Wafer-Level Manufacturing Equipment Market Size 2025-2029

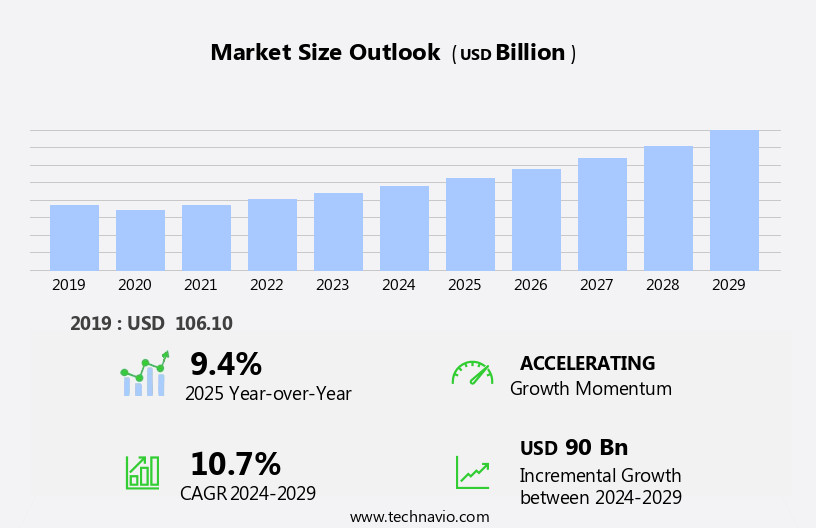

The wafer-level manufacturing equipment market size is forecast to increase by USD 90 billion at a CAGR of 10.7% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand for Internet of Things (IoT) devices. This trend is fueled by the escalating need for advanced semiconductor technology to support the proliferation of smart devices and the expansion of Industry 4.0 applications. Another key driver is the growing focus on large-diameter semiconductor wafers, which enable the production of more complex and feature-rich chips. However, the cyclical nature of the semiconductor industry poses a significant challenge to market participants. This industry is characterized by its high degree of volatility, with demand and prices for semiconductors and related equipment fluctuating based on market conditions.

- Additionally, the high capital intensity of wafer-level manufacturing equipment and the rapid pace of technological advancements necessitate continuous innovation and investment to remain competitive. Companies seeking to capitalize on market opportunities and navigate challenges effectively must stay abreast of these trends and be prepared to adapt quickly to changing market conditions.

What will be the Size of the Wafer-Level Manufacturing Equipment Market during the forecast period?

- The market is characterized by continuous evolution and dynamism, driven by advancements in technology and applications across various sectors. Yield optimization and thin film deposition are key focus areas, with cleanroom technology and ultraviolet (UV) light playing essential roles in process control. Dielectric deposition and process analytics enable semiconductor materials to meet the demands of integrated circuits (ICS) and advanced devices. Artificial intelligence (AI) and machine learning are transforming manufacturing processes, from wafer packaging to 2D materials and precision engineering. Smart manufacturing and automated manufacturing are increasingly important, with defect inspection and advanced materials enabling throughput enhancement and quantum computing.

- Contamination control and high-volume manufacturing remain critical for maintaining quality in semiconductor manufacturing. Front-end-of-line (FEOL) and back-end-of-line (BEOL) processes are continuously refined, with wafer handling and inspection ensuring consistency. Memory devices, logic devices, and analog devices are all benefiting from these advancements, as are emerging technologies like printed electronics and organic electronics. Plasma etching and vacuum technology are essential for fabricating complex structures, while system-on-a-chip (SOC) and advanced packaging enable greater integration and functionality. The market's ongoing unfolding is shaped by research & development, wafer probing, and wafer bonding, as well as the integration of particle control and equipment automation.

How is this Wafer-Level Manufacturing Equipment Industry segmented?

The wafer-level manufacturing equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Foundry

- Memory

- IDM

- Product

- Wafer fab equipment

- Wafer level packaging

- Technology

- Photolithography equipment

- Etching equipment

- Component

- Equipment hardware

- Software solutions

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- Australia

- China

- Japan

- South Korea

- Taiwan

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

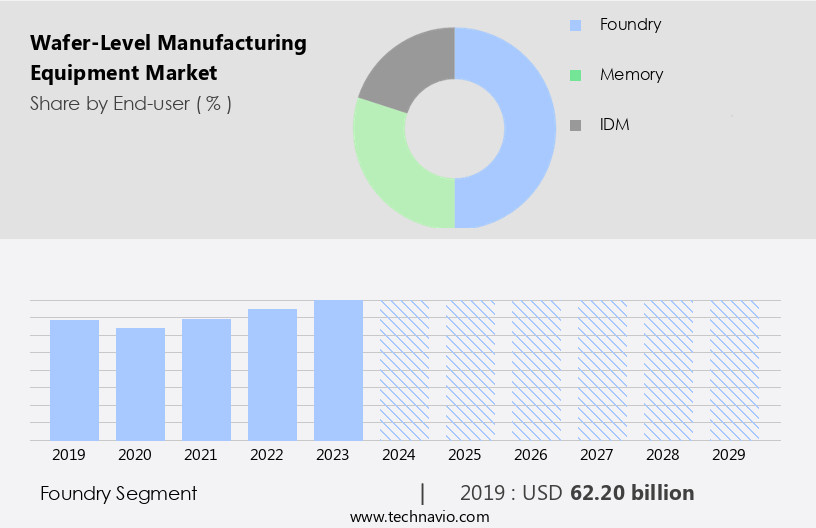

The foundry segment is estimated to witness significant growth during the forecast period.

In the dynamic semiconductor industry, wafer-level manufacturing equipment plays a pivotal role in optimizing yield and enhancing the production of advanced semiconductor materials. Thin film deposition techniques, such as chemical vapor deposition and physical vapor deposition, are integral to this process, enabling the deposition of dielectric and conductive films for integrated circuits (ICs). Ultraviolet (UV) light and process analytics are employed for precise process control during dielectric deposition and photolithography. Artificial intelligence (AI) and machine learning algorithms are revolutionizing wafer fabrication by automating manufacturing processes and improving defect inspection. Advanced materials, including compound semiconductors and 2D materials, are transforming the industry with their unique properties.

Research and development in quantum computing, organic electronics, and printed electronics are driving the demand for wafer-level manufacturing equipment in these emerging fields. Cleanroom technology and contamination control are essential for maintaining the high standards required in semiconductor manufacturing. High-volume manufacturing and precision engineering are key trends, with smart manufacturing and automated manufacturing enabling throughput enhancement and reducing production costs. Wafer handling, wafer inspection, and wafer probing are critical processes in the front-end-of-line (FEOL) and back-end-of-line (BEOL) stages of IC production. Memory devices, logic devices, and analog devices are major applications for wafer-level manufacturing equipment. System-on-a-chip (SoC) technology and advanced packaging are driving the demand for more sophisticated manufacturing processes.

Contamination control, particle control, and vacuum technology are essential for maintaining the high standards required in semiconductor manufacturing. The foundry segment holds a significant market share due to the increasing demand for ICs in various industries, including aerospace and defense, automotive, communication, healthcare, and telecommunication. The rise in orders for ICs is expected to fuel the demand for wafer-level manufacturing equipment to meet production needs.

The Foundry segment was valued at USD 62.20 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

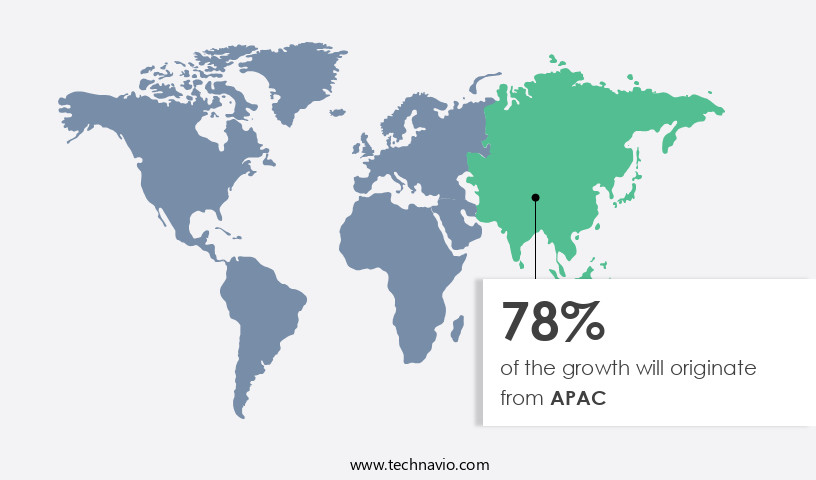

APAC is estimated to contribute 78% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to the region's high concentration of original equipment manufacturers (OEMs) in the consumer electronics, automotive, telecommunications, and enterprise networking industries. Notable OEMs in APAC include Acer Inc., ASUSTeK Computer Inc., Seiko Epson Corp., and Panasonic Corp. The advantage of lower manufacturing costs in APAC enables these companies to produce products at a lower price point than in other regions, leading to an increased availability of affordable consumer electronics. Advancements in technology are also driving market growth. Yield optimization and process control technologies, such as thin film deposition and dielectric deposition, are essential for manufacturing high-performance integrated circuits (ICS).

Ultraviolet (UV) light and process analytics are used for precise process control, while contamination control and particle control are crucial for maintaining wafer quality. Moreover, the adoption of advanced materials, including 2D materials and compound semiconductors, is transforming the semiconductor manufacturing landscape. Artificial intelligence (AI) and machine learning are being integrated into manufacturing processes for predictive maintenance and throughput enhancement. The market is also witnessing the emergence of smart manufacturing and automated manufacturing, which are essential for producing complex devices such as system-on-a-chip (SOC), advanced packaging, and flexible electronics. Wafer handling, wafer inspection, and wafer probing are critical processes in the front-end-of-line (FEOL) and back-end-of-line (BEOL) stages of wafer fabrication.

Furthermore, research and development in areas such as quantum computing, organic electronics, and plasma etching are pushing the boundaries of technology and creating new opportunities for the market. Wafer bonding, vacuum technology, and equipment automation are also essential for enhancing manufacturing efficiency and reducing costs. In conclusion, the market in APAC is experiencing significant growth due to the region's competitive manufacturing costs and technological advancements. The market is driven by the demand for high-performance ICs, the adoption of advanced materials, and the integration of AI and machine learning into manufacturing processes. The emergence of smart manufacturing and automated manufacturing is also transforming the industry, enabling the production of complex devices and pushing the boundaries of technology.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Wafer-Level Manufacturing Equipment Industry?

- The increasing demand for Internet of Things (IoT) devices serves as the primary market driver.

- The market encompasses technologies and tools essential for the production of semiconductor devices, including wafer bonding, feol processes, wafer handling, wafer inspection, and particle control. Compound semiconductors and memory devices, such as flash memory and DRAM, are primary applications for this equipment. Automation plays a significant role in semiconductor manufacturing, ensuring high precision and repeatability. Advancements in technology have led to the integration of printed electronics and the development of analog devices. Wafer bonding is a critical process in semiconductor manufacturing, enabling the fusion of two wafers to create complex structures. Effective particle control is crucial to maintain wafer quality and prevent defects.

- The increasing demand for IoT devices, such as smartphones, smart speakers, and smart meters, fuels the growth of the market. These devices require advanced semiconductor technology for efficient resource utilization and minimal human effort, driving the need for sophisticated manufacturing equipment. In conclusion, the market is experiencing significant growth due to the increasing demand for semiconductor devices, particularly in the IoT sector. Automation, particle control, and advanced manufacturing processes are key drivers in this market. The development of new technologies and applications, such as compound semiconductors and printed electronics, further expand the market's potential.

What are the market trends shaping the Wafer-Level Manufacturing Equipment Industry?

- The focus on large-diameter semiconductor wafers is gaining significant attention in the market. This trend is driven by the increasing demand for advanced technology and higher performance in various industries, including automotive, telecommunications, and consumer electronics.

- The wafer fabrication industry is experiencing significant advancements, with machine learning and vacuum technology playing pivotal roles in enhancing throughput and improving production efficiency. Wafer cleaning and plasma etching are essential processes in wafer manufacturing, which are being optimized through the implementation of these technologies. Logic devices, back-end-of-line (BEOL) processes, and advanced packaging are the primary applications of wafer fabrication. Memory devices, particularly those using large-diameter wafers, dominate the market due to their high demand. The industry is witnessing a shift towards larger wafer sizes, such as 300mm, which offer cost savings and increased surface area for chip production.

- While some manufacturers are exploring the development of 450mm wafers, the current IC requirements can be met with the use of 300mm, 200mm, 150mm, and 100mm wafers. Organic electronics is an emerging field that is expected to significantly impact the wafer fabrication market in the coming years. In conclusion, the wafer fabrication market is undergoing rapid transformations, driven by technological advancements and the growing demand for miniaturized and high-performance electronic devices. The implementation of machine learning, vacuum technology, and other advanced processes is enabling throughput enhancement, cost savings, and improved production efficiency. The market is expected to continue growing, with memory devices and logic devices being the major applications.

- Organic electronics is an emerging field that is poised to bring about significant changes in the industry.

What challenges does the Wafer-Level Manufacturing Equipment Industry face during its growth?

- The cyclical nature of the semiconductor industry poses a significant challenge to its growth, requiring companies to navigate through periods of expansion and contraction in order to remain competitive.

- The market is subject to the cyclical nature of the semiconductor industry, influencing IC manufacturers' revenue due to inconsistent demand for ICs. To meet varying demands, manufacturers must optimally utilize their production capacity. However, high capital requirements pose challenges for R&D investments. The unpredictable demand for electronic products, such as consumer electronics and mobile devices, complicates semiconductor market forecasting, potentially leading to oversupply or undersupply situations for ICs.

- Manufacturers must navigate these challenges to ensure business continuity and profitability in the market.

Exclusive Customer Landscape

The wafer-level manufacturing equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wafer-level manufacturing equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, wafer-level manufacturing equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advantest Corp. - This company specializes in advanced wafer level manufacturing solutions, featuring equipment like the T5822 system. Designed for memory device manufacturers, this technology delivers cost efficiency and superior functionality. By utilizing cutting-edge technology, it caters to the diverse needs of the industry, enhancing productivity and optimizing processes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advantest Corp.

- Applied Materials Inc.

- ASM International NV

- ASML

- BE Semiconductor Industries NV

- Canon Inc.

- DISCO Corp.

- EV Group

- Ferrotec Holdings Corp.

- Hitachi Ltd.

- Intel Corp.

- JEOL Ltd.

- KLA Corp.

- Kulicke and Soffa Industries Inc.

- Lam Research Corp.

- Plasma Therm

- Screen Holdings Co. Ltd

- Tokyo Electron Ltd.

- ULVAC Inc.

- Veeco Instruments Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Wafer-Level Manufacturing Equipment Market

- In February 2024, ASML Holding NV, a leading provider of photolithography systems for the semiconductor industry, announced the successful installation and qualification of its new EUV lithography system, the NXT:3400, at a major wafer foundry in Taiwan. This marks a significant technological advancement in wafer-level manufacturing equipment, enabling the production of smaller, more efficient chips (ASML Press Release, 2024).

- In August 2025, Tokyo Electron Limited and Applied Materials, Inc., two prominent players in the market, announced their strategic collaboration to develop and commercialize next-generation semiconductor manufacturing technologies. This partnership aims to combine Tokyo Electron's expertise in manufacturing equipment and Applied Materials' strength in materials engineering, potentially leading to innovative solutions and increased competitiveness (Tokyo Electron Press Release, 2025).

- In October 2024, Lam Research Corporation, a leading supplier of wafer fabrication equipment and services, announced the completion of its acquisition of KLA-Tencor Corporation, a provider of process control and yield management solutions for the semiconductor industry. This merger is expected to create a comprehensive semiconductor manufacturing solutions provider, with a combined market capitalization of over USD100 billion (Bloomberg, 2024).

- In December 2025, Intel Corporation, a global leader in technology innovation, announced the expansion of its manufacturing operations in Arizona, USA, with a USD20 billion investment in a new semiconductor fabrication plant. This significant geographic expansion is aimed at increasing Intel's manufacturing capacity and reducing its reliance on external foundries, positioning the company for future growth in the market (Intel Press Release, 2025).

Research Analyst Overview

The market is witnessing significant advancements, driven by the need for automation solutions to enhance manufacturing efficiency and yield improvement. Die-to-wafer bonding and wafer-to-wafer bonding are critical processes undergoing innovation, with process simulation and data analytics playing essential roles in optimizing these techniques. Environmental regulations and compliance standards are shaping the market, pushing manufacturers to adopt sustainable initiatives and safety standards. Scaling limits and Moore's Law are driving the adoption of next-generation technologies such as sub-10nm lithography, 3D integration, and advanced node processes. Robotic systems and high-aspect ratio structures are becoming increasingly important for handling complex geometries and ensuring product quality.

Manufacturing efficiency, cost optimization, and process reliability are key concerns, leading to the integration of multi-level metallization, validation testing, and equipment qualification. Heterogeneous integration, through-silicon vias (TSVs), fan-out packaging, and direct wafer bonding are emerging trends, enabling the creation of high-k dielectrics and low-k dielectrics for improved performance. Sustainability initiatives and safety standards are also crucial, with an emphasis on reducing waste and ensuring worker safety. The market is expected to continue evolving, with a focus on cost optimization and process innovation to meet the demands of next-generation technologies.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Wafer-Level Manufacturing Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.7% |

|

Market growth 2025-2029 |

USD 90 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.4 |

|

Key countries |

South Korea, Taiwan, Japan, US, China, Australia, Canada, Germany, UK, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Wafer-Level Manufacturing Equipment Market Research and Growth Report?

- CAGR of the Wafer-Level Manufacturing Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the wafer-level manufacturing equipment market growth of industry companies

We can help! Our analysts can customize this wafer-level manufacturing equipment market research report to meet your requirements.