Ultra Wideband Market Size 2024-2028

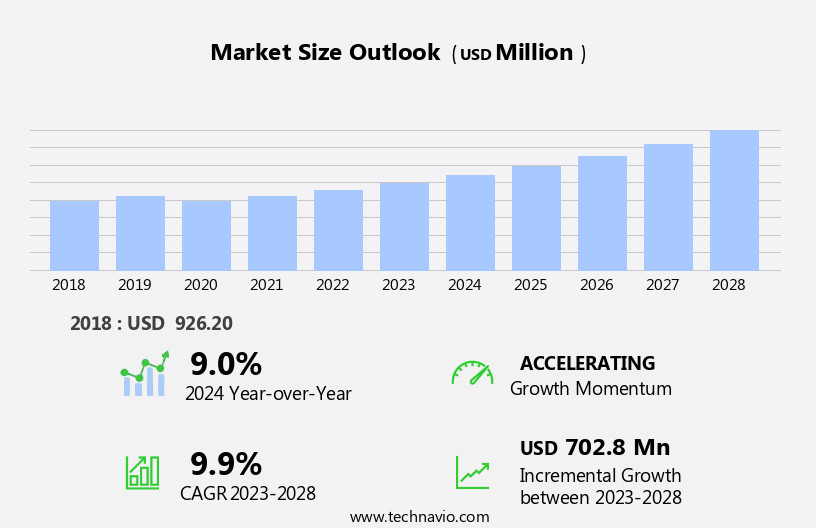

The ultra wideband market size is forecast to increase by USD 702.8 million, at a CAGR of 9.9% between 2023 and 2028.

- The Ultra Wideband (UWB) market is experiencing significant growth due to the increasing adoption of Real-Time Location System (RTLS) technology in various industries. UWB's ability to provide precise location information in real-time makes it an attractive solution for asset tracking, indoor navigation, and proximity marketing applications. However, this market is not without challenges. Cybersecurity vulnerabilities pose a significant threat, as UWB's long-range and low-power capabilities make it susceptible to potential hacking and data breaches. Companies must prioritize implementing robust security measures to mitigate these risks and protect sensitive information.

- Despite these challenges, the opportunities for innovation and growth in the UWB market are substantial, particularly in sectors such as healthcare, logistics, and retail. By focusing on developing secure and reliable UWB solutions, businesses can capitalize on the technology's potential to enhance operational efficiency and deliver new value-added services to their customers.

What will be the Size of the Ultra Wideband Market during the forecast period?

Ultra-wideband (UWB) technology continues to evolve, offering versatile applications across various sectors. With its ability to provide high precision positioning and low power consumption, UWB is increasingly adopted in industries such as robotics, healthcare, and automotive. UWB's large bandwidth enables high data rate transmission, making it an ideal choice for various applications. UWB's channel estimation and ranging capabilities ensure accurate and reliable communication, even in complex environments. The ongoing development of UWB standards, such as IEEE 802.15.4a and Fira Consortium's 802.15.4z, further enhances its capabilities and interoperability. UWB's integration in wearables and sensors offers new possibilities for real-time monitoring and tracking.

However, challenges such as multipath propagation, privacy concerns, and interference mitigation require continuous attention from industry players. UWB's precision and low latency make it a promising technology for time-of-flight applications. Its potential in healthcare, for instance, includes non-invasive medical imaging and patient monitoring. In automotive, UWB is being explored for vehicle-to-vehicle communication and collision avoidance systems. UWB's evolving nature calls for ongoing efforts in power consumption optimization, bandwidth expansion, and security enhancements. The technology's potential is vast, and its continuous unfolding promises new applications and innovations.

How is this Ultra Wideband Industry segmented?

The ultra wideband industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Communication

- RTLS

- Imaging

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

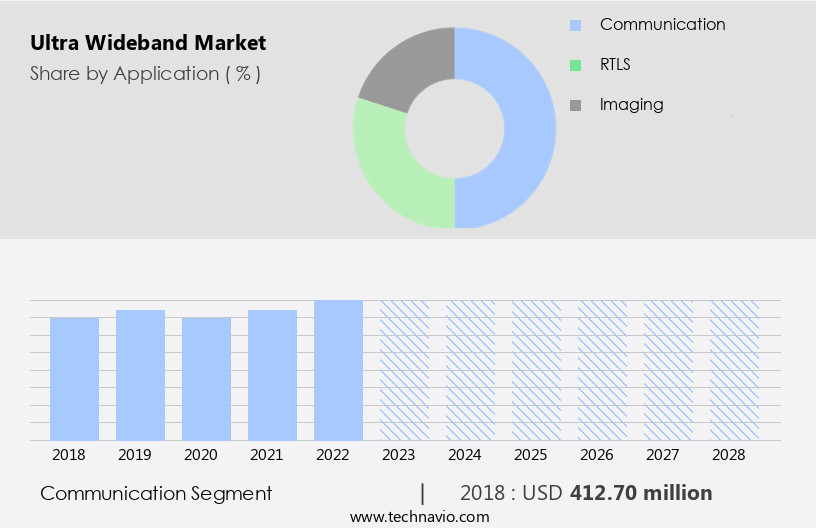

The communication segment is estimated to witness significant growth during the forecast period.

Ultra Wideband (UWB) technology is an advanced communication method characterized by its wide bandwidth and low power consumption. UWB modules and chips, essential components of UWB systems, enable high-precision positioning and low-latency data transfer. UWB transceivers facilitate reliable communication between devices, while location tracking and multipath propagation enhance accuracy. UWB's privacy features ensure secure data transmission, and standards, such as IEEE 802.15.4a and Fira Consortium's UWB, ensure interoperability. UWB's applications extend to robotics, wearables, healthcare, and automotive industries. In robotics, UWB enables precise control and positioning. In wearables, it powers continuous health monitoring. In healthcare, UWB's accuracy and low power consumption make it suitable for medical devices.

In automotive, UWB's time-of-flight technology enhances safety and parking systems. UWB sensors and positioning systems offer real-time data, while compliance with regulations ensures safety and reliability. UWB's low power consumption and high bandwidth make it an attractive alternative to Bluetooth. UWB's precision and interference mitigation capabilities improve performance and reliability. UWB's channel estimation and ranging features enable accurate distance measurement. UWB antennas optimize signal transmission and reception. UWB's security features protect data from unauthorized access, making it a preferred choice for secure communication. UWB technology's evolution continues with the development of IEEE 802.15.4z and pulse shaping techniques, further enhancing its capabilities.

UWB's potential applications are vast, and its adoption is expected to grow as technology advances and costs decrease.

The Communication segment was valued at USD 412.70 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

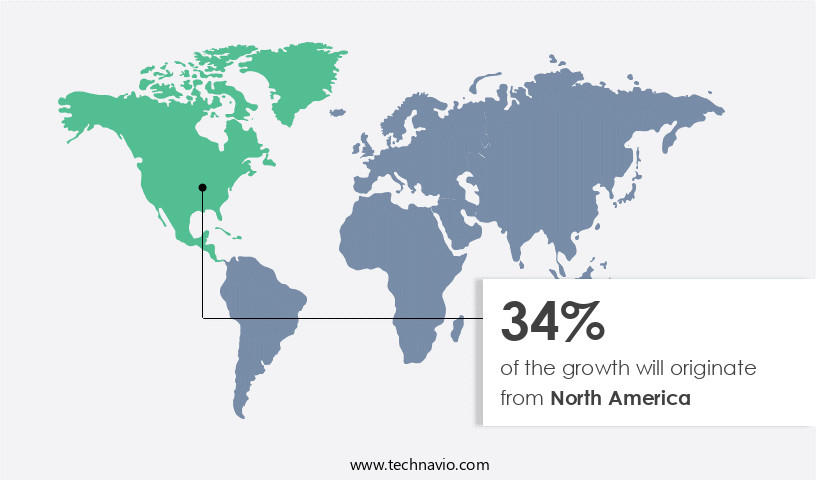

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, driven by the increasing adoption of UWB technology in various industries. The US, as the largest revenue contributor, is witnessing high demand due to the widespread use of UWB real-time location systems (RTLS) in transportation and logistics, hospitals, enterprises, retail, and automotive sectors. UWB modules, ultra-wideband chips, and transceivers are essential components of these systems, enabling precise location tracking and reducing multipath propagation issues. UWB's privacy features and compliance with standards like IEEE 802.15.4a and Fira Consortium's UWB 1.0 are crucial factors in its growing popularity. In addition, the integration of UWB in robotics, wearables, healthcare, and automotive industries is expanding its applications.

UWB's low power consumption, high bandwidth, and advanced channel estimation and ranging capabilities make it an attractive choice for various use cases. Canada and Mexico are also witnessing increased demand for UWB, particularly in the form of RFID tags. SMEs and hospitals in these regions are adopting RFID tags, contributing to the growth of the UWB market in North America. UWB's precision, security, and interference mitigation capabilities make it an ideal solution for various applications, including time-of-flight measurements and data rate-intensive applications. The integration of UWB pulse shaping further enhances its performance and reliability. Overall, the North American UWB market is poised for continued growth, driven by the increasing adoption of UWB technology across various industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Ultra Wideband Industry?

- The expanding utilization of Ultra-Wideband (UWB) technology is the primary catalyst fueling market growth.

- Ultra-Wideband (UWB) technology is gaining significant traction in various industries for people positioning and secure access control applications. UWB modules, which consist of ultra-wideband chips and transceivers, enable precise location tracking and real-time monitoring of personnel movements. This technology offers several advantages, including immersive and harmonious user experiences, instant access without human interaction, and protection from relay attacks, making it suitable for secure-access applications. Commercial and residential access control is an extension of UWB's initial activities within the automotive secure-access realm. UWB technology tracks users' exact locations in relation to entrances or exits and verifies their security credentials, granting instant, hands-free access.

- Minew, a leading technology company, entered the UWB market in December 2021 by launching its own UWB tag for smarter ways to find lost or misplaced items. UWB's ability to provide precise location information and ensure security makes it an attractive option for various industries, including manufacturing, logistics, and healthcare. The technology's multipath propagation properties and privacy features further enhance its appeal, ensuring secure data transmission and user privacy. UWB's role in robotics is also noteworthy, as it enables precise positioning and control for industrial robots and drones. In conclusion, UWB technology's market dynamics are driven by its ability to provide precise location tracking, ensure security, and offer immersive user experiences.

- Its applications in people positioning, secure access control, and robotics are expected to fuel its growth in the coming years.

What are the market trends shaping the Ultra Wideband Industry?

- UWB Real-Time Location System (RTLS) technology is gaining significant traction in the market due to its adoption. This advanced technology enables accurate real-time tracking of assets and people, making it an essential solution for various industries, including healthcare, manufacturing, and logistics.

- Ultra Wideband (UWB) technology is a real-time location system (RTLS) consisting of tags, sensors, timing cables or wireless bridges, a location engine, and software applications. UWB RTLS provides high-accuracy positioning over short-to-medium distances at a lower cost compared to other RTLS technologies. With a data rate reaching up to 100 Mbps, UWB is an ideal solution for near-field data transmission. The technology's potential to deliver precise results in various applications, including communication and sensors, positioning and tracking, and radar, benefits end-users significantly. UWB's channel estimation and ranging capabilities enable accurate distance measurement and location determination.

- IEEE 802.15.4a and the FIRA (Forum for Impulse Radio and Low-Power Wireless Personal Area Networks) Consortium have played crucial roles in standardizing UWB technology. UWB's low power consumption and high bandwidth make it a promising technology for various industries, including healthcare, retail, logistics, and manufacturing. In wearables, UWB's accuracy and low power consumption make it an attractive choice for tracking and monitoring applications. Overall, UWB RTLS is a valuable technology for businesses seeking precise, real-time location information.

What challenges does the Ultra Wideband Industry face during its growth?

- The growth of the industry is significantly impeded by the vulnerability to cyberthreats, which poses a critical challenge that necessitates continuous attention and effective mitigation strategies from professionals.

- Ultrawideband (UWB) technology, characterized by its ability to provide precise location data and low latency, is gaining traction in various applications. UWB sensors enable accurate positioning systems, offering benefits in industries such as automotive, healthcare, and retail. However, this advanced technology comes with potential risks. UWB's high precision makes it susceptible to interference and security concerns. Hackers could exploit the location data, posing privacy threats and even enabling stalking. Moreover, the growing adoption of UWB in IoT and connected environments necessitates robust compliance and security measures. As the number of stakeholders involved in these ecosystems increases, so does the need for securing the vast amounts of data being shared.

- UWB's low latency is another critical factor, making it essential for real-time applications. However, it can also lead to potential interference issues that need to be addressed. In conclusion, while UWB technology offers numerous benefits, it is crucial to address the challenges surrounding its security, compliance, and interference mitigation. Ensuring a secure and reliable UWB ecosystem will be vital for its widespread adoption and successful implementation in various applications.

Exclusive Customer Landscape

The ultra wideband market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ultra wideband market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ultra wideband market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Altaeros - The Humatics Rail Navigation System (HRNS) is an advanced railway technology solution, characterized by a robust architecture and stringent positioning performance metrics.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Altaeros

- BLEESK SP Z O.O.

- Fractus S.A

- Humatics Corp.

- infsoft GmbH

- Johanson Technology Inc.

- LitePoint Corp.

- Nanotron Technologies GmbH

- NOVELDA

- NXP Semiconductors NV

- Pulse LINK Inc.

- Qorvo Inc.

- Samsung Electronics Co. Ltd.

- Siemens AG

- Sony Group Corp.

- Starix Technology Inc.

- STMicroelectronics International NV

- Texas Instruments Inc.

- Ubisense Ltd.

- Zebra Technologies Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Ultra Wideband Market

- In March 2023, Intel and Apple announced a strategic collaboration to integrate Ultra Wideband (UWB) technology into Apple's iPhone 15 series, marking a significant leap in the mass adoption of UWB technology in consumer electronics (Intel Press Release, 2023). This partnership is expected to boost the market growth, as Apple's influence in the smartphone industry is substantial.

- In July 2024, Qualcomm and Broadcom completed their merger, creating a leading semiconductor company with a strong presence in UWB technology. This merger is expected to result in increased R&D investment and accelerated innovation in UWB solutions (Broadcom Press Release, 2024).

- In November 2024, the Federal Communications Commission (FCC) approved the use of UWB technology for automotive applications, paving the way for the development of advanced driver-assistance systems (ADAS) and autonomous vehicles. This regulatory approval is a major milestone for the UWB market in the transportation sector (FCC Press Release, 2024).

- In March 2025, Samsung Electronics and Google announced a partnership to develop UWB-enabled devices, aiming to enhance the user experience in areas like contactless payments and location-based services. This collaboration is expected to intensify competition in the UWB market, driving innovation and growth (Samsung Newsroom, 2025).

Research Analyst Overview

- Ultra-wideband (UWB) technology is revolutionizing various industries by enabling real-time, high-precision data communication and locationing. In the realm of smart retail, UWB enhances inventory management and contactless payment systems through digital twins and ML-driven image processing. Digital transformation in manufacturing propels the adoption of UWB in smart factories, where AI, edge computing, and industrial robotics optimize production lines. Wearable technology and VR integrate UWB for biometric authentication and precision time synchronization, ensuring data privacy. Precision agriculture leverages UWB for sensor fusion, DL, and data analytics to boost crop yields.

- UWB's role in autonomous vehicles lies in signal processing, environmental monitoring, and GNSS positioning. In digital healthcare, UWB-enabled AR and computer vision streamline patient care. Near-field communication and smart infrastructure applications further expand UWB's market reach. Cellular networks and data privacy concerns are addressed through UWB's low power consumption and secure data transmission.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Ultra Wideband Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.9% |

|

Market growth 2024-2028 |

USD 702.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.0 |

|

Key countries |

US, Germany, China, UK, Japan, Canada, France, India, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ultra Wideband Market Research and Growth Report?

- CAGR of the Ultra Wideband industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ultra wideband market growth of industry companies

We can help! Our analysts can customize this ultra wideband market research report to meet your requirements.