Tax Advisory Services Market Size 2025-2029

The tax advisory services market size is forecast to increase by USD 12.82 billion, at a CAGR of 5.9% between 2024 and 2029.

- The market is characterized by the complexity of tax regulations and the increasing trend towards digital transformation and automation. The intricacy of tax laws necessitates the expertise of tax advisory services to help businesses navigate the intricacies and ensure compliance. Simultaneously, the adoption of digital technologies and automation in tax processes is transforming the market landscape, offering opportunities for enhanced efficiency and accuracy. However, this digital shift also introduces new challenges, particularly in the realm of data security and privacy risks.

- As businesses increasingly rely on digital platforms to manage tax data, protecting sensitive information becomes paramount. These dynamics underscore the importance of tax advisory services in helping organizations navigate the intricacies of tax regulations while leveraging digital technologies to streamline processes and mitigate risks. Companies seeking to capitalize on market opportunities and effectively address challenges must prioritize expertise in tax regulations, digital transformation, and data security.

What will be the Size of the Tax Advisory Services Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the complex and intricate nature of tax regulations and the dynamic business environment. Financial reporting, internal controls, and risk management are crucial aspects of tax advisory services, ensuring compliance with OECD guidelines and various tax laws. Indirect tax, financial planning, gift tax, tax deductions, tax evasion, and tax avoidance are integral components of this market, requiring continuous adaptation to changing regulatory landscapes and business needs. Tax advisory services extend to corporate tax, tax efficiency, tax education, tax litigation, international taxation, estate planning, tax research, tax optimization, tax legislation, tax technology, tax treaties, and various other areas.

The ongoing unfolding of market activities reveals evolving patterns in tax compliance, regulatory compliance, tax return preparation, and tax controversy. Tax advisory services play a vital role in tax evasion and tax avoidance strategies, as well as tax planning and tax incentives. They also encompass tax technology, data analytics, and transaction advisory services, providing clients with comprehensive solutions to manage their tax obligations effectively. The market is a critical partner for businesses and individuals seeking to navigate the complexities of tax regulations and optimize their tax positions. As tax laws and regulations continue to evolve, tax advisory services remain indispensable in ensuring compliance and maximizing tax efficiency.

How is this Tax Advisory Services Industry segmented?

The tax advisory services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- BFSI

- IT and telecom

- Retail and e-commerce

- Healthcare

- Others

- Type

- Direct advisory tax

- Indirect advisory tax

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Switzerland

- UK

- APAC

- Australia

- China

- India

- Singapore

- Rest of World (ROW)

- North America

By End-user Insights

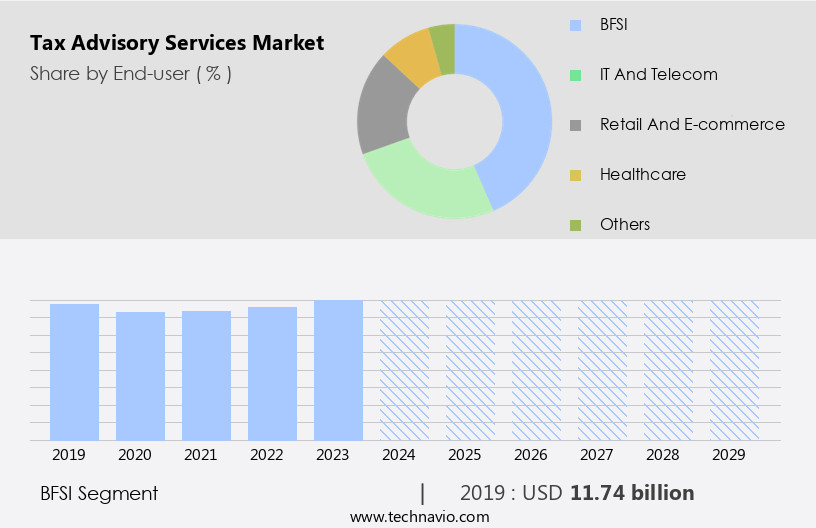

The bfsi segment is estimated to witness significant growth during the forecast period.

The market caters to the extensive requirements of the banking, financial services, and insurance (BFSI) sector, which faces intricate challenges in adhering to global tax laws, compliance regulations, and evolving jurisdictional complexities. To tackle these issues, the BFSI industry heavily relies on specialized tax advisory services for corporate tax planning, transfer pricing, regulatory compliance, mergers and acquisitions, and risk management. With the increasing trend of cross-border transactions, the significance of expert tax advisory services amplifies, enabling financial institutions to optimize their tax structures and ensure adherence to both local and international tax regulations. Forensic accounting, tax research, and data analytics play pivotal roles in uncovering potential tax evasion and avoidance schemes, while tax software and technology enhance the efficiency and accuracy of tax processes.

Capital gains tax, income tax, sales tax, property tax, and wealth tax are among the various taxes that demand expert advisory services. Tax legislation, OECD guidelines, and international taxation necessitate continuous research and consultation. Tax credits, incentives, and treaties offer opportunities for tax optimization, while tax litigation, controversy, and controversy resolution require specialized expertise. Estate planning, succession planning, and retirement planning are essential services for individuals. Indirect tax, gift tax, and inheritance tax necessitate expert advice. Mergers and acquisitions, transaction advisory, and client onboarding also fall under the tax advisory services umbrella. Risk management, internal controls, and anti-money laundering (AML) regulations are critical components of tax advisory services, ensuring regulatory compliance and mitigating risks.

Tax efficiency, tax education, and tax education are essential for businesses and individuals to make informed decisions. In summary, the market plays a vital role in helping businesses and individuals navigate the intricacies of taxation, ensuring compliance and optimizing tax structures.

The BFSI segment was valued at USD 11.74 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

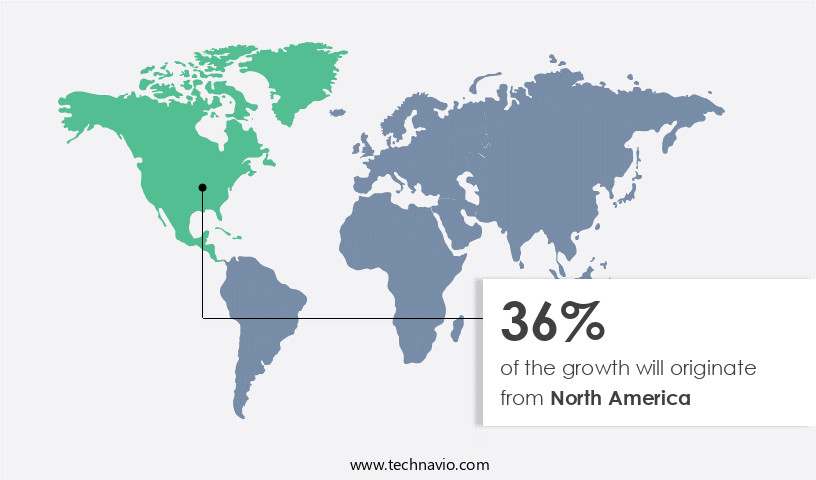

North America is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant activity and evolution, with North America leading the charge due to its intricate tax regulations and ongoing corporate tax reforms. The United States, in particular, is a major player, as businesses navigate complex tax laws such as the Tax Cuts and Jobs Act (TCJA) and Base Erosion and Anti-Abuse Tax (BEAT). Canada also contributes significantly, driven by the need for tax compliance and cross-border advisory services due to extensive trade relationships and foreign investments. Expertise in areas like tax amnesty, regulatory compliance, forensic accounting, tax return preparation, individual tax, tax havens, payroll tax, investment strategies, financial modeling, capital gains tax, tax software, data analytics, sales tax, financial reporting, internal controls, risk management, OECD guidelines, indirect tax, financial planning, gift tax, tax deductions, tax evasion, tax avoidance, corporate tax, tax efficiency, tax education, tax litigation, international taxation, estate planning, tax research, tax optimization, tax legislation, tax technology, tax treaties, double taxation agreements, portfolio management, tax credits, transfer pricing, transaction advisory, retirement planning, client onboarding, tax consulting, tax controversy, inheritance tax, mergers & acquisitions tax, tax audits, tax planning, AML (anti-money laundering), wealth tax, due diligence, tax incentives, property tax, tax shelters, direct tax, and succession planning are in high demand.

Leading global tax advisory firms like Deloitte Touche Tohmatsu Ltd. Play a robust role in this market, providing valuable insights and guidance to businesses seeking to minimize tax liabilities and maximize efficiency while adhering to evolving regulations. The market's landscape is shaped by ongoing regulatory changes, increasing globalization, and the growing importance of tax transparency and risk management.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and complex tax landscape, tax advisory services play a pivotal role for businesses and individuals seeking to optimize their financial position. These services encompass a range of specialized expertise, including tax planning, compliance, consulting, and controversy resolution. Tax advisors leverage innovative technologies and in-depth industry knowledge to minimize tax liabilities, maximize deductions, and ensure regulatory compliance. They provide strategic guidance on international, federal, and state tax laws, as well as tax implications of mergers and acquisitions, restructuring, and transactions. Tax advisory services are essential for businesses of all sizes, from startups to multinationals, and for high net worth individuals, ensuring they make informed decisions and maintain a strong tax posture. Effective tax planning can lead to significant cost savings and increased profitability, making tax advisory services an indispensable tool in the financial toolkit.

What are the key market drivers leading to the rise in the adoption of Tax Advisory Services Industry?

- The intricacy of tax regulations serves as the primary catalyst for market complexity.

- The market is witnessing significant growth due to the intricacy of tax regulations and compliance requirements in various jurisdictions. As tax laws become increasingly complex, businesses are turning to specialized advisory services to effectively manage their tax obligations and minimize risks. In the UK, the tax system's complexity has led to a surge in administrative costs, reaching USD5.33 billion according to the National Audit Office (NAO). This rise in complexity has not only strained government resources but also imposed substantial compliance costs on businesses, estimated at USD19 billion. Tax advisory services encompass tax amnesty, tax compliance, forensic accounting, regulatory compliance, tax return preparation, individual tax, tax havens, payroll tax, investment strategies, financial modeling, capital gains tax, tax software, data analytics, and sales tax.

- These services help businesses navigate the complex tax landscape, optimize their tax positions, and ensure regulatory compliance. Tax advisory firms use advanced tools and techniques, including data analytics, to provide accurate and timely advice to their clients. The importance of tax advisory services is further emphasized by the increasing focus on transparency and the crackdown on tax evasion and avoidance strategies.

What are the market trends shaping the Tax Advisory Services Industry?

- Digital transformation and automation are currently mandated trends in the market. Companies are increasingly adopting these technologies to streamline their operations and enhance efficiency.

- The market is experiencing significant transformation due to the integration of advanced technologies. Cloud-based tax platforms, artificial intelligence (AI), and machine learning are revolutionizing tax processes, enhancing accuracy and reducing manual efforts. These technologies enable businesses to achieve real-time tax compliance, conduct comprehensive data analysis, and manage risks more effectively. Automation plays a crucial role in streamlining tax-related tasks, allowing for real-time updates and compliance checks. This reduces the burden of manual data entry and minimizes the risk of errors, ensuring businesses remain compliant with complex tax regulations.

- Additionally, tax advisory services encompass various aspects, including financial reporting, internal controls, risk management, OECD guidelines, indirect tax, financial planning, gift tax, tax deductions, tax evasion, tax avoidance, and corporate tax. Tax education and tax litigation are also essential components. By leveraging technology and expertise, tax advisory services provide businesses with tax efficiency and peace of mind.

What challenges does the Tax Advisory Services Industry face during its growth?

- Data security and privacy risks pose a significant challenge to the industry's growth, requiring organizations to invest heavily in protective measures to safeguard sensitive information and maintain customer trust.

- In today's complex tax landscape, tax advisory services play a crucial role in helping businesses navigate international taxation, estate planning, tax research, and tax optimization. With the increasing globalization of business and continuous changes in tax legislation, tax technology, tax treaties, and double taxation agreements have become essential tools for portfolio management, tax credits, transfer pricing, transaction advisory, retirement planning, and client onboarding. However, the digital transformation of tax advisory services brings significant data security and privacy risks. Firms must ensure robust data protection and compliance with stringent data privacy laws, such as the General Data Protection Regulation (GDPR), as they handle vast amounts of sensitive client information.

- The reliance on digital platforms exposes firms to heightened cybersecurity threats, including data breaches, ransomware attacks, and phishing schemes. Implementing advanced security measures, such as encryption, multi-factor authentication, and access controls, is essential to safeguard client data and maintain trust and confidence.

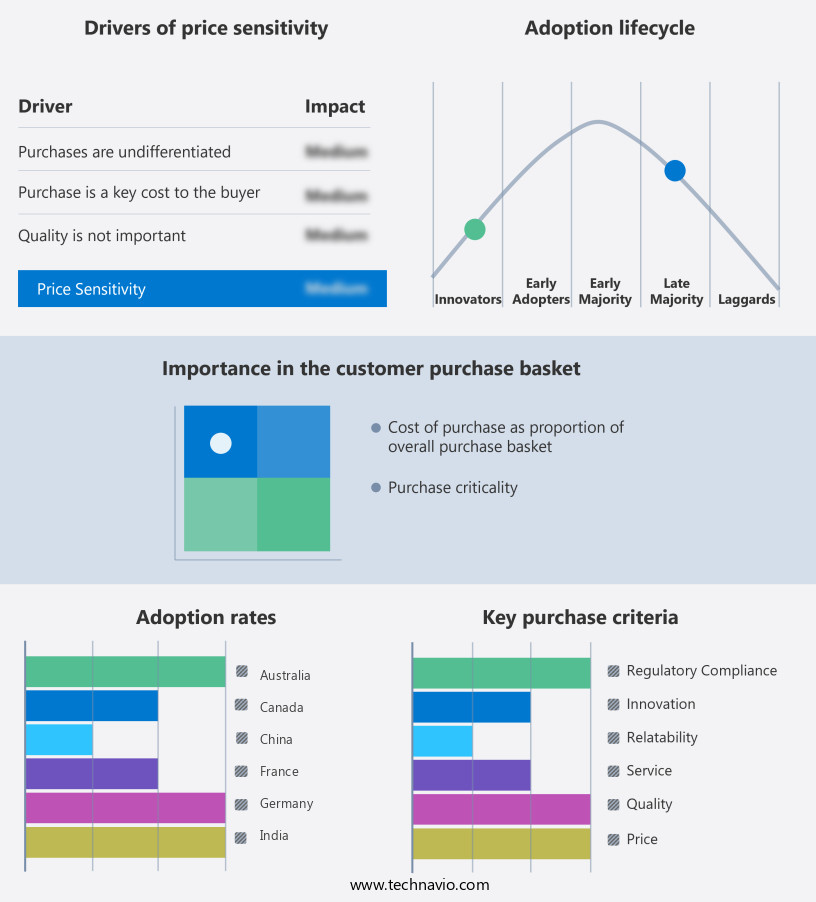

Exclusive Customer Landscape

The tax advisory services market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the tax advisory services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, tax advisory services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Baker Tilly International - Specialized tax advisory services encompass investment structure optimization, permanent establishment tax compliance for multinational corporations, and withholding, repatriation, and double taxation guidance. Our team provides expert advice on these complex tax matters, ensuring regulatory compliance and tax efficiency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Baker Tilly International

- BDO International Ltd.

- Crowe LLP

- Deloitte Touche Tohmatsu Ltd.

- Ernst and Young Global Ltd.

- Forvis Mazars

- Grant Thornton International Ltd.

- H and R Block Inc.

- HLB International Ltd.

- KPMG International Ltd.

- Kroll LLC

- Marcum LLP

- Moore Global Network Ltd.

- Nexia

- PricewaterhouseCoopers LLP

- RSM International Ltd.

- Ryan LLC

- SAGE Tax Advisory

- Wolters Kluwer NV

- WTS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Tax Advisory Services Market

- In January 2024, PwC, a leading tax advisory services firm, announced the launch of its new Artificial Intelligence (AI) and machine learning-powered tax compliance solution, 'TaxBot' (Source: PwC Press Release). This innovative offering is designed to automate repetitive tax compliance tasks, thereby improving efficiency and reducing errors.

- In March 2024, EY and Deloitte, two major tax advisory services providers, formed a strategic partnership to expand their offerings in the renewable energy sector (Source: Deloitte Press Release). The collaboration aims to provide comprehensive tax services to renewable energy companies, including tax incentive consulting, regulatory compliance, and transaction support.

- In May 2024, KPMG, a global professional services firm, acquired a significant stake in a leading Indian tax advisory firm, Taxmantra Consultants (Source: KPMG Press Release). This strategic investment is expected to strengthen KPMG's presence in the Indian market and expand its tax advisory services offerings.

- In April 2025, the European Union (EU) introduced new tax transparency regulations, requiring multinational corporations to disclose their tax schemes and country-by-country reporting (Source: EU Official Journal). This regulatory development is expected to increase demand for tax advisory services, as companies seek expert guidance on compliance with these new regulations.

Research Analyst Overview

- The market is a critical component of the financial landscape, with chartered accountants, tax enforcement agencies, wealth managers, investment bankers, financial advisors, tax attorneys, certified public accountants, enrolled agents, taxpayer advocacy groups, and tax professionals playing pivotal roles. Tax revenue and expenditure are significant drivers of economic growth, yet the tax gap persists, necessitating the need for tax advisors and taxpayer services. Tax morale and taxpayer behavior are essential factors influencing tax compliance costs. Tax policy and reform efforts aim to address tax incidence and tax rate concerns, while venture capital and private equity firms seek to optimize tax burdens for their portfolios.

- Tax advisors provide valuable insights into tax policy and taxpayer rights, helping businesses navigate complex tax environments and ensure regulatory compliance. Tax administration and taxpayer services are increasingly important as tax enforcement becomes more rigorous. Wealth managers and investment bankers rely on tax advisors to minimize tax liabilities and maximize returns for their clients. Certified public accountants and enrolled agents offer expertise in tax compliance and taxpayer advocacy, ensuring taxpayers receive fair treatment from tax authorities. Tax advisors help businesses and individuals navigate the intricacies of tax law, providing invaluable guidance on tax policy, tax reform, and taxpayer rights.

- Tax advisory services are essential for managing tax burden, tax rate, and tax compliance costs, making them an indispensable resource for businesses and individuals alike.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Tax Advisory Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2025-2029 |

USD 12.82 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.6 |

|

Key countries |

US, China, UK, Germany, India, Australia, Canada, France, Switzerland, and Singapore |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Tax Advisory Services Market Research and Growth Report?

- CAGR of the Tax Advisory Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the tax advisory services market growth of industry companies

We can help! Our analysts can customize this tax advisory services market research report to meet your requirements.