracy in product labeling to support health claims. Superfoods offer numerous health benefits, but consumers must be informed about the value they provide to justify the higher prices.

Exclusive Customer Landscape

The superfoods market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the superfoods market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, superfoods market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Archer Daniels Midland Co. - The company specializes in providing a range of superfoods, including HarvestEdge flours, NutriStemTM beans, pulses, nuts, and seeds.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Archer Daniels Midland Co.

- Barleans Organic Oils LLC

- Cornish Seaweed Co. Ltd.

- Creative Nature Ltd.

- General Mills Inc.

- Healthy Truth

- ITC Ltd.

- Navitas LLC

- Nirvaanic Life Foods Pvt. Ltd.

- Nua Naturals

- Nutiva Inc.

- NutriAsia Inc.

- Nutrisure Ltd.

- Ocean Spray Cranberries Inc.

- OMG Food Company LLC

- Power Super Foods

- Rhythm Superfoods LLC

- Suncore Foods Inc.

- Sunfood

- Superlife Co. Pte. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Superfoods Market

- In February 2023, Archer Daniels Midland Company (ADM), a leading global food ingredient manufacturer, announced the launch of its new line of plant-based protein powders, dubbed "ProLeap Superfoods." These powders, derived from peas, chickpeas, and lentils, are rich in protein and essential nutrients, positioning ADM to cater to the growing demand for plant-based alternatives (ADM press release, 2023).

- In June 2024, PepsiCo, a multinational food, snack, and beverage corporation, entered into a strategic partnership with Ripple Foods, a leading plant-based milk and protein company. This collaboration aimed to develop and market new plant-based dairy alternatives infused with Ripple's pea protein and ADM's proprietary nutrient blend, further expanding PepsiCo's presence in the market (PepsiCo press release, 2024).

- In October 2024, Danone Manifesto Ventures, a venture capital arm of Danone, led a USD40 million Series C funding round in Rhythm Superfoods, a U.S.-based producer of plant-based snacks. This investment will support Rhythm's expansion into new markets and the development of innovative, nutrient-dense products (Danone Manifesto Ventures press release, 2024).

- In March 2025, the European Commission approved the use of chia seeds as a novel food ingredient, paving the way for their commercialization across Europe. This approval marks a significant milestone for the superfoods industry, as chia seeds have gained popularity for their high nutritional value and versatility in various food applications (European Commission press release, 2025).

Research Analyst Overview

- In the dynamic superfood market, studies continue to uncover the health benefits of various foods, fueling the demand for certified superfood tablets and capsules. Superfood standards ensure product authenticity and quality, while innovations in superfood pastries, yogurts, oils, and soups cater to diverse consumer preferences. Superfood events, recipes, research, and podcasts engage audiences, driving market trends. Superfood websites, blogs, and videos disseminate information, shaping consumer behavior.

- Salads, coffee, tea, cereals, and concentrates are common superfood offerings, but startups also introduce superfood blends, crackers, bites, bread, desserts, drinks, labeling, and ice cream. Regulations play a crucial role in superfood market growth, with ongoing discussions on claims, certifications, and product safety. Superfood conferences foster industry collaboration and knowledge sharing.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Superfoods Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

226 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.1% |

|

Market growth 2025-2029 |

USD 90.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.3 |

|

Key countries |

US, Germany, China, Canada, Japan, UK, India, France, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Superfoods Market Research and Growth Report?

- CAGR of the Superfoods industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the superfoods market growth of industry companies

We can help! Our analysts can customize this superfoods market research report to meet your requirements.