Thermoformed Plastics Market Size 2024-2028

The thermoformed plastics market size is forecast to increase by USD 8.88 billion at a CAGR of 4.36% between 2023 and 2028.

What will be the Size of the Thermoformed Plastics Market During the Forecast Period?

How is this Thermoformed Plastics Industry segmented and which is the largest segment?

The thermoformed plastics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Vacuum formed

- Pressure formed

- Application

- Food packaging

- Medical

- Consumer products

- Others

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By Type Insights

- The vacuum formed segment is estimated to witness significant growth during the forecast period.

Thermoformed plastics are produced through a vacuum forming process, where a thermoplastic sheet is heated, softened, and vacuum-formed over a mold. This results in a three-dimensional part with the desired shape. Vacuum forming is an efficient method for creating large, complex parts with faster cycle times and lower tooling costs compared to other manufacturing techniques. Thermoplastics, such as polypropylene, polyethylene, and polystyrene, are commonly used due to their high impact strength, good thermal strength, and minimal shrinkage. Industries like aerospace, industrial equipment, medical devices, and food packaging heavily utilize thermoformed plastics in applications ranging from medical electronics and kiosks to lightweight vehicles and beverage containers.

Thermoplastics offer benefits such as extended service life, high surface hardness, light transmission, and recyclability, making them an environmentally-friendly alternative to metals. Additionally, thermoforming processes include contact heating, radiant heating, and hot air heating for various applications. Thermoplastic polymers like polymethyl methacrylate (PMMA) are also used for applications requiring high clarity and rigidity.

Get a glance at the Thermoformed Plastics Industry report of share of various segments Request Free Sample

The Vacuum formed segment was valued at USD 20.51 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

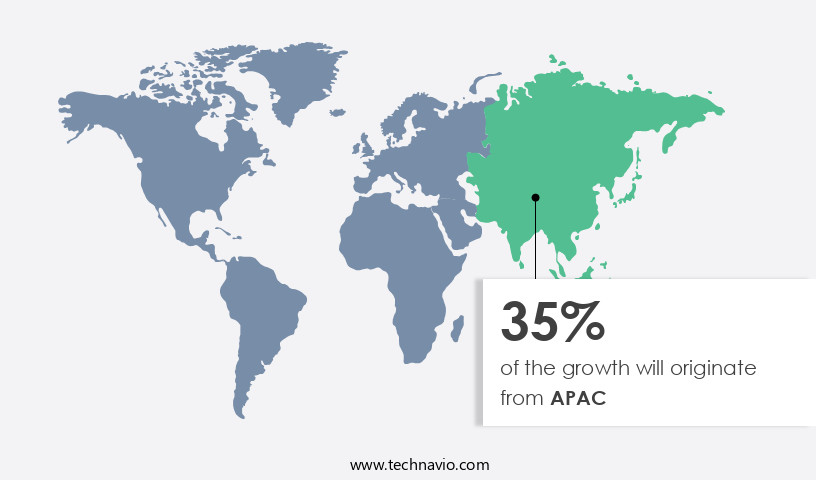

- APAC is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is experiencing significant growth, driven by the packaging and automotive industries in China, India, Indonesia, South Korea, and Japan. Thermoforming is a process that uses heat to shape thermoplastic materials into various forms, making it an ideal solution for industries requiring lightweight and durable products. In the packaging sector, thermoformed plastics extend the shelf life of food and beverages, catering to the increasing preference for convenient and easy-to-cook meals among the growing middle class. The automotive industry also benefits from thermoformed plastics due to their lightweight properties, contributing to the production of fuel-efficient vehicles. Organized retailing, particularly in supermarkets and hypermarkets, is driving the growth of the food packaging industry In the region.

Thermoformed plastics offer advantages such as high surface hardness, extended service life, and recyclability, making them an environmentally-friendly alternative to metal and traditional materials in various industries, including aerospace, medical devices, industrial equipment, and food packaging.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Thermoformed Plastics Industry?

Diverse applications of thermoformed plastics is the key driver of the market.

What are the market trends shaping the Thermoformed Plastics Industry?

Use of recycled plastics In thermoform packaging applications is the upcoming market trend.

What challenges does the Thermoformed Plastics Industry face during its growth?

Stringent regulations and policies is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The thermoformed plastics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the thermoformed plastics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, thermoformed plastics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Allied Plastics Inc. - Thermoformed plastics, a specialized offering, are utilized extensively in manufacturing leak-resistant food containers with superior 360-degree performance. These containers, available in various sizes and shapes, provide optimal protection against spills and leaks. The versatility of thermoformed plastics allows for customizable designs and applications across numerous industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allied Plastics Inc.

- Amcor Plc

- Anchor Packaging LLC

- Berry Global Inc.

- Brentwood Industries Inc.

- Coveris Management GmbH

- D and W Fine Pack

- Dart Container Corp.

- Dordan Manufacturing Co.

- Fabri Kal Corp.

- Greiner Packaging International GmbH

- JJR ENGINEERING and FABRICATION

- Lindar Corp.

- Penda

- Placon Corp.

- Reynolds Group Ltd.

- Sabert Corp.

- Sonoco Products Co.

- The Jim Pattison Group

- Winpak Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Thermoformed plastics have gained significant traction in various industries due to their versatility and inherent benefits. These plastics are formed through a process that involves heating a thermoplastic material until it becomes soft and malleable, then applying vacuum or pressure to shape it into the desired form. The resulting products exhibit several desirable properties, making them suitable replacements for traditional materials in numerous sectors. In the industrial equipment industry, thermoformed plastics have emerged as a preferred choice for manufacturing components due to their lightweight nature and excellent durability. The aerospace industry also utilizes these plastics extensively, given their high surface hardness and extended service life.

In the kiosks industry, thermoformed plastics are used to create various components, including bases, panels, and covers, due to their uniform wall thickness and recyclable nature. The medical devices industry, including the medical industry and diagnostic systems, has adopted thermoformed plastics for the production of prefilled syringes, pharmaceutical bottles, and medical electronics. The lightweight and shatterproof properties of these plastics make them ideal for use in medical applications, where safety and reliability are paramount. The food packaging sector is another significant market for thermoformed plastics. These plastics are used to create a wide range of products, including cups, trays, margarine tubs, sandwich packs, disposable products, beverage glasses, and microwaveable containers.

The food packaging industry's demand for lightweight, recyclable, and environment-friendly materials has driven the growth of the market. The automotive industry has also embraced thermoformed plastics, particularly In the production of lightweight vehicles. Thermoformed plastics are used to create various components, including cowlings, dash components, fenders, engine covers, and construction equipment. The use of these plastics in automotive applications results in reduced vehicle weight, improved fuel efficiency, and extended service life. Process insights into the thermoforming process reveal several advantages that contribute to the growing popularity of thermoformed plastics. Contact heating, radiant heating, and hot air heating are common methods used In thermoforming.

Thick gauge thermoforms are also utilized in various industries, including electronic equipment, fitness equipment, signage, and cowlings, due to their high strength and durability. Polymers such as polypropylene, polyethylene, polystyrene, thermoplastic polymer, polymethyl methacrylate (PMMA), and various other acronyms are commonly used In the production of thermoformed plastics. These polymers offer unique properties, such as high light transmission, UV light resistance, and recyclability, making them suitable for various applications. The thermoforming machine market is driven by the increasing demand for thermoformed plastics in various industries. Servo-driven plug assist, mold clamping, cutting force performance, and heat oven configurations are some of the advanced features offered by modern thermoforming machines.

Additionally, the use of materials like PVC, PLA, EPS, PS, HIPS, OPS, CPET, RPET, and APET further expands the applications of thermoformed plastics. In conclusion, the market is experiencing robust growth due to their versatility and inherent benefits. These plastics are replacing traditional materials in various industries, including industrial equipment, aerospace, kiosks, medical devices, food packaging, automotive, and construction equipment. The thermoforming process offers several advantages, including contact heating, radiant heating, hot air heating, and thick gauge thermoforms. The use of various polymers and advanced thermoforming machines further enhances the applications and properties of thermoformed plastics.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 8.88 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

US, China, India, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Thermoformed Plastics Market Research and Growth Report?

- CAGR of the Thermoformed Plastics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the thermoformed plastics market growth of industry companies

We can help! Our analysts can customize this thermoformed plastics market research report to meet your requirements.