Malaysia Textile Manufacturing Market Size 2024-2028

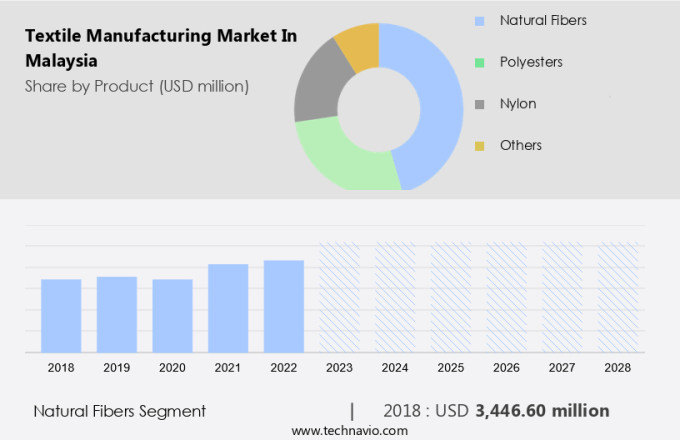

The Malaysia textile manufacturing market size is forecast to increase by USD 2.13 billion, at a CAGR of 4% between 2023 and 2028.

- The market is driven by the well-established industry and the increasing demand for technical textiles in the automotive sector. Malaysia's textile industry has been a significant contributor to the country's economy, with a strong focus on export-oriented production. The automotive industry's growing demand for technical textiles, such as those used in seat covers, carpets, and airbags, presents a substantial growth opportunity for textile manufacturers. However, the market faces challenges, including health hazards associated with textile production. Workers in textile factories are exposed to various chemicals used in the manufacturing process, which can lead to health issues. Ensuring worker safety and implementing sustainable production methods will be crucial for companies looking to mitigate these challenges and maintain a competitive edge.

- Companies that can effectively manage these challenges while capitalizing on the growing demand for technical textiles in the automotive sector will be well-positioned to succeed in the Malaysian textile manufacturing market.

What will be the size of the Malaysia Textile Manufacturing Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

- The market is characterized by a diverse range of product categories, including performance textiles, medical textiles, protective textiles, textile insulation, and textile acoustics. Labor rights and ethical sourcing are increasingly important considerations for textile businesses, driving the adoption of sustainable practices and transparency in supply chains. Innovation in textiles continues to shape the industry, with advancements in areas such as artificial intelligence, biodegradable textiles, and textile traceability. Sustainability reporting and energy efficiency are key focus areas for companies seeking to reduce their environmental impact and enhance their corporate social responsibility. Textile startups are disrupting traditional business models with new offerings in areas like recycled fibers, circular economy, and textile filters.

- Data analytics and water conservation are also becoming essential tools for optimizing production processes and reducing waste. Market trends include the growing popularity of bio-based textiles, textile geotextiles, and textile composites, as well as the increasing use of blockchain technology for textile marketing and supply chain transparency. Fashion trends continue to influence the industry, with a focus on textile membranes and textile filters for functional clothing. Brand building and competitive differentiation are critical for success in the textile market, with companies leveraging innovation, sustainability, and data analytics to stand out from the competition.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Natural fibers

- Polyesters

- Nylon

- Others

- Application

- Fashion

- Technical

- Household

- Others

- Geography

- APAC

- Malaysia

- APAC

By Product Insights

The natural fibers segment is estimated to witness significant growth during the forecast period.

The textile industry in Malaysia is a significant contributor to the country's economy, with a focus on exporting textiles and apparel to international markets. Malaysia's textile manufacturing sector encompasses various entities, including export and import, textile certifications, finishing machines, textile testing, textile waste management, fabric testing, textile logistics, knitting machines, ISO standards, digital printing, sustainable textile production, yarn production, fabric colorfastness, smart textiles, 3D printing, textile standards, apparel manufacturing, textile technology, dyeing and finishing, supply chain management, textile quality, textile machinery, textile retail, textile industry trends, weaving looms, textile innovation, ASTM standards, textile manufacturing, textile research, textile blends, textile chemicals, textile fibers, production cost, fabric weaving, fabric durability, synthetic fibers, textile design, fabric width, yarn count, technical textiles, textile engineering, textile recycling, labor cost, home furnishings, dyeing equipment, industrial textiles, fabric weight, functional textiles, fabric count, textile automation, and natural fibers.

Natural fibers, derived from plant and animal sources, are extensively used in producing garments, apparel, construction materials, medical dressings, and automotive interiors. Wool, obtained from sheep, is known for its flexibility, resilience, insulation, thermal stability, and suitability for all climatic conditions. Silk, spun by silkworms, is renowned for its quick-drying nature, durability, and luxurious softness, making it suitable for various applications such as clothing, tasar materials, tablecloths, curtains, upholstery, cushions, valets, ties, and socks. Malaysia's textile industry is committed to maintaining textile quality through adherence to international standards, such as ISO and ASTM, and implementing advanced technologies like digital printing, 3D printing, and textile automation.

The industry also prioritizes sustainable textile production and waste management, with a focus on reducing labor costs and increasing fabric durability through the use of synthetic fibers and textile engineering. The textile industry's continued innovation in textile design, fabric weaving, and yarn production keeps it at the forefront of global textile trends.

The Natural fibers segment was valued at USD 3446.60 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Malaysia Textile Manufacturing Market drivers leading to the rise in adoption of the Industry?

- The well-established textile industry in Malaysia plays a pivotal role in driving the market, given its significant contribution to the sector.

- The textile manufacturing industry in Malaysia is a significant contributor to the country's economy, with a strong focus on producing a diverse range of textile products. The Malaysian government's industrial master plan has facilitated product quality improvement, price competitiveness, and export-oriented marketing, attracting numerous textile companies to the region. Malaysian manufacturers are increasingly adopting sustainable and ethically produced textiles in response to global market trends. This includes the use of technical textiles, textile engineering, and textile recycling. The production of industrial textiles, home furnishings, and functional textiles is common, with varying fabric weights and counts.

- Textile automation, dyeing equipment, and natural fiber processing are essential aspects of the industry, ensuring efficient and high-quality production. Malaysian manufacturers prioritize innovation, using advanced spinning machines and other technologies to create harmonious and functional textiles. The future of the textile industry in Malaysia looks promising, with a focus on maintaining a competitive edge in the international market through eco-friendly practices and technological advancements.

What are the Malaysia Textile Manufacturing Market trends shaping the Industry?

- The automotive industry's growing requirement for technical textiles represents a significant market trend. Technical textiles, with their enhanced properties, are increasingly being adopted for use in automotive applications.

- The textile manufacturing market encompasses the production of various types of textiles, including technical textiles, which hold significant importance due to their extensive usage in various industries. In particular, the automotive sector is a major consumer of technical textiles, utilizing them for components such as composites, sound insulation, and vibration control in automobile interiors. These textiles are also used for making seat covers, seatbelts, carpets, and other automotive upholstery, with synthetic fibers like nylon, polyester, wool, and polypropylene being commonly used due to their desirable properties such as high abrasion resistance, superior strength, low extensibility, and excellent UV resistance. Additionally, technical textiles are employed in engine components such as hoses, belts, air filters, and fluid filters.

- To ensure the quality and safety of textile products, certifications such as ISO standards are crucial. Finishing machines and fabric testing equipment are employed for textile processing to meet these standards. Digital printing technology is increasingly being adopted for sustainable textile production, reducing water usage and minimizing waste. Textile waste management is another critical aspect of the textile industry, with various methods being employed for recycling and repurposing textile waste. Textile logistics plays a vital role in the supply chain, ensuring efficient and timely delivery of textile products. Knitting machines are used extensively in textile manufacturing for producing knitted fabrics, which are then subjected to fabric testing for colorfastness and other essential properties.

- Overall, the textile manufacturing market is driven by the demand for high-quality, sustainable, and technologically advanced textile products.

How does Malaysia Textile Manufacturing Market face challenges during its growth?

- The textile industry faces significant challenges from health hazards, which pose a threat to both workers and the industry's growth trajectory. These hazards, which include exposure to chemicals and fibers, must be addressed through stringent safety regulations and continuous process improvements to ensure the industry's sustainable development.

- Textile manufacturing in Malaysia is a significant sector, encompassing various processes such as textile technology, apparel manufacturing, and textile retail. Innovations like smart textiles and 3D printing are transforming the industry, offering enhanced functionality and sustainability. However, textile manufacturing also presents challenges, particularly in areas of textile standards and supply chain management. Dyeing and finishing, a crucial part of textile production, involve the use of dyeing agents. While essential for producing vibrant colors, these agents have raised health concerns. The National Institute for Occupational Safety and Health (NIOSH) and the Occupational Safety and Health Administration (OSHA) have identified health hazards associated with textile manufacturing, including musculoskeletal disorders (MSD), hormonal deficiency, and skin irritations.

- MSD, the most prevalent work-related health issue, includes conditions like musculoskeletal system deterioration, lower back pain, and acute injuries from cuts or fractures. Textile quality, a key concern for both manufacturers and retailers, is addressed through rigorous quality control measures and investment in advanced textile machinery. Textile technology continues to evolve, with weaving looms becoming increasingly sophisticated and efficient. The textile industry trends towards sustainability and innovation, with a focus on reducing waste, improving energy efficiency, and developing new textile materials.

Exclusive Malaysia Textile Manufacturing Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AG Apparel Industries Sdn Bhd

- Body Work Apparel Sdn Bhd

- Chrischel Collections Sdn Bhd

- Classita M Sdn Bhd

- Domain and Range Sdn Bhd

- Happiness Garment Sdn Bhd

- Hing Fong Garments Sdn Bhd

- Iceblue Inter Apparel

- Lelitex

- Lippotex Industries Sdn Bhd

- Livertex Industries M Sdn Bhd

- MDT Garment

- Nyok Lan Garments Sdn Bhd

- Sherwood Protective Apparel Sdn Bhd

- Whitex Garments Sdn Bhd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Textile Manufacturing Market In Malaysia

- In March 2023, Malaysian textile manufacturer, Poh Yit Khang Holdings Berhad, announced a strategic collaboration with Japan's Teikoku Sen-I Co. Ltd. To establish a joint venture in producing high-performance textiles. This partnership aims to strengthen Poh Yit Khang's market position and expand its product offerings in the global textile industry (Bernama, 2023).

- In August 2024, the Malaysian Investment Development Authority (MIDA) approved the expansion of Texhong Textile Industries Sdn Bhd's manufacturing facility in Selangor. The RM200 million (approximately USD48 million) project is expected to create 1,500 jobs and increase the company's production capacity by 30% (MIDA, 2024).

- In January 2025, Malaysian textile company, Tengri, secured a significant investment from Singaporean investment firm, Temasek Holdings. The undisclosed amount of funding will be used to expand Tengri's production capacity and support its global growth plans (Temasek, 2025).

- In May 2025, the Malaysian government launched the National Textile Transformation Programme (NTTP) to revitalize the textile industry and increase its competitiveness in the global market. The programme includes initiatives to improve technology, promote research and development, and provide financial incentives for companies to invest in the sector (Malaysian Global Investment Corporation, 2025).

Research Analyst Overview

The market continues to evolve, driven by dynamic market trends and advancements in technology. Export and import activities remain a significant aspect of the industry, with certification processes playing a crucial role in ensuring compliance with international standards. Finishing machines and textile testing equipment are essential tools for enhancing fabric quality and ensuring colorfastness. Textile waste management is a pressing concern, with innovative solutions emerging for sustainable textile production. Digital printing technology and smart textiles are revolutionizing the industry, while textile logistics and supply chain management optimize production and distribution. Knitting machines and weaving looms are integral components of textile manufacturing, with ISO standards and ASTM regulations guiding their operation.

Yarn production and fabric weaving are foundational processes, with advances in technology leading to increased fabric durability and production efficiency. Synthetic and natural fibers, textile chemicals, and textile blends are subject to ongoing research and development. Textile technology continues to advance, with innovations in dyeing and finishing, textile engineering, and textile recycling. Apparel manufacturing, home furnishings, and industrial textiles all benefit from these advancements, with textile retail and textile industry trends shaping consumer preferences. Functional textiles and technical textiles are increasingly in demand, with fabric testing and textile automation ensuring their quality and performance. The textile industry's continuous evolution reflects its adaptability and resilience, with textile design, fabric width, fabric count, and fabric weight all influenced by market dynamics and consumer demands.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Textile Manufacturing Market in Malaysia insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

138 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4% |

|

Market growth 2024-2028 |

USD 2129.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.8 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Malaysia

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch