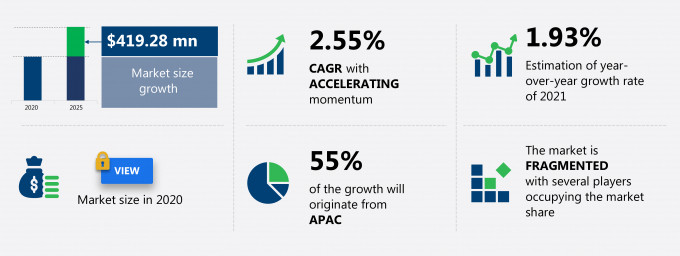

The woolen blanket market share is expected to increase by USD 419.28 million from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 2.55%.

This woolen blanket market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers woolen blanket market segmentation by end-user (residential and commercial) and geography (APAC, Europe, North America, MEA, and South America). The woolen blanket market report also offers information on several market vendors, including AUMORE WOOL PTY LTD., Barker Textiles UAB, Faribault Woolen Mill Co., FelinFach Natural Textiles, MiniJumbuk, New Zealand Wool Blankets Ltd., Pendleton Woolen Mills Inc., Target Corp., The Tartan Blanket Co., and Urbanara GmbH among others.

What will the Woolen Blanket Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Woolen Blanket Market Size for the Forecast Period and Other Important Statistics

Woolen Blanket Market: Key Drivers, Trends, and Challenges

The benefits provided by woolen blankets is notably driving the woolen blanket market growth, although factors such as lack of addressable market may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the woolen blanket industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Woolen Blanket Market Driver

One of the key factors driving growth in the woolen blanket market is the benefits provided by woolen blankets. Wool provides several benefits, which drive its adoption. Some of the benefits of wool include flame resistance, soil and stain resistance, non-toxicity, hypoallergenic, breathability, dust and mite resistance, and durability. Wool is a breathable fiber and provides instant warmth compared with synthetic material. In addition, woolen blankets are ideal for windy and snowy weather. Wool is a highly durable fiber and is easy to clean. Therefore, woolen blankets need very little washing or laundry. It also dries quickly. As woolen blankets wick moisture away, they act as a barrier against the growth of dust mites. Thus, the benefits provided by woolen blankets are expected to be prominent factors driving the growth of the market.

Key Woolen Blanket Market Trend

The advent of organic-certified woolen blankets is another factor supporting the woolen blanket market share growth. Consumers globally are increasingly concerned about the consumption of animal-based consumer goods and products. Such developments influence the decision-making pattern of consumers, especially in developed countries such as the US and the UK. For wool to be certified as organic in the US, it must be produced in accordance with federal standards for organic livestock production as described in the US Department of Agriculture's National Organic Standards. Increasing consumer awareness about animal sustainability and ethical manufacturing of textiles are key factors that are expected to impact the global woolen blanket market. The trend of using organic-certified wool for making woolen blankets is expected to garner momentum with more vendors trying to use certified wool for making woolen blankets.

Key Woolen Blanket Market Challenge

The lack of an addressable market will be a major challenge for the woolen blanket market during the forecast period. Even though woolen blankets provide several advantages, the addressable market remains a major challenge for market growth. The sale of woolen blankets in countries with tropical climates is a major challenge. A tropical climate can be briefly stated as a non-arid climate having a temperature warmer than 18 °C (64 °F) throughout the year. Tropical climates are frost-free, and the changes in the solar angle are relatively small. In tropical countries, the hot weather lasts for at least seven to eight months, which is considered as the slack period for the global woolen blanket market. Therefore, the woolen textile industry is a seasonal phenomenon in these countries, which poses a challenge for the growth of the woolen blanket market in these tropical countries

This woolen blanket market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global woolen blanket market as a part of the global textiles market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the woolen blanket market during the forecast period.

Who are the Major Woolen Blanket Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- AUMORE WOOL PTY LTD.

- Barker Textiles UAB

- Faribault Woolen Mill Co.

- FelinFach Natural Textiles

- MiniJumbuk

- New Zealand Wool Blankets Ltd.

- Pendleton Woolen Mills Inc.

- Target Corp.

- The Tartan Blanket Co.

- Urbanara GmbH

This statistical study of the woolen blanket market encompasses successful business strategies deployed by the key vendors. The woolen blanket market is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

-

AUMORE WOOL PTY LTD. - The company offers woolen blankets such as Aumore Underblankets.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The woolen blanket market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Woolen Blanket Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the woolen blanket market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chains is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the textiles market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Woolen Blanket Market?

For more insights on the market share of various regions Request for a FREE sample now!

55% of the market’s growth will originate from APAC during the forecast period. China and Japan are the key markets for woolen blankets in APAC. Market growth in this region will be faster than the growth of the market in other regions.

The presence of leading wool-producing countries such as Australia, New Zealand, China, and India will facilitate the woolen blanket market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

In 2020, the COVID-19 pandemic had a negative impact on the regional woolen blanket market. In 2020, amid the peak of the COVID-19 outbreak in China, the wool processing plants in the country were shut or ran at a fraction of the usual capacity. This had a significant impact on demand and pricing for Australian wool. As per auction results, the benchmark price for Australian merino wool fell to $6.1 in September 2020, which was lower than 2019. In 2021, as wool production stabilized in the major wool exporting countries of Australia New Zealand, the demand for woolen blankets rebounded in the region. These factors will contribute to the growth of the regional woolen blanket market during the forecast period.

What are the Revenue-generating End-user Segments in the Woolen Blanket Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The woolen blanket market share growth by the residential segment will be significant during the forecast period. The growth of the residential sector is closely linked to economic conditions as financial constraints limit product purchases; consumers postpone buying non-essential items until they have adequate disposable income. However, the positive economic outlook in emerging as well as developed economies are expected to drive the growth of the residential sector. Further, the growth of e-commerce and the expansion of the online retailing industry are other key drivers affecting the demand for woolen blankets by the residential sector.

This report provides an accurate prediction of the contribution of all the segments to the growth of the woolen blanket market size and actionable market insights on post COVID-19 impact on each segment.

|

Woolen Blanket Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.55% |

|

Market growth 2021-2025 |

$ 419.28 million |

|

Market structure |

Fragmented |

|

YoY growth (%) |

1.93 |

|

Regional analysis |

APAC, Europe, North America, MEA, and South America |

|

Performing market contribution |

APAC at 55% |

|

Key consumer countries |

China, US, Germany, Japan, and UK |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

AUMORE WOOL PTY LTD., Barker Textiles UAB, Faribault Woolen Mill Co., FelinFach Natural Textiles, MiniJumbuk, New Zealand Wool Blankets Ltd., Pendleton Woolen Mills Inc., Target Corp., The Tartan Blanket Co., and Urbanara GmbH |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Woolen Blanket Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive woolen blanket market growth during the next five years

- Precise estimation of the woolen blanket market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the woolen blanket industry across APAC, Europe, North America, MEA, and South America

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of woolen blanket market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch