Surgical Drains/Wound Drainage Market Size 2024-2028

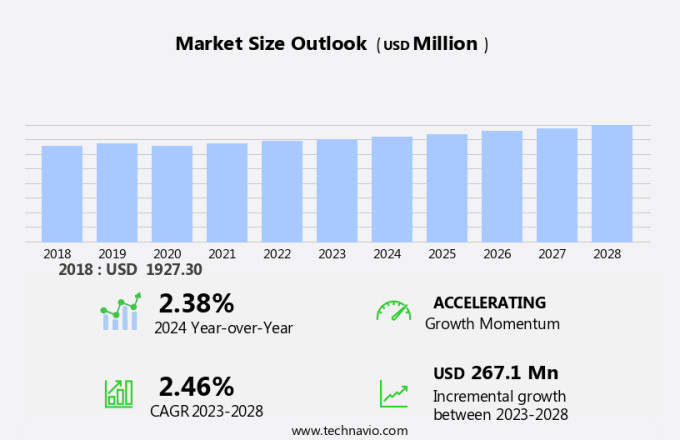

The surgical drains/wound drainage market size is forecast to increase by USD 267.1 million, at a CAGR of 2.46% between 2023 and 2028.

- The market is experiencing significant growth due to the rising number of surgeries and increasing healthcare expenditure worldwide. With the global population aging and an upward trend in chronic diseases, the demand for surgical procedures is on the rise, leading to a corresponding increase in the use of surgical drains for postoperative wound management. Furthermore, the healthcare sector's continuous investment in advanced medical technologies and treatments is driving market expansion. However, the market faces challenges as well. The rise in healthcare costs and postoperative complications, such as infection and drain malfunction, pose significant obstacles to market growth.

- Healthcare providers and manufacturers must collaborate to develop cost-effective, reliable, and efficient solutions to address these challenges and ensure patient safety. Companies that successfully navigate these hurdles and provide innovative, high-quality products will be well-positioned to capitalize on the market's potential and maintain a competitive edge.

What will be the Size of the Surgical Drains/Wound Drainage Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The surgical drains market continues to evolve, driven by advancements in drainage technologies and their applications across various medical sectors. Occlusive dressings, available in various sizes and materials, play a crucial role in managing post-surgical wound exudate. Closed suction drains, with their ability to actively remove tissue fluid, have gained popularity due to their effectiveness in infection prevention and hematoma drainage. Drainage systems, incorporating pressure monitoring and drainage volume assessment, enable efficient fluid management and early detection of drainage complications. Active drainage systems, utilizing motorized pumps, offer enhanced fluid removal capabilities. Drainage materials, such as silicone and polyvinyl chloride, provide biocompatibility and durability.

Gravity drainage and passive drainage systems continue to be used in specific surgical contexts, while pressure monitoring and drainage volume assessment are essential for optimizing drainage duration and promoting wound healing. Lymphedema treatment and seroma evacuation are other applications where surgical drains play a significant role. Innovations in drain placement techniques and drain removal protocols contribute to minimizing post-operative complications and improving patient outcomes. The ongoing focus on infection prevention and tissue fluid removal ensures that surgical drains remain a vital component of modern healthcare practices.

How is this Surgical Drains/Wound Drainage Industry segmented?

The surgical drains/wound drainage industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Active drains

- Passive drains

- Geography

- North America

- US

- Europe

- France

- Germany

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Type Insights

The active drains segment is estimated to witness significant growth during the forecast period.

The market is witnessing notable growth due to the increasing prevalence of surgical procedures and the need for effective tissue fluid removal. Active drainage systems, which utilize suction devices to create negative pressure, are gaining popularity over passive drainage systems. Active drains, including Jackson-Pratt and Blake drains, facilitate efficient fluid collection and promote wound healing. Jackson-Pratt drains consist of a perforated tube connected to a negative pressure collection device, while Blake drains are inserted through a separate incision and connected to an external drainage system. Infection prevention is a significant concern in surgical procedures, leading to the widespread use of biocompatible materials in drainage systems.

Drainage materials, such as silicone and polyvinyl chloride, offer advantages like flexibility, durability, and biocompatibility. Closed suction drains, which minimize the risk of contamination, are increasingly being adopted for hematoma drainage and seroma evacuation. Pressure monitoring and drainage volume assessment are essential components of drainage management. Drainage systems with pressure monitoring capabilities enable healthcare professionals to assess the wound healing process and prevent post-operative complications, such as infection and fluid accumulation. Drain removal protocols play a crucial role in minimizing the risk of wound complications. Proper drain placement techniques and timely drain removal contribute to successful wound healing and reduced hospital stays.

Open drainage systems and wound exudate management are also crucial aspects of the market. Despite the benefits, drainage complications, including infection, drain blockage, and incorrect placement, can adversely impact patient outcomes. Continuous advancements in drainage technology, such as active drainage, pressure monitoring, and drainage monitoring, are expected to address these challenges and drive market growth.

The Active drains segment was valued at USD 1217.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

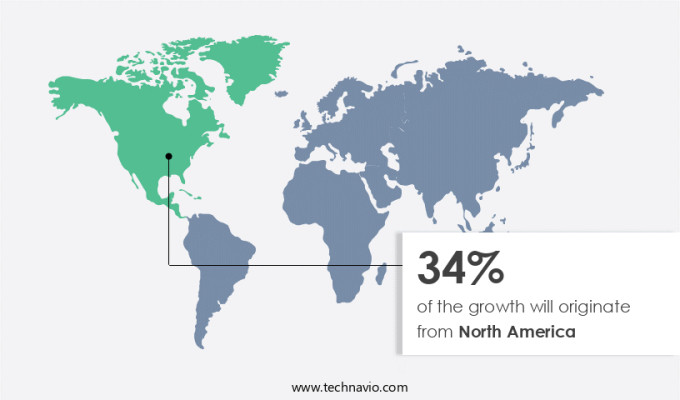

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth due to various factors. In 2023, North America held the largest market share, driven by the increasing number of chronic conditions, surgical procedures, and insurance coverage. The region's robust healthcare infrastructure, presence of specialized hospitals and ASCs, and new product launches further fuel market expansion. Surgical drains play a crucial role in tissue fluid removal post-surgery. Drainage systems, including closed suction drains, gravity drainage, and passive drainage, facilitate efficient fluid collection. Active drainage systems offer pressure monitoring and drainage volume control, ensuring optimal wound healing. Infection prevention is a significant concern, leading to the use of biocompatible materials and advanced drainage technologies.

Hematoma drainage and seroma evacuation are essential applications, reducing post-operative complications. Drain removal protocols ensure proper timing for drain removal, minimizing the risk of wound complications. Various drain placement techniques cater to different surgical sites and patient needs. Open drainage systems enable continuous wound exudate management, while lymphedema treatment applications expand market opportunities. Innovations in drainage materials, such as silicone and polyvinyl chloride, enhance product functionality and patient comfort. Pressure monitoring and drainage monitoring systems enable real-time assessment of wound healing progress. Despite advancements, drainage complications remain a challenge, necessitating ongoing research and development efforts. In conclusion, the market is poised for continued growth, driven by the increasing demand for efficient tissue fluid removal, infection prevention, and advanced wound healing solutions.

Market trends include the development of biocompatible materials, pressure monitoring systems, and minimally invasive drain placement techniques.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Surgical Drains/Wound Drainage Industry?

- The increase in the number of surgeries served as the primary growth driver for the market.

- The global surgical drains market has seen significant growth due to the increasing number of surgeries performed worldwide since 2022. Chronic diseases, such as cancer, have been on the rise, leading to an increase in surgical procedures. According to the American Cancer Society, approximately 1.9 million new cancer cases and 609,360 cancer deaths were reported in the US alone in 2022. Surgical drains are essential in cancer surgeries to prevent postoperative complications, such as seroma formation. Open drainage systems have gained popularity due to their ability to manage wound exudate effectively. Biocompatible materials used in the production of surgical drains ensure minimal tissue damage during drainage.

- Proper wound assessment and drainage duration are crucial factors in ensuring optimal wound healing. However, an extended drainage duration may increase the risk of surgical site infections. Therefore, ongoing research focuses on developing advanced drainage systems that minimize infection risks while ensuring effective wound exudate management.

What are the market trends shaping the Surgical Drains/Wound Drainage Industry?

- The increasing trend in healthcare expenditure is a significant market development. This upward trajectory in healthcare costs is a noteworthy observation for professionals in the industry.

- The market is witnessing significant growth due to the increasing demand for advanced drainage systems in healthcare. Occlusive dressings and drainage tubes of various sizes are essential components of closed suction drains, which facilitate active drainage and efficient tissue fluid removal. Drainage systems are designed to maintain a consistent drainage volume and utilize drainage materials that minimize the risk of infection. The market dynamics are driven by the rising healthcare expenditure, increasing prevalence of chronic diseases, and the growing focus on minimally invasive surgical procedures.

- In 2022, the US healthcare spending reached nearly USD4 trillion, with Medicare accounting for a substantial portion of this expenditure. The market for surgical drains and wound drainage systems is expected to continue its growth trajectory, driven by the increasing demand for effective and efficient drainage solutions.

What challenges does the Surgical Drains/Wound Drainage Industry face during its growth?

- The postoperative complication rate poses a significant challenge to the growth of the industry, requiring continuous efforts to enhance patient care and surgical techniques.

- Surgical drains are essential medical devices used to prevent fluid build-up and infection after surgery. However, their use comes with potential complications. One risk is drains breaking inside the abdomen during removal, which may require additional surgery. Drains can also get tangled in IV tubes or electrocardiograms, leading to bleeding or pain. Removing drains from deep-seated wounds can be challenging, and improper removal can lead to infection. Excessive fluid accumulation increases the risk of bacterial growth and subsequent infection. Moreover, insertion of drains can cause patient discomfort and immobility, increasing the risk of postoperative complications. Proper drain removal protocols and infection prevention measures are crucial to mitigate these risks and ensure optimal patient outcomes.

- Two common types of surgical drains are gravity drainage systems and closed-suction drainage systems, each with its advantages and disadvantages. Polyvinyl chloride drains are a popular choice due to their flexibility and durability. It's essential to follow best practices for drain management to minimize complications and optimize patient recovery.

Exclusive Customer Landscape

The surgical drains/wound drainage market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the surgical drains/wound drainage market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, surgical drains/wound drainage market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AdvaCare Pharma - This company specializes in advanced surgical drainage solutions, providing High-Vacuum, Low-Vacuum, Gravity, and specialized Wound Drainage Systems, along with accessories.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AdvaCare Pharma

- Angiplast Pvt Ltd

- Aspen Surgical Products Inc.

- B.Braun SE

- Becton Dickinson and Co.

- Cardinal Health Inc.

- ConvaTec Group Plc

- Cook Group Inc.

- Global Medikit Ltd.

- ICU Medical Inc.

- Johnson and Johnson Services Inc.

- Kaneka Medix Corp.

- McKesson Medical Surgical

- Medline Industries LP

- Ningbo Luke Medical Devices Co. Ltd

- Poly Medicure Ltd.

- QMD

- Redax S.p.A.

- Romsons Scientific and Surgical Pvt. Ltd

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Surgical Drains/Wound Drainage Market

- In January 2024, Medtronic plc, a global healthcare solutions company, announced the launch of its new, advanced SurgiDrain Active suction drainage system. This innovative product offers real-time drainage volume measurement and automatic suction adjustment, enhancing patient care and clinical efficiency (Medtronic Press Release).

- In March 2024, 3M and Stryker collaborated to expand their partnership, focusing on the development and distribution of advanced wound care and surgical drainage solutions. This strategic alliance aimed to combine 3M's innovative adhesive technologies with Stryker's surgical expertise, creating a comprehensive portfolio of products (3M Press Release).

- In May 2024, Smith & Nephew, a leading medical device manufacturer, completed the acquisition of Osiris Therapeutics, a biotechnology company specializing in regenerative medicine. This strategic move enabled Smith & Nephew to expand its product offerings, including advanced wound care and surgical drainage solutions, using Osiris's cell therapy technologies (Smith & Nephew Press Release).

- In April 2025, Ethicon, a Johnson & Johnson company, received FDA approval for its new, reusable, and disposable surgical drainage systems, the EXPANDABLE and the REUSABLE. These innovative products offer improved patient safety, reduced healthcare costs, and enhanced clinical outcomes (Johnson & Johnson Press Release).

Research Analyst Overview

- The surgical drains market encompasses the production and distribution of drainage devices used to remove excess body fluid from surgical wounds. The timing of drainage removal is a critical factor in wound closure and tissue regeneration, as delayed drainage can lead to increased complication rates and tissue perfusion issues. Advanced drainage technology enables real-time wound fluid analysis for bioburden reduction and infection control. Material compatibility and drainage efficacy are essential considerations in surgical drain selection, as they impact patient outcomes and drainage rate and capacity.

- Surgical techniques, such as wound debridement, influence drainage pathways and the need for larger collection reservoirs in drainage bags. Post-surgical care and infection control remain key drivers in the market, with ongoing research focusing on tissue perfusion and drainage technology advancements to improve patient outcomes.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Surgical Drains/Wound Drainage Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.46% |

|

Market growth 2024-2028 |

USD 267.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.38 |

|

Key countries |

US, Germany, France, China, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Surgical Drains/Wound Drainage Market Research and Growth Report?

- CAGR of the Surgical Drains/Wound Drainage industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the surgical drains/wound drainage market growth of industry companies

We can help! Our analysts can customize this surgical drains/wound drainage market research report to meet your requirements.