Tinplate Market Size 2022-2026

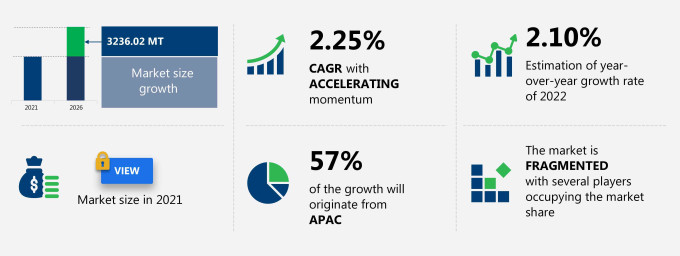

Based on Technavio's market sizing methodology, the tinplate market size is predicted to surge to 3236.02 metric tons from 2021 to 2026 at a CAGR of 2.25%.

This tinplate market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. The tinplate market report offers information on several market vendors, including ArcelorMittal SA, GPT Steel Industries Ltd., JFE Holdings Inc., JSW STEEL Ltd., Nippon Steel Corp., POSCO Group, Sinosteel Corp., Thyssenkrupp AG, Tinplate Co. Of India Ltd., and United States Steel Corp. among others.

This report further entails tinplate market segmentations, including:

- Type - Double reduced and single reduced

- Geography - APAC, Europe, North America, MEA, and South America

What will the Tinplate Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Tinplate Market Size for the Forecast Period and Other Important Statistics

Tinplate Market: Key Drivers, Trends, and Challenges

The increasing launch of new food and beverage products in metal cans is notably driving the tinplate market growth, although factors such as volatility in raw material prices may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the tinplate industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Tinplate Market Driver

One of the key factors driving growth in the tinplate market is the increasing launch of new food and beverage products in metal cans. Nowadays, vendors prefer to use metal packaging for new products. Some new food and beverages that use metal packaging are, in September 2019, Diageo plc (Diageo) launched its new Guinness’ Over the Moon Milk Stout in metal cans. The new product contains about 5.3% ABV (alcohol by volume). In July 2019, Princes Ltd. (Princes) launched two new canned fish-based product ranges, Infused Tuna Fillets and Mackerel Sizzle. The Mackerel line contains skinless and boneless mackerel fillets in a marinade, while the Tuna range features the hand-picked pieces of tuna infused in oil. Thus, the rising number of launches of food and beverage products in metal packaging is expected to drive the growth of the global tinplate market in the F&B packaging sector during the forecast period.

Key Tinplate Market Trend

One of the key tinplate market trends fueling the market growth is the product launches and recycled packaging. Vendors are investing in R&D to increase the usability of tinplate for end-users. For instance, in July 2019, JSW Steel, a subsidiary of JSW Group, introduced Platina, a premium tinplate material in India. For the project, the company invested more than USD130 million to expand its tinplate capacity to 0.5 million MT in Maharashtra. This kind of product launch will strengthen vendors’ market presence. Furthermore, end-users such as packaging industry players are coming with recycled tinplate materials for F&B packaging and FMCG packaging. Due to the increasing popularity of recycled tinplate, vendors are expected to focus more on sustainable tinplate production.

Key Tinplate Market Challenge

The volatility in raw material prices will be a major challenge for the tinplate market during the forecast period. Various types of raw materials are used in tinplate, such as iron or steel and tin. The cost of these raw materials determines the price of the end product. The widening gap between the demand for and supply of the above raw materials in the last few years has led to a considerable increase in their prices. Factors affecting the price of raw materials are the changing economic conditions, currency fluctuations, commodity price fluctuations, transportation costs, resource availability, and political instability. Thus, fluctuations in the prices of raw materials like steel and tin are expected to pose a challenge to the market.

This tinplate market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the global tinplate market as a part of the global diversified metals and mining market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the tinplate market during the forecast period.

Who are the Major Tinplate Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- ArcelorMittal SA

- GPT Steel Industries Ltd.

- JFE Holdings Inc.

- JSW STEEL Ltd.

- Nippon Steel Corp.

- POSCO Group

- Sinosteel Corp.

- Thyssenkrupp AG

- Tinplate Co. Of India Ltd.

- United States Steel Corp.

This statistical study of the tinplate market encompasses successful business strategies deployed by the key vendors. The tinplate market is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

-

ArcelorMittal SA - The company offers tinplate namely Tin Mill Black Plate through its subsidiary ArcelorMittal Dofasco.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The tinplate market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Tinplate Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the tinplate market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chains is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the diversified metals and mining market includes the following core components:

- Inputs

- Operations

- Mine development and extraction

- Outbound logistics

- Marketing and sales

- End-user industries

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Tinplate Market?

For more insights on the market share of various regions Request for a FREE sample now!

57% of the market’s growth will originate from APAC during the forecast period. China and India are the key markets for tinplate in APAC. Market growth in this region will be faster than the growth of the market in other regions.

The large-scale production of steel in China, India, and Japan will facilitate the tinplate market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The outbreak of the COVID-19 pandemic severely impacted the lives of people around the world. In 2020, several countries imposed lockdowns in the region, which affected the supply chain for tinplate materials as they were classified under non-essential goods. However, in Q4 2020 and the first half of 2021, most lockdowns were lifted, and manufacturing and supply chain activities were resumed. Moreover, the rise in awareness among people about the consequences of using single-use plastics and government initiatives to ban the use of such plastics, as they harm the environment, is expected to have a substantial impact on the demand for tinplate in packaging,

What are the Revenue-generating Type Segments in the Tinplate Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The tinplate market share growth by the double reduces segment will be significant during the forecast period. A Double-reduced tinplate is produced through the double cold reduction of hot-rolled steel. After the hot-rolled steel is cold-reduced and annealed, it is again cold-reduced to produce the finished tinplate. Owing to double cold-reduction, it is more rigid and stiffer than single-reduced tinplate. Such features of double reduced tinplate will drive the tinplate market growth during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the tinplate market size and actionable market insights on post COVID-19 impact on each segment.

|

Tinplate Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.25% |

|

Market growth 2022-2026 |

3236.02 MT |

|

Market structure |

Fragmented |

|

YoY growth (%) |

2.10 |

|

Regional analysis |

APAC, Europe, North America, MEA, and South America |

|

Performing market contribution |

APAC at 57% |

|

Key consumer countries |

China, US, India, Germany, Brazil, and UAE |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

ArcelorMittal SA, GPT Steel Industries Ltd., JFE Holdings Inc., JSW STEEL Ltd., Nippon Steel Corp., POSCO Group, Sinosteel Corp., Thyssenkrupp AG, Tinplate Co. Of India Ltd., and United States Steel Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Tinplate Market Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive tinplate market growth during the next five years

- Precise estimation of the tinplate market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the tinplate industry across APAC, Europe, North America, MEA, and South America

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of tinplate market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch