Thermosetting Plastics Market Size 2024-2028

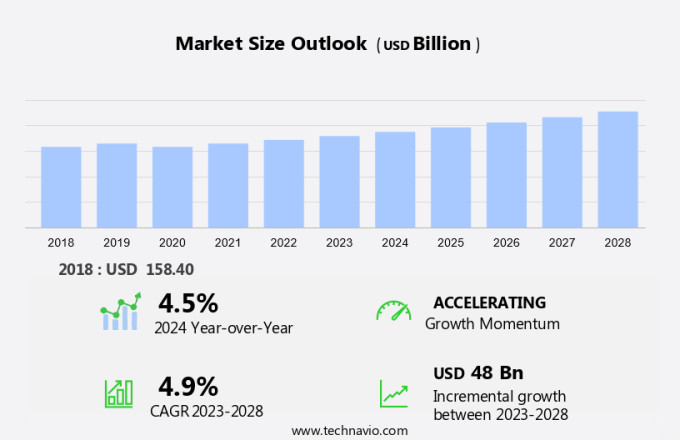

The thermosetting plastics market size is forecast to increase by USD 48 billion at a CAGR of 4.9% between 2023 and 2028.

- The market is experiencing significant growth due to several key drivers. One of the primary factors is the increasing demand from developing countries, particularly in the automotive and construction industries, where lightweight and chemically flexible materials like polyethylene, polyethylene terephthalate, and fiberglass-reinforced plastics (FRP) made of unsaturated polyester resins are increasingly being used. Another trend is the rise in infrastructure development and energy projects, which require durable and high-performance materials such as FDCA-based thermosets. Additionally, the volatility in crude oil prices has led to a shift towards more cost-effective alternatives, including bioplastics derived from renewable resources and dibasic organic thermosets. The market is expected to continue growing, driven by these trends and the ongoing demand for lightweight, durable, and chemically resistant materials in various industries.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth due to their unique properties and wide applications in various industries. These plastics offer superior corrosion resistance, thermal resistance, and fire resistance, making them ideal for use in engineering applications. Thermosetting plastics exhibit excellent creep resistance, which is essential for applications where dimensional stability is critical. The materials' high impact resistance and durability make them suitable for use in structural composites and advanced materials. Furthermore, their chemical resistance and electrical conductivity make them a preferred choice in the automotive and electrical industries. The construction sector is another significant end-user of thermosetting plastics.

- These materials offer excellent thermal conductivity, which is crucial in green building and sustainable building materials such as aluminum. Additionally, their noise reduction properties contribute to the optimization of industrial design and material selection in manufacturing processes. The increasing focus on circular economy and recycling solutions has led to the development of renewable plastics and bio-based polymers. Thermosetting plastics offer cost-effective solutions for the production of these materials, making them a preferred choice for manufacturers. The use of additive manufacturing and 3D printing technology in the production of fiber-reinforced polymers and composite materials has expanded the applications of thermosetting plastics. These materials offer excellent UV resistance and di-electrical properties, making them suitable for use in high-performance plastics and automotive parts. The development of new manufacturing processes and product design techniques has led to the creation of new applications for thermosetting plastics.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Construction

- Automotive

- Electronics

- Adhesives and sealants

- Others

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By Application Insights

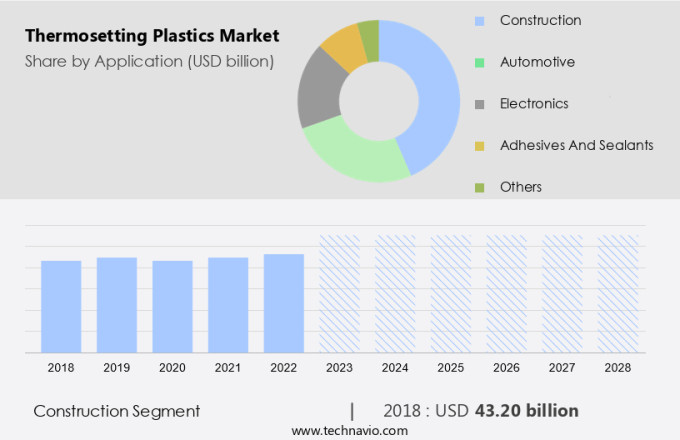

- The construction segment is estimated to witness significant growth during the forecast period.

The construction industry's ongoing quest for durable, lightweight, and high-performance materials has led to a swell in demand for thermosetting plastics. Thermosetting plastics, including epoxy resins, phenolic resins, and polyurethanes, offer superior mechanical properties, chemical resistance, and thermal stability, making them indispensable in modern construction projects. Their applications span from producing adhesives, coatings, insulation, to structural parts. Infrastructure development, especially in emerging economies, is a significant growth driver for thermosetting plastics. Furthermore, the push towards sustainable and energy-efficient building practices is accelerating the adoption of these materials. Thermosetting plastics, such as unsaturated polyester resins and fiberglass, contribute to reducing the overall weight and energy consumption of buildings, aligning with the industry's sustainability goals.

FDCA, a type of thermosetting plastic, is gaining popularity in the automotive composites sector due to its lightweight and chemical flexibility. Bioplastics, another subset of thermosetting plastics, are increasingly being used as eco-friendly alternatives, further expanding the market's scope. The market for thermosetting plastics is expected to continue its growth trajectory, driven by the increasing demand for advanced materials in various industries.

Get a glance at the market report of share of various segments Request Free Sample

The construction segment was valued at USD 43.20 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 61% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The automotive industries in China and India have witnessed substantial growth, with China's industry undergoing significant transformations. In August 2024, China sold over 1 million new energy vehicles (NEVs), marking a major milestone in the expansion of the electric vehicle market. India produced approximately 25.9 million vehicles in FY23. Both countries are imposing regulations to decrease the weight of automobiles to enhance fuel efficiency and minimize carbon emissions. As a result, plastics are increasingly being used as alternatives to metals, such as aluminum and steel, in automotive components. One type of plastic gaining popularity is thermosetting plastics, which offer superior abrasion resistance and excellent chemical resistance.

Thus, these plastics undergo a curing process during manufacturing, resulting in a rigid and stable structure. Thermosetting plastics are used extensively in various automotive applications, including noise-suppressing carpets, piping, and composite materials. Moreover, thermosetting plastics are widely used in healthcare and technical industries due to their excellent environmental and economic performance.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Thermosetting Plastics Market ?

Increasing demand from developing countries is the key driver of the market.

- Thermosetting plastics, including phenolic resins, are increasingly utilized in various industries due to their unique properties such as heat resistance, electrical resistance, and durability. In the automotive sector, these plastics are employed for manufacturing electronic housings and car seat cushioning, providing flexibility and hardness. In the construction industry, cross-linked polymers are used to enhance the structural integrity of buildings and pipes. The Asia Pacific region, specifically countries like China, India, Indonesia, Brazil, and South Africa, are significant contributors to The market. Manufacturers are establishing production facilities in these regions due to factors such as accessible land, low labor costs, and efficient supply of raw materials.

- Lenient regulations on plastic usage in these countries are anticipated to positively impact market growth. The expanding population and increasing purchasing power in the Asia Pacific region are driving investments in industries like construction and automotive. China and India, in particular, are becoming major manufacturing hubs for these sectors, leading to a wave in demand for thermosetting plastics. These plastics' versatility and ability to withstand high temperatures make them an ideal choice for various applications, further fueling market growth. In conclusion, The market is poised for significant growth due to its wide application in various industries and the favorable business environment in developing countries.

What are the market trends shaping the Thermosetting Plastics Market?

The rise in urbanization and infrastructure development is the upcoming trend in the market.

- The market in the United States is witnessing notable expansion due to the escalating urbanization and infrastructure development. As urban populations grow and new construction projects emerge, there is an increasing demand for resilient, heat-resistant, and chemically stable materials like thermosetting plastics. These plastics are indispensable in sectors such as construction, automotive, and electrical, owing to their superior mechanical properties and resistance to deformation at high temperatures. Urbanization results in the construction of residential, commercial, and industrial buildings, all of which necessitate long-lasting materials for durability and safety. Furthermore, infrastructure development, including roads, bridges, and public transportation systems, heavily relies on thermosetting plastics for applications such as coatings, adhesives, and polymer composites.

- The use of thermosetting plastics in the form of wall panels, molding compounds, and anchor bolt adhesives made from polyethylene, polyethylene terephthalate (PET), and polyester resins, among others, contributes significantly to their popularity. Additionally, the increasing focus on fuel efficiency and the utilization of plastic waste in the production of thermosetting plastics through the employment of polyhydric alcohols is expected to further boost market growth.

What challenges does Thermosetting Plastics Market face during the growth?

Volatility in crude oil price is a key challenge affecting the market growth.

- The market faces a significant challenge due to the volatile pricing of raw materials, including polymers and resins, which are essential for their production. These materials, derived from crude oil, have experienced price fluctuations since 2015. The manufacturing process for thermoset plastics begins with propylene and ethylene, making their prices sensitive to crude oil costs. In the oil and gas sector, the decline in oil prices led to cost-saving measures such as workforce reductions. Their insolubility and rehabilitation properties in architecture and thermal insulation further expand their usage. In summary, the market is influenced by the price fluctuations of raw materials, primarily crude oil, which impacts their production costs. The industry's resilience is demonstrated by its continued use in various sectors, including construction and oil and gas, despite these challenges. Hence, the above factors will impede the growth of the market during the forecast period

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alchemie Ltd.

- Arkema

- Asahi Kasei Corp.

- BASF SE

- BUFA GmbH and Co. KG

- Celanese Corp.

- Covestro AG

- Daicel Corp.

- Dow Inc.

- Eastman Chemical Co.

- Evonik Industries AG

- INEOS Group Holdings S.A.

- Lanxess AG

- LG Chem Ltd.

- LyondellBasell Industries Holdings BV

- Rochling SE and Co. KG

- Saudi Basic Industries Corp.

- Solvay SA

- Teijin Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Thermosetting plastics, a category of polymers, undergo an irreversible reaction during manufacturing, resulting in cross-linked polymers with superior mechanical properties. These plastics offer excellent chemical resistance, heat resistance, and electrical insulating properties, making them ideal for various applications. Polyester resins, unsaturated polyester resins, and epoxy resins are popular types of thermosetting plastics. They find extensive use in industries such as automotive, infrastructure, and construction. In the automotive sector, these plastics are used to manufacture lightweight components like steering wheels, air filters, and noise-suppressing carpets. They also serve as anchor bolt adhesives and in the production of fiberglass and composite materials. In the infrastructure sector, thermosetting plastics are used in the manufacturing of pipes, tanks, and chemical processing equipment. They provide excellent structural integrity and insulation, making them suitable for use in harsh environments. In the construction industry, they are used in roofing, wall panels, and sealants.

Additionally, the use of thermosetting plastics in various industries is driven by their economic performance and environmental benefits. They offer excellent fuel effectiveness and reduce the need for frequent repairs due to their durability and abrasion-resistant properties. Additionally, they are used in healthcare applications, such as catheters and medical equipment, due to their biocompatibility and flexibility. Thermosetting plastics are also used in the production of electrical housing, electronic components, and tooling jigs. They offer excellent chemical resistance, insulation, and electrical resistance, making them ideal for use in these applications. In summary, thermosetting plastics offer superior mechanical properties, chemical resistance, and heat resistance, making them a versatile and valuable material in various industries. Their use is driven by their economic performance, environmental benefits, and ability to provide solutions for a wide range of applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.9% |

|

Market Growth 2024-2028 |

USD 48 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.5 |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch