Translation Management Software Market Size 2024-2028

The translation management software market size is forecast to increase by USD 2.33 billion at a CAGR of 14.66% between 2023 and 2028.

What will be the Size of the Translation Management Software Market During the Forecast Period?

How is this Translation Management Software Industry segmented and which is the largest segment?

The translation management software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- On-premises

- Cloud

- End-user

- BFSI

- Legal

- Life sciences

- Tourism and travel

- Others

- Geography

- Europe

- Germany

- UK

- France

- North America

- Canada

- US

- APAC

- Middle East and Africa

- South America

- Europe

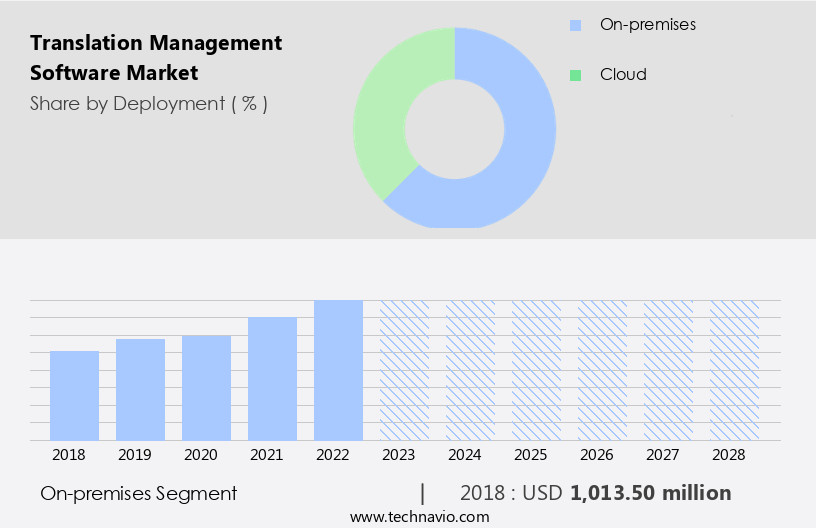

By Deployment Insights

- The on-premises segment is estimated to witness significant growth during the forecast period.

On-premises translation management software enables businesses to install and operate translation solutions on their own servers and IT infrastructure. This deployment model offers organizations control over their translation processes, ensuring data security, privacy, and customization. Key industries, such as healthcare, finance, and legal sectors, which prioritize data sensitivity and regulatory compliance, often prefer on-premises solutions. Machine translation, artificial intelligence, and natural language processing are integral components of translation management software, enhancing linguistic consistency, improving translation accuracy, and facilitating multimodal translation. API capabilities, data security, and collaboration technologies further streamline workflows and ensure quality and accuracy. Industry-specific language, digital content proliferation, and cross-border collaboration necessitate advanced translation solutions.

Cloud-based platforms and project management tools further optimize translation services, enabling real-time collaboration and content delivery across various digital platforms, including social media, e-commerce, and digital marketing.

Get a glance at the Translation Management Software Industry report of share of various segments Request Free Sample

The On-premises segment was valued at USD 1.01 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European the market experiences significant growth due to the region's diverse linguistic landscape and high international business activity. With advanced economies like the UK, Germany, and France, which have a thriving industrial sector, driving market expansion, the adoption of translation software is high. In the EU, which is a global trade hub, countries such as France and Germany, where English is not the primary language for documentation, have a high demand for translation solutions. The market is saturated with large companies, providing advanced translation offerings, including AI-based solutions, machine translation, neural machine translation, and terminology management. These tools address language barriers, ensuring linguistic consistency, precision, and cultural sensitivity in cross-border communication.

Translation workflows are streamlined with collaboration technologies, cloud computing, and project management tools. Additionally, industry-specific language, multimedia content, and content localization are addressed through automatic speech recognition, multimodal translation, and natural language processing. Data security, API capabilities, and blockchain integration are essential features for businesses to ensure data confidentiality.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Translation Management Software Industry?

Increasing volume of data among organizations is the key driver of the market.

What are the market trends shaping the Translation Management Software Industry?

Increasing adoption of neural machine translation (NMT) is the upcoming market trend.

What challenges does the Translation Management Software Industry face during its growth?

Threat from open-source translation management software is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The translation management software market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the translation management software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, translation management software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Acolad Group - The company provides translation management software services encompassing portal-based solutions for website, document, and video translation. These offerings facilitate efficient and effective language processing for businesses seeking multilingual communication. Translation Management Software (TMS) streamlines workflows, ensuring consistency and accuracy across various projects and formats. By utilizing advanced technologies and integrations, this solution caters to diverse industries and enterprises, enabling seamless global communication.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acolad Group

- Across Systems GmbH

- Alphabet Inc.

- Babylon Software Ltd.

- Crowdin

- International Business Machines Corp.

- LanguageLine Solutions

- Lionbridge Technologies LLC

- Lokalise Inc.

- MemoQ Translation Technologies Ltd.

- Microsoft Corp.

- Pairaphrase LLC

- RWS Holdings PLC

- SAP SE

- Smartling Inc.

- STAR AG

- TextUnited GmbH

- TransPerfect Global Inc.

- Welocalize Inc.

- Wordfast LLC

- XTM International Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Translation management software (TMS) is a crucial tool for businesses aiming to expand their reach across borders and communicate effectively with diverse audiences. This software facilitates the management of translation workflows, ensuring linguistic consistency and precision in an increasingly digital world. As digital content proliferates, language barriers pose significant challenges for businesses seeking to engage with customers and stakeholders In their native languages. TMS addresses these challenges by streamlining translation processes and enabling real-time collaboration between linguistic resources and project teams. The translation industry has seen significant advancements in technology, with artificial intelligence (AI) and machine learning playing increasingly important roles.

Neural machine translation and natural language processing have revolutionized the way businesses approach translation, providing more accurate and efficient solutions. Data security is a critical concern for businesses using TMS. API capabilities and cloud computing enable secure integration with other systems, while blockchain integration adds an additional layer of security. TMS also offers collaboration technologies, enabling seamless communication between team members and language service providers. Multimodal translation is another key feature of TMS, allowing businesses to translate text-based, audio-based, and video-based content. Industry-specific language and terminology management ensure that translations are accurate and culturally sensitive, enhancing global communication and customer engagement.

The translation services market is experiencing significant growth, driven by the digital transformation of industries such as travel and hospitality, e-commerce, and digital marketing. TMS enables businesses to localize content for these industries, ensuring that communication flows effectively and accurately. Social media and customer support documentation are essential channels for businesses to engage with their customers. TMS enables automated translation of user-generated content, ensuring that businesses can respond to customer queries in a timely and accurate manner. The increasing use of AI-based solutions in TMS has led to improvements in translation accuracy, particularly for less common languages and complex language structures.

Rule-based translation software and linguistic resources continue to play a role, ensuring that translations are of the highest quality and accuracy. Cloud-based platforms and workflow management tools enable cross-border collaboration, reducing the need for physical travel and enabling businesses to work with language service providers from anywhere In the world. Professional and managed services offer additional support, ensuring that businesses can focus on their core competencies while leaving translation and localization to the experts. In conclusion, TMS is an essential tool for businesses seeking to expand their reach and communicate effectively with diverse audiences. With features such as AI-based solutions, collaboration technologies, and industry-specific language management, TMS enables businesses to overcome language barriers and engage with customers In their native languages.

The market for TMS is expected to continue growing, driven by the digital transformation of industries and the increasing importance of global communication.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.66% |

|

Market growth 2024-2028 |

USD 2331.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

14.26 |

|

Key countries |

US, Germany, France, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Translation Management Software Market Research and Growth Report?

- CAGR of the Translation Management Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the translation management software market growth of industry companies

We can help! Our analysts can customize this translation management software market research report to meet your requirements.