Europe Vinyl Records Market Size 2025-2029

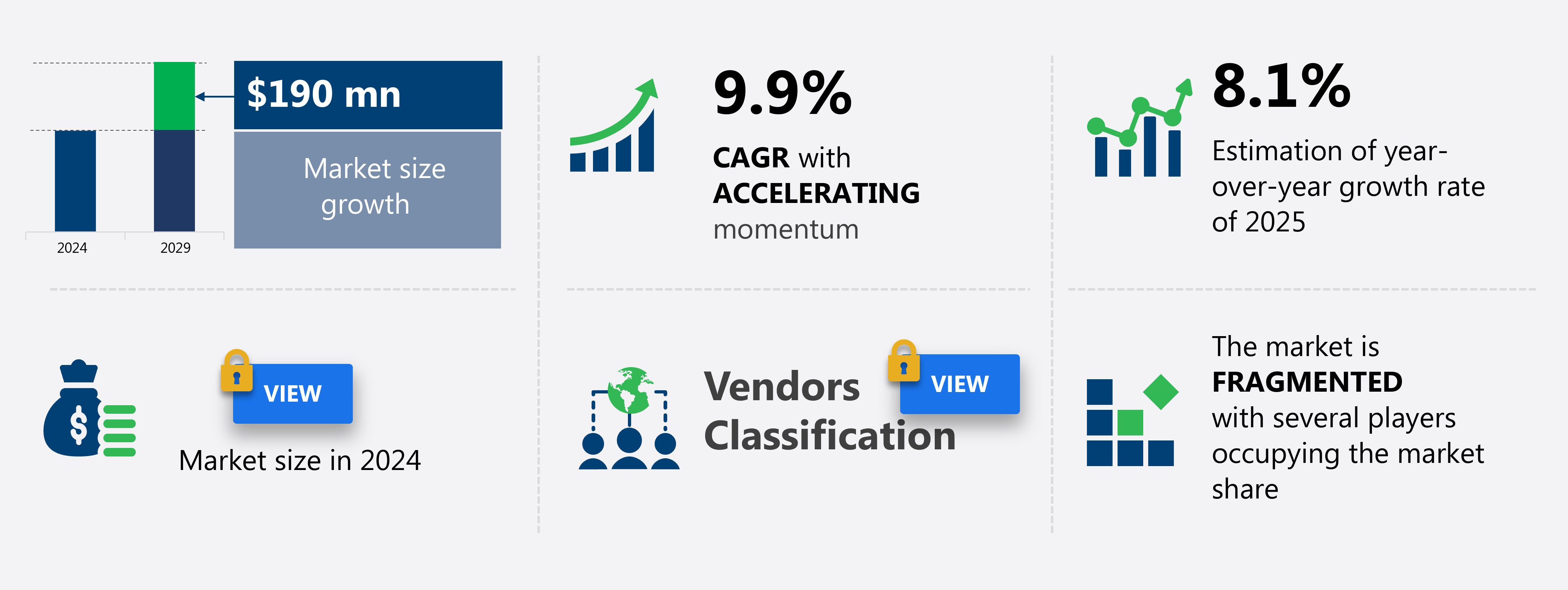

The European vinyl records market size is forecast to increase by USD 190 million at a CAGR of 9.9% between 2024 and 2029.

- The vinyl records market in Europe is growing steadily, driven by a renewed interest in analog music and advancements in manufacturing technology and music publishing. Key factors include the aesthetic appeal of vinyl, appealing to collectors and audiophiles, and the increasing number of promotional events, which boost consumer engagement and sales.

- This report provides a focused analysis for businesses, detailing market size, growth forecasts through 2028, and key segments like LP/EP vinyl records, which dominate due to their capacity and popularity. It highlights the trend of innovation in vinyl production processes, such as eco-friendly materials, and addresses challenges like rising prices of audio equipment, which could deter some buyers. The data is tailored for practical use in strategy, marketing, and supply chain decisions.

- For companies aiming to compete in the European vinyl records market, this report offers clear insights into consumer trends and pricing pressures, providing a solid foundation for navigating this niche yet expanding industry

What will be the Size of the market During the Forecast Period?

The vinyl records market has experienced a significant revival in recent years, fueled by a rence in interest for analog audio and the unique listening experience it offers. This trend is driven by various factors, including the nostalgic appeal of vintage audio, the growing collectors' community, and the desire for high-fidelity sound. The market's size is substantial, with record stores, pressing plants, and record labels contributing to its growth. The vinyl market also caters to music memorabilia collectors, offering record art and limited-edition pressings. The debate between digital and analog media continues, with vinyl records offering a tangible connection to music history. Additionally, the industry is embracing eco-conscious production methods, focusing on sustainable manufacturing processes and reducing waste. The record market's future direction is promising, with continued growth and innovation in record design, pressing technology, and music production software.

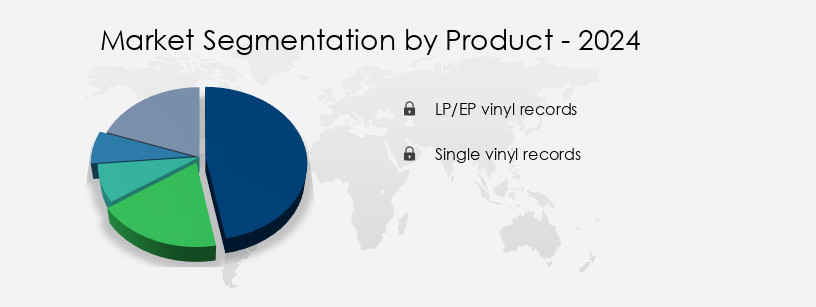

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- LP/EP vinyl records

- Single vinyl records

- Distribution Channel

- Offline

- Online

- Gender

- Men

- Women

- Geography

- Europe

- Germany

- UK

- France

- Italy

- Europe

By Product Insights

The LP/EP vinyl records segment is estimated to witness significant growth during the forecast period. The market is characterized by the production and sale of LP (long-play) phonograph records, with a diameter of 12 or 10 inches and a speed exceeding 33 rpm. Major record labels predominantly utilize LP vinyl for vinyl record production. For instance, music on vinyl, a Dutch vinyl-only record label, specializes in LP and 7-inch vinyl pressings of licensed products from various record companies and artists. The rise of retro music in the region has fueled the growth of the LP vinyl segment. To attract customers, companies offer LP vinyl records in various colors and creative packaging. Additionally, technological integration, such as the Internet of Things and electronic technological advancements, enhances the listening experience with high-end playback equipment.

The market also caters to record collectors, DJs, and music enthusiasts, offering exclusive artwork, limited and special editions, and themed collections. Manufacturing technologies, such as PVC and recycled materials, prioritize eco-friendliness and energy efficiency. The organic expansion tactic includes concert merchandising, CD sales, and streaming services, while niche artists and record labels capitalize on the exclusivity and timeless masterpiece appeal.

Get a glance at the share of various segments. Request Free Sample

Market Dynamics

The Europe vinyl records market has seen a remarkable resurgence, driven by a growing interest in retro music playback and the nostalgic appeal of analogue sound quality. Vinyl pressing plants have ramped up production to meet the demand for collectible record editions, with audiophiles seeking high-fidelity playback and vintage audio revival. Limited release albums and classic album reissues have captured the attention of collectors, while independent music labels are increasingly turning to vinyl to showcase their artists' work.

Turntable accessories, including vinyl cleaning kits and portable record players, have become essential for enthusiasts seeking to preserve their collections and enhance the listening experience. Record sleeve art and album artwork displays have also gained popularity, adding an aesthetic dimension to the experience. Specialty vinyl shops and online retailers cater to the demand for rare record finds, while vinyl storage solutions help collectors maintain their prized collections in pristine condition.

The rise of vinyl enthusiast clubs and analogue listening rooms has further fueled this cultural revival, creating communities centered around music nostalgia trends. Custom pressing services have also emerged, offering personalized vinyl records. Overall, the market has become a vibrant space where music lovers indulge in the timeless appeal of vinyl sound dynamics, supporting both established and emerging artists.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers for the Europe Vinyl Records industry?

- Aesthetic appeal of vinyl records is the key driver of the market. Vinyl records have experienced a remarkable rise in Europe, bucking the trend of digital music's dominance. This revival is fueled by a blend of cultural nostalgia, the tactile appeal of records, and strategic business innovations. In 2023, physical formats, including vinyl, accounted for 32.7% of global music revenues, amounting to USD 5.1 billion, with vinyl sales increasing by 15.4% to USD 1.7 billion. Notably, in countries like France and Poland, vinyl sales grew by 7.3% and 16.5% year-over-year, respectively, contributing significantly to their total music revenues. This trend is not just about nostalgia; it's also about the unique analog sound quality that vinyl offers. Music enthusiasts, record collectors, and even younger generations are drawn to the deliberate listening experience that vinyl provides. Companies are responding with cutting-edge technology, such as electronic technological integration, and vinyl record pressing facilities using manufacturing technologies like PVC and recycled materials.

- Moreover, the vinyl market caters to various genres, from folk and pop to niche artists, and offers exclusive artwork, limited editions, and special editions. Record collectors, disc jockeys, and concert merchandising also contribute to the demand for vinyl records. The industry is also exploring eco-friendly practices, such as energy-efficient pressing techniques and omnichannel sales strategies, including subscription services and streaming platforms. Thus, the vinyl record market's growth is a testament to the enduring appeal of physical music formats. Despite the dominance of digital media, vinyl continues to thrive, offering a unique listening experience and catering to the diverse tastes of music enthusiasts.

What are the market trends shaping the Europe Vinyl Records industry?

- Innovation in vinyl record manufacturing processes is the upcoming trend In the market. The European vinyl records market is experiencing increased scrutiny due to its environmental impact, particularly its reliance on polyvinyl chloride (PVC) in manufacturing. A report published in 2024 revealed that a standard 140g vinyl record generates approximately 1.15kg of CO2 equivalent (CO2e) during its production, with significant emissions stemming from PVC manufacturing and energy-intensive pressing processes. The use of toxic additives like carbon black and heavy metals in vinyl records is also a concern, although European regulations have led to the phasing out of hazardous substances such as cadmium and lead. As environmental consciousness grows, the vinyl industry is exploring organic expansion tactics, such as the use of recycled materials and eco-friendly manufacturing technologies.

- Technological integration, including promotional materials, electronic record sales, and streaming services, is also expanding the market's reach. Despite these challenges, vinyl enthusiasts continue to value the analog sound quality and the exclusivity of records, with niche artists and special editions remaining popular among collectors. The market is also exploring themed collections, high-end playback equipment, and carbon footprint reduction initiatives. The future of the vinyl records market lies in deliberate listening experiences, omnichannel retail strategies, and the integration of the Internet of Things, all while minimizing energy consumption and environmental impact.

What challenges doesEurope Vinyl Records Market face?

- Increasing price of vinyl records is a key challenge affecting the market growth. The vinyl record market has experienced a rise in popularity among music enthusiasts, driven by the desire for the authentic, analog sound quality that only vinyl can provide. This revival has led to a shift in market dynamics, with cutting-edge technology and technological integration playing a significant role. However, the industry faces challenges such as the limited capacity of record pressing facilities and the complex manufacturing processes, which drive up the cost of vinyl records. These inorganic expansion tactics have resulted in longer turnaround times, with production taking between four and five weeks. Despite these challenges, the vinyl record market continues to grow, with record collectors and younger generations seeking out exclusive, limited edition, and special edition records. The industry also incorporates eco-friendly practices, such as the use of recycled materials and energy-efficient manufacturing techniques, appealing to consumers who value sustainability.

- The vinyl record ecosystem includes various players, from lacquer makers and master engineers to music distributors, record labels, and retail shops, all working together to deliver a unique music experience. The market also offers various formats, including colored records, subscription services, and streaming services, catering to diverse consumer preferences. The vinyl record industry's growth is further fueled by the integration of the Internet of Things, high-end playback equipment, and concert merchandising, creating an omnichannel experience for consumers. The market's niche artists and exclusive, timeless masterpieces continue to attract record collectors and enthusiasts, making vinyl records a valuable and collectible item. However, the industry's carbon footprint and energy consumption remain areas of concern, with the industry exploring ways to reduce its impact on the environment.

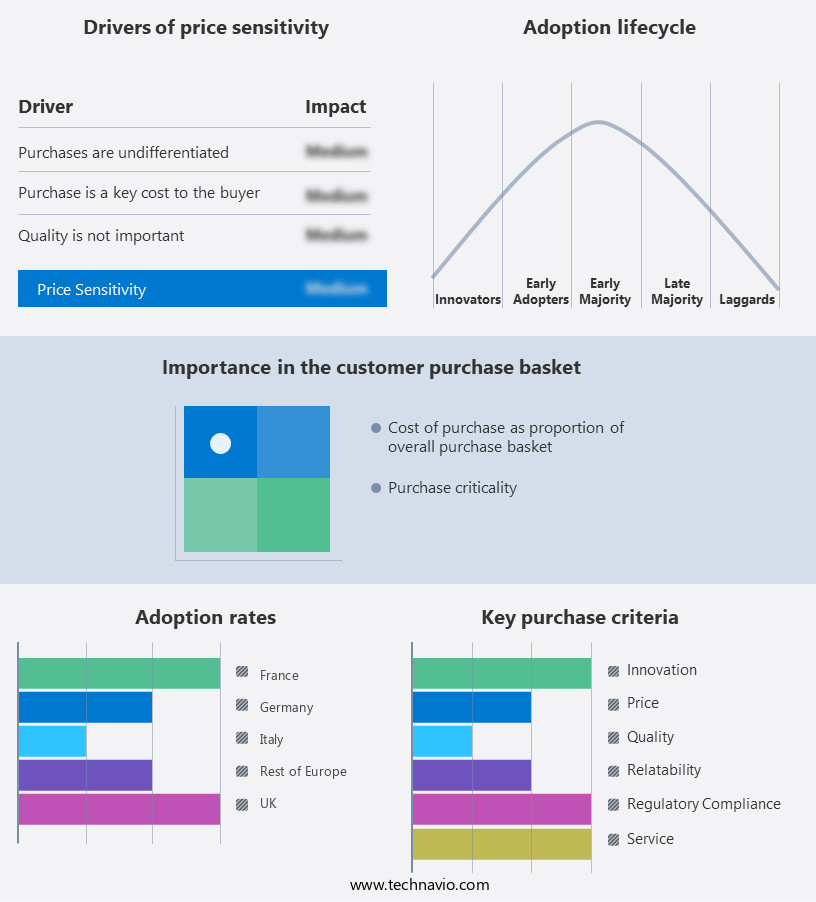

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, market report, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

Deepgrooves BV: The company offers vinyl records in different sizes, such as 7-inch, 10-inch, and 12-inch records.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Deepgrooves BV

- Europress Vinyl Srl

- GZ Media AS

- handle with care manufacturing

- Krakatoa Records

- Kuroneko Phonogram Manufacture

- MPO France

- Optimal media GmbH

- Pallas Group

- Press Play Vinyl

- R.A.N.D. MUZIK GbR

- Record Industry BV

- T mediagroup GmbH

- Takt Direct GmbH

- The Vinyl Factory Ltd.

- Vinilificio

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The vinyl records market continues to experience significant growth, driven by the enduring appeal of music enthusiasts and the allure of cutting-edge technology. This sector's expansion is not limited to organic means, as some players employ inorganic tactics to increase their market presence. The analog sound quality of vinyl records has captivated music lovers for decades. With the integration of electronic technologies, these records offer a unique listening experience that digital recordings cannot replicate. This technological fusion has led to the emergence of various promotional materials, including themed collections, limited editions, and special editions. This expansion has enabled the company to cater to the increasing demand for records, using advanced manufacturing technologies. The facility produces records in various sizes, colors, and pressing techniques, catering to diverse music genres, from folk to pop. Record collectors continue to be a significant consumer base, with their demand for exclusive artwork and limited editions driving the market's growth.

The omnichannel approach is a popular strategy among record labels, allowing them to reach a wider audience and increase sales. This approach includes selling records through retail outlets, concert merchandising, and online platforms. Subscription services and streaming services have also emerged as viable revenue streams, offering customers access to a vast library of music. The vinyl records market is not without its challenges. The use of PVC in record production raises concerns regarding its carbon footprint and potential environmental impact. Record labels and manufacturers are addressing these concerns by exploring eco-friendly manufacturing processes and recycled materials. The market's growth is not limited to traditional music genres. Niche artists and timeless masterpieces continue to find a home on vinyl, appealing to both record collectors and casual listeners. High-end playback equipment and the Internet of Things have further enhanced the vinyl listening experience, making it a deliberate and engaging activity. The vinyl records market in Europe is experiencing a significant resurgence, defying the trends of digital music dominance.

Record stores across Europe are thriving, offering not just records but also record player reviews, and a community where record lovers connect. The record culture is expanding, with record trends such as high fidelity pressing, eco-conscious music, and sustainable production gaining popularity. The pressing process, a critical part of record production, is undergoing a transformation with modern pressing plants employing advanced technology to meet the growing demand. Record investment is on the rise, with many seeing vinyl as a valuable asset. Music streaming services have not dampened the vinyl market's growth. Instead, they have coexisted with it, providing convenience while vinyl offers an authentic, tactile experience. Record artists are also embracing the format, with many releasing new music on vinyl. Record collectors and enthusiasts invest in record storage solutions to preserve their collections. Turntable sales are soaring, with many models catering to various budgets and preferences.

Despite the growth, the vinyl records market faces competition from digital media. CD sales have declined significantly, and streaming platforms have become the go-to source for music consumption. However, the unique listening experience offered by vinyl records continues to set them apart, ensuring their place In the music industry. Thus, the vinyl records market is experiencing growth, driven by the enduring appeal of music enthusiasts and the integration of cutting-edge technology. Players in the market are employing various strategies, including inorganic expansion tactics, to cater to the increasing demand for records. The sector's future looks promising, with opportunities for innovation and growth in eco-friendly manufacturing processes and technological advancements.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.9% |

|

Market growth 2025-2029 |

USD 190 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.1 |

|

Key countries |

Germany, UK, France, Italy, and Rest of Europe |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch