Warning Labels and Stickers Market 2024-2028

The warning labels and stickers market size is estimated to grow at a CAGR of 5.27% between 2023 and 2028. The market size is forecast to increase by USD 4.25 billion. The growth of the market depends on several factors such as the increasing regulations and safety standards across end-users, the expanding international trade and product distribution, and the advancements in label printing technologies and materials. Our report examines historical data from 2018-2022, besides analyzing the current market scenario.

This report extensively covers market segmentation by end-user (pharmaceuticals, tobacco, food and beverages, chemicals, and others), type (chemical labels, hazardous labels, electrical labels, and custom labels), and geography (APAC, Europe, North America, Middle East and Africa, and South America). It also includes an in-depth analysis of drivers, trends, and challenges.

What will be the Size of the Warning Labels And Stickers Market During the Forecast Period?

Warning Labels and Stickers Market Forecast 2024-2028

To learn more about this report, Request Free Sample

Warning Labels and Stickers Market Dynamic

Our researchers studied the data for years, with 2023 as the base year and 2024 as the estimated year, and presented the key drivers, trends, and challenges for the market. Although there has been a disruption in the growth of the market during the COVID-19 pandemic, a holistic analysis of drivers, trends, and challenges will help companies refine marketing strategies to gain a competitive advantage.

Driver- Increasing regulations and safety standards across end-users

The implementation of laws and safety standards aims to enhance consumer safety, furnish essential information, and guarantee that potential hazards are suitably conveyed. Government agencies from all over the world play a crucial role in establishing and upholding these regulations, which in turn fuels demand for stickers and warning labels to satisfy compliance needs.

Furthermore, compliance is a key factor driving the market because of these regulatory obligations, which also generate a steady and increasing demand for digital label printing solutions. To comply with these rules and uphold the safety and trust of their customers, businesses must invest in high-quality, compliant labeling. Increasing regulations and safety standards across end-users will drive the growth of the market during the forecast period. Digital label printing solutions offer flexibility, efficiency, and the ability to produce labels with high precision and customization. These technologies enable businesses to meet regulatory requirements while maintaining product differentiation and brand integrity. As industries prioritize compliance and consumer safety, the adoption of digital label printing solutions is expected to rise, supporting the market's expansion as businesses seek reliable and versatile labeling solutions.

Trends- Incorporating Near Field Communication (NFC), Radio-Frequency Identification (RFID), or Quick Response (QR) codes into labels

Global government agencies are placing increasing emphasis on using these technologies to improve product traceability and safety. For example, the food labeling requirements of the European Union (EU) mandate the use of QR codes to transmit comprehensive product information, encompassing allergens and nutritional details.

Moreover, this trend facilitates regulatory compliance and tracking across the supply chain in addition to providing consumers with better access to crucial product data. Thus, incorporating NFC, RFID, or QR codes into labels is a trend that can drive the growth of the market in focus during the forecast period. Enterprise labeling software plays a crucial role in enabling businesses to implement these advanced labeling technologies effectively. This software facilitates the design, printing, and management of labels that incorporate NFC, RFID, or QR codes, ensuring accurate information dissemination and compliance with regulatory requirements. By integrating enterprise labeling software, organizations can streamline label creation processes, enhance supply chain visibility, and improve operational efficiency. As industries increasingly adopt digital solutions for labeling and data management, the demand for enterprise labeling software is expected to grow, supporting the market's expansion as businesses seek robust solutions for modern labeling challenges.

Challenge- Risk of counterfeit warning labels and stickers

The prevalence of counterfeit warning labels and stickers on the international market compromises the security of products and damages consumer confidence in brands. Counterfeit labels frequently exclude vital safety information and are not authentic, endangering customers and harming the standing of respectable companies.

Moreover, this challenge is especially important for sectors like pharmaceuticals, where using fake medications can have major negative health effects. Government sources from all around the world have acknowledged this danger. Hence, the presence of counterfeit warning labels is a potential challenge that can impede the revenue growth of the global warning labels and sticker market during the forecast period. Addressing this issue requires robust labeling equipment capable of applying secure and tamper-evident features to warning labels. Labeling equipment ensures the application of authentication measures such as holographic labels, QR codes, or RFID tags, which help verify product authenticity and prevent counterfeiting.

Warning Labels and Stickers Market Segmentation by End-user, Type, and Geography

End-user Segment Analysis:

The pharmaceutical segment will account for a major share of the market's growth during the forecast period.?Superior warning labels and stickers are required by strict regulatory regulations, which demand thorough and unambiguous labeling on pharmaceutical products to guarantee patient safety. Additionally, the need for labeling solutions is continuously created by the pharmaceutical industry growth, which is fueled by rising healthcare costs and R&D activities.

Customized Report as per your requirements!

The pharmaceutical segment was valued at USD 2.65 billion in 2018. Additionally, the growth of biologics, specialty pharmaceuticals, and personalized medicine has increased the demand for informative and personalized pharmaceutical warning labels and stickers, propelling the growth in demand for warning labels and stickers in pharmaceuticals, thereby driving the growth of the market in focus during the forecast period.

Type Segment Analysis

Based on type, the market has been segmented into chemical labels, hazardous labels, electrical labels, and custom labels. The chemical labels?segment will account for the largest share of this segment.?Growing regulatory requirements and the need for improved safety in the handling and transportation of hazardous materials are driving the growth of chemical labels. Chemical labels are becoming increasingly common globally since the chemical industry itself depends on specialized labels to meet safety requirements when transporting and storing hazardous goods. Due to such factors, the demand for chemical labels is expected to increase, which will drive the growth of the market during the forecast period.

Regional Analysis

For more insights on the market share of various regions Download Sample PDF now!

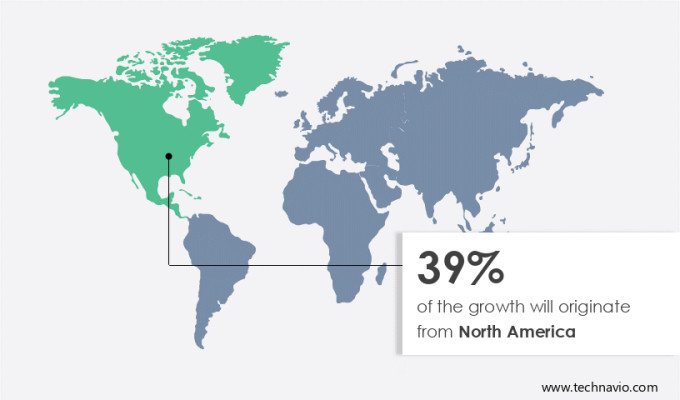

North America is estimated to contribute 39% to the growth by 2027. Technavio’s analysts have elaborately explained the regional trends, drivers, and challenges that are expected to shape the market during the forecast period. In APAC, there is a greater need for safety and compliance labeling due to the growing manufacturing and industrial sectors in nations like China and India. Furthermore, the region's thriving e-commerce sector has led to a rise in the usage of warning labels on packages with handling guidelines and safety advice. Due to such factors, the warning labels and stickers market in APAC is anticipated to grow significantly during the forecast period.

COVID Recovery Analysis:

In 2020, the COVID-19 pandemic negatively affected the warning labels and stickers market in APAC. However, in 2021, the initiation of large-scale vaccination drives?lifted the lockdown and travel restrictions, which led to the resumption of supply chain activities. Furthermore, the growth in the warning labels and stickers market in APAC is anticipated to be propelled by sectors including chemicals, pharmaceuticals, and logistics during the forecast period, where regulatory compliance and safety are still top priorities.

Who are the Major Warning Labels and Stickers Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Advanced Labels: The company offers warning labels and stickers for pharmaceutical, dairy industry, and butchery.

We also have detailed analyses of the market’s competitive landscape and offer information on 20 market companies, including:

3M Co., CCL Industries Inc., CircleOne, Consolidated Label Co., DuraMark Technologies, Edwards Label Inc., Etsy Inc., Justrite Mfg. Co. LLC, MaverickLabel.Com, Inc., Mercian Labels, Multi Color Corp., ONLINE LABELS, LLC, Pro Mach Inc., SheetLabels, Taylor Corp., U.S. Nameplate Co, Avery Dennison Corp, Brady Corp., and Brimar Industries, LLC

Technavio report provides an in-depth analysis of the market and its players through combined qualitative and quantitative data. The analysis classifies companies into categories based on their business approaches, including pure-play, category-focused, industry-focused, and diversified. Companies are specially categorized into dominant, leading, strong, tentative, and weak, based on their quantitative data analysis.

Segment Overview

The warning labels and stickers market report forecasts market growth by revenue at global, regional & country levels and provides an analysis of the latest trends and growth opportunities from 2018 to 2028.

- Enduser Outlook

- Pharmaceuticals

- Tobacco

- Food and beverages

- Chemicals

- Others

- Type Outlook

- Chemical labels

- Hazardous labels

- Electrical labels

- Custom labels

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

|

Warning Labels And Stickers Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

157 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.27% |

|

Market Growth 2024-2028 |

USD 4.25 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.92 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 39% |

|

Key countries |

US, China, Japan, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., Advanced Labels, CCL Industries Inc., CircleOne, Consolidated Label Co., DuraMark Technologies, Edwards Label Inc., Etsy Inc., Justrite Mfg. Co. LLC, MaverickLabel.Com, Inc., Mercian Labels, Multi Color Corp., ONLINE LABELS, LLC, Pro Mach Inc., SheetLabels, Taylor Corp., U.S. Nameplate Co, Avery Dennison Corp, Brady Corp., and Brimar Industries, LLC |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Warning Labels And Stickers Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the warning labels and stickers market between 2024 and 2028

- Precise estimation of the warning labels and stickers market size and their contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- A thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of warning labels and stickers market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch