Tooling Composites Market 2024-2028

The tooling composites market size is estimated to grow at a CAGR of 8.37% between 2023 and 2028. The market size is forecast to increase by USD 303.44 million. The growth of the market depends on several factors, including the increasing demand for composite fibers in construction, the increasing demand for tooling composites in the aerospace sector, and the growing use of advanced manufacturing technologies to produce tooling composites

The report offers extensive research analysis on the Tooling Composites Market, with a categorization based on Application, including aerospace, automotive, construction, wind energy, and others. It further segments the market by Raw Material, encompassing polyester, glass fiber, and vinyl esters, and others. Additionally, the report provides Geographical segmentation, covering APAC, Europe, North America, Middle East and Africa, and South America. Market size, historical data (2018-2022), and future projections are presented in terms of value (in USD million) for all the mentioned segments.

What will be the Tooling Composites Market Size During the Forecast Period?

Tooling Composites Market Definition

Tooling composites or composite tooling refers to the use of composites in the engineering of tools as raw materials, which are used for manufacturing new parts or product components. They are less costly and are lightweight with high durability.

To Know more about the Market Report Request Free Sample

Tooling Composites Market: Key Drivers, Trends, Challenges

Key Tooling Composites Market Driver

One of the key factors driving the tooling composites market growth is the increasing demand for tooling composites in the aerospace sector. The aerospace industry places a strong focus on lightweight materials to minimize the weight of aircraft components and enhance fuel efficiency. In addition, tooling composites, known for their high strength-to-weight ratio, are vital for fabricating lightweight components and molds used in the aerospace manufacturing process.

Moreover, aerospace components require a high degree of precision and customization. In addition, tooling composites enable the creation of molds and patterns that replicate complex and customized parts accurately. Furthermore, aerospace manufacturers often employ advanced manufacturing techniques, such as autoclave curing and resin infusion. Therefore, tooling composites are used to create tooling that can withstand these advanced processes. Hence, such factors are driving the market growth during the forecast period.

Significant Tooling Composites Market Trends

A key factor shaping the tooling composites market growth is the growing use of tooling composites in automotive racing. There is an increasing demand for lightweight and high-performance components in automotive racing to improve the speed, agility, and handling of racing vehicles. In addition, tooling composites play a crucial role in manufacturing these components due to their excellent strength-to-weight ratio.

Moreover, racing teams require precision and customization to achieve optimal performance. In addition, tooling composites are used to create molds and tooling that enable the precise replication of intricate, custom-designed parts. Furthermore, aerodynamics is a critical aspect of racing. Therefore, tooling composites are employed to fabricate aerodynamically efficient components, such as body panels, wings, and spoilers, helping enhance the vehicle performance. Hence, such factors are driving the market growth during the forecast period.

Major Tooling Composites Market Challenge

The high cost of composites is one of the key challenges hindering the tooling composites market growth. The high cost of composites materials in tooling has been a key point of concern related to their increasing use in structural applications. For example, carbon fiber is gaining traction in applications where performance gains derived from a lighter and stiffer part outweigh the additional cost.

Moreover, carbon fiber composite parts offer clear benefits over steel, aluminum, wood, and performance plastics due to their high specific strength and modulus. In addition, the main raw materials of carbon composite materials in tooling are polymeric resins and carbon fibers. Furthermore, the cost of carbon fibers is directly related to the cost and yield of its precursors and the conversion cost. Hence, such factors are hindering the market growth during the forecast period.

Tooling Composites Market Segmentation by Application, Raw Material and Geography

Tooling Composites Market Application Analysis

The aerospace segment is estimated to witness significant growth during the forecast period. There is an increasing adoption of tooling composites to fabricate molds to manufacture aerospace components, such as fuselage panels, wings, and engine components. In addition, these molds are created with high precision to ensure accurate replication of the intended part geometry. Furthermore, tooling composites are used to create prototype molds for the development and testing of new aircraft components.

Get a glance at the market contribution of the End User segment Request Free Sample

The aerospace segment was the largest segment and was valued at USD 138.17 million in 2018. Moreover, this enables quick iterations and adjustments before finalizing the production molds. In addition, in aerospace applications, composite materials, such as carbon fiber-reinforced composites, are widely used for their high strength-to-weight ratio. Furthermore, tooling composites are employed to create molds for laying composite materials in specific shapes and patterns. In addition, tooling composites are used in the production of aerostructures, including the wings and fuselage sections of aircraft. Hence, such factors are fuelling the growth of this segment which in turn will drive the market growth during the forecast period.

Tooling Composites Market Raw Material Analysis

Based on the raw material, the segment is classified into polyester, glass fiber, vinyl esters, and others. The polyester segment will account for the largest share of this segment. This segment has low viscosity, enabling the easy impregnation of reinforcing materials like fiberglass. In addition, this facilitates the wetting of fibers and ensures good adhesion between the resin and the reinforcement material. Moreover, polyester resins typically have a relatively fast curing time, enabling shorter production cycles and faster mold turnaround times. Furthermore, polyester resins bond well with reinforcing fibers, providing good adhesion and resulting in the production of composite materials with enhanced strength. Hence, such factors are fuelling the growth of this segment which in turn will drive the market growth during the forecast period.

Tooling Composites Market Region Analysis

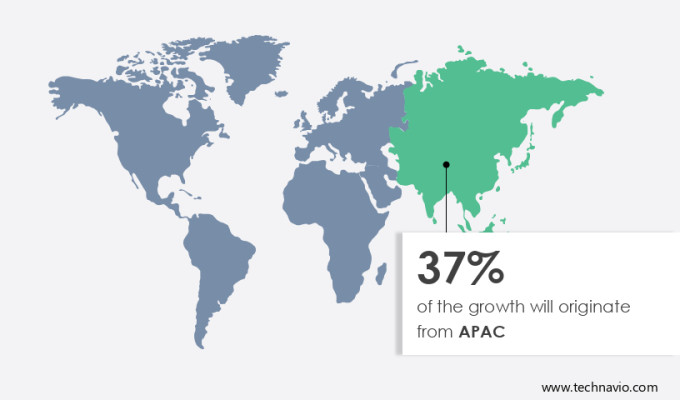

APAC is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Another region offering significant growth opportunities to companies is North America. One of the main factors that are contributing to the market growth in North America is the presence of some of the biggest tooling composite manufacturers and their end-users in the region. In addition, in the US, the demand for tooling composites is primarily driven by the increasing demand for lightweight materials in the automotive industry. Moreover, as composite materials such as glass fiber and carbon fiber provide greater strength than steel and lightweight and non-corrosive properties, they are highly preferred by automotive manufacturers. Furthermore, the presence of some of the biggest automakers, such as General Motors, coupled with the steady growth of the automotive industry, will drive growth in North America during the forecast period.

Key Tooling Composites Market Companies

Companies are implementing various strategies by analyzing factors such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product or service launches, to enhance their presence in the market.

Airtech International Inc: The company offers tooling composites such as bagging films, release films, breathers and bleeders, non liquid mold releases and others.

The report also includes detailed analyses of the competitive landscape of the market and information about 18 market companies, including:

BASF SE, Celanese Corp., Dow Chemical Co., Formaplex Technologies Ltd., GKN Aerospace Services Ltd., Gurit Holding AG, Hexcel Corp., Honeywell International Inc., Hyosung Corp., Kaman Corp., Komarine Co., Magna International Inc., Plastic Reinforcement Fabrics Ltd., SGL Carbon SE, Sika AG, Solvay SA, Teijin Ltd., TPI Composites Inc., and Toray TCAC Holding B.V.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Segment Overview

The report forecasts market growth by revenue at global, regional & country levels and provides an analysis of the latest trends and growth opportunities from 2018-2028.

- Application Outlook

- Aerospace

- Automotive

- Construction

- Wind energy

- Others

- Raw Material Outlook

- Polyester

- Glass fiber

- Vinyl esters and others

- Geography Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Argentina

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

|

Tooling Composites Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.37% |

|

Market Growth 2024-2028 |

USD 303.44 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.79 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 37% |

|

Key countries |

US, China, Japan, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Airtech International Inc., BASF SE, Celanese Corp., Dow Chemical Co., Formaplex Technologies Ltd., GKN Aerospace Services Ltd., Gurit Holding AG, Hexcel Corp., Honeywell International Inc., Hyosung Corp., Kaman Corp., Komarine Co., Magna International Inc., Plastic Reinforcement Fabrics Ltd., SGL Carbon SE, Sika AG, Solvay SA, Teijin Ltd., TPI Composites Inc., and Toray TCAC Holding B.V. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Tooling Composites Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market across North America, APAC, Europe, South America, and the Middle East and Africa

- A thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of tooling composites market companies

We can help! Our analysts can customize this report to meet your requirements. Get in touch