US Population Health Management (PHM) Market Size 2025-2029

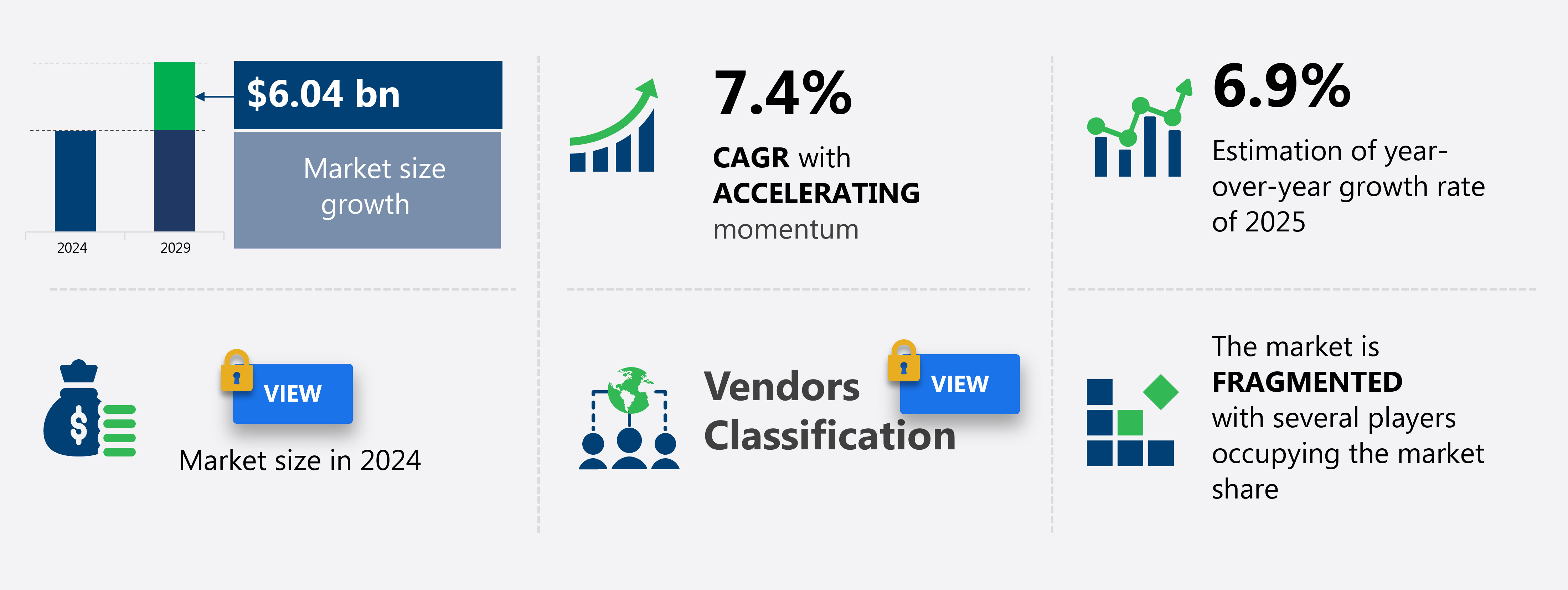

The us population health management (phm) market size is forecast to increase by USD 6.04 billion at a CAGR of 7.4% between 2024 and 2029.

- The Population Health Management (PHM) market in the US is experiencing significant growth, driven by the increasing adoption of healthcare IT solutions and analytics. These technologies enable healthcare providers to collect, analyze, and act on patient data to improve health outcomes and reduce costs. However, the high perceived costs associated with PHM solutions pose a challenge for some organizations, limiting their ability to fully implement and optimize these technologies. Despite this obstacle, the potential benefits of PHM, including improved patient care and population health, make it a strategic priority for many healthcare organizations.

- To capitalize on this opportunity, companies must focus on cost-effective solutions and innovative approaches to addressing the challenges of PHM implementation and optimization. By leveraging advanced analytics, cloud technologies, and strategic partnerships, organizations can overcome cost barriers and deliver better care to their patient populations.

What will be the size of the US Population Health Management (PHM) Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The Population Health Management (PHM) market in the US is experiencing significant advancements, integrating various elements to improve patient outcomes and reduce healthcare costs. Public health surveillance and data governance ensure accurate population health data, enabling healthcare leaders to identify health disparities and target interventions. Quality measures and health literacy initiatives promote transparency and patient activation, while data visualization and business intelligence facilitate data-driven decision-making. Behavioral health integration, substance abuse treatment, and mental health services address the growing need for holistic care, and outcome-based contracts incentivize providers to focus on patient outcomes. Health communication, community health workers, and patient portals enhance patient engagement, while wearable devices and mHealth technologies provide real-time data for personalized care plans.

- Precision medicine and predictive modeling leverage advanced analytics to tailor treatment approaches, and social service integration addresses the social determinants of health. Health data management, data storytelling, and healthcare innovation continue to drive market growth, transforming the industry and improving overall population health.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Software

- Services

- Deployment

- Cloud

- On-premises

- End-user

- Healthcare providers

- Healthcare payers

- Employers and government bodies

- Geography

- North America

- US

- North America

By Product Insights

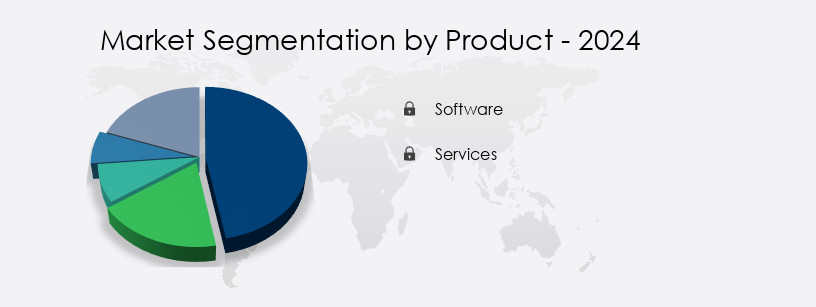

The software segment is estimated to witness significant growth during the forecast period.

Population Health Management (PHM) software in the US gathers patient data from healthcare systems and utilizes advanced analytics tools, including data visualization and business intelligence, to predict health conditions and improve patient care. PHM software aims to enhance healthcare efficiency, reduce costs, and ensure quality patient care. By analyzing accurate patient data, PHM software enables the identification of community health risks, leading to proactive interventions and better health outcomes. The adoption of PHM software is on the rise in the US due to the growing emphasis on value-based care and the increasing prevalence of chronic diseases. Machine learning, artificial intelligence, and predictive analytics are integral components of PHM software, enabling healthcare payers to develop personalized care plans and improve care coordination.

Data integration and interoperability facilitate seamless data sharing among various healthcare stakeholders, while data visualization tools help in making informed decisions. Public health agencies and healthcare providers leverage PHM software for population health research, disease management programs, and quality improvement initiatives. Cloud computing and data warehousing provide the necessary infrastructure for storing and managing large volumes of population health data. Healthcare regulations mandate the adoption of PHM software to ensure compliance with data privacy and security standards. PHM software also supports care management services, patient engagement platforms, and remote patient monitoring, empowering patients to take charge of their health. Wellness programs, community health outreach, and patient education resources are essential components of PHM software, promoting health equity and improving overall population health.

PHM software plays a crucial role in healthcare informatics, enabling evidence-based practices and clinical decision support, and facilitating clinical trials and care coordination.

The Software segment was valued at USD 7.08 billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the US Population Health Management (PHM) Market market drivers leading to the rise in adoption of the Industry?

- The significant growth in the healthcare industry's acceptance of IT solutions serves as the primary catalyst for the market's expansion.

- Population Health Management (PHM) has emerged as a critical area of investment for US healthcare providers, driven by the need to reduce costs and improve patient outcomes. PHM utilizes various tools and technologies, including risk stratification, value-based care, remote patient monitoring, patient engagement platforms, and machine learning, to manage large patient populations more effectively. Public health agencies and healthcare policy makers are increasingly emphasizing the importance of PHM in chronic disease management. Data visualization tools enable healthcare providers to analyze patient data and identify trends, while machine learning algorithms help in predicting patient risks and personalizing care plans.

- Remote patient monitoring allows for real-time monitoring of patients, reducing the need for hospital visits and lowering healthcare costs. Patient engagement platforms enable patients to take an active role in managing their health, leading to better adherence to treatment plans. The use of PHM software facilitates automated patient history management, computerized reminders, and decision-making, reducing human intervention and improving the quality of patient services. The ongoing trend towards value-based care is expected to further drive the adoption of PHM solutions. The healthcare industry's increasing focus on data-driven insights and personalized care plans is expected to create significant opportunities for PHM market growth.

What are the US Population Health Management (PHM) Market market trends shaping the Industry?

- Population health management (PHM) is witnessing an upward trend in the adoption of analytics. This innovative approach is becoming increasingly common in the healthcare industry.

- Population Health Management (PHM) in the US healthcare industry is witnessing significant growth due to the increasing adoption of data analytics and business intelligence solutions. Healthcare organizations generate vast amounts of clinical and non-clinical data, which necessitates advanced tools and techniques for effective data integration and analysis. Data integration is crucial for population health management as it enables the collection and analysis of data from various sources, including electronic health records, claims data, and social determinants of health. Population health metrics, such as health equity, are essential for identifying disparities and improving overall population health. Artificial intelligence (AI) and predictive analytics are transforming PHM by providing healthcare payers with insights into patient health trends and care coordination needs.

- Cloud computing enables secure and efficient data storage and access, making it an essential component of PHM. Healthcare regulations mandate the use of standardized data formats and interoperability, making data integration and analysis more complex. However, these regulations also promote data sharing and collaboration, which can lead to improved patient outcomes and cost savings. Care coordination is a critical aspect of PHM, and predictive analytics can help identify patients at risk for chronic conditions or readmissions, enabling early intervention and prevention. PHM strategies aim to improve patient outcomes while reducing healthcare costs by addressing the social determinants of health and providing personalized care plans.

How does US Population Health Management (PHM) Market market faces challenges face during its growth?

- The high perceived costs of Predictive Maintenance (PHM) solutions represent a significant challenge to the industry's growth, as organizations must carefully weigh the benefits against the investment required to implement and maintain these advanced technologies.

- Population Health Management (PHM) in the health insurance industry is driven by the need to improve patient outcomes, reduce costs, and enhance the overall healthcare experience. Health analytics software plays a pivotal role in PHM by enabling data collection, analysis, and reporting on large sets of clinical, financial, and demographic data. This data is used to identify trends, risks, and opportunities for intervention, leading to evidence-based practices and clinical decision support. Big data analytics, clinical data warehousing, and data interoperability are essential components of PHM, facilitating the integration and sharing of data across various healthcare providers and systems.

- Clinical trials and provider network management are also critical elements, ensuring the delivery of high-quality care and coordinated services. Wellness programs are increasingly popular in PHM, focusing on preventative care and patient engagement. These initiatives aim to improve population health, reduce healthcare costs, and enhance the overall patient experience. Despite the benefits, the implementation of PHM strategies requires significant investment in technology, infrastructure, and human resources. The high cost of health analytics software, clinical trials, and provider network management may be a challenge for some health insurers, particularly those serving price-sensitive customer bases. In conclusion, PHM offers significant opportunities for improving healthcare outcomes and reducing costs, but its successful implementation requires a strategic approach and a commitment to investing in the necessary resources.

- Recent research suggests that PHM is gaining momentum, with increasing adoption and innovation in the field.

Exclusive US Population Health Management (PHM) Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- athenahealth Inc.

- CareCloud Inc.

- Cedar Gate Technologies

- CureMD

- DrChrono Inc.

- eClinicalWorks LLC

- Epic Systems Corp.

- Global Payments Inc.

- Greenway Health LLC

- Koninklijke Philips NV

- McKesson Corp.

- Medecision Inc.

- Medical Information Technology Inc.

- NextGen Healthcare Inc.

- Oracle Corp.

- PointClickCare Technologies Inc.

- Tebra Technologies Inc.

- Tenet Healthcare Corp.

- United Health Group Inc.

- Veradigm LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Population Health Management (PHM) Market In US

- In February 2024, IBM Watson Health announced the expansion of its IBM Watson Health Platform with new population health management capabilities. This development aimed to help healthcare organizations identify and manage high-risk patient populations more effectively, integrating data from various sources (IBM Press Release, 2024).

- In May 2024, Amazon Care, Amazon's healthcare service, entered into a partnership with Cedars-Sinai to offer virtual primary care services to the latter's employees. This collaboration represented a significant step in the integration of technology and healthcare, with Amazon Care's telehealth services being made available to Cedars-Sinai's workforce (Cedars-Sinai Press Release, 2024).

- In January 2025, Cerner Corporation, a leading health IT solutions provider, completed the acquisition of AI-powered population health management company, Piedmont Healthcare Analytics. The acquisition was expected to strengthen Cerner's population health management capabilities and expand its market presence (Cerner Corporation Press Release, 2025).

- In March 2025, the Centers for Medicare & Medicaid Services (CMS) launched the Primary Care First initiative, a new payment model designed to incentivize value-based care and population health management. This initiative aimed to shift the focus from fee-for-service to value-based care, with participating providers receiving a monthly payment for each attributed beneficiary (CMS Press Release, 2025).

Research Analyst Overview

The population health management (PHM) market in the US continues to evolve, driven by the ongoing integration of data and technology to improve healthcare delivery and outcomes. PHM encompasses various sectors, including healthcare payers, providers, and public health agencies, all working towards reducing costs, enhancing risk stratification, and promoting value-based care. Remote patient monitoring, machine learning, and data visualization tools are increasingly utilized to facilitate patient engagement and enable more effective chronic disease management. Health equity is a critical focus area, with cloud computing and population health data playing essential roles in addressing disparities. Healthcare regulations and payer strategies continue to shape the PHM landscape, with predictive analytics and care coordination becoming increasingly important for managing population health.

Health insurance companies are investing in health analytics software and clinical trials to optimize their offerings and improve health outcomes. Artificial intelligence (AI) and big data analytics are revolutionizing healthcare informatics, enabling evidence-based practices and clinical decision support. Data interoperability and clinical data warehousing are crucial for integrating and analyzing diverse data sources, enhancing care management services and population health reporting. Provider network management, wellness programs, community health outreach, and patient education resources are all integral components of PHM, as healthcare organizations strive to improve health outcomes and provide quality improvement initiatives. The continuous unfolding of market activities and evolving patterns underscore the importance of adaptability and innovation in the PHM space.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Population Health Management (PHM) Market in US insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 6.04 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.9 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch