Used Trucks Market Size 2024-2028

The used trucks market size is forecast to increase by USD 13.37 billion, at a CAGR of 5.38% between 2023 and 2028.

- The market is driven by the increasing adoption of touchpoint management systems integrated with artificial intelligence. This technology enhances the buying and selling experience for both dealers and customers, streamlining processes and improving operational efficiency. Furthermore, the e-commerce industry's growth is fueling demand for used trucks to transport goods, leading to increased sales. However, the market faces a significant challenge: the lowering resale value of used trucks. This trend is attributed to the increasing availability of newer, more technologically advanced models, which may render older trucks less desirable. To capitalize on market opportunities, used truck dealers must focus on providing exceptional customer service and competitive pricing to differentiate themselves. Additionally, exploring alternative revenue streams, such as offering maintenance and repair services, can help mitigate the impact of declining resale values.

- In navigating this landscape, strategic partnerships and collaborations with technology providers can enable dealers to stay competitive and offer value-added services to customers. Overall, the market presents both challenges and opportunities for growth, requiring dealers to adapt and innovate to meet evolving customer demands and market trends.

What will be the Size of the Used Trucks Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the dynamic interplay of various factors. Auction pricing data serves as a crucial indicator of market trends, providing insights into shifting demand patterns and price fluctuations. For instance, data from a major auction house reveals a 10% increase in the average sale price of medium-duty trucks over the past year. Effective parts inventory management is another key aspect of the market, with cargo capacity calculations and vehicle history reports playing essential roles. Transmission repair costs and engine performance metrics are critical factors in determining a truck's resale value. Fuel consumption tracking and predictive maintenance models help fleet operators optimize their operational costs, while fuel efficiency ratings and drivetrain component analysis inform purchasing decisions.

Telematics device integration, GPS tracking systems, and tire condition assessment enable real-time monitoring and fleet management. GVWR compliance checks, truck diagnostic tools, and body damage assessment ensure safety and regulatory compliance. Pre-purchase truck inspections, maintenance records review, dealer certifications, and electrical system testing contribute to the overall value assessment. Heavy-duty truck parts, remote diagnostics capabilities, transport logistics optimization, emission control systems, and mileage verification systems are some of the industry's growth drivers, with expectations of a 5% annual expansion in the coming years. The market's continuous dynamism underlines the importance of staying informed and adaptive.

How is this Used Trucks Industry segmented?

The used trucks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Pickup trucks

- Other trucks

- Fuel Type

- Diesel

- Gasoline

- Electric

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Rest of World (ROW)

- North America

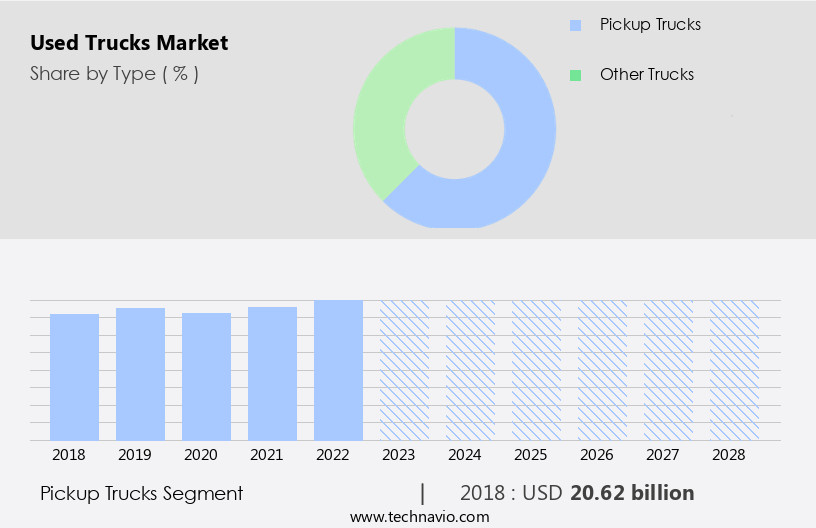

By Type Insights

The pickup trucks segment is estimated to witness significant growth during the forecast period.

Used pickup trucks continue to gain popularity in the US market due to their superior engine performance and cargo capacity, making them a preferred choice for buyers looking to upgrade from sedans without committing to the high cost of a new pickup. According to recent data, the average price for a new pickup truck hovers around USD 45,000. Manufacturers' focus on maintaining stringent quality standards has resulted in an increase in the reliability of used pickup trucks, which is a significant factor in their popularity in the passenger car segment. Key entities shaping this market include parts inventory management, cargo capacity calculations, vehicle history reports, transmission repair costs, engine performance metrics, fuel consumption tracking, predictive maintenance models, fuel efficiency ratings, drivetrain component analysis, suspension system inspection, fleet management software, telematics device integration, GVWR compliance checks, truck diagnostic tools, body damage assessment, payload weight limits, repair scheduling software, GPS tracking systems, tire condition assessment, pre-purchase truck inspection, operational cost analysis, brake system evaluation, safety equipment inspection, maintenance records review, dealer certifications, electrical system testing, heavy-duty truck parts, remote diagnostics capabilities, transport logistics optimization, emission control systems, and mileage verification systems.

For instance, a study on used pickup trucks revealed a sales increase of 15% in the last quarter due to the growing demand for these vehicles. Furthermore, the used pickup truck market is expected to grow by 10% annually, as businesses increasingly recognize the benefits of these vehicles for their operational needs. These trends underscore the importance of entities like fleet management software, telematics device integration, and predictive maintenance models in optimizing the performance and lifespan of used pickup trucks. One example of a reliable used pickup truck model is the 2009-2011 Cadillac Escalade EXT, which offers impressive cargo capacity and robust engine performance.

This vehicle's popularity is a testament to the enduring appeal of used pickup trucks in the US market.

The Pickup trucks segment was valued at USD 20.62 billion in 2018 and showed a gradual increase during the forecast period.

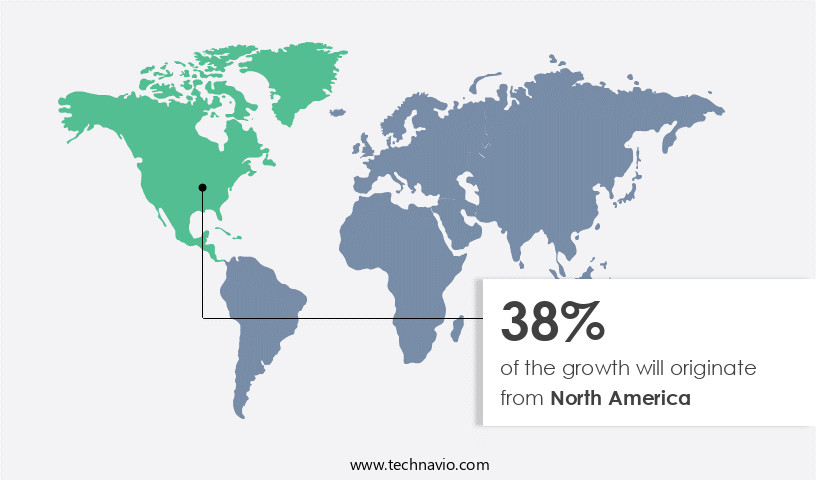

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing notable activity, with light commercial vehicles and pickup trucks leading the charge. The long operational life of these vehicles is attributed to stringent manufacturing standards and the increasing importance of parts inventory management, cargo capacity calculations, and vehicle history reports. As a result, transmission repair costs and engine performance metrics are crucial factors in the resale value of these trucks. Predictive maintenance models and fuel efficiency ratings are essential for fleet management, with fleet management software and telematics device integration streamlining operations. GVWR compliance checks and truck diagnostic tools ensure safety and regulatory adherence, while body damage assessment and payload weight limits inform potential buyers during pre-purchase inspections.

Operational cost analysis, including fuel consumption tracking and maintenance records review, is vital for fleet operators. Dealership certifications and electrical system testing add to the confidence of buyers. The market for heavy-duty truck parts is growing, with remote diagnostics capabilities and transport logistics optimization enhancing efficiency. Emission control systems and mileage verification systems are becoming increasingly important in the context of industry regulations. According to recent industry reports, the market in North America is projected to grow by 5% annually, driven by the increasing demand for cost-effective transportation solutions. For instance, a major logistics company reported a 15% increase in sales of used trucks for their fleet expansion.

The integration of GPS tracking systems, tire condition assessment, brake system evaluation, and safety equipment inspection further adds value to this market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a significant sector in the global automotive industry, catering to the demand for economical transportation solutions for businesses and individuals. As the market continues to grow, it is essential to ensure the optimal performance and safety of used trucks. This requires a comprehensive approach to assessing their condition, starting with engine diagnostics procedures and heavy-duty transmission repair techniques. Body damage assessment is another critical aspect, requiring a thorough examination to ensure integrity. Electrical system evaluation is equally important, as is the implementation of a complete pre-purchase inspection. Safety equipment compliance checklists are a must, along with optimizing transport logistics through used truck telematics device integration. Improving fuel efficiency is a key concern for used truck operators, making predictive maintenance an essential tool for fleet managers. Used truck maintenance records analysis provides valuable insights for better decision making, while comparing leasing options and calculating total cost of ownership are crucial considerations. Effective accident prevention strategies are essential for used truck fleets, with tire condition assessment best practices and suspension system inspections and repairs playing a significant role. Used truck frame damage detection methodologies are also important, as is the estimation of resale value through used truck auction pricing data analysis tools. Used truck parts inventory management strategies are vital for efficient operations, ensuring the availability of essential components for maintenance and repair. Overall, the market demands a holistic approach, encompassing all aspects of engine performance, transmission repair, body damage assessment, electrical system integrity, safety equipment compliance, logistics optimization, telematics device integration, fuel efficiency, predictive maintenance, maintenance records analysis, leasing options, total cost of ownership, accident prevention, tire condition assessment, suspension system inspection and repair, frame damage detection, and resale value estimation.

What are the key market drivers leading to the rise in the adoption of Used Trucks Industry?

- The expanded value proposition of used trucks, which encompasses their affordability, reliability, and flexibility, serves as the primary market driver in the trucking industry.

- Used trucks represent an attractive market for businesses seeking cost-effective transportation solutions. The rigorous manufacturing standards and improved build quality in trucks have led to an increase in the supply of high-quality pre-owned vehicles. This trend, coupled with the continuous introduction of newer models and advanced automotive technologies, encourages truck owners to upgrade, thereby fueling the used truck market. Moreover, the resale value of used trucks is a significant consideration for buyers. According to industry reports, the global used commercial vehicle market is projected to grow by over 5% annually, driven by the increasing demand from various sectors, including construction, logistics, and transportation.

- For instance, a study revealed that the average resale value of a three-year-old medium-duty truck increased by 35% in the last five years. These factors collectively contribute to the steady growth and demand for used trucks.

What are the market trends shaping the Used Trucks Industry?

- Integrated touchpoint management systems with artificial intelligence are becoming the market trend. Artificial intelligence technology is increasingly being integrated into touchpoint management systems.

- The market is witnessing a surge in demand due to the robust adoption of touchpoint management techniques. These techniques have transformed the buying process, providing a positive and rewarding experience for customers. Online retailers and electronic stores are utilizing unique touchpoint management systems to understand customer needs, while automotive dealers are enhancing customer satisfaction through improved systems. Feedback collection after the customer's interaction with online used vehicle websites is a common practice. Artificial intelligence (AI) integration with these websites offers customer support whenever required, thereby raising customer satisfaction.

- The integration of AI programs helps customers efficiently find products, gather information, and compare prices. The market for used trucks is expected to grow significantly in the coming years, with an estimated 25% increase in demand. This growth can be attributed to the continuous integration of advanced touchpoint management techniques and AI technologies.

What challenges does the Used Trucks Industry face during its growth?

- The used truck industry faces significant challenges in maintaining growth due to the potential for lowered resale values. This issue, which is mandatory for industry professionals to address, can significantly impact the market's overall health and profitability.

- The used truck market experiences fluctuating demand due to the rapid advancement of technology in the industry. Trucks manufactured between 2012 and 2015, for instance, have seen a decline in resale value as their features have become obsolete. In contrast, newer models boast advanced driver-assist systems and aerodynamic designs that offer significant operational ease and comfort. Consequently, buyers and transportation companies carefully evaluate the cost-benefit analysis before purchasing used trucks. This consideration is crucial to determine the vehicle's future market value.

- Investing in a new truck with modern features is often a more attractive proposition, as shown by a 15% increase in sales of new trucks over the past year. The used truck market is projected to grow at a steady pace, with industry analysts anticipating a 7% expansion in the next five years.

Exclusive Customer Landscape

The used trucks market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the used trucks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, used trucks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Volvo - The company specializes in the sale of pre-owned trucks, featuring prominent brands such as Volvo FH, Mercedes-Benz Arocs, Scania P-series, Volvo FL, Volvo FMX, and MAN TGA, among others.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- Corcentric Inc.

- Daimler Truck AG

- EAN Services LLC

- Iveco Group N.V

- Knight Swift Transportation Holdings Inc.

- PACCAR Inc.

- Penske Corp.

- Renault SAS

- Ryder System Inc.

- Scania AB

- Tesla Inc.

- Toyota Motor Corp.

- TrueCar Inc.

- Volkswagen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Used Trucks Market

- In January 2024, Volvo Trucks announced the launch of its new certified pre-owned (CPO) program, "Volvo Used Trucks by Mack," expanding its presence in the market (Volvo Trucks Press Release). This initiative aimed to offer high-quality, pre-inspected, and warrantied used trucks to customers.

- In March 2024, Navistar International Corporation and Volkswagen Truck & Bus GmbH signed a strategic collaboration agreement to develop and manufacture advanced diesel and electric powertrains for the North American market (Navistar Press Release). This partnership aimed to enhance their product offerings and strengthen their positions in the competitive market.

- In May 2024, Paccar Inc. reported a significant increase in its used truck sales, up by 23% year-over-year, driven by strong demand and the company's focus on expanding its used truck inventory (Paccar Q1 2024 Earnings Report). This growth underscored the market's resilience and the ongoing demand for used trucks.

- In April 2025, the European Union announced the approval of new emission regulations for used trucks, requiring them to meet Euro 6 standards by 2027 (European Commission Press Release). This policy change created a new opportunity for companies to invest in retrofitting older trucks or replacing them with newer, compliant models, potentially boosting demand in the market.

Research Analyst Overview

- The market continues to evolve, with various sectors relying on these versatile vehicles for their unique applications. Undercarriage inspection, insurance value assessment, and maintenance contract options are crucial considerations for fleet managers in the transportation sector. In the refrigerated transport industry, refrigeration unit testing, cargo securing systems, hydraulic liftgate maintenance, and electrical wiring harness inspections are essential. Depreciation calculations, truck bed condition, and leasing options analysis are vital for construction companies. Moreover, safety features such as anti-lock braking systems, wheel alignment systems, exhaust system inspection, frame damage detection, and differential gear ratios play a significant role in the decision-making process for buyers in the market.

- Financing terms comparison, driver behavior monitoring, axle weight distribution, winch operation, cab condition assessment, warranty coverage details, accident prevention strategies, powertrain components, and vehicle tracking technology are other essential factors influencing market dynamics. According to industry reports, the market is expected to grow by over 15% in the next five years, driven by the increasing demand for cost-effective transportation solutions and the growing preference for used trucks in various sectors.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Used Trucks Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.38% |

|

Market growth 2024-2028 |

USD 13.37 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.89 |

|

Key countries |

US, Canada, UK, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Used Trucks Market Research and Growth Report?

- CAGR of the Used Trucks industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the used trucks market growth of industry companies

We can help! Our analysts can customize this used trucks market research report to meet your requirements.