X-Ray Crystallography Market Size 2024-2028

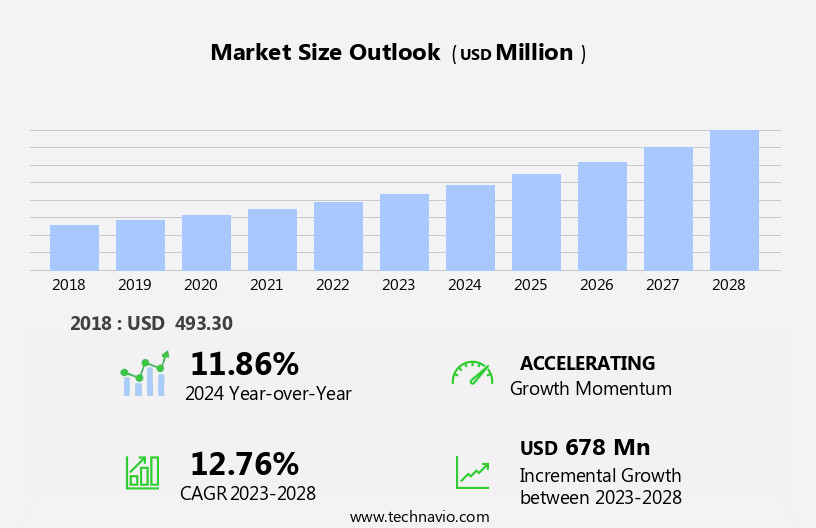

The X-ray crystallography market size is forecast to increase by USD 678 million, at a CAGR of 12.76% between 2023 and 2028.

- The market is witnessing significant growth, driven by the increasing investment in drug discovery and the outsourcing of the drug discovery process. Pharmaceutical companies are recognizing the value of X-Ray Crystallography in understanding molecular structures and optimizing drug design, leading to a surge in demand for this technology. Furthermore, the outsourcing of drug discovery processes to specialized laboratories and contract research organizations (CROs) is becoming increasingly common, providing new opportunities for market participants. However, the market faces challenges, primarily the lack of trained laboratory professionals. As the demand for X-Ray Crystallography services continues to grow, ensuring a steady supply of skilled labor will be crucial for market players to maintain their competitive edge.

- Companies seeking to capitalize on market opportunities should focus on building a strong talent pool and collaborating with academic institutions to attract and train the next generation of X-Ray Crystallography experts. Additionally, partnerships with CROs and other service providers can help companies expand their capabilities and reach a wider client base. Overall, the market is poised for continued growth, with opportunities for innovation and collaboration driving the strategic landscape.

What will be the Size of the X-Ray Crystallography Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

X-ray crystallography, a vital technique in structural biology, continues to evolve, shaping market dynamics through its extensive applications across various sectors. Protein crystallography techniques, such as heavy atom derivatization and molecular replacement method, are employed to elucidate intricate protein structures. Crystal structure visualization, structure factor calculation, and space group determination are integral parts of the process, revealing the molecular architecture of biological macromolecules. X-ray diffraction patterns, obtained through single crystal diffraction, are analyzed using crystallographic software tools and synchrotron radiation sources. Anomalous scattering effects and data resolution limits are crucial factors in determining the success of data collection strategies.

Crystal growth optimization, molecular structure modeling, and diffraction intensity integration are ongoing efforts to enhance the quality of X-ray data. Crystallographic symmetry, Bragg's law application, and Ramachandran plot analysis are essential aspects of structure validation metrics. Atomic coordinates refinement and detector calibration processes are integral to ensuring accurate and reliable results. Data processing pipelines and crystal lattice parameters are continually refined to improve the efficiency and resolution of X-ray crystallography experiments. Structure factor amplitudes and unit cell determination are fundamental components of the X-ray crystallography methodology, enabling a deeper understanding of molecular interactions and functions. Powder diffraction data and phase identification methods are additional techniques that expand the scope of X-ray crystallography, contributing to the ongoing evolution of this dynamic market.

How is this X-Ray Crystallography Industry segmented?

The x-ray crystallography industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Pharmaceutical

- Biotechnology

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

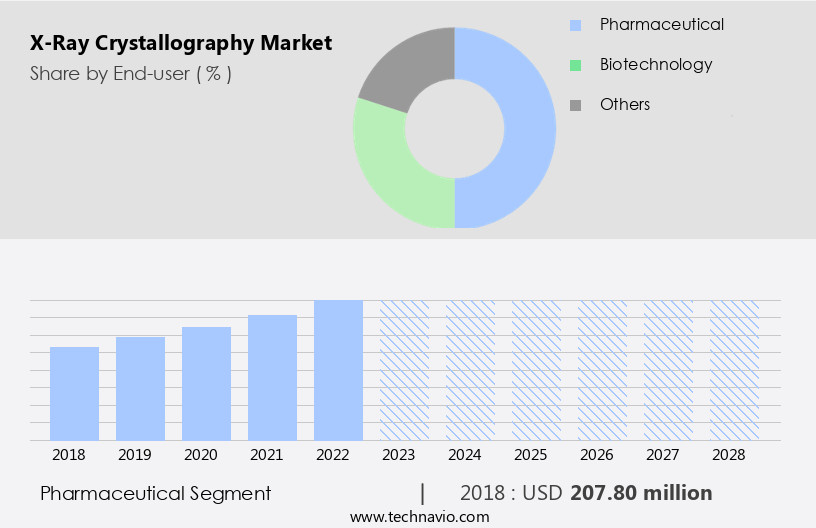

The pharmaceutical segment is estimated to witness significant growth during the forecast period.

X-ray crystallography plays a pivotal role in the pharmaceutical industry, particularly in drug discovery and the analysis of membrane proteins. This technique allows for the examination of protein structures, including those embedded in cell membranes. The global investment in pharmaceutical R&D serves as the primary market driver, with Europe leading the way in spending as of a 2015 report by the Organization for Economic Co-operation and Development (OECD), with Switzerland, Belgium, Slovenia, and Denmark having the highest R&D investment as a percentage of their respective GDPs. Advancements in X-ray crystallography include protein crystallography techniques, heavy atom derivatization, crystal structure visualization, structure factor calculation, space group determination, and X-ray diffraction patterns.

The molecular replacement method, anomalous scattering effects, crystallographic software tools, crystal growth optimization, molecular structure modeling, diffraction intensity integration, synchrotron radiation source, data resolution limits, X-ray beam wavelength, data collection strategies, single crystal diffraction, ramachandran plot analysis, electron density mapping, phase identification methods, powder diffraction data, crystallographic symmetry, Bragg's law application, small molecule crystallography, structure validation metrics, atomic coordinates refinement, detector calibration process, data processing pipelines, crystal lattice parameters, structure factor amplitudes, and unit cell determination are all integral components of this technology. In summary, X-ray crystallography's ability to provide detailed insights into protein structures, especially membrane proteins, makes it an essential tool in the pharmaceutical industry.

The significant investment in R&D in this sector continues to fuel the growth of this market. The technique's advancements, including the aforementioned components, contribute to its increasing importance in drug discovery and other applications.

The Pharmaceutical segment was valued at USD 207.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

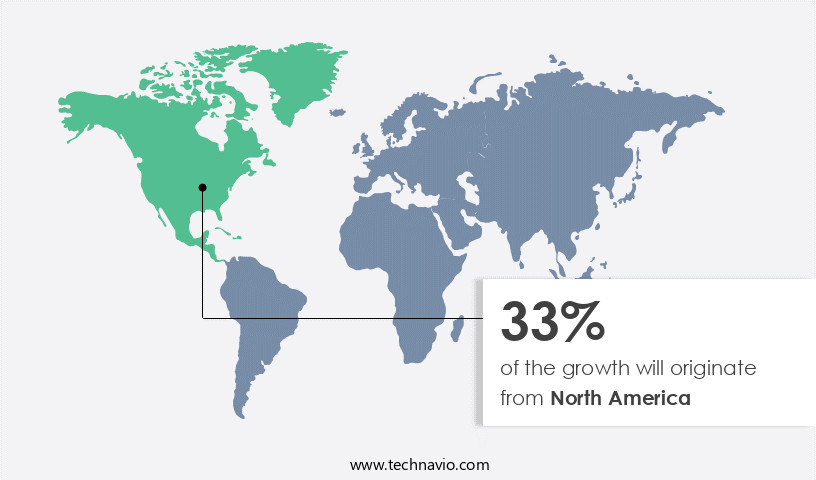

North America is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America, primarily driven by the US, experiences significant growth due to the region's robust pharmaceutical and biotechnology sector. Companies such as Novartis and Pfizer, based in the US, conduct extensive research for drug development and vaccine creation, thereby increasing the demand for X-ray crystallography techniques. These techniques include protein crystallography, heavy atom derivatization, crystal structure visualization, structure factor calculation, space group determination, and single crystal diffraction. Advanced methods like molecular replacement, anomalous scattering effects, and electron density mapping are also employed for phase identification and structure determination. Crystallographic software tools facilitate crystal growth optimization and molecular structure modeling, while synchrotron radiation sources provide high-intensity X-rays for data collection.

Data processing pipelines integrate diffraction intensity and data resolution limits, ensuring accurate crystal lattice parameters, structure factor amplitudes, and unit cell determination. Bragg's law application is crucial for understanding the relationship between the crystal lattice and the diffraction pattern. The market also encompasses powder diffraction data and crystallographic symmetry analysis. The increasing prevalence of fatal diseases, infectious diseases like respiratory diseases and STDs, and the demand for personalized medicine fuel the pharmaceutical industry's growth in North America. This growth, in turn, necessitates the use of advanced X-ray crystallography techniques to aid in drug discovery and development.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a range of techniques and software solutions used in the determination of crystal structures, primarily for proteins and small molecules. The process begins with high resolution X-ray diffraction data collection at synchrotron radiation facilities, which is then processed using various pipelines to produce a clear and accurate dataset. This data is then subjected to various methods for structure solution, such as molecular replacement using known structures or ab initio methods like direct methods for small molecules. Structure factor calculation using Fourier transform is a crucial step in the process, followed by crystallographic data interpretation and visualization using specialized tools. Crystal structure validation is essential, and this is achieved through methods like the Ramachandran plot analysis, which checks the allowed regions for the backbone dihedral angles. Crystallographic symmetry operations are analyzed to determine the space group, while crystal lattice parameters are determined using Bragg's law. Protein-ligand interaction analysis is carried out to understand the binding modes, and heavy atom derivatization is used for isomorphous replacement. Electron density map interpretation is used for structure modeling, and atomic coordinate refinement is performed using the least squares method. Crystal growth optimization techniques are employed to improve the quality of the crystals, while reciprocal space mapping is used for crystallographic characterization. Diffractometer operation and data acquisition parameters are optimized to ensure the best possible data. Powder diffraction data analysis is used for phase identification in X-ray crystallography applications. The market offers a range of software solutions for each step of this process, ensuring the most accurate and efficient structure determination possible.

What are the key market drivers leading to the rise in the adoption of X-Ray Crystallography Industry?

- The significant expansion of investment in drug discovery serves as the primary catalyst for market growth.

- The global pharmaceutical industry is witnessing significant growth due to the increasing prevalence of diseases and the resulting demand for new therapeutic solutions. According to the Centers for Disease Control and Prevention (CDC), the number of cancer diagnoses in the US is projected to reach 2 million by the end of 2022. In response, pharmaceutical and biopharmaceutical companies are investing heavily in research and development (R&D) to bring innovative drugs to market. Approximately 65% of their revenue is allocated to discovery and early-stage product development. Advancements in X-ray crystallography technology are playing a crucial role in this process.

- This technique enables researchers to determine the atomic coordinates of a crystal structure, refine those coordinates through structure validation metrics, and obtain crystal lattice parameters and structure factor amplitudes. The detector calibration process and data processing pipelines are essential steps in ensuring the accuracy of the results. Unit cell determination is another critical aspect of X-ray crystallography, as it provides the fundamental building blocks of the crystal structure. These insights underscore the importance of X-ray crystallography in the pharmaceutical industry's pursuit of new drugs and therapies. By providing a detailed understanding of molecular structures, this technology enables researchers to develop more effective treatments and improve patient outcomes.

What are the market trends shaping the X-Ray Crystallography Industry?

- The outsourcing of drug discovery processes is an emerging market trend. This approach allows organizations to leverage external expertise and resources to enhance their research and development capabilities in the pharmaceutical industry.

- X-ray crystallography is a crucial technique in protein research, enabling scientists to determine the three-dimensional structures of biological macromolecules. This process involves heavy atom derivatization, crystal structure visualization, and various methods such as space group determination, structure factor calculation, and molecular replacement. Anomalous scattering effects are utilized to enhance the resolution of X-ray diffraction patterns. Pharmaceutical and biotechnology companies, seeking to innovate and bring new drugs to market, often face high capital requirements for in-house research facilities. Outsourcing drug discovery processes to Contract Research Organizations (CROs) has become a popular solution. CROs offer cost savings, allowing companies to allocate resources towards marketing and other strategic initiatives.

- Pharmaceutical companies can thus benefit from the expertise of CROs in X-ray crystallography and other research areas, while focusing on manufacturing and marketing activities. The growing emphasis on R&D investments and the need for new drug discoveries have made X-ray crystallography an essential tool for the pharmaceutical industry. By outsourcing this research to CROs, companies can achieve significant cost savings and dedicate more resources to innovation and marketing strategies.

What challenges does the X-Ray Crystallography Industry face during its growth?

- The insufficient workforce of adequately trained laboratory professionals poses a significant obstacle to the expansion and growth of the industry.

- X-ray crystallography is a crucial technique in molecular research, enabling scientists to determine the three-dimensional structures of crystallized biological macromolecules and inorganic compounds. This process involves the careful application of reagents and handling of apparatus, as well as the correct interpretation of results. However, the industry faces a significant challenge: a shortage of skilled professionals. According to recent research, over 60% of jobs in the pharmaceutical sector in the US are projected to be vacant by 2025 due to a lack of effective education policies and increased competition from other countries. To address these challenges, researchers rely on advanced crystallographic software tools for crystal growth optimization, molecular structure modeling, and diffraction intensity integration.

- These tools help streamline the data collection process and improve data resolution limits, enabling researchers to work more efficiently with X-ray beam wavelengths. Data collection strategies, such as those utilizing synchrotron radiation sources, further enhance the accuracy and reliability of results. Despite these advancements, the shortage of skilled professionals remains a major concern. To mitigate this issue, collaborations between academia and industry, as well as increased investment in education and training programs, are essential. By working together, we can ensure that the molecular research industry continues to advance and make significant contributions to scientific discovery.

Exclusive Customer Landscape

The x-ray crystallography market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the X-ray crystallography market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, x-ray crystallography market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agilent Technologies Inc. - The company specializes in x-ray crystallography, specifically X-ray diffraction, a technique used to determine the molecular structures of crystalline materials, providing essential insights into their chemical composition and atomic arrangements.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- Anton Paar GmbH

- ARINAX SAS

- Bruker Corp.

- Calibre Scientific Inc.

- Charles River Laboratories International Inc.

- Hitachi High Tech Corp.

- HUBER Diffraktionstechnik GmbH and Co. KG

- Intertek Group Plc

- MiTeGen LLC

- Nippon Kayaku Co. Ltd.

- Olympus Corp.

- Perkin Elmer Inc.

- Rigaku Corp.

- Shimadzu Corp.

- Spectris Plc

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

- WuXi AppTec Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in X-Ray Crystallography Market

- In January 2024, Bruker Corporation, a leading X-ray crystallography solutions provider, announced the launch of their new D8 Quest X-ray diffractometer, designed for academic and industrial research applications. This innovative product features a compact footprint and improved data collection capabilities, making it an attractive option for laboratories with space constraints (Bruker Corporation Press Release).

- In March 2024, Hamamatsu Photonics K.K. And Rigaku Corporation, major players in the market, entered into a strategic partnership to develop and commercialize advanced X-ray detectors. This collaboration aimed to enhance the sensitivity and performance of X-ray diffraction systems (Rigaku Corporation Press Release).

- In May 2024, Malvern Panalytical, a global leader in analytical instrumentation, completed the acquisition of Micromeritics Instrument Corporation, a prominent supplier of materials characterization solutions, including X-ray diffraction systems. This acquisition expanded Malvern Panalytical's product portfolio and strengthened its position in the materials characterization market (Malvern Panalytical Press Release).

- In April 2025, the European Commission approved the Horizon Europe research and innovation program, which includes a significant focus on advanced materials research and development. This initiative is expected to drive demand for X-ray crystallography technologies in Europe, as researchers utilize these tools to better understand the atomic structure of materials (European Commission Press Release).

Research Analyst Overview

- The market encompasses a range of techniques and technologies used to determine the three-dimensional structures of crystalline materials. Thermal vibration analysis and diffractometer operation are essential for understanding crystal dynamics and improving data quality. Structure factor phases, crystal morphology analysis, and crystal packing arrangements are crucial for interpreting X-ray diffraction patterns. Reciprocal space mapping, background noise reduction, and crystallographic image processing are vital for enhancing data accuracy and resolving overlapping peaks. Atomic displacement parameters, unit cell indexing, and Patterson function analysis aid in refining crystal structures. Ligand binding analysis, protein-ligand interactions, peak intensity measurement, isomorphous replacement, water molecule modeling, and structure refinement cycles are integral parts of the structure solution process.

- Density modification methods, molecular dynamics simulation, and data indexing techniques contribute to the determination of high-resolution structures. Crystallographic databases, hydrogen atom placement, and structure solution methods facilitate the sharing and comparison of structural information, advancing scientific research and innovation. Overall, the market continues to evolve, driven by advancements in technology and the growing demand for precise structural information.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled X-Ray Crystallography Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.76% |

|

Market growth 2024-2028 |

USD 678 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.86 |

|

Key countries |

US, Germany, China, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this X-Ray Crystallography Market Research and Growth Report?

- CAGR of the X-Ray Crystallography industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the x-ray crystallography market growth of industry companies

We can help! Our analysts can customize this x-ray crystallography market research report to meet your requirements.