Vending Machine Food And Beverages Market Size 2024-2028

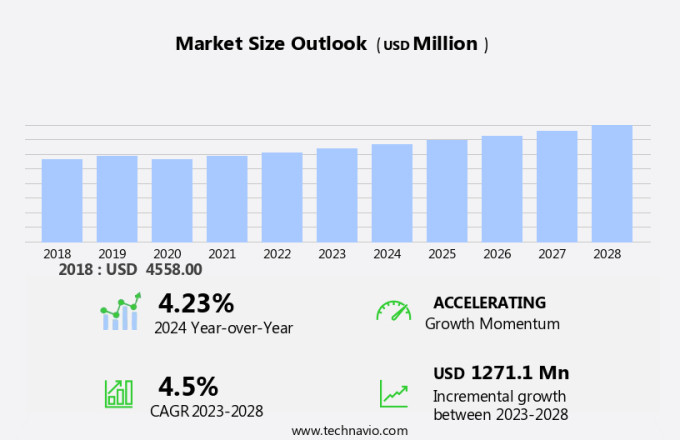

The vending machine food and beverages market size is forecast to increase by USD 1.27 billion at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth, driven by the increasing preference for convenient and quick consumption options. One trend influencing the market is the rise of flavored water and healthier food choices in vending machines. Another trend is the integration of technology, such as contactless vending machines and IoT sensors, which enhance the retail experience and enable inventory management and personalized recommendations. These innovations are particularly relevant in sectors like office cafeterias, retail stores, airports, and hotels. However, regulatory issues, such as food safety concerns and restrictions on vending machine installation, pose challenges for market growth. The beverage segment, in particular, is expected to dominate the market due to its high consumer demand.

What will be the Size of the Market During the Forecast Period?

The vending machine food and beverages market is evolving rapidly, driven by the demand for healthier alternatives in the corporate sector and office buildings and workplaces. Consumers are increasingly looking for fresh, nutritious options in addition to traditional canned and bottled beverages and fast food. The rise of customizable vending machine interfaces allows users to select from a wide variety of snacks, drinks, and meals tailored to their preferences. Innovative solutions like the pizza vending machine and advanced touch screen ordering technology offer quick and convenient food options. Payment options are also expanding, with machines now accepting cash, debit, or credit card payments, enhancing convenience for consumers on the go. As the market grows, these machines are becoming more integrated into everyday life, providing both convenience and healthier choices.

Further, both snack vending machines and beverage vending machines are in high demand, with the former accounting for a larger market share. Innovations in technology, such as AI and IoT, have transformed traditional vending machines into smart machines. These machines now feature touch interfaces and digital screens, allowing customers to make purchases with ease and providing them with a more personalized experience. Eco-friendly packaging materials are increasingly being used in the vending machine industry to reduce environmental impact. This trend is particularly important in educational institutions, such as schools and colleges, where there is a growing emphasis on sustainability. With the increasing use of technology, eco-friendly practices, and a wide range of product offerings, vending machines are becoming an essential part of modern life.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Vending machine beverage

- Vending machine food

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

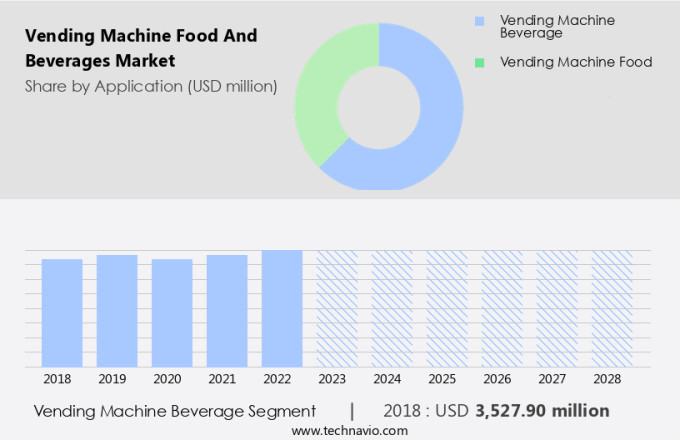

By Application Insights

The vending machine beverage segment is estimated to witness significant growth during the forecast period. The market is projected to expand at a consistent pace over the coming years. Companies in this sector are introducing innovative products to captivate consumers. For example, there is an increasing trend towards the launch of flavored water and low-sugar beverage options, such as Diet Coke and Diet Pepsi, to address the rising issue of obesity.

In addition, companies are investing in research and development to create more intelligent vending machines. The market for vending machines in retail experiences, including office cafeterias, airports, hotels, and retail stores, is expected to witness significant growth due to the convenience and contactless nature of these machines.

Get a glance at the market share of various segments Request Free Sample

The vending machine beverage segment accounted for USD 3.53 billion in 2018 and showed a gradual increase during the forecast period.

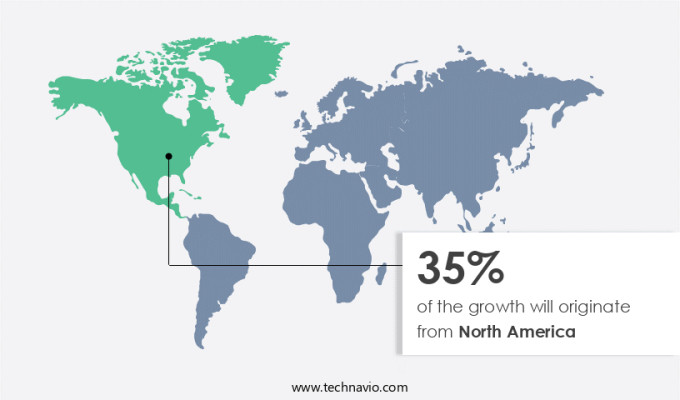

Regional Insights

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is expected to expand significantly due to the convenience they offer consumers. The integration of digital screens, cashless payment options via QR codes, and mobile apps with geolocation data has made vending machines more accessible and user-friendly. Additionally, the use of eco-friendly packaging materials and energy-efficient machines aligns with consumer preferences for sustainability. Food safety standards and hygiene practices are essential considerations for the market. Vending machine operators prioritize these aspects to ensure the quality and safety of the products. Bulk snack bins and customization options cater to various consumer preferences, further boosting sales.

Further, advancements in technology include AI-powered vending machines that allow for custom requests and on-demand delivery. These machines offer a personalized experience for consumers, contributing to the growth of the market. The adoption of these intelligent vending machines is on the rise, making the purchasing process more seamless and efficient. In conclusion, the market in North America is poised for growth due to the integration of technology, consumer preferences, and the convenience they offer. The use of digital interfaces, eco-friendly materials, and energy-efficient machines are key trends driving the market's expansion. Additionally, the focus on food safety and hygiene practices ensures the quality and safety of the products. The adoption of AI-powered vending machines offers a personalized purchasing experience, further enhancing the market's appeal.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The increasing popularity of vending machines is the key driver of the market. The market is experiencing significant growth due to the rising preference for convenience among consumers. Vending machines offering processed foods and sugary beverages continue to gain popularity, particularly in educational institutions and workplaces. IoT technology and automation are increasingly being integrated into these machines, enabling 24/7 service and manageability. The sales of colas and cold drinks account for a substantial portion of vending machine sales, with the number of machines continuing to increase. The convenience and availability of these machines make them an attractive option for consumers, contributing to the market's expansion.

Market Trends

Innovations in vending machines is the upcoming trend in the market. Vending machines selling packaged food products and beverages have gained significant traction in the market due to the fast-paced lifestyles of consumers. The convenience offered by these machines, particularly in corporate settings, has made on-the-go snacks and beverages a popular choice for many. Innovations in vending machine technology continue to drive sales growth. For example, cashless payment options, such as credit cards, debit cards, and mobile payments, have become increasingly common. This ease of transaction is expected to boost sales of food and beverage items through vending machines during the forecast period. Furthermore, the growing popularity of near field technology (NFT) is also contributing to the trend towards cashless transactions.

Companies like Coca-Cola are leading the way with AI-powered smart digital vending machines that enhance the consumer experience. These machines offer personalized recommendations and the ability to track inventory levels in real-time. Overall, the market for vending machine food and beverages is poised for continued growth due to the convenience and innovation offered by these machines.

Market Challenge

Bans and restrictions on installation of vending machines is a key challenge affecting the market growth. The market is experiencing significant shifts due to changing consumer preferences and regulatory requirements. The trend towards cashless and contactless payments is gaining momentum, with an increasing number of consumers opting for credit or debit cards, mobile wallets, and other digital payment methods. This trend is particularly noticeable in sectors such as fitness clubs, where members prefer to pay for their supplements, protein bars, and other health-conscious snacks using contactless methods. Simultaneously, there are regulatory challenges to the growth of the market. For instance, some states and cities have imposed bans on the installation of vending machines, particularly those selling sugary drinks and non-nutritious foods, in public places such as shopping complexes, train stations, hospitals, and interstate highways.

In conclusion, the market is undergoing significant changes, driven by shifting consumer preferences, regulatory requirements, and technological innovations. Despite the challenges, the market continues to grow, offering convenience and a diverse range of products to consumers across various sectors. Market players are focusing on innovation and technology to enhance the consumer experience and address concerns around health and nutrition.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

American Food and Vending: The company offers vending machine such as snack machines, vending machines for food and hot and cold beverages, fresh and frozen food vending machines, and coffee machines.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aramark

- Automated Merchandising Systems Inc.

- Azkoyen SA

- Bianchi Industry SpA

- BULK VENDING SYSTEMS Ltd.

- Compass Group Plc

- Crane Holdings Co.

- FAS International Srl

- Fuji Electric Co. Ltd.

- Honeywell International Inc.

- Kellogg Co.

- Mondelez International Inc.

- Nestle SA

- PepsiCo Inc.

- Royal Companies Inc.

- Seaga Manufacturing Inc.

- Selecta Group BV

- The Coca Cola Co.

- Westomatic Vending Services Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

In today's fast-paced world, the demand for convenient and on-the-go food and beverage options has flooded. Packaged food products, including chips, chocolates, granola bars, nuts, and sodas, have become staples in food vending machines. These machines cater to various sectors such as corporate offices, retail stores, airports, hotels, and educational institutions. The integration of AI and IoT technology in vending machines has revolutionized the industry. Contactless vending machines, inventory management, personalized recommendations, and touch interfaces are some of the features that enhance the retail experience. The beverage segment, including coffee, energy drinks, and flavored water, dominates the market. Food safety and hygiene practices are essential considerations in the vending industry. Eco-friendly packaging materials, cashless payment options, and QR codes are becoming increasingly popular. The food segment, which offers ready-to-eat food products, is growing rapidly.

Further, vending operators use IoT sensors for inventory management and machine performance monitoring. Customization, product packaging, and bulk snack bins are other features that attract customers. Food safety standards and health risks associated with processed foods and sugary beverages are key concerns. The market includes traditional vending machines, branded vending machines, and snack and beverage vending machines. Automation, 24/7 service, manageability, and energy efficiency are essential factors driving the growth of the vending machine industry. The fitness industry, including fitness clubs and sports stadiums, is a new and emerging market for vending machines, offering supplements, protein bars, and energy drinks.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

153 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 1.27 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 35% |

|

Key countries |

US, Japan, UK, Germany, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

American Food and Vending, Aramark, Automated Merchandising Systems Inc., Azkoyen SA, Bianchi Industry SpA, BULK VENDING SYSTEMS Ltd., Compass Group Plc, Crane Holdings Co., FAS International Srl, Fuji Electric Co. Ltd., Honeywell International Inc., Kellogg Co., Mondelez International Inc., Nestle SA, PepsiCo Inc., Royal companies Inc., Seaga Manufacturing Inc., Selecta Group BV, The Coca Cola Co., and Westomatic Vending Services Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch