Tethered Drones Market Size 2024-2028

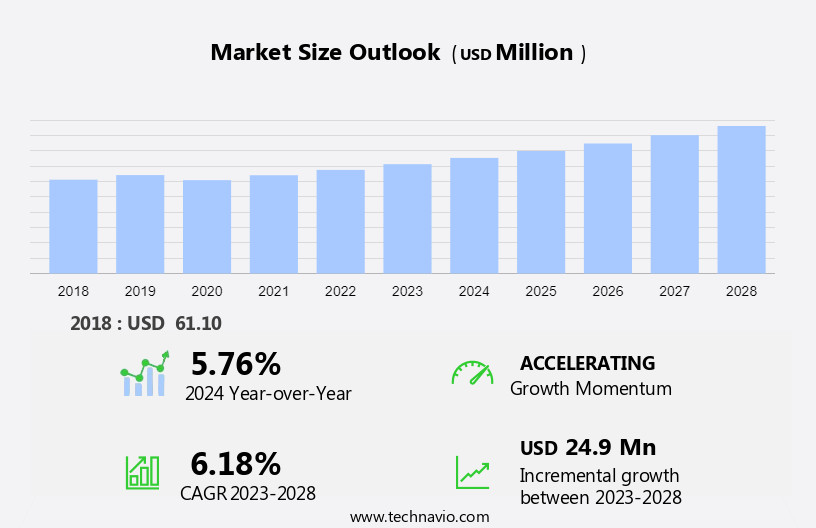

The tethered drones market size is forecast to increase by USD 24.9 million at a CAGR of 6.18% between 2023 and 2028.

- The global warehousing and storage market is experiencing steady growth, driven by rising demand from e-commerce and advancements in automation technology. Shifts in consumer behavior, particularly the preference for faster delivery, are pushing companies to expand warehouse networks, while innovations like automated storage systems and robotics are improving efficiency to meet these needs.

- This report delivers actionable insights for businesses, detailing market size, growth forecasts through 2029, and key segments like leased warehousing, which holds the largest share. It explores trends such as the increasing adoption of smart warehouse solutions and warehouse management systems and addresses challenges like supply chain disruptions that impact operations. Designed for practical use, the report supports strategic planning, client engagement, and operational adjustments with data-backed analysis.

- For companies navigating the global warehousing and storage market, this report offers a clear view of emerging trends and persistent challenges, providing the tools needed to stay competitive in a dynamic landscape.

What will be the Size of the Market During the Forecast Period?

The market encompasses the use of unmanned aerial vehicles (UAVs) that remain connected to a ground control station via a tether for extended periods. This technology is increasingly being adopted in various sectors, including carrier networks for radio planning and line-of-sight testing. Antenna installation and connection maintenance are also facilitated by tethered drones. In the realm of first responders and disaster recovery, these drones are employed for infrastructure inspection, event monitoring, and data collection. Ad hoc networks and cellular coverage expansion are further applications. Infrared cameras and flying COW drones are integral components, enabling functions such as crop monitoring in precision agriculture, data transmission, surveillance, and monitoring. Machine learning algorithms and artificial intelligence enhance the capabilities of tethered drones, expanding their use in security, reconnaissance, and cargo capacity enhancement. Data transmission capabilities are a critical factor in the market's growth.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Defense

- Telecommunication

- Inspection and others

- Type

- Multi-copter

- Quadcopter

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- North America

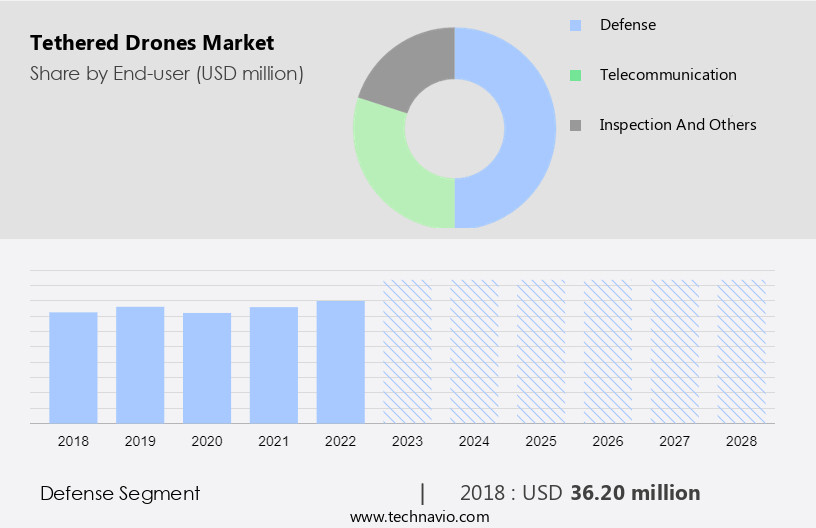

By End-user Insights

The defense segment is estimated to witness significant growth during the forecast period. Tethered drones have emerged as a significant market trend in various sectors, including defense, first responders, and commercial applications. The advancements in microelectronic components and technology have led to the development of these drones, which offer extended surveillance capabilities for hours at a time. Tethered drones are designed for ease of transportation, quick deployment, and minimal operating skills, making them an essential tool for security forces. Carrier networks and radio planning play a crucial role in ensuring seamless connection for tethered drones. Line-of-sight testing and antenna installation are essential components of the deployment process.

Military and commercial drones equipped with infrared aerial cameras and EO/IR payloads offer ISR solutions for various applications. Infrared sensors and sensors in general are essential components for monitoring and inspection tasks. Controller systems, cameras, batteries, and sensors are key product lines in the tethered drone market. Mission profiles for tethered drones vary from sector to sector, with military applications requiring high-security features and commercial applications focusing on cost-effectiveness and ease of use. The tethered drone market is expected to grow, with new product releases and advancements in technology driving innovation.

Get a glance at the share of various segments. Request Free Sample

The defense segment accounted for USD 36.20 million in 2018 and showed a gradual increase during the forecast period.

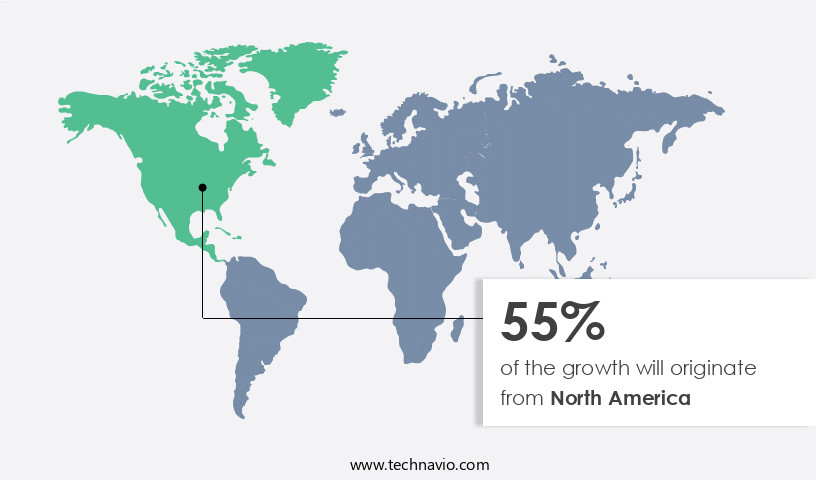

Regional Insights

North America is estimated to contribute 55% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Tethered drones have gained significant traction in various industries due to their unique capabilities and applications. The market for tethered drones encompasses a range of offerings, including the V-Line Pro and Tethered Kit from Easy Aerial, as well as NX70 micro-drones. These drones are employed for structure inspection, data transmission, and surveillance and monitoring tasks. Precision farming technologies and tower inspections are among the commercial applications, while military end-users leverage tethered drones for reconnaissance and security purposes. The DJI M30 drone and Raptor drone, both multi-copter and quadcopter models, are prominent players in the tethered drone market. These drones offer advanced features such as telemetry and communication, long-range surveillance, and cargo capacity.

Market Dynamics

Artificial Intelligence (AI) and machine learning algorithms are increasingly being integrated into tethered drones for enhanced functionality and autonomy. Regulatory agencies play a vital role in governing the use of tethered drones, ensuring safety and compliance with regulations. Tethered drones are employed in search and rescue missions, disaster response, and infrastructure inspection. Long-range surveillance is another significant application, providing valuable insights for security and protection purposes. Commercial and recreational users also benefit from tethered drones, with applications ranging from event monitoring to aerial photography. In conclusion, the tethered drone market is a dynamic and evolving landscape, driven by advancements in technology and increasing demand for efficient and cost-effective solutions across various industries.

The tethered drones market is experiencing significant growth as these systems offer unique advantages for continuous, high-altitude aerial surveillance and real-time monitoring. Aerial surveillance networks powered by tethered drones provide persistent observation tools, ensuring uninterrupted flight for long-range monitoring and security operations. High-altitude tethering systems, combined with power tether systems, enable drones to remain operational for extended periods without the need for frequent recharging, making them ideal for continuous mission support. Ground control units, aerial sensor integration, and drone communication relays facilitate seamless data streaming platforms and live video feeds, enabling real-time imaging systems for applications such as environmental monitoring, incident response, and telecom relay stations. The integration of advanced tether designs and operational endurance solutions ensures that drones can maintain flight stability and reliability even in remote areas.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growing demand for drones in telecommunications is the key driver of the market. Tethered drones have become a significant innovation in the telecom industry, offering various advantages for carrier networks. They play a crucial role in radio planning and line-of-sight testing for antenna installation, transmitting data directly to the network for efficient analysis. In disaster recovery situations, tethered drones can create ad-hoc networks, improving cellular coverage and providing connectivity in remote areas. Equipped with antennae and transmission equipment, they can even serve as temporary transmission towers in case of tower damage. First responders and military drones utilize tethered drones for ISR solutions, featuring EO/IR payloads, infrared sensors, and mission profiles. Commercial drones, such as the DJI Mavic 2, V-Box, V-Line, and V-Pack, are also employed in industries like precision agriculture, aerial photography, freight management, traffic monitoring, and surveying.

Drone technology continues to expand, with new product releases and cost-effective merchandise enhancing inspection and monitoring capabilities for law enforcement and smart farming applications. Controller systems, batteries, sensors, cameras, and batteries are essential components of these drones, enabling diverse mission profiles.

Market Trends

The emergence of miniaturized EO/IR systems is the upcoming trend in the market. Tethered drones have emerged as a significant market segment in the aerospace and defense industry, as well as in commercial applications. These drones offer unique advantages, such as extended flight time, improved data transmission, and reduced reliance on carrier networks for connectivity. In the context of tethered drones, radio planning and line-of-sight testing assume critical importance. Antenna installation and ad hoc networks enable seamless cellular coverage and reliable connection, making these drones indispensable for first responders during disaster recovery situations. Infrared cameras and EO/IR payloads equipped with infrared sensors enhance the capabilities of ISR solutions, enabling mission profiles for military and commercial drones in various sectors.

Smart farming and smart city initiatives are also expected to contribute to the increasing demand for this technology. Drone technology continues to evolve, with advancements in sensor capabilities, controller systems, and camera quality, further expanding the potential applications for tethered drones.

Market Challenge

Inadequately trained drone pilots is a key challenge affecting the market growth. The market has gained significant traction in various industries due to the advantages they offer, such as extended flight time and improved connectivity. However, the implementation of tethered drones requires meticulous planning and execution, including carrier network considerations, radio frequency planning, and line-of-sight testing for antenna installation. Ad hoc networks and cellular coverage are crucial for maintaining a stable connection between the ground control station and the tethered drone. First responders and disaster recovery teams have embraced tethered drones for ISR solutions, equipped with EO/IR payloads and infrared sensors. Military and commercial drone operators utilize tethered drones for mission profiles that demand prolonged flight time and real-time data transmission.

In conclusion, the market is poised for growth, driven by the increasing demand for extended flight time, real-time data transmission, and improved connectivity. The challenges associated with the implementation of tethered drones necessitate a collaborative effort between industry experts, technology providers, and regulatory bodies to ensure the safe and effective integration of tethered drones into various industries.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Dragonfly Pictures Inc. - The company offers unmanned helicopters for defense and provides service for payload integration.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AeroVironment Inc.

- COMSovereign Holding Corp.

- Elistair Sas

- Exail Technologies

- Flyfocus sp. z o.o

- Hoverfly Technology Inc.

- Menet Aero LLC.

- Mistral Solutions Pvt. Ltd.

- Novadem

- Perspective Robotics AG

- Sky Drones Technologies Ltd.

- Sky Sapience Ltd.

- Skyshot Pte Ltd

- Spooky Action Inc.

- Teledyne Technologies Inc.

- UAVTEK Ltd.

- Volarious

- Yuneec International Co. Ltd.

- Zenith Aerotech

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the increasing demand for continuous aerial data collection and transmission. These drones are connected to a ground control station via a tether, enabling uninterrupted data transfer and longer operational hours. The technology is finding extensive applications in various sectors such as surveillance, inspection, and mapping. The market is driven by factors like the need for real-time data, increasing demand for high-resolution imagery, and the growing adoption of drone technology in various industries. The market is expected to witness substantial growth in the coming years due to the advantages they offer over traditional drones, including longer flight times, improved data quality, and enhanced safety features.

Moreover, the integration of advanced technologies like AI and machine learning is expected to further boost the market growth. The market is also witnessing intense competition, with key players focusing on product innovation and strategic collaborations to gain a competitive edge. Overall, the market is poised for strong expansion in the coming years. Tethered drones optimize payload capabilities, supporting a variety of applications including security drone operations and remote monitoring for industries ranging from defense to telecommunications. With their ability to cover large areas and provide uninterrupted power, these drones are increasingly used in mobile surveillance units and for incident response purposes. The market is poised for further expansion as advancements in drone technology continue to enhance the capabilities of tethered drones for both commercial and military applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.18% |

|

Market growth 2024-2028 |

USD 24.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.76 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 55% |

|

Key countries |

US, China, Germany, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AeroVironment Inc., COMSovereign Holding Corp., Dragonfly Pictures Inc., Elistair Sas, Exail Technologies, Flyfocus sp. z o.o, Hoverfly Technology Inc., Menet Aero LLC., Mistral Solutions Pvt. Ltd., Novadem, Perspective Robotics AG, Sky Drones Technologies Ltd., Sky Sapience Ltd., Skyshot Pte Ltd, Spooky Action Inc., Teledyne Technologies Inc., UAVTEK Ltd., Volarious, Yuneec International Co. Ltd., and Zenith Aerotech |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch