Thailand Lubricants Market Size 2025-2029

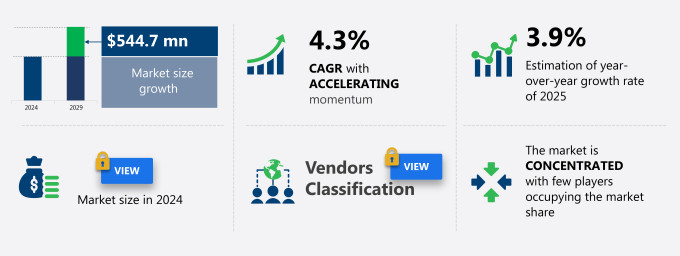

The lubricants market in Thailand size is forecast to increase by USD 544.7 million million at a CAGR of 4.3% between 2024 and 2029.

- The market is experiencing significant growth, driven by industrial automation expansion and manufacturing sector development. This expansion is leading to increased demand for high-performance lubricants to ensure the smooth operation of machinery and equipment. Additionally, the introduction of new lubricant products catering to various industries, including automotive, industrial, and food and beverage, is fueling market growth. However, the market faces challenges from fluctuating raw material costs, which can impact the profitability of lubricant manufacturers.

- Despite these challenges, the market's potential for growth remains robust, making it an attractive investment opportunity for industry players. By staying informed of market trends and dynamics, businesses can position themselves to capitalize on the opportunities presented by this thriving market.

What will be the Size of the Market During the Forecast Period?

- Thai lubricants market, formulation and handling play crucial roles in ensuring lubricant reliability and safety. Lubricant trends lean towards innovation and value, driving competition in pricing and distribution. Life cycle management, including testing and research, is essential to mitigate lubricant degradation and contamination. The lubricant supply chain faces challenges in maintaining quality and cost efficiency, while regulations continue to evolve.

- Lubricant selection, blending, and marketing require a deep understanding of applications and performance benefits. Storage and disposal are also critical aspects of the lubricant industry, impacting both environmental sustainability and operational efficiency. Overall, the Thai lubricants market is characterized by a focus on performance, cost, and regulatory compliance.

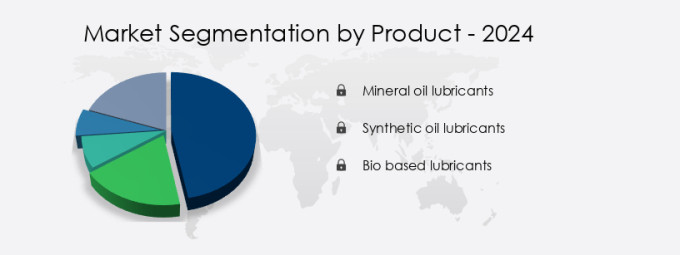

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Mineral oil lubricants

- Synthetic oil lubricants

- Bio based lubricants

- Application

- Automotive oil

- Industrial oil

- Metalworking fluid

- Process oil

- Grease

- End-user

- Transportation

- Industrial

- Distribution Channel

- Direct Sales

- Distributors

- Online Retail

- Geography

- APAC

- Thailand

- APAC

By Product Insights

- The mineral oil lubricants segment is estimated to witness significant growth during the forecast period.

In Thailand's lubricants market, mineral oil lubricants dominate due to their versatile lubricating properties and broad temperature range, which spans from -17 degrees Celsius to 150 degrees Celsius. Suitable for various mechanical components such as bearings, chains, gears, slides, and threaded connections, mineral oil lubricants ensure reliable performance under diverse conditions. Additives, which can be easily incorporated into mineral oil, enhance its performance by addressing specific lubrication needs. Environmental regulations significantly influence the Thai lubricants market, with a focus on oxidation resistance and energy efficiency. High-performance lubricants, including synthetic oils, cater to this demand, offering superior temperature stability and wear protection.

Moreover, the market prioritizes biodegradable lubricants and lubrication management systems to minimize environmental impact. Gear oils, hydraulic fluids,automotive transmission fluids, and engine oils are essential industrial and automotive lubricants, each with unique specifications and requirements. OEM specifications and API classifications ensure compatibility and optimal performance. Aerospace lubricants and food-grade lubricants cater to specialized industries, while lubrication consulting and training services provide expertise and guidance. Lubrication optimization, condition monitoring, and friction reduction are essential practices to maximize efficiency and minimize downtime. Corrosion prevention and biodegradable lubricants are crucial for heavy machinery applications. Marine lubricants cater to the unique demands of the maritime industry.

Lubrication standards and best practices ensure consistent performance and safety across various industries. The market continues to evolve, with ongoing research and development in additive technology, lubrication management systems, and energy-efficient lubricants.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our Thailand Lubricants Market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Lubricants Market in Thailand, projected to grow steadily, advances with lubricants for automotive industry and industrial lubricants in Thailand. Lubricants market trends 2025 emphasize bio-based lubricants Thailand and synthetic lubricants for efficiency. Lubricants for manufacturing and marine lubricants Thailand fuel demand, per Thailand lubricants market forecast. Eco-friendly lubricants leverage lubricants for heavy machinery, while lubricants for power generation ensure reliability. Lubricants for food processing and lubricants for construction enhance versatility. Lubricants for sustainability, advanced lubricant formulations, and lubricants supply chain Thailand drive efficiency. Lubricants for regulatory compliance, lubricants for ASEAN markets, lubricants for fuel economy, lubricants for industrial growth, and lubricants for B2B sectors propel growth through 2029.

What are the key market drivers leading to the rise in adoption of Thailand Lubricants Market?

- Industrial expansion and manufacturing is the key driver of the market.The market is experiencing significant growth due to the country's industrial expansion and manufacturing sector development. The manufacturing sector, which comprises around 30% of Thailand's GDP and employs approximately 10% of the population, is a key driver of this market. The continuous modernization and development of industries require the use of high-quality lubricants to ensure efficient machinery operation and minimize downtime. Industrial lubricants, including mineral oil, engine oil, and lubricant additives, are in high demand to maintain productivity and meet the increasing requirements of various industries.

- Additionally, the marine sector and automotive industry also contribute to the market's growth, with a focus on using advanced lubrication technologies and guidelines to optimize performance and reduce maintenance costs. Lubrication consulting and training services are also gaining popularity to ensure the effective use and application of lubricants in various industries.

What are the market trends shaping the Thailand Lubricants Market?

- Introduction of new products is the upcoming trend in the market.The market is witnessing growth due to the introduction of new products that cater to evolving consumer demands and enhance vehicle performance. PETRONAS Lubricants International (PLI) recently launched PETRONAS Nexta, a line of premium-quality, cost-effective engine oils. Designed for cost-conscious drivers, PETRONAS Nexta utilizes advanced Fluid Technology Solutions from Formula One to improve engine performance, extend engine life, and reduce maintenance costs. This product line adheres to SAE classifications and OEM specifications, ensuring compatibility with various vehicle types. PETRONAS Nexta also features oxidation resistance and additive technology for enhanced lubrication optimization.

-

Furthermore, it complies with environmental regulations, making it an eco-friendly choice. Additionally, PETRONAS offers lubrication services for various industries, including aerospace and food processing, where the use of food-grade lubricants is essential. The launch of PETRONAS Nexta underscores the company's commitment to providing high-performance, affordable lubricants that cater to a broad customer base.

What challenges doesThailand Lubricants Market face during the growth?

- Fluctuating raw material costs is a key challenge affecting the market growth.The Thai lubricants market faces challenges from fluctuating raw material costs, primarily driven by the volatility of crude oil prices. In 2023, Brent crude oil prices saw significant fluctuations, reaching a high of USD125.82 per barrel in September and dropping to USD101.12 per barrel by December. This price instability directly impacts the cost of base oils, a crucial component in lubricant production. Other factors contributing to this volatility include supply and demand imbalances and geopolitical tensions. Despite these challenges, the market continues to prioritize heavy machinery lubrication for industries such as construction and manufacturing. Corrosion prevention, hydraulic fluid, transmission fluid, and synthetic oil remain key areas of focus for lubrication best practices and standards.

-

Friction reduction and efficient lubrication are essential for maintaining machinery performance and longevity. By staying informed of market dynamics and adhering to industry standards, businesses can effectively navigate the challenges and opportunities in the Thai lubricants market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- PTT Lubricants

- Chevron (Caltex)

- Shell

- ExxonMobil

- BP (Castrol)

- TotalEnergies

- Idemitsu Kosan

- Petronas

- Bangchak Corporation

- Thai Oil

- Siam Lubricants

- ENEOS Corporation

- FUCHS Petrolub

- Valvoline

- Gulf Oil

- PetroChina

- SK Lubricants

- Motul

- Liqui Moly

- Bardahl

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Lubricants Market In Thailand

- In February 2023, Thai Lubricants Public Company Limited, the leading lubricant manufacturer in Thailand, announced the launch of its new line of bio-based lubricants, aiming to cater to the growing demand for eco-friendly products (Thai Lubricants Press Release, 2023). This expansion represents a significant strategic move towards sustainability and innovation in the Thai lubricants market.

- In August 2022, Shell and Caltex, two major international oil companies, signed a strategic partnership to expand their joint venture, Shell Caltex Thailand, focusing on the production and distribution of lubricants and other related products (Shell Media Center, 2022). This collaboration is expected to strengthen their market position and enhance their offerings in the competitive Thai lubricants industry.

- In January 2021, PTT Global Chemical Public Company Limited, Thailand's leading integrated petrochemical and refining company, received regulatory approval to construct a new lubricant base oil plant with an annual production capacity of 250,000 metric tons (PTT Global Chemical Press Release, 2021). This investment underscores the company's commitment to increasing its market share and meeting the growing demand for lubricants in Thailand and the region.

- In March 2020, Chevron Oronite, a leading supplier of lubricant additives, opened its new research and development (R&D) center in Rayong, Thailand (Chevron Oronite Press Release, 2020). This investment signifies a significant technological advancement in the Thai lubricants market, as the new R&D center will focus on developing innovative lubricant additives to cater to the evolving needs of customers and the industry.

Research Analyst Overview

The market continues to evolve, driven by the diverse applications across various sectors. Industrial lubricants are essential for heavy machinery, ensuring optimal performance and reducing wear and corrosion. In the automotive industry, automotive lubricants, including engine oil, gear oil, and transmission fluid, are crucial for maintaining vehicle efficiency and longevity. Lubricant additives play a significant role in enhancing the performance of these lubricants. Additive technology offers improved oxidation resistance, friction reduction, and temperature stability, ensuring energy efficiency and prolonging the life of machinery. Environmental regulations continue to shape the market, with a growing demand for eco-friendly lubricants such as bio-based lubricants and biodegradable lubricants.

Mineral oil remains a popular choice due to its availability and cost-effectiveness, but synthetic oil is gaining traction for its superior performance in extreme temperatures and heavy-duty applications. Marine lubricants are essential for the maritime industry, ensuring the smooth operation of ships and offshore platforms. Lubrication training and guidelines are crucial for ensuring proper application and maintenance, leading to increased efficiency and cost savings. The aerospace industry requires high-performance lubricants that meet stringent OEM specifications and API classifications. Lubrication management and condition monitoring are essential for maintaining the reliability and safety of aircraft. Lubrication consulting services offer expert advice on lubrication best practices and standards, ensuring that businesses remain competitive and compliant with industry regulations. The ongoing unfolding of market activities and evolving patterns underscore the importance of staying informed and adaptable in this dynamic market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market growth 2025-2029 |

USD 544.7 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

3.9 |

|

Key countries |

Thailand and APAC |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Thailand

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch