White-Box Server Market Size 2024-2028

The white-box server market size is forecast to increase by USD 72.2 billion, at a CAGR of 26.97% between 2023 and 2028.

- The market is experiencing significant growth, driven by the emergence of mini data centers and the construction of energy-efficient and eco-friendly facilities. This trend reflects the increasing demand for cost-effective and sustainable IT infrastructure solutions. However, the market faces a substantial challenge from branded server companies, who continue to dominate the industry with their established brands, extensive distribution networks, and robust product offerings. To capitalize on the opportunities presented by the mini data center trend and navigate the competitive landscape effectively, companies in the market must focus on offering competitive pricing, superior performance, and customizable solutions that cater to the unique needs of their clients.

- Additionally, investments in research and development to enhance energy efficiency and expand product offerings will be crucial for long-term success.

What will be the Size of the White-Box Server Market during the forecast period?

The market continues to evolve, driven by the dynamic needs of various sectors. Hardware flexibility is a key factor, with web servers and application servers requiring optimized performance tuning for high availability. Small businesses opt for DIY servers, while enterprise servers demand custom configuration for data analytics and big data processing. Cooling systems and energy efficiency are crucial considerations in server hardware design. Open source software and network attached storage facilitate seamless integration with software-defined networking and virtual machines. Database servers and high-performance computing applications require robust power supplies and disaster recovery solutions. Artificial intelligence and machine learning are transforming server applications, necessitating advanced hardware capabilities.

Cloud computing, including bare metal and cloud storage, offers cost optimization and scalability. Gaming servers and blade servers cater to specific niches, while server management solutions ensure optimal server performance. The ongoing unfolding of market activities reveals evolving patterns, with continuous innovation in server hardware, software, and networking technologies. Cost optimization, data center efficiency, and customization remain key priorities, as the market adapts to the ever-changing demands of businesses and industries.

How is this White-Box Server Industry segmented?

The white-box server industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Data centers

- SME and large enterprises

- Type

- Rack and tower servers

- Blade servers

- Density optimized servers

- Geography

- North America

- US

- Europe

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

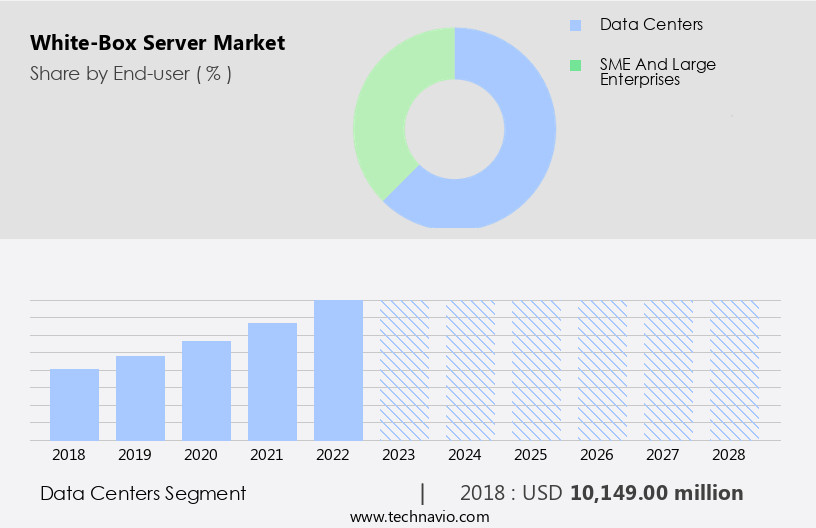

The data centers segment is estimated to witness significant growth during the forecast period.

Data centers have emerged as essential infrastructure for businesses handling large volumes of data and intricate IT systems. White-box servers, which offer flexibility in catering to organizations' business and operational needs, are increasingly utilized in constructing data centers for small and medium-sized enterprises (SME) and redundant functions like web hosting. These servers are also gaining popularity in micro-mobile and containerized data centers through collaborations with ODMs and infrastructure providers. Flexibility is a significant factor driving the adoption of white-box servers, as they allow custom configuration and cost optimization. Furthermore, the integration of artificial intelligence, machine learning, and data analytics in these servers enhances their capabilities for high-performance computing, big data processing, and energy efficiency.

Additionally, high availability, performance tuning, and disaster recovery features ensure business continuity. White-box servers also support various deployment models, including bare metal, cloud storage, and virtual machines, catering to diverse requirements. In summary, the flexibility, cost optimization, and advanced capabilities of white-box servers make them a preferred choice for businesses constructing data centers.

The Data centers segment was valued at USD 10.15 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

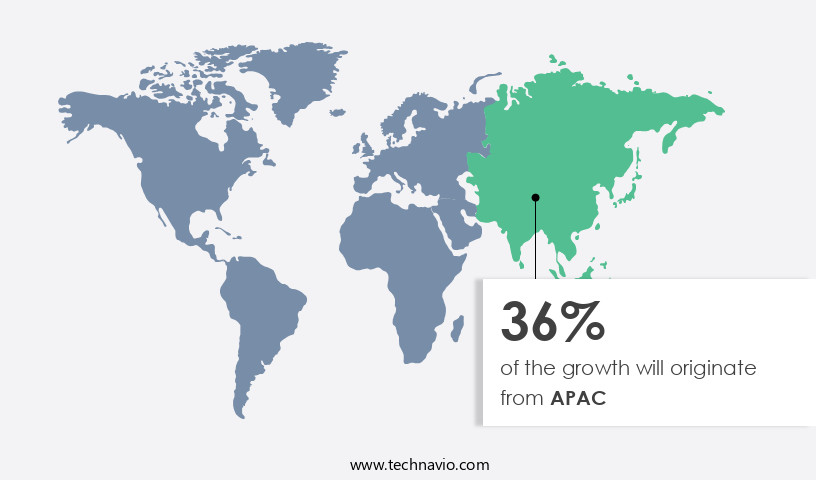

APAC is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the US market, data centers continue to expand with the addition of more rack cabinets and servers to accommodate the increasing demand for digital services. The adoption of containerized data centers is more prevalent in this region due to its advanced technological infrastructure. The growth of cloud services and big data analytics is driving the need for mission-critical and high-performance computing servers. Small and medium-sized enterprises (SMEs) in the US are increasingly adopting data center services due to cost savings, leading to a significant increase in the demand for white-box servers. Energy efficiency and custom configuration are key considerations for data center operators, making server hardware a critical component of their infrastructure.

Artificial intelligence and machine learning applications are also gaining traction, necessitating the use of powerful servers for data processing. High availability and disaster recovery solutions are essential to ensure business continuity, leading to the adoption of advanced cooling systems and server management tools. Network attached storage and cloud storage are becoming increasingly popular for data backup and retrieval. Virtual machines and software-defined networking enable greater flexibility and scalability for businesses. Database servers and DIY servers cater to specific use cases, while enterprise servers and blade servers offer high-performance computing for large organizations. Data analytics and custom configuration options are crucial for businesses seeking to gain insights from their data and optimize costs.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of White-Box Server Industry?

- The emergence of mini data centers serves as the primary catalyst for market growth.

- Mini data centers, comprising a self-contained system for housing a single rack to up to 40 rack enclosures, have gained traction due to their ability to support IT loads of up to 250 kW. These data centers, featuring integrated power, cooling, and IT infrastructure, offer a cost-effective solution for businesses seeking to minimize infrastructure spending on large-scale data centers. The high capital expenditure (CAPEX) associated with constructing extensive data centers poses a significant challenge. Mini data centers address this issue by consolidating IT infrastructure requirements into a compact, yet powerful system. Additionally, these data centers are frequently utilized for disaster recovery and branch office operations.

- The adoption of open source software, high-performance computing, big data, and network attached storage in various industries further fuels the demand for mini data centers. Power supply systems, such as redundant power supplies, ensure uninterrupted operations, while cloud storage offers flexibility and scalability. Bare metal servers and tower servers are also compatible with mini data centers, catering to diverse IT requirements.

What are the market trends shaping the White-Box Server Industry?

- Green and energy-efficient construction is becoming a mandated trend in the data center industry. Two distinct yet interconnected developments are shaping this market: the increasing demand for sustainable business practices and the technological advancements enabling more efficient energy usage in data centers.

- White-box servers have gained traction in the business world due to their energy efficiency and cost-effectiveness. Compared to traditional servers, white-box servers consume less energy, making them an attractive option for enterprises seeking to reduce their carbon footprint. This trend is particularly significant in the context of the growing awareness of the environmental impact of data centers. Large organizations are increasingly adopting white-box servers for smaller workloads and even for their overall operations. Tech giants like Google, Amazon, Facebook, and Microsoft are leading the way in this regard, having already established green data center facilities. These facilities employ white-box servers, which not only consume less energy but also reduce cooling requirements and rack-level power density, leading to lower power bills.

- Software-defined networking, virtual machines, and database servers are among the applications where white-box servers are commonly used. DIY servers and blade servers are also popular choices for businesses looking to optimize their IT infrastructure. Cloud computing further enhances the flexibility and scalability of white-box servers, making them a versatile solution for various business needs. In summary, the adoption of white-box servers is driven by their energy efficiency, cost-effectiveness, and flexibility. As more businesses seek to reduce their environmental impact and optimize their IT infrastructure, the demand for white-box servers is expected to continue growing.

What challenges does the White-Box Server Industry face during its growth?

- Branded server companies pose a significant threat that impedes the growth of the industry. This challenge arises from the competitive pressure to offer advanced technology and innovative solutions at competitive prices, which smaller companies may find difficult to match. Consequently, the industry's expansion is affected as businesses may opt for established companies, hindering the growth potential of new entrants.

- The market represents a growing segment in the enterprise server landscape, accounting for less than 10% of the global server market share. Despite this, the market's growth trajectory has been robust, with white-box servers gaining traction in data centers. This trend poses a challenge to leading branded server companies, including HP, Dell, and IBM, as white-box servers offer custom configuration, energy efficiency, and cost optimization advantages. The adoption of data analytics, machine learning, and other data-intensive applications further fuels the demand for white-box servers.

- To remain competitive, branded companies must offer server infrastructure that matches the cost-effectiveness and performance efficiency of white-box servers. In conclusion, the market is poised for significant growth, and its impact on the server market dynamics is a topic of ongoing interest for businesses.

Exclusive Customer Landscape

The white-box server market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the white-box server market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, white-box server market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Cisco Systems Inc. - This company specializes in providing advanced technology solutions, including white box servers and UCS C Series Rack Servers. Our offerings cater to businesses seeking customizable, high-performance IT infrastructure. By opting for white box servers, clients gain flexibility in hardware configuration and cost savings. UCS C Series Rack Servers, on the other hand, offer enterprise-class capabilities, ensuring scalability and reliability. Our commitment to innovation and quality underpins our ability to deliver cutting-edge technology solutions that cater to diverse business needs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Cisco Systems Inc.

- Equus Computer Systems Inc.

- Fujitsu Ltd.

- Happyware Server Europe GmbH

- Hon Hai Precision Industry Co. Ltd.

- Huawei Technologies Co. Ltd.

- Hyve Solutions Corp.

- Inspur Systems Inc.

- Intel Corp.

- Inventec Corp.

- Jabil Inc.

- MiTAC Holdings Corp.

- Penguin Solutions

- Quanta Computer Inc.

- Servers Direct

- Silicon Mechanics

- Super Micro Computer Inc.

- Whitestack

- Wistron Corp.

- ZT Systems

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in White-Box Server Market

- In February 2023, Intel unveiled its new line of high-performance, cost-effective FPGA-based white-box servers, aiming to challenge traditional ASIC servers in the market (Intel Press Release, 2023). This strategic move signifies a significant technological advancement, as FPGAs offer flexibility and customization, making them suitable for various workloads.

- In July 2024, Google Cloud and Marvell Technology announced a partnership to develop custom white-box servers using Marvell's ThunderX2 processors. This collaboration represents a major strategic partnership, as Google Cloud aims to enhance its infrastructure capabilities and Marvell seeks to expand its market reach (Google Cloud Blog, 2024).

- In December 2024, Huawei's subsidiary, FusionInfo, secured a USD300 million investment from the Chinese government to expand its white-box server production capacity. This substantial funding round signifies a key geographic expansion and market entry, as FusionInfo plans to target the growing data center market in Southeast Asia (Reuters, 2024).

- In March 2025, IBM and AMD announced a collaboration to develop custom white-box servers using AMD's EPYC processors. This partnership represents a significant shift in the market, as IBM, traditionally known for its proprietary systems, embraces open-standard white-box servers to cater to the increasing demand for flexible and cost-effective solutions (IBM Press Release, 2025).

Research Analyst Overview

- The market is experiencing significant activity and trends, with a focus on server customization, cooling systems, and edge computing. Server components undergo automated deployment, enabling system integration and continuous delivery. Cloud migration and server deployment require infrastructure as code, ensuring hardware compatibility and software stack consistency. AI hardware acceleration and server monitoring are essential for data center efficiency and system stability. Hybrid cloud solutions and data center security are top priorities, necessitating fire suppression systems, technical support, and security cameras. Performance benchmarking and server lifecycle management are crucial for optimizing power consumption and ensuring fault tolerance.

- Uninterruptible power supplies and power distribution units are integral to maintaining service level agreements and reducing power consumption. Server room design prioritizes cooling efficiency and fault tolerance, while serverless computing offers new possibilities for system stability and scalability. Continuous integration and hardware upgrades ensure software patches and system updates are implemented promptly, enhancing overall performance and reliability.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled White-Box Server Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 26.97% |

|

Market growth 2024-2028 |

USD 72201.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

20.86 |

|

Key countries |

US, China, Japan, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this White-Box Server Market Research and Growth Report?

- CAGR of the White-Box Server industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the white-box server market growth of industry companies

We can help! Our analysts can customize this white-box server market research report to meet your requirements.