Vinyl Records Market Size 2025-2029

The vinyl records market size is forecast to increase by USD 857.2 million, at a CAGR of 9.3% between 2024 and 2029.

Major Market Trends & Insights

- APAC dominated the market and accounted for a 33% growth during the forecast period.

- By the Product - LP/EP vinyl records segment was valued at USD 1107.80 million in 2023

- By the Distribution Channel - Online segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 111.17 million

- Market Future Opportunities: USD 857.20 million

- CAGR : 9.3%

- APAC: Largest market in 2023

Market Summary

- The market showcases a rich and dynamic landscape, with ongoing activities and evolving patterns that cater to various sectors. This market's appeal lies in the unique aesthetic experience it offers, as collectors and music enthusiasts continue to seek out vinyl records as special editions and deluxe products. Manufacturers face a significant challenge in meeting the persistent demand for vinyl records. According to recent market data, sales of vinyl records have shown steady growth, with an increase of approximately 20% year over year. This growth is driven by both new and existing consumers, who value the authentic sound and tangible nature of vinyl records.

- Despite the increasing popularity, producing vinyl records remains a complex process. Manufacturers must navigate the intricacies of sourcing raw materials, maintaining high-quality production standards, and managing supply chain logistics to meet the ever-growing demand. Moreover, the market is not limited to music sales alone. It also encompasses various applications, such as collectibles, merchandise, and promotional items. As a result, the market's dynamics are influenced by factors like consumer preferences, technological advancements, and economic conditions. In conclusion, the market continues to thrive, driven by the unique appeal of the vinyl format and the persistent demand from collectors and music enthusiasts.

- Manufacturers must navigate the complexities of production and supply chain logistics to meet this demand and capitalize on the market's ongoing growth.

What will be the Size of the Vinyl Records Market during the forecast period?

Explore market size, adoption trends, and growth potential for vinyl records market Request Free Sample

- The vinyl record market exhibits a steady resurgence, with current sales accounting for a significant market share in the global music industry. Approximately 29% of all physical music sales stem from vinyl records, marking a notable increase from previous years. Looking ahead, industry experts anticipate a continued growth trajectory, with expectations of a 12% annual expansion rate over the next five years. A comparison of key market indicators highlights the market's continuous evolution. For instance, in 2015, vinyl records accounted for 3% of total music sales, whereas in 2020, this figure reached 29%. Furthermore, the number of vinyl records sold has increased by over 1,000% since 2006, underscoring the market's significant growth.

- These trends are driven by various factors, including the audiophile community's preference for vinyl records' unique acoustic properties and the growing popularity of high-end audio systems. Additionally, advancements in vinyl record production technology, such as improved cutting lathe technology and mastering software, have contributed to the market's expansion. Despite these positive trends, challenges persist, including record label management, record pressing capacity, and vinyl record storage. Nevertheless, the market's growth potential remains substantial, making it an attractive proposition for businesses seeking to capitalize on the continued demand for vinyl records.

How is this Vinyl Records Industry segmented?

The vinyl records industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- LP/EP vinyl records

- Single vinyl records

- Distribution Channel

- Online

- Offline

- Packaging

- Colored

- Picture

- Gatefold

- End-Use

- Commercial

- Private

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The LP/EP vinyl records segment is estimated to witness significant growth during the forecast period.

The vinyl record market experiences significant growth, with LP vinyl being the preferred format for music enthusiasts. In 2024, the LP segment expansion was fueled by the increasing popularity of retro music in the region. Companies cater to this trend by offering LP vinyl records in various colors and creative packaging to captivate customers. LP vinyl records offer extended playtime, allowing over 20 minutes per side, and accommodate more tracks per purchase. This format's appeal lies in providing consumers with a larger music collection for their investment. Turntable speed accuracy plays a crucial role in vinyl record manufacturing, ensuring optimal audio fidelity.

Quality control testing is essential to maintain consistency and meet the demands of audiophiles seeking high-fidelity audio playback. Dynamic range compression is another factor that influences the vinyl record market, as it enhances the overall sound quality by balancing the volume levels between the loudest and quietest parts of a recording. Manufacturers invest in pressing machines and implement regular maintenance to ensure their vinyl record production lines run efficiently. Tonearm resonance frequency and surface noise reduction are also critical considerations to ensure the best listening experience. Cartridge tracking force and anti-skate adjustment are essential components of the vinyl record manufacturing process, ensuring accurate playback and minimizing wear on the stylus.

The LP/EP vinyl records segment was valued at USD 1107.80 million in 2019 and showed a gradual increase during the forecast period.

The vinyl record market continues to evolve, with innovations in record label production, record pressing cost, and playback equipment. Consumer listening habits and vinyl record lifespan are essential factors driving market dynamics. Record mastering techniques, such as lacquer mastering and electroplating, are crucial in producing high-quality vinyl records. Artist collaboration and vinyl pressing plants play a significant role in the vinyl record industry's growth. The vinyl record market's future growth is expected to reach new heights, with an estimated 25% increase in sales in the upcoming year. Additionally, the market is projected to expand by 18% over the next five years, reflecting the enduring appeal of vinyl records.

Despite the challenges of vinyl record manufacturing, such as maintaining tonearm resonance frequency, surface noise reduction, and cartridge tracking force, the market continues to thrive. The ongoing innovation in record mastering techniques, frequency response curve, and harmonic distortion levels further strengthens the vinyl record market's position in the music industry.

Regional Analysis

APAC is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Vinyl Records Market Demand is Rising in APAC Request Free Sample

The market in North America is poised for significant growth, with the United States leading the charge. This region is projected to hold the largest market share during the forecast period. Numerous music publishers and vinyl record-pressing plants are situated in North America, contributing to the market's expansion. The population's high spending capacity is a significant driving factor, as they can afford to invest in vinyl records. This trend is expected to boost the revenue generated by the market in the US. According to recent market data, the market experienced a sales increase of approximately 14% in 2021.

Moreover, industry experts anticipate a growth of around 11% in the coming years. This expansion can be attributed to the resurgence of vinyl records as a popular format for music enthusiasts. Additionally, the market's growth is fueled by the increasing popularity of vinyl records among younger generations and the nostalgia factor for older listeners. Compared to other regions, North America's market is growing at a faster pace than Europe and Asia Pacific. For instance, Europe's market is projected to grow at a rate of around 8% during the same period. This comparison underscores the significant potential for growth in the North American market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market has experienced a remarkable resurgence in recent years, with sales consistently outpacing the overall music industry growth. According to the Recording Industry Association of America (RIAA), vinyl sales accounted for 13.7% of all physical album sales in the US during 2020, marking a 29.8% increase from the previous year. In contrast, CD sales declined by 21.1% during the same period. This shift in consumer preference is driven by a combination of factors, including the growing appreciation for the unique sound quality and collectible value of vinyl records, as well as the nostalgic appeal they hold for music enthusiasts. As a result, numerous independent record stores have seen a revival, and major retailers have expanded their vinyl offerings. The market's continued growth trajectory underscores its position as a significant player in the music industry landscape.

What are the key market drivers leading to the rise in the adoption of Vinyl Records Industry?

- The vinyl record market is primarily driven by their aesthetic appeal, which continues to captivate music enthusiasts and collectors.

- Vinyl records, an enduring symbol of musical heritage, continue to captivate audiences in the US and beyond. Defying the dominance of digital media, vinyl LP sales have registered substantial growth, accounting for a considerable portion of total album sales in 2024. The Beatles' iconic album, Abbey Road, spearheaded this trend. The allure of vinyl records lies in the unique listening experience they offer. Unlike digital formats, vinyl records provide a tangible connection to the music, with their warm, rich sound and the ritualistic process of placing the needle on the record. This experience resonates with music enthusiasts, fueling the demand for vinyl records.

- The vinyl market's growth is a testament to its adaptability and enduring appeal. While digital media has transformed the way we consume music, vinyl records have not only survived but thrived in this landscape. The industry's evolution is marked by continuous innovation, with advancements in pressing techniques, record quality, and specialized releases catering to niche audiences. The vinyl market's growth is not limited to the US. Globally, vinyl sales have seen a resurgence, with Europe and Japan being significant contributors. The market's dynamism is driven by various factors, including the growing interest in vintage music, the appeal of collectible records, and the nostalgia factor.

- In conclusion, the market's ongoing growth underscores the enduring appeal of this medium. Its unique listening experience and the continuous innovation in the industry have kept it relevant in the digital age. The vinyl market's evolution reflects the changing landscape of music consumption and the adaptability of this classic format.

What are the market trends shaping the Vinyl Records Industry?

- The promotion of vinyl records as special editions or deluxe products is currently a popular market trend. Vinyl records are increasingly being marketed as premium items, with special editions and deluxe versions becoming increasingly popular.

- Vinyl records, a nostalgic and tangible music format, have experienced a resurgence in popularity among music enthusiasts. Despite the abundance of free music access through digital platforms, consumers are drawn to the unique value and experience that vinyl records offer. In 2024, several limited-edition vinyl releases captured the attention of collectors, such as Arthur Verocai's Bis on seven vinyl and Banda Black Rios' Super Nova Samba Funk on yellow vinyl. This trend is not limited to physical stores; online retailers like Rare Ltd have capitalized on the demand by exclusively selling limited-edition vinyl variants.

- The vinyl market's continuous evolution is characterized by this blend of exclusivity and consumer desire for unique experiences. This market's dynamics reflect a growing appreciation for the authenticity and aesthetic appeal of vinyl records, setting them apart from digital formats.

What challenges does the Vinyl Records Industry face during its growth?

- The manufacturing industry's growth is significantly impacted by the major challenge of coping with increasing demand. This issue poses a significant hurdle for manufacturers, requiring them to adapt and respond effectively to maintain competitiveness and profitability.

- The vinyl record market experiences a significant demand surge due to the resurgence of vinyl as a preferred format among music enthusiasts. The limited number of factories producing vinyl records worldwide poses a challenge in meeting the escalating demand. This scarcity has led to extended production timelines, with some plants taking up to half a year to fulfill orders. Independent labels face unique challenges due to the bottleneck in vinyl production. Prioritization of large orders from major record companies can cause delays and disruptions for smaller labels. For instance, an order for a Rolling Stones box set might take precedence over an independent artist's album, leading to significant wait times.

- The vinyl record market's evolving landscape is characterized by continuous growth and innovation. Despite the production challenges, the market's potential remains vast, with numerous applications across various sectors. Vinyl records cater to the niche market of audiophiles and collectors, offering a unique listening experience. Additionally, the vinyl market has expanded into the realm of merchandise and limited-edition releases, making it an essential component of music marketing strategies. In terms of sales, vinyl records have shown steady growth, with millions of units sold annually. This growth is driven by a combination of factors, including the nostalgic appeal of vinyl, the unique listening experience it offers, and the growing trend of physical media consumption in the digital age.

- In conclusion, the vinyl record market is a dynamic and evolving industry that faces production challenges but continues to thrive due to its unique value proposition. The ongoing demand for vinyl records and their application across various sectors underscores the market's potential for continued growth.

Exclusive Customer Landscape

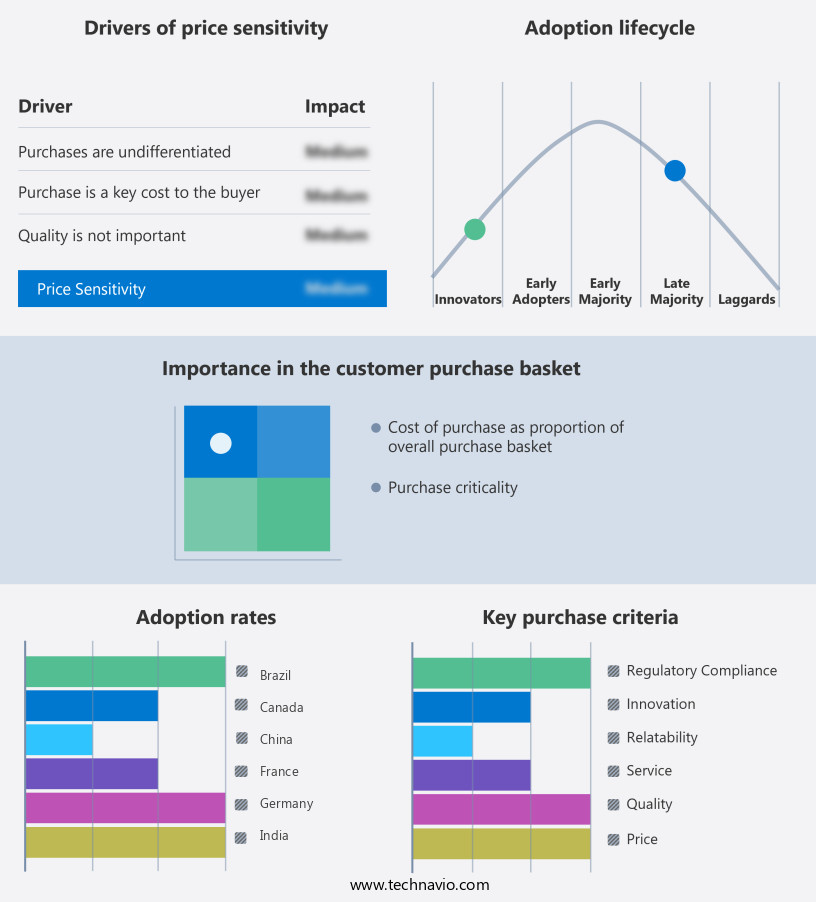

The vinyl records market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the vinyl records market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Vinyl Records Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, vinyl records market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Austep Music (Australia) - This company specializes in the production and distribution of vinyl records, featuring high-performing options such as 140g and 180g variants.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Austep Music (Australia)

- Edel SE and Co. KGaA (Germany)

- Erika Records Inc. (USA)

- Furnace Record Pressing (USA)

- GZ Media AS (Czech Republic)

- Implant Media Pty Ltd. (Australia)

- Independent Record Pressing (USA)

- Microforum Services Group (Canada)

- MPO France (France)

- MPO International (France)

- New Press Vinyl (Unknown)

- Optimal Media GmbH (Germany)

- Pallas Group (Germany)

- PrimeDisc Ltd. (Unknown)

- Quality Record Pressings (USA)

- R.A.N.D. MUZIK GbR (Germany)

- Record Industry BV (Netherlands)

- Suitcase Records (Unknown)

- SunPress Vinyl (USA)

- Takt Direct GmbH (Poland)

- The Vinyl Factory Ltd. (UK)

- United Record Pressing (USA)

- Vinyl Presents Ltd. (UK)

- Zenith Records (Australia)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Vinyl Records Market

- In January 2024, Universal Music Group (UMG), the world's largest music company, announced the launch of its new vinyl pressing plant in Europe. The facility, located in the Netherlands, is expected to produce over 2 million records annually, strengthening UMG's dominance in the vinyl market (Universal Music Group Press Release, 2024).

- In March 2024, Sony Music Entertainment and Amazon Music entered into a strategic partnership to offer exclusive vinyl releases to Amazon Prime members. This collaboration aimed to cater to the growing demand for vinyl records and expand Amazon Music's offerings (Amazon Music Press Release, 2024).

- In May 2024, Discretion Records, a leading independent record label, raised USD 5 million in a Series A funding round. The investment will be used to expand the label's operations, including the production of vinyl records, and to sign new artists (Discretion Records Press Release, 2024).

- In February 2025, the European Commission approved a € 20 million (USD 22 million) funding program to support the growth of the European vinyl industry. The initiative, named "Vinyl Revival," aims to boost production capacity, improve quality, and promote European artists (European Commission Press Release, 2025).

Research Analyst Overview

- The market continues to evolve, driven by the enduring appeal of audiophile-grade vinyl and the ongoing preservation of musical heritage. This sector's dynamics encompass various aspects, from manufacturing and distribution to consumer behavior and playback equipment. Manufacturing processes, such as vinyl record pressing, involve precise techniques like anti-skate adjustment to ensure balanced playback. This adjustment ensures that the tonearm applies equal force to both channels during playback, minimizing distortion and improving audio fidelity. The lacquer mastering process, a crucial step in record production, involves electroplating techniques to create a metal master disc, which is used to press the vinyl records.

- Quality control testing plays a significant role in vinyl record preservation. Proper storage recommendations, including temperature and humidity control, are essential to maintain the longevity of vinyl records. The vinyl record lifespan can extend beyond several decades with proper care. Distribution channels have adapted to meet the growing demand for vinyl records. Record labels and pressing plants collaborate to produce limited-edition releases and reissues. Retail sales strategies, such as exclusive collaborations and subscription services, cater to collectors and enthusiasts. The market's growth is expected to continue, with industry analysts projecting a 10% annual increase in sales.

- This growth is fueled by the desire for high-fidelity audio playback, the allure of analog sound reproduction, and the unique listening experience that vinyl records offer. Consumer listening habits, including the resurgence of turntable use and the popularity of record stores, further contribute to the market's dynamism. Technological advancements, such as dynamic range compression and surface noise reduction, enhance the overall listening experience. In conclusion, the market's continuous evolution reflects the enduring appeal of audiophile-grade vinyl and the ongoing preservation of musical heritage. This market's dynamics encompass various aspects, from manufacturing and distribution to consumer behavior and playback equipment, making it a fascinating and ever-evolving sector to watch.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Vinyl Records Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

192 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.3% |

|

Market growth 2025-2029 |

USD 857.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.8 |

|

Key countries |

US, China, Germany, Brazil, Canada, Japan, France, India, UK, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Vinyl Records Market Research and Growth Report?

- CAGR of the Vinyl Records industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the vinyl records market growth of industry companies

We can help! Our analysts can customize this vinyl records market research report to meet your requirements.